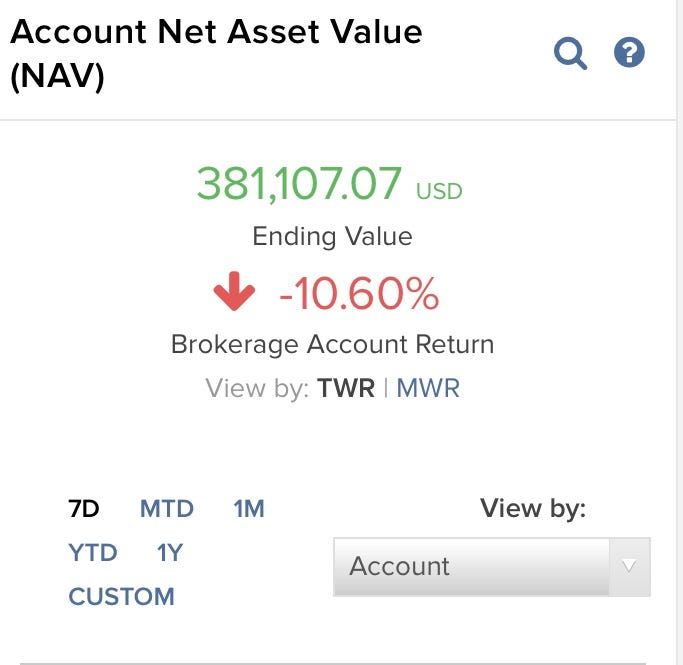

Weekly Review: Down $44,240 (-10.6%)

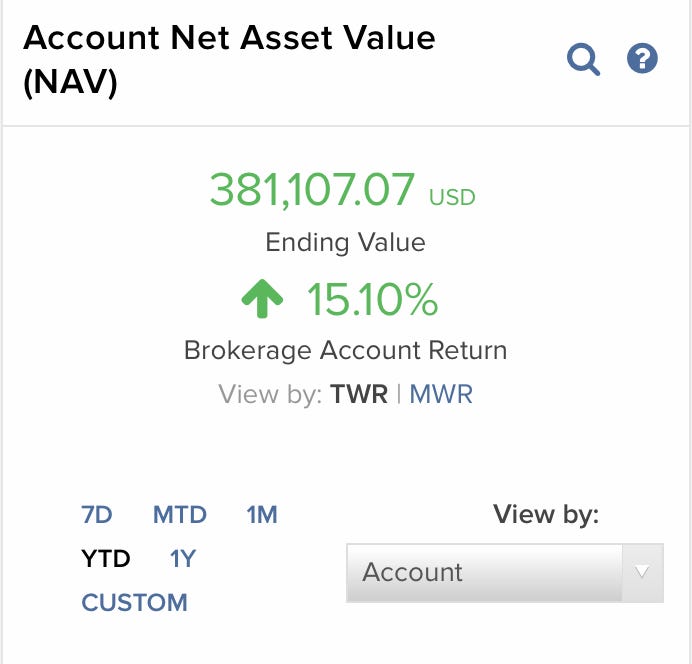

We're still up 15% but boy have these last few weeks been painful

Okay, I’m back home for this update, Hannah’s recovering well from surgery, and other than my portfolio being beaten down for what feels like the 50th week in a row, life is great.

I was in Savannah, GA last week. I took some time to walk around the city and went for a run with no phone, no watch, no GPS. I have no idea how long or how far I ran but it was one of my most enjoyable runs in a while. What a beautiful place.

Thank you all so much for reading and helping to support my goal of making investing accessible to anyone with an internet connection. We are now at 965 total subscribers and 66 paid subscribers which brings in roughly $3,500/yr (before taxes). If you enjoy this newsletter or my amazing iPhone photography skills (see below) please hit the ❤️ at the top of the page (this helps others find us on substack.com), share with friends, and/or start a paid subscription for $5/month or $50/year.

Savannah, Ga: Photo by me!

Portfolio returns

7-Day performance: -10%

Year to date (YTD) performance: +15%

Year to date S&P 500 performance: +18%

Portfolio vs S&P 500 YTD = -3%

*Returns as of after market close on Friday, Sep 27, 2019

*This is the first time we have trailed the S&P 500 YTD in over 2 years. Ouch!

2019 portfolio starting value: $283,862

Current portfolio value: $381,107

YTD change: +$97,244

*The YTD change includes contributions, but the YTD performance (+15%) does not factor in contributions. With contributions, the portfolio value is roughly 34% higher than where we began the year ($97,244 / $283,862 = .34 x 100 = +34%).

*For a better reading experience, I’ve moved the screenshots of our returns down to the very end of the post. If you want to verify I’m not lying about losing a ton of money these past few weeks, that’s where you can do so!

Current thoughts and portfolio companies

This is likely a great buying opportunity if we’re investing in the best Founder-led companies with a 5+ year time horizon and not investing any money we need in the next 5 years. I could certainly be wrong but what I view as a more likely obstacle is investors (myself included) not being able to handle the volatility in these stocks to withstand these types of downturns. Especially once their spouses find out how much their portfolios are down (not me of course!).

There is such a feeling of panic swirling around the market and more specifically these high-growth SaaS type companies. It is really easy to feel like an idiot for owning these companies and not selling when the portfolio was up 70% year to date and over $500k in value just a couple of months ago. But the tricky thing is, the market and these stocks could just have easily been up another 10%-20% and if they were, I’d feel like a genius for holding and silly if I had sold.

So what do we do?

For me, it all comes back to the basics. Which I have admittedly screwed up this year (hello stupid short-term options gambles). But here is my framework.

Goal: Build incredible long term wealth to provide security for my family and make a positive impact on the lives of others.

