This is crazy.

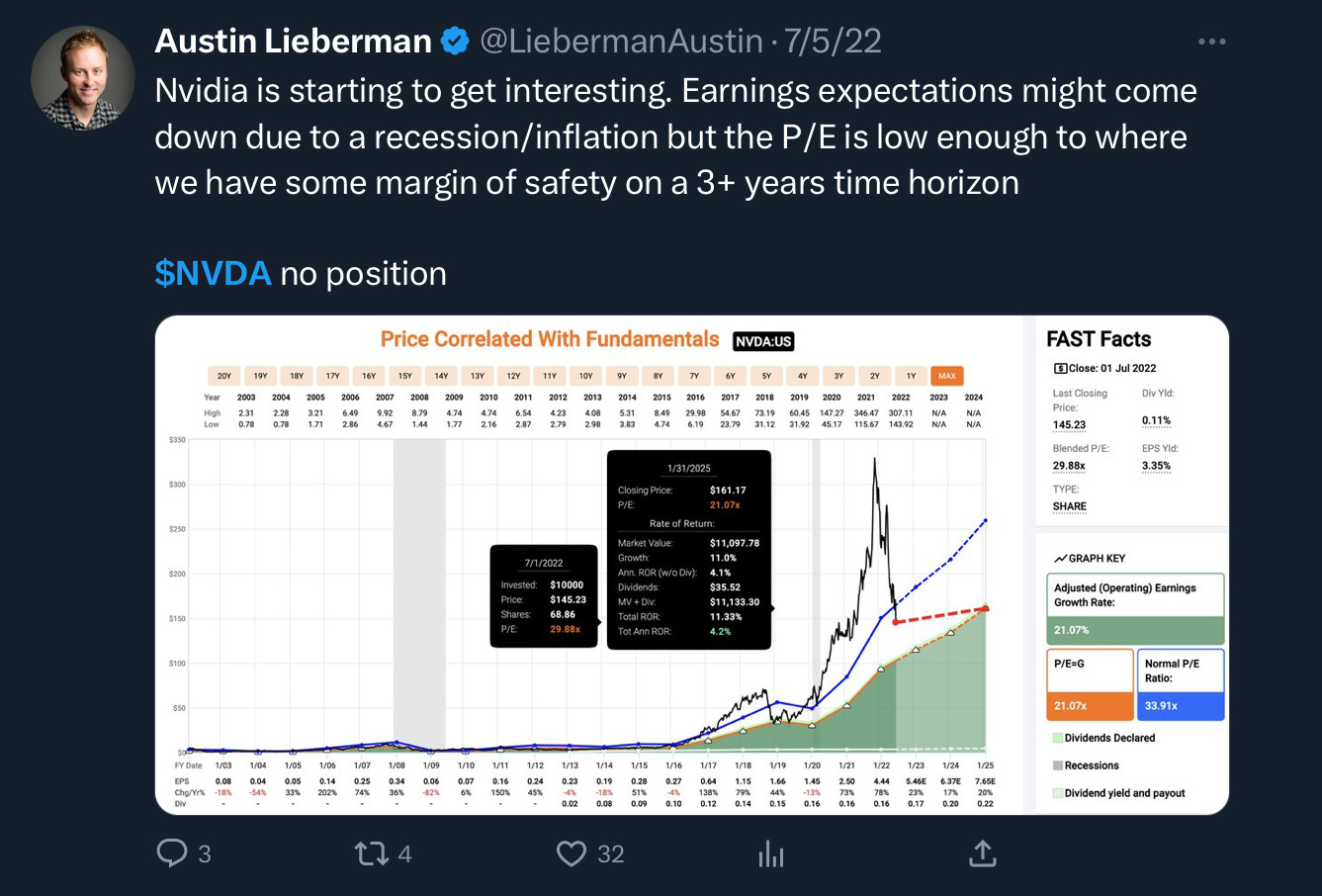

On July 5th, 2022 when NVDA 0.00%↑ was trading at $145 I shared that I thought Nvidia “was starting to get interesting”.

Shares are currently trading at $423, up 191% since that tweet. But I’m still sitting on the sidelines.

What is wrong with me? I made some very common mistakes that a lot of investors make. Hopefully by reviewing them it will help you and me avoid making the same mistakes in the future.

#1 I was obsessed with all the (mostly) negative macro news headlines.

