Welcome to Growth Curve! Our last deep dive was “CNX Resources: The Most Aggressive Buyback Plan I have Ever Seen”. Our next deep dive comes out on, Tuesday, May 9.

In our last update, I shared my big reckless bet on SQQQ (link), so I think it’s appropriate to share and update after the Fed rate hike and conference.

My main purpose of this newsletter will continue to research and share deep dives on what I believe are the best stocks to own. In general, those will be small to mid-cap companies because I believe they have the most long-term growth potential.

Sometimes, when I think there’s a dislocation in business fundamentals and how the market is pricing a stock, I’ll own large or even mega-cap stocks. I did that with Meta in 2022, and I currently own a large position in Amazon.

That analysis is the “value” that I think this newsletter offers to paying subscribers.

However, I also believe in transparency, so I will continue to share my own portfolio. When I do that, I want to be clear that I am not recommending anyone follow what I do, and I’m not saying that what I do is a responsible way to manage a portfolio. I take some risky and stupid bets.

These 6 rules are what I encourage my friends and family to do

Don’t invest on margin

Start by having most of your money in index funds/ETFs

If you want to own individual stocks, slowly start putting money into them. Maybe start with 5% of your portfolio, then work your way up ~2% per year until you’ve proven to yourself that you’re comfortable with individual stocks

Never put more than around 5% of your portfolio in any individual stock

Own 20 - 30 stocks

Have your average holding period be 3+ years (the longer the better)

I do genuinely believe that given where the market’s current valuation is and that we’re pretty clearly entering an economic slowdown, investors should expect something more like 5% annualized returns from here over the next 5 years instead of 8% - 10% of the last few decades.

What I’m trying to do by owning SQQQ is capitalize on what I think is a mismatch in the market (trading at the high-end of its 20 year Average P/E) and the weakening economy with higher interest rates than we’ve had in the last decade.

If it works out, and the market pulls back 5% - 10%, SQQQ would be up 15% - 30% and I’d have more money to invest in my best ideas at lower prices. This would be a 20% - 40% difference in the value of my portfolio if I just stayed invested which is why I’m taking this risk.

If my SQQQ position goes in the red by ~5% I’d probably cut my losses to avoid doing serious damage.

That’s my plan.

A safer way to do this if someone is uncomfortable with the market valuation and the various risks out there are to

#1 Raise cash in the portfolio to re-invest in great companies if we get a pullback or

#2 Buy something like 3 Month US Treasuries which are currently yielding 5.1% which is almost a risk-free return. TBIL 0.00%↑ is a great option for this.

What happened with the rate hike today?

This is the main takeaway from the fed rate hike and statement:

“The Federal Reserve raised interest rates by a quarter of a percentage point, bringing the benchmark funds rate to 5% to 5.25%. In its post-meeting statement, the central bank appeared to soften its language on future rate increases, removing a line on “additional policy firming.” In his press conference, however, Chair Jerome Powell noted that the policy-setting committee thinks it will take time for inflation to come down and it would not be appropriate to cut rates.” - CNBC

The market rallied a bit because the fed removed “additional policy firming” and indicated they would take a more data-dependent approach to whether or not more rate hikes were necessary.

But then, during the press meeting Q&A, Powell indicated he thinks inflation is here to stay and a rate cut wouldn’t be appropriate unless inflation comes down or the economy slows substantially. Here’s the quote:

“It will take some time, and in that world, if that forecast is broadly right, it would not be appropriate to cut rates and we won’t cut rates”

Here’s a link to the replay and a summary of Jerome Powell’s comments from CNBC (link).

The Dow, S&P 500, and Nasdaq all ended in the red, and SQQQ ended up 2% today.

So as of now I’m not changing anything in the portfolio. I think there’s a chance the market sells off for the rest of the week but Apple reports earnings tomorrow after the market closes so who knows what’s going to happen.

Qualcomm just reported earnings, the stock is down about 3% after hours because of this statement:

"macroeconomic headwinds, weaker global handset units, and channel inventory drawdown." Additionally, Qualcomm (QCOM) said it expects to see "a larger-than-normal" sequential decline in revenue for its QCT division

Qualcomm’s QCT division includes most of the company's mobile-phone chipsets and other mobile device products. I lean towards thinking this is bearish for Apple, but who knows.

Apparently, PacWest Bank is down 40% after market close because it announced it is weighing a sale (link). Other regional banks are down as well.

I really, really hate to say this, but I wouldn’t be surprised to see a major pullback in the market this week if this spreads panic.

Stuff like this is why I just can’t fathom why the market is trading at such high multiples. It just feels complacent and like the market thinks the Fed lowering rates will miraculously save the market.

I agree that the market will eventually rally after the Fed lowers rates, but I think the market needs to go lower between now and the Fed starting to lower rates before that happens.

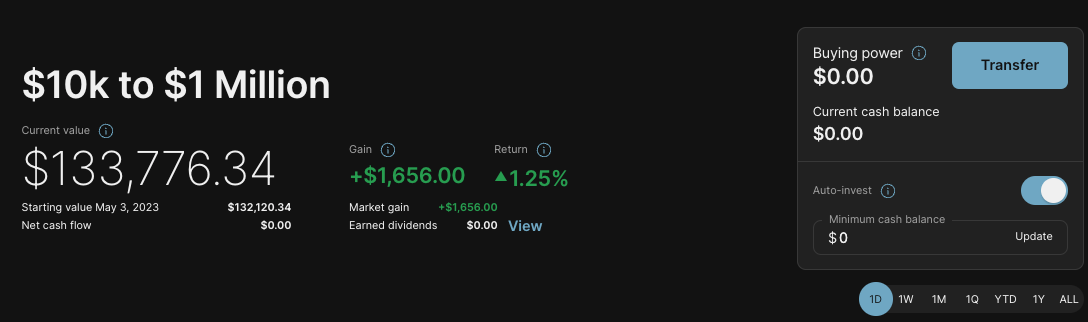

Here’s the current portfolio. As always, I’ll keep you updated of any changes and I’ll send our weekly review out Saturday morning.

Keep reading with a 7-day free trial

Subscribe to Growth Curve By Austin Lieberman to keep reading this post and get 7 days of free access to the full post archives.