Invest in the best 10-15 Founder-led companies I can find (don’t let any company get much larger than 20% of the portfolio)

Aim to hold for 5+ years (sell if business worsens or there’s a better opportunity)

Sleep comfortably (don’t invest any money we might need in the next 5 years and have a substantial emergency fund parked in a non-investment account)

Spend most of my time focused on my family, my job (not investing), and military service

By keeping these goals in mind, I am creating the habit of being a great long-term investor who is not obsessed with the markets and all of the macroeconomic fear or hubris that’s going on. Most importantly, it keeps investing as something that supplements and improves the amount of time I have with my family rather than detracts from it which is what obsessing about daily changes in the market would do.

So to sum it up. I’m hiding underground, holding the positions I have, popping my head up to add when my monthly contributions come in, immediately hiding again, and repeating until I can come out of my hole and talk about how great my portfolio is doing…

Companies we own

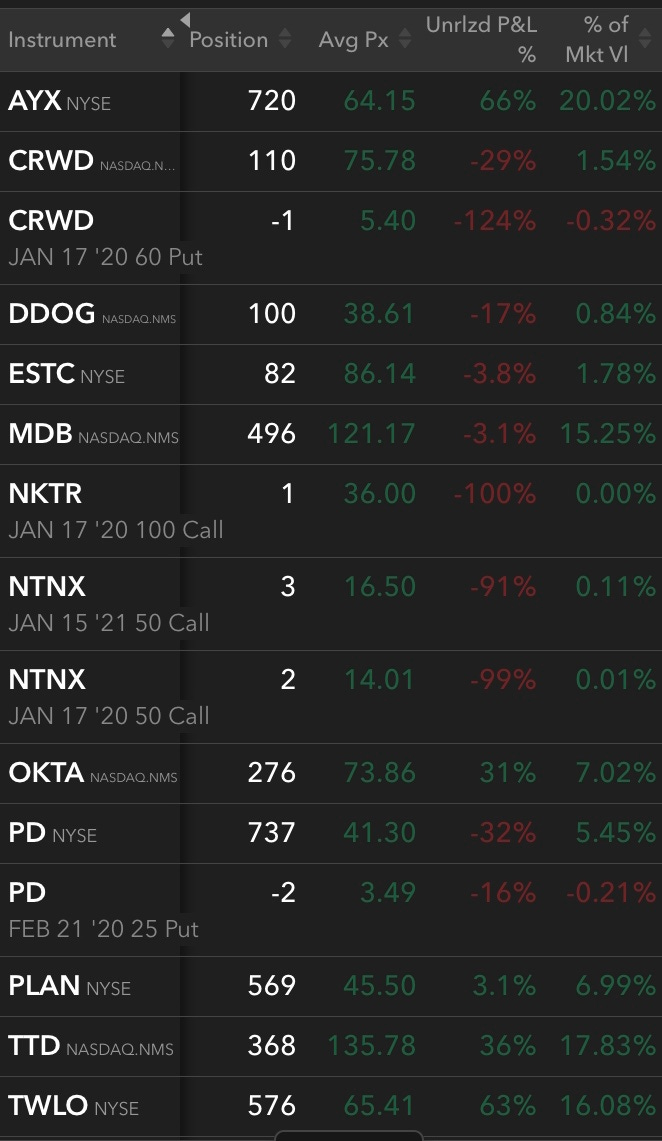

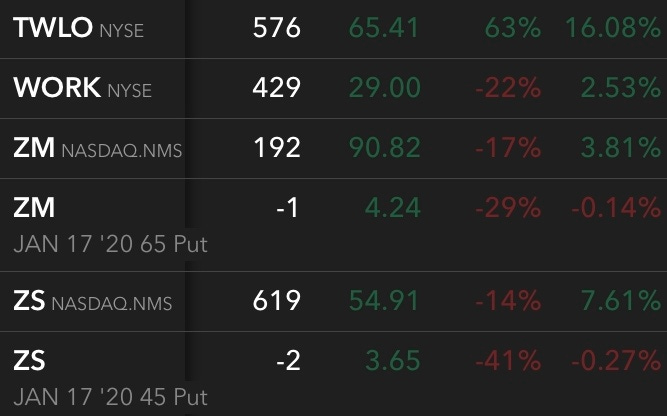

The images below show our current holdings.

Position = how many shares or options contracts we have.

Unrealized P&L % = how much that position is up or down.

% of Mkt Vl = what percentage that position makes up of our entire portfolio.

We made no changes to the portfolio this week. AYX, TWLO, TTD, and MDB are still our largest four positions by far and I am just as confident in all four of their businesses as I was before their stocks dropped significantly.

We are short puts on CRWD, PD, ZM, and ZS which means we are obligated to buy 100 shares per options contract if those companies are below the strike prices on or before the option contract expiration date. I explained these in more detail in last weeks review.

Around mid-October I plan to sell some losers to do what’s called “tax-loss harvesting”. Doing so allows us to offset taxes on both capital gains and income. Here is a link to a more thorough explanation. When I do that, I’ll most likely reinvest any cash balance in the portfolio into other companies, not keep a cash position. I’ll send updates when that happens. If I was buying today I’d likely add to MDB, TWLO, and TTD even though they are such large positions in my portfolio. I’m a big fan of their businesses and management teams.

Thanks again for reading everyone! I’ll probably send some interesting links about our companies and other things that matter out on Mondays, then try to get these reviews out on Friday or Saturday (I have a full-time job you know). It feels like packing too much into these reviews to also include links…would love to hear what you would prefer if anyone is still reading. Please send any questions or feedback to me by replying to the email or in the comments section

7-Day Return:

YTD Return:

I am also down this week, but I am still ahead of S&P 500. Picked up more ROKU, TWLO, SWAV, NVTA!