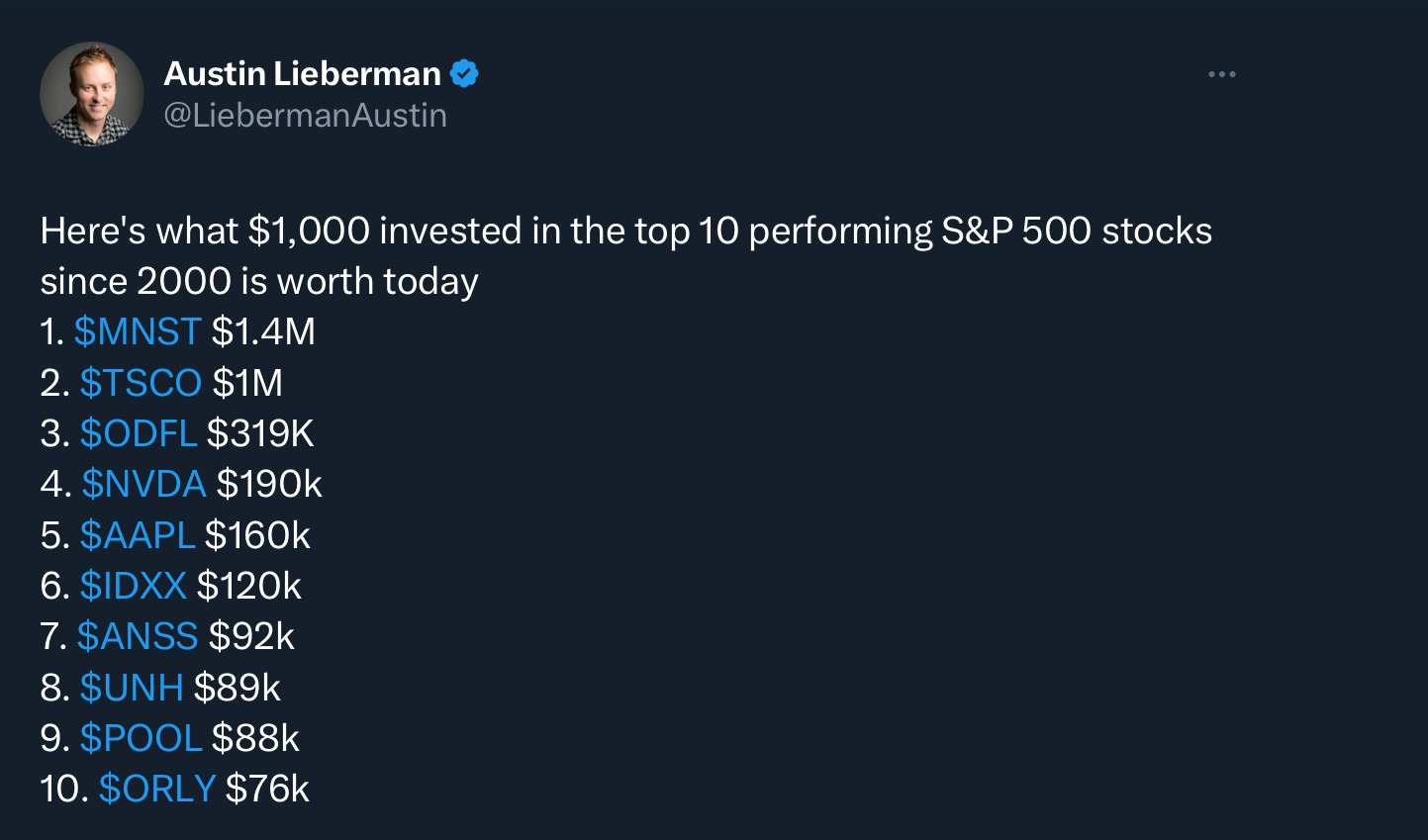

This led to me over analyzing every stock and trying to avoid a short-term drop. The Tweet below shows how powerful buying and holding can be even with the great financial crisis happening during that time period.

#2 I was only focused on valuation.

