Well, this email is going to be interesting.

First, a quick portfolio update, then we’ll get to why I’m selling Tesla.

Why I’m Selling Tesla

The stock is just ridiculously expensive. I believe they are one of the best automakers in the world. I believe they’re going to keep innovating and move into higher gross margin segments like FSD software, energy storage, and robotics, and I believe that the company will be worth more in the future than it is worth today.

But I also believe much of that is already priced into today’s share price and they have a long way to go before those things begin to move the needle.

Here’s a chart from Fast Graphs. If you look on the right side, you see the blended Price to sales (P/S) ratio is 8.04. The orange line represents the average P/S ratio since 2009 of 9.90.

So you might think… hey, shares are undervalued!

Here’s the thing. Every dollar we have invested into a company is a dollar that could be invested in another company (or kept in cash).

Right now, as excited as I am about the future of Tesla. I can’t justify continuing to own shares when it’s so much more expensive than other companies I could own.

Tesla is trading at a FWD 3 year P/E of 29 while Google is at 13, Datadog is at 52, Taiwan Semi is at 12, and Advance Auto is at 11.

It’s also trading at a premium EV/Sales multiple.

One argument could be that Tesla deserves to trade at a premium multiple. If that’s the case then it either needs to grow a lot faster than my other investment options, or it needs to be more profitable.

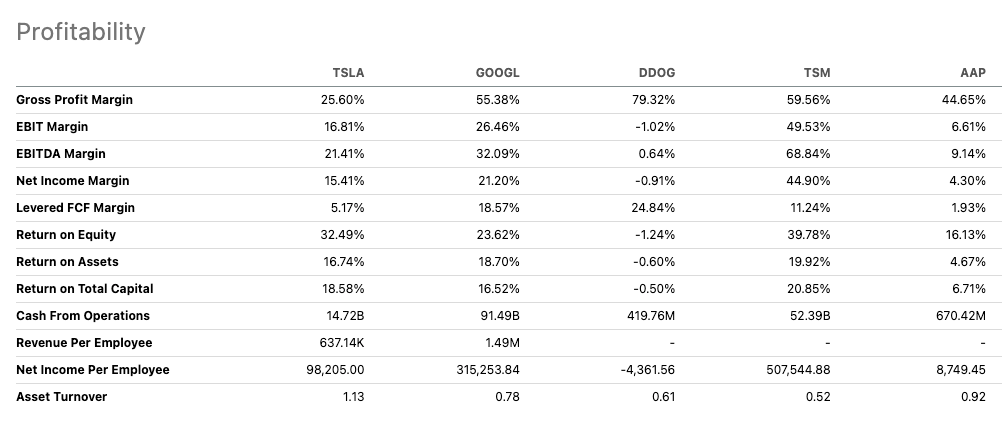

Tesla’s gross profit margin is currently 25% while Google is 55%, Datadog is 79%, TSM is 59%, and AAP is 45%.

As a reminder, gross margin is the amount of money a company has left after subtracting all direct costs of producing or purchasing the goods or services it sells.

Tesla’s FCF margin is 5% while Google’s is 18%, DDOG is 25%, TSM is 11%, and AAP is 1.93%.

So Tesla does not stand out from a profitability standpoint as deserving a premium multiple to these companies.

