This report took me over 20 hours of research and 5 hours of writing. My work is 100% funded through paid subscriptions to this newsletter. If you find my analysis valuable, I would greatly appreciate you becoming a paid member.

An Intro to “Outsider” CEOs:

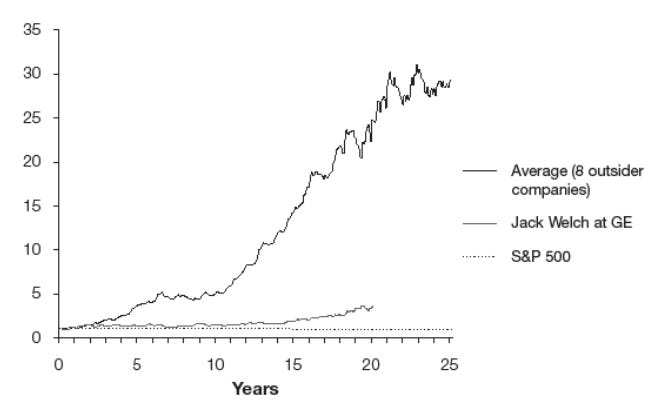

Will Thorndike published his book The Outsiders in 2012. In the book, he studied 8 CEOs from different industries who outperformed the S&P 500 by over twenty times and their industry peers by over seven times on average over a period of 25+ years.

The CEOs outperformed during both growing and declining markets in industries ranging from manufacturing, media, defense, consumer products, and financial services.

The CEOs each had unique approaches to business, but as a group, they were very similar in a few key aspects that Thorndike believes can be used to create a potential blueprint for success that is “highly correlated with extraordinary returns.”

After reading the book multiple times and listening to Will Thorndike’s podcast interviews, I realized he’s on the board of two public companies. Perimeter Solutions PRM 0.00%↑ and CNX Resources CNX 0.00%↑ .

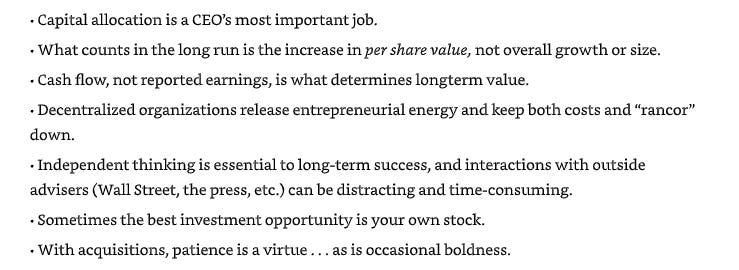

After doing my own research (and admittedly influenced by Will’s investing track record), I bought shares in both companies because I see the potential for extraordinary long-term returns.

My CNX Position:

CNX Investment Thesis

Bottom Line Up Front:

An important industry: CNX is a premier independent natural gas and midstream company engaged in the exploration, development, production and acquisition of natural gas properties in the Appalachian Basin.

Competitive advantages: I believe, their footprint in two of the world’s most important natural gas formations (Marcellus Shale and Utica Shale) combined with their low-cost approach to operations give them a significant moat.

Long-term focus: Their CEO Nick DeIuliis and the Board of Directors, with Will Thorndike as Chairman, are “intensely focused on long-term value per share creation over short termism and instant gratification.”

Aggressively reducing share count: The company has bought back 24% of shares outstanding since 2020 which is nearly unmatched by any other company over the same period and management is willing to continue bringing down the share count. If executed well, this can significantly increase long-term shareholder returns.

The Threat from Wind and Solar

Two big bear cases for own CNX or any other natural gas companies are the move towards renewable energy sources like wind and solar, and the looming recession that would likely slow demand for energy consumption. Both are bad for natural gas prices.

I think these fears are already baked into the share price of CNX (and other nat gas companies) and over blown.