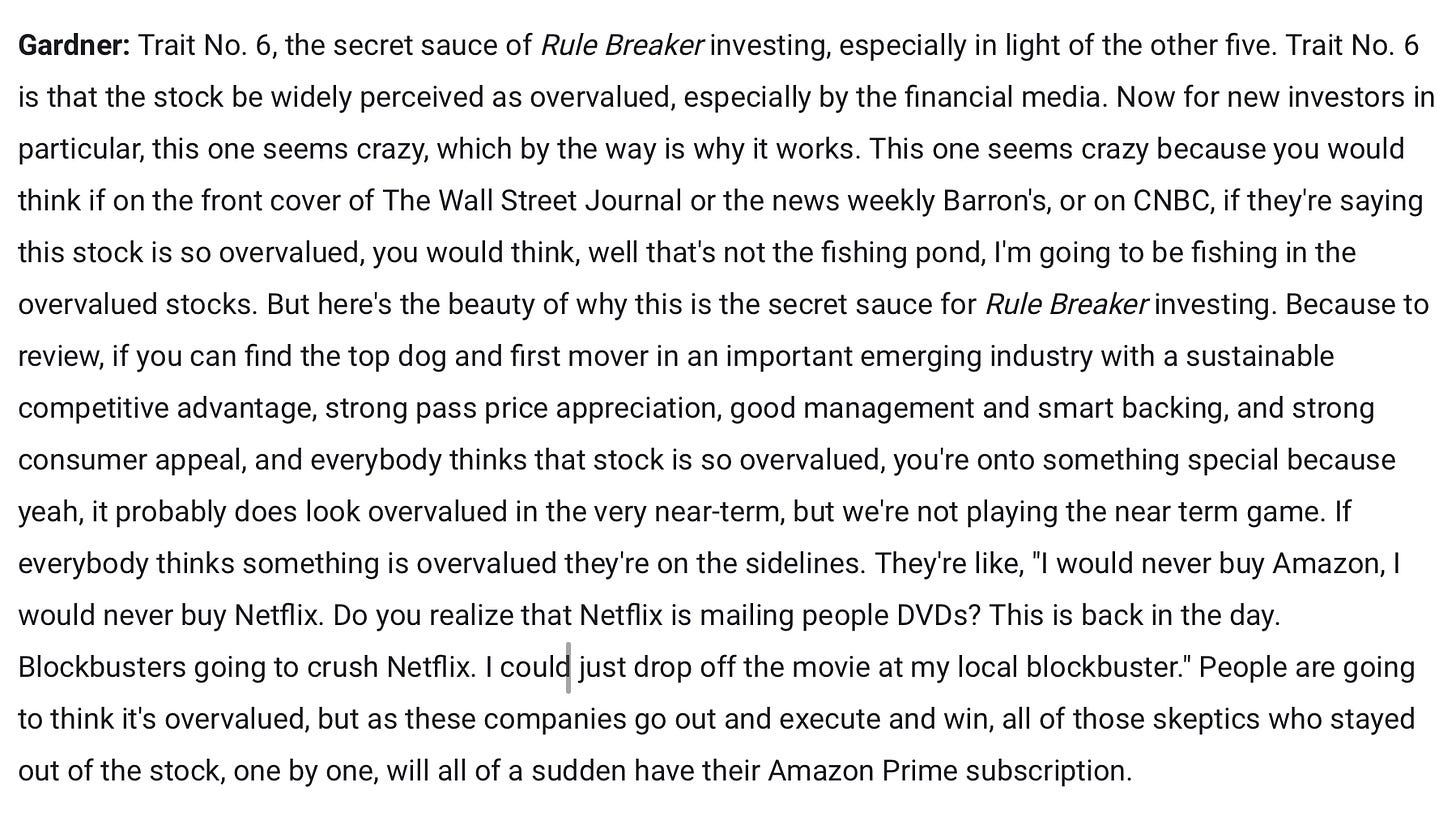

David Gardner is one of my favorite investors and business leaders ever. He created the Rule Breaker investing framework and established “6 traits of a Rule Breaker” over a decade ago.

Trait #6 is that “the stock be widely perceived as overvalued, especially by the financial media.” Especially if the company displays traits #1 - #5 which Nvidia did.

#3 Price and narrative anchoring

Once I was “negative” on the stock, as the price went up, I maintained and even increased my negative outlook. To be clear I never shorted the stock, but I was focused on the fundamentals and the P/E & P/S multiples. Until Nvidia’s recent earnings report, as the stock price went higher, the fundamentals got worse. So logically, I was even less interested in owning the stock.

Now I actually think this could be a good trait for investors to have, but the problem in my case was that I was ONLY focused on the numbers and not on things like management, moat, Nvidia’s industry leadership, and this tiny new market/demand that popped up over the last 6 - 9 months (Large Language Models, ChatGPT, etc).

Instead of doing the work and analyzing new information, I stuck to my pre-established narrative.