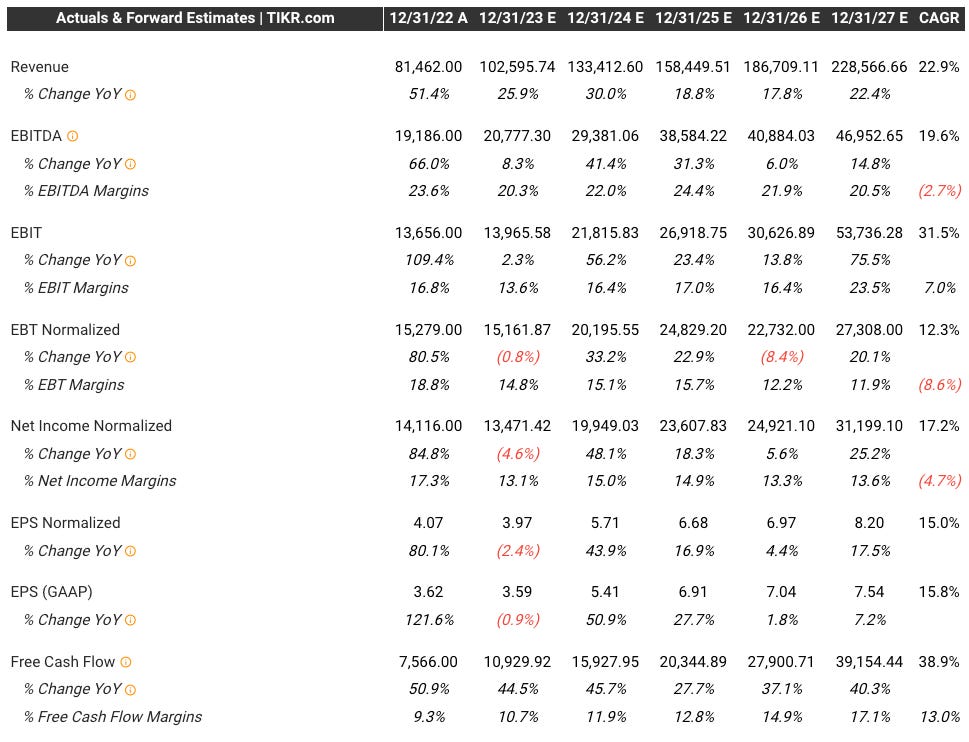

Through 2027, analysts are expecting revenue to compound at 23% per year resulting in $228.5B in annual revenue in 2027, up from $81.5B in 2022.

Analysts are expecting a 2027 income margin of 14% and a FCF margin of 17%

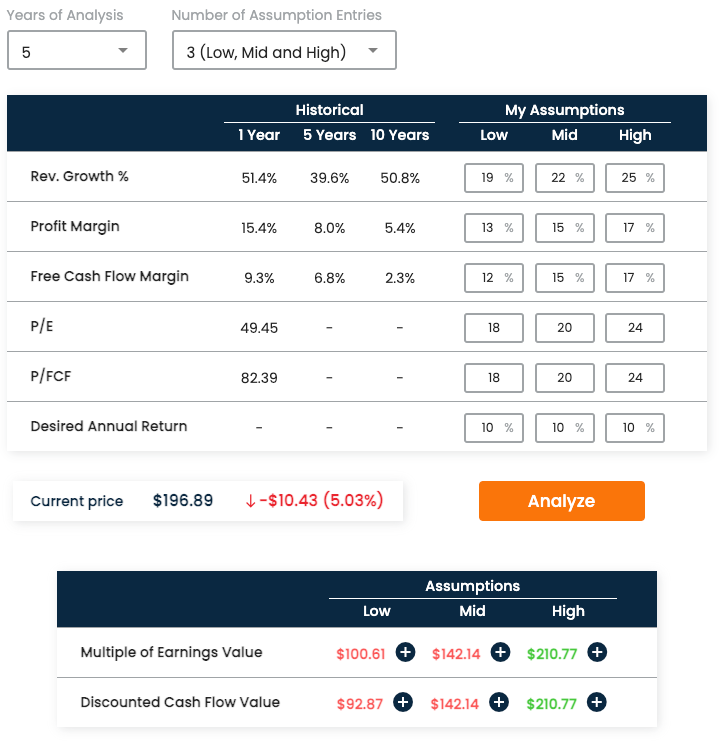

So let’s run a simple 5-year bear/base/bull case using those expectations as a baseline. We’re using low/mid/high revenue growth of 19%/22%/25%, a profit margin of 13%/15%/17%, and a P/E of 18/20/24 with a 10% desired annual return.

If you believe these numbers to be true, you’d need the high scenario to play out in order to hit your 10% annual return goal over the next 5 years.

Someone might argue that 25% revenue growth over the next 5 years is way too low or that Tesla will command a much higher P/E than 24.