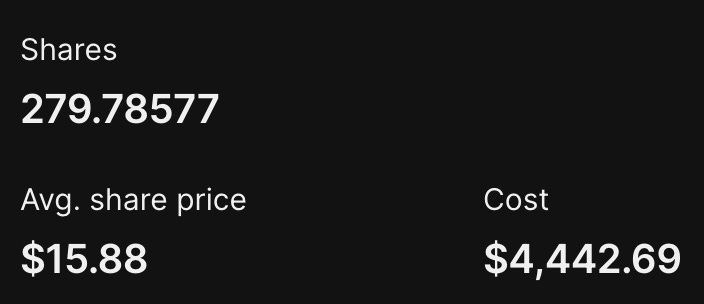

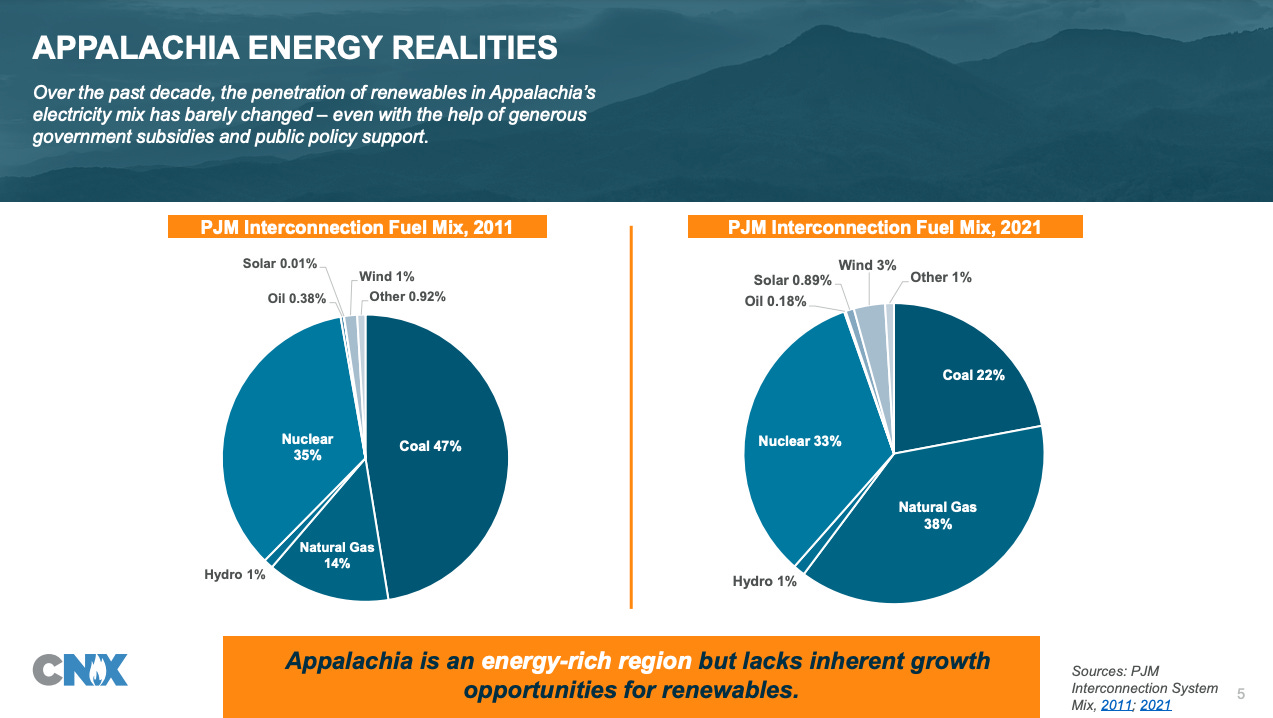

First, CNX is focused in Appalachia which is at a disadvantage for Solar and wind-based energy generation.

And second, even with government subsidies, renewable penetration in Appalachia has barely increased over the last decade.

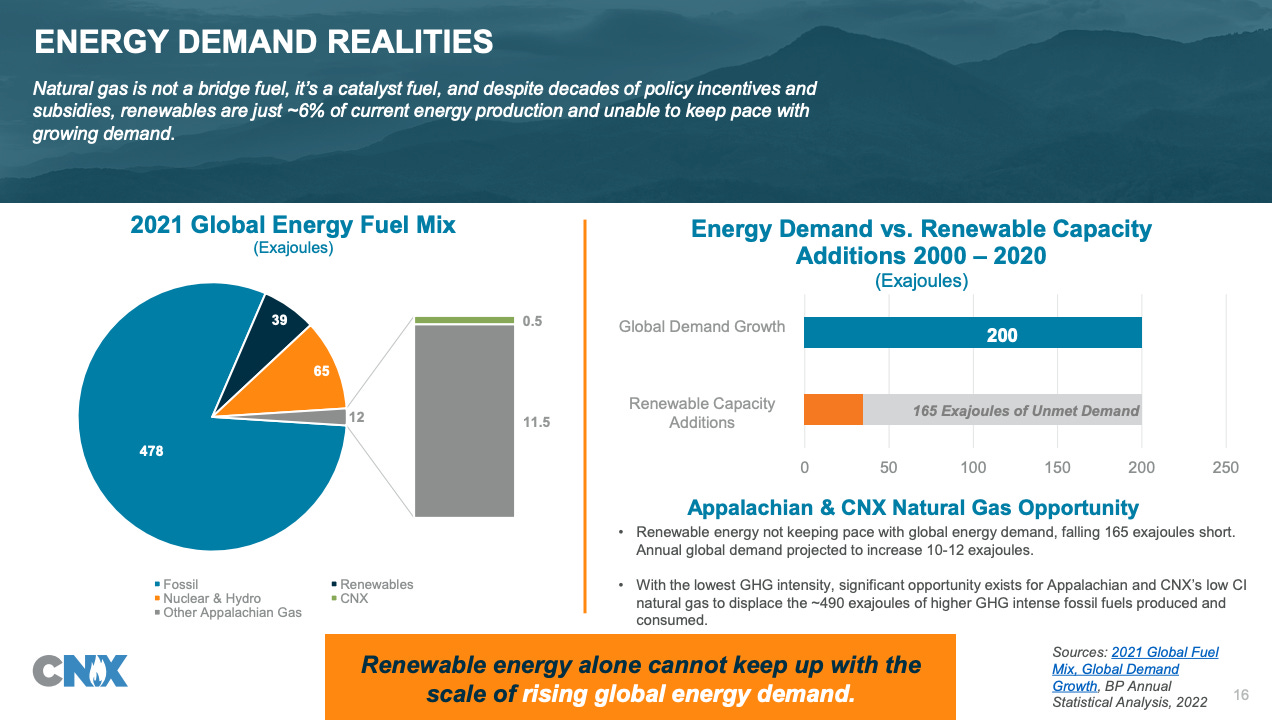

Global energy demand is up by 200 Exajoules since 2000 with renewable energy capacity only up to 35 Exajoules. Renewable sources simply cannot currently meet the growing energy demand so we will rely on natural gas for many years to come.

I believe we will become more reliant on natural gas as companies like CNX continue to innovate and make production “cleaner”.

*I pulled the slides above from CNX’s “Appalachia First” presentation which I highly encourage you to check out if you want to learn more about management’s long-term vision for natural gas (linked in the resources section at the end of this report).

CNX’s Strategy & FY 2022 Results

Keep reading with a 7-day free trial

Subscribe to Growth Curve By Austin Lieberman to keep reading this post and get 7 days of free access to the full post archives.