I’m at the point in my life where I’m starting to help family members make retirement decisions.

For myself with a 30+ year investing horizon, I’m happy to be 100% exposed to equities. But for people near retirement, it starts to make a lot of sense to consider adding fixed income and less volatile assets.

That’s why I’m excited to partner with Percent, which offers alternatives to the traditional 60/40 retiree favorite.

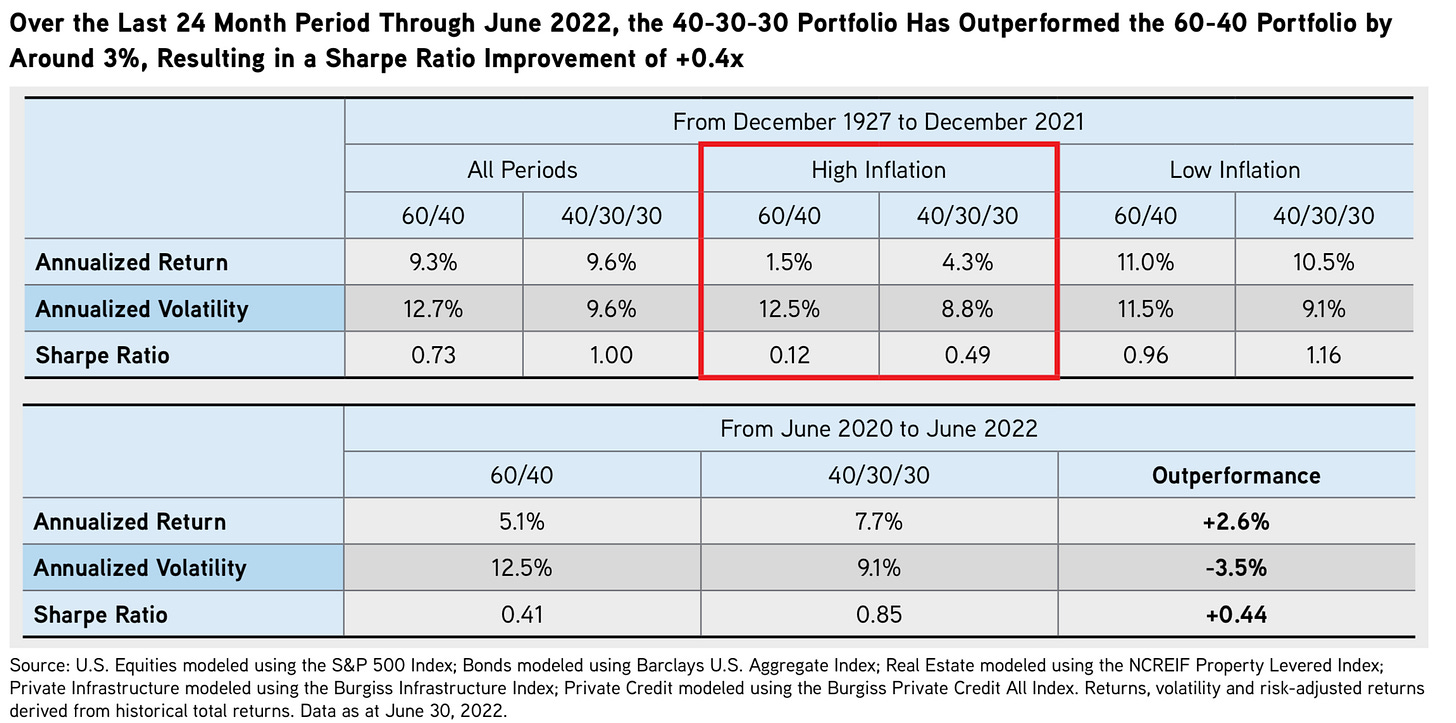

For years, the 60/40 stock/bond portfolio has been a staple for investors. But, it needs a rethink.

A study from investment giant KKR explored the benefits of adding alternative investments into the mix over almost a century of returns. Their findings? The 40/30/30 portfolio, which adds real estate, infrastructure and private credit assets into the holdings, offered higher returns — with lower volatility — during periods of high inflation.

One part of that portfolio that's interesting is private credit — an asset class usually out of reach for main street investors.

But that's changing thanks to Percent, which offers accredited investors access to a wide variety of high yield, short duration (9-month average) offerings, that have historically outperformed their benchmark by 6-7%. As of June 1, 2023, the historical weighted average APY of matured deals is 12.78%.