With 25% revenue growth and a P/E of 40 five years from now, the current FV is $331. With 30% revenue growth and a P/E of 30 five years from now, the current FV is $309.

If you believe those scenarios to be more probable then the bull case I laid out, then Tesla is a great investment today.

Why I’m buying Advance Auto Parts (AAP)

Now I’m going to bring all of the trolls out of the woodwork and talk about why I’d rather own Advance Auto Parts over Tesla right now.

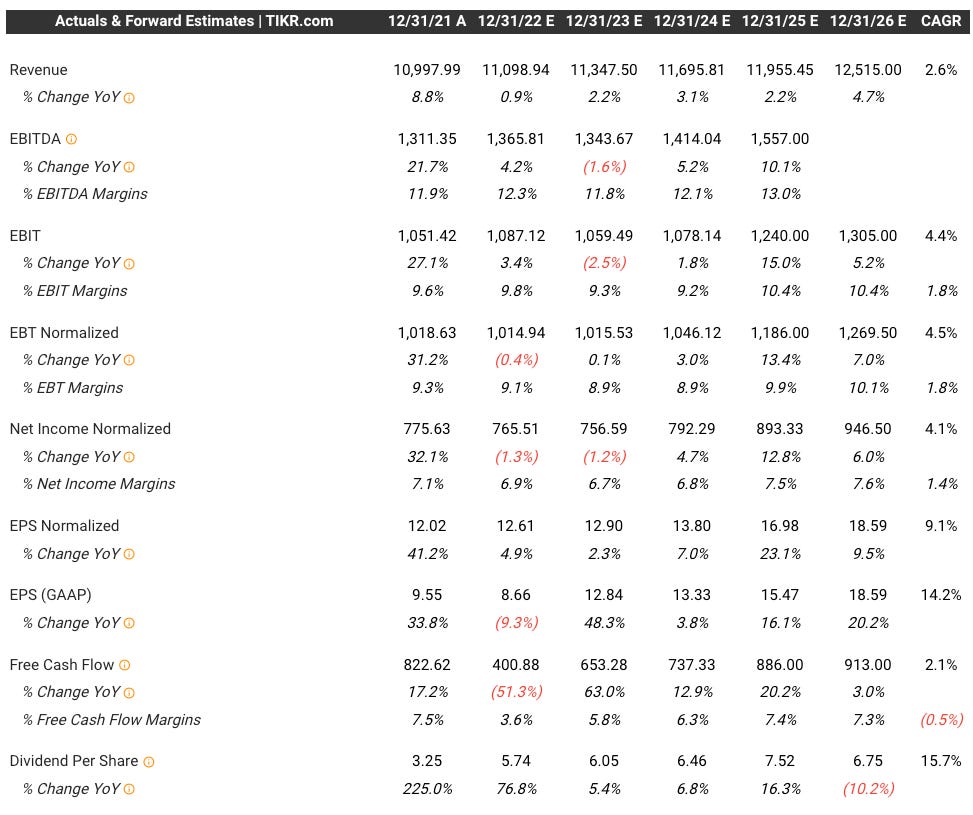

Through 2026, analysts are expecting revenue to compound at 2.6% results in $12.5B in revenue, up from $11B in 2021.

Analysts are expecting a 2026 income margin of 7.6% and a free cash flow margin of 7.3% with a $6.75 dividend per share, up from $3.25 in 2021.