My readers can also earn up to a $500 bonus. The website also has a ton of great resources and research. Check it out here.

My thoughts on Nvidia moving forward

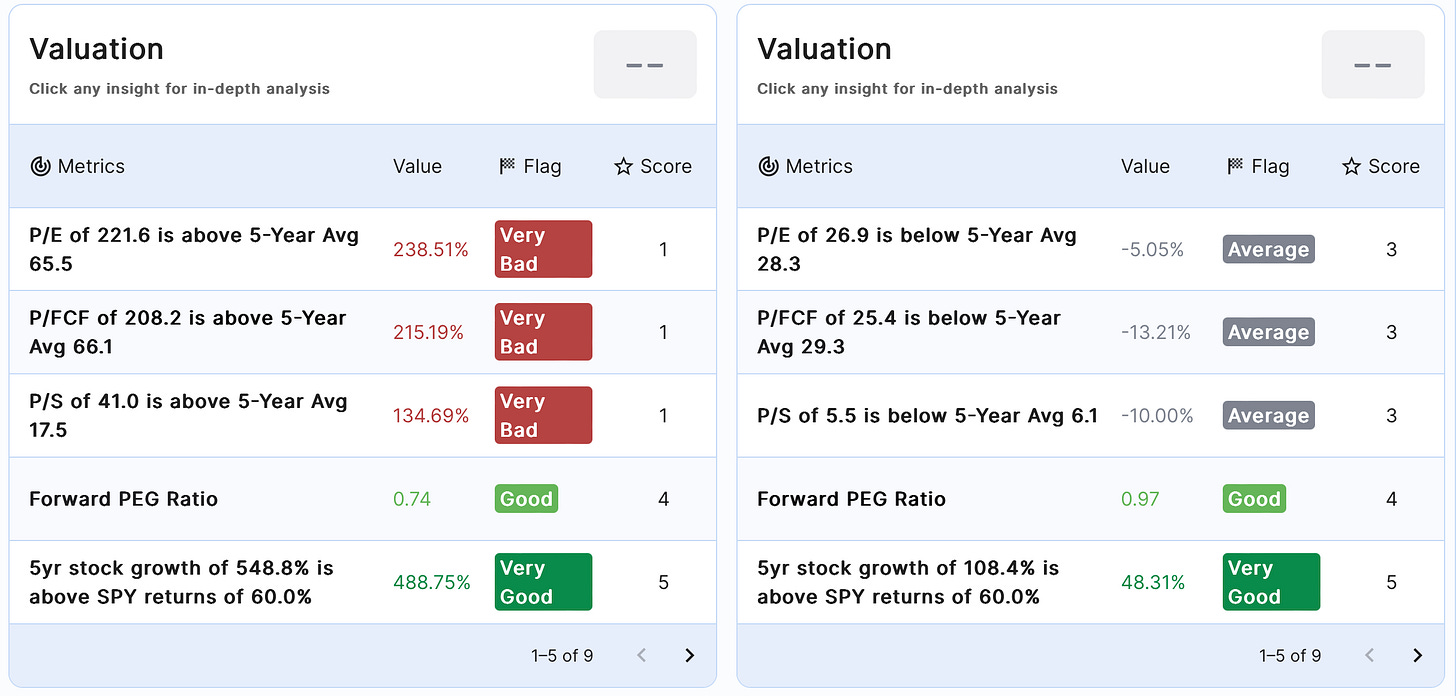

After reading the post above you might be surprised to read that I have no intention of buying NVDA 0.00%↑ at these levels. There are a lot of great companies that will benefit from the AI tailwind and Nvidia is extremely overvalued.