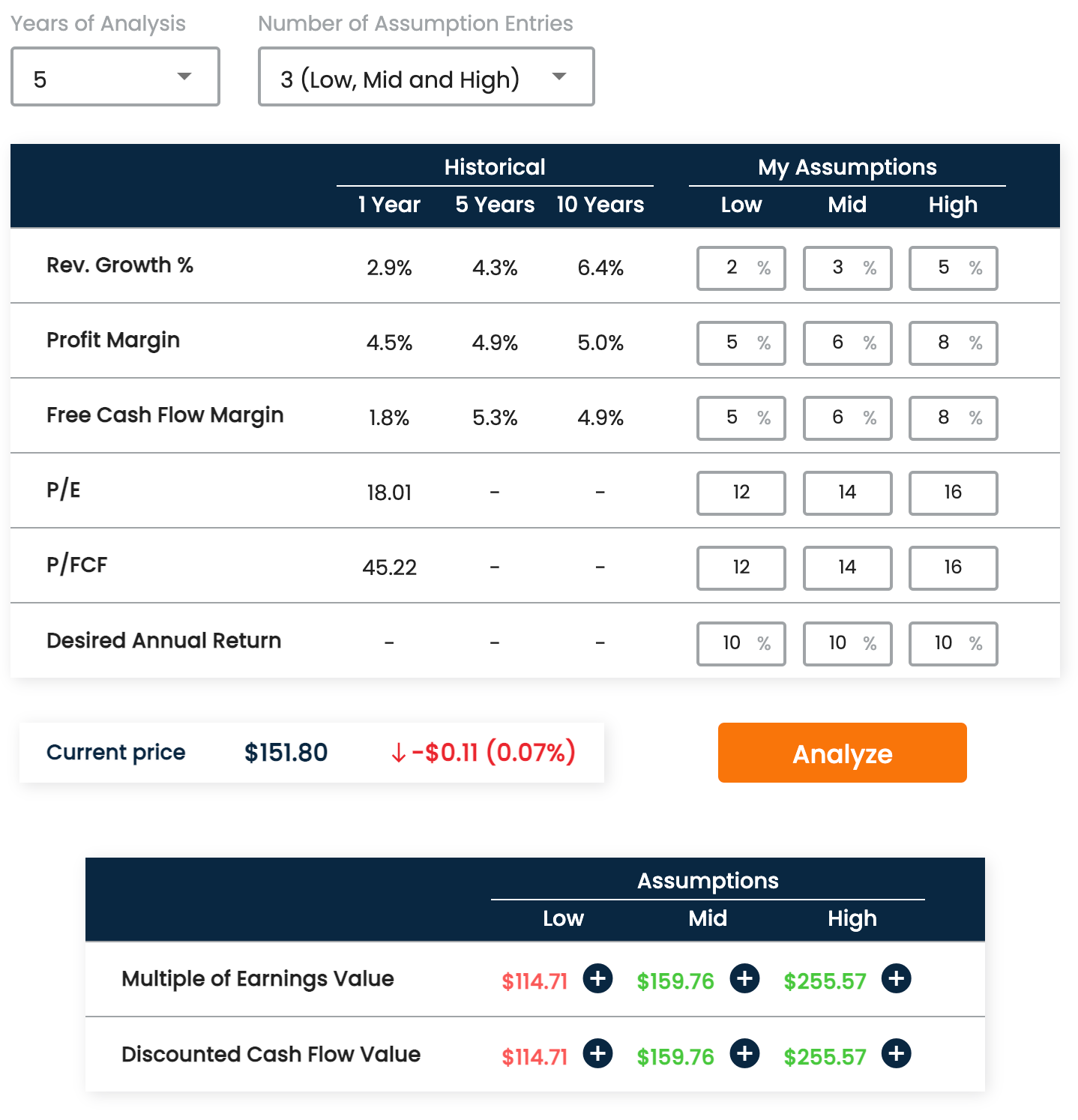

So let’s run a simple 5-year bear/base/bull case using those expectations as a baseline. We’re using low/mid/high revenue growth of 2%/3%/5%, a profit margin of 5%/6%/8%, and a P/E of 12/14/16 with a 10% desired annual return.

This scenario gives investors a better outcome over the next 5 years than Tesla. It also doesn’t take into account share dilution/buybacks.