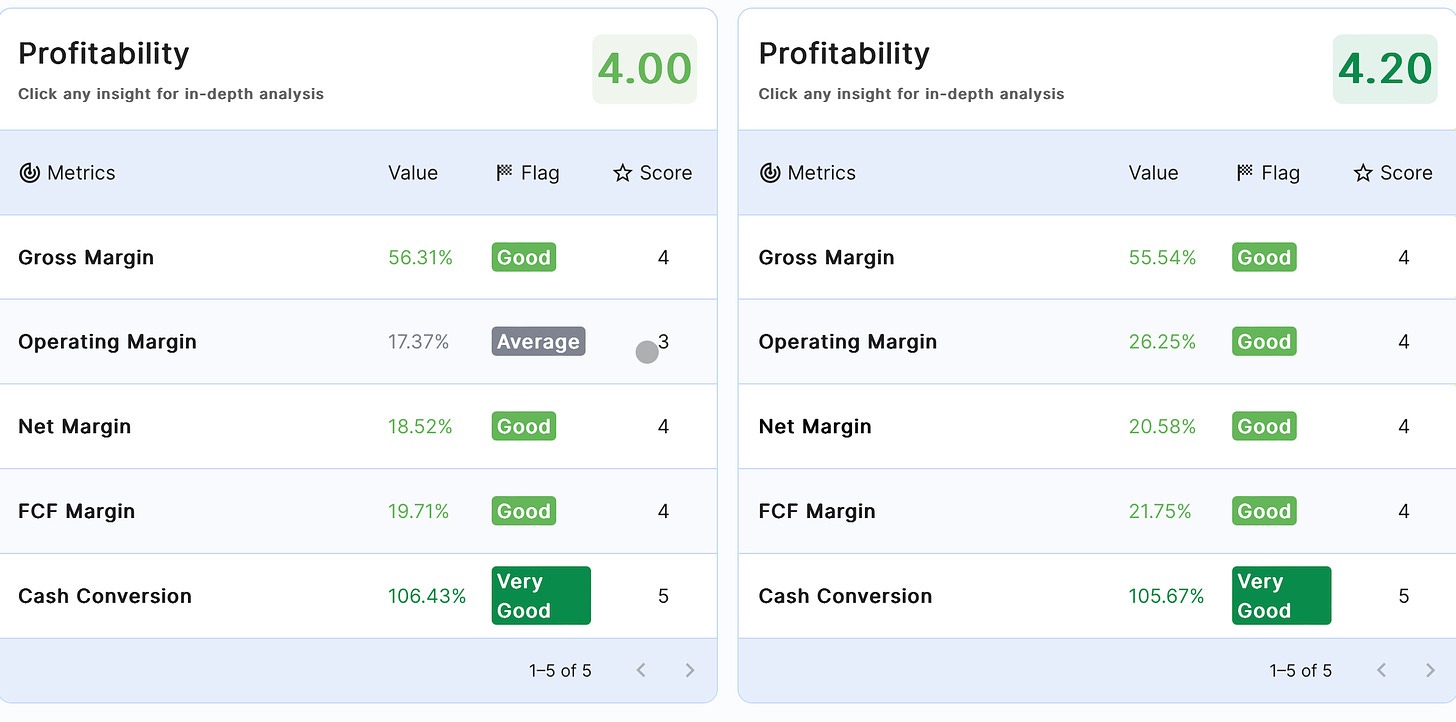

I can’t justify owning a $1T market cap company with a P/E of 221 and a P/S of 41. If that means I miss out on additional upside then I am totally fine with that. Especially when GOOGL 0.00%↑ is trading at a P/E of 27, a P/S of 5.5, and also stands to benefit from the AI boom.

Nvidia is on the left and Google (I refuse to call it Alphabet) is on the right in the Stock Unlock comparison below.

I use Stock Unlock for the data above and all my fundamental research. Give the platform a try 100% free (no credit card required)

Let me know your thoughts in the comments. If I’m missing something about Nvidia that justifies such an extreme valuation, please let me know.

Nothing in your write up talks about the products and services that these two companies sell and whether they are supported by secular tailwinds.

I start my analysis with a focus on the product, services, market fit and need, tailwinds, headwinds...then growth forecasts, earnings reports, trends and comparison with peers.

Notice that valuation has not even been looked at thus far. That is the last piece of my analysis process.

If a stock meets my criteria in all the preceding analysis, then I can look at valuations to check if it is "expensive" or "cheap".

Value is in the eye of the beholder and I prefer to look at the business fundamentals first to decide whether I would buy or wait or move onto something else.

e.g. right now SOFI looks "cheap", however I would not buy it because it fails most of my fundamental analysis.

Cheers!

Thanks for the great analysis. I rely on analysts for my fundamentals. But I’m a swing trader, so I balance fundamentals with technical analysis. I rely on EMAs, and RSIs. I also rely on daily, 5 minute, and 1 minute charts.

Plus of course, stops. I factor in 5-15 % for slippage. It’s very simple actually. I’ve stopped relying 100 % on fundamentals because they easily get outdated. I also discount analyst predictions because I’ve caught them napping a few times....the crossovers have helped tremendously in selling NVDA on January 2022 and buying it on September 2022.