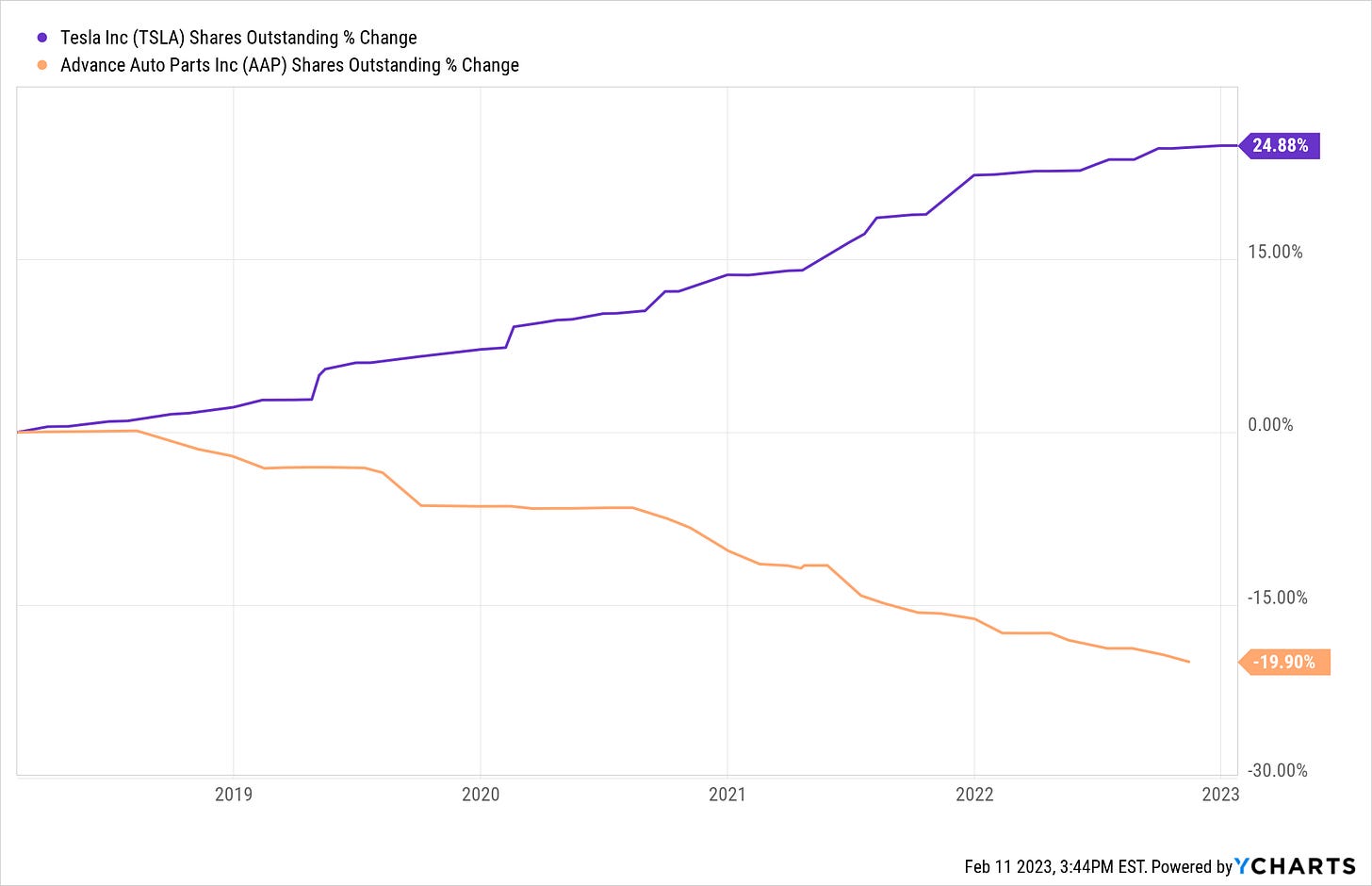

Over the last 5 years, Tesla shares outstanding have increased by 25% while Advance Auto shares outstanding have decreased by 20%

The scenario also doesn’t take dividends into account. AAP currently yields roughly 4%, while Tesla does not pay a dividend.

On Monday I will be selling $16,709 of Tesla and buying $16,709 of AAP.

I can already see the hate mail I’m going to get. I’m fine with that. I’m not trying to make anyone happy.

I’m trying to build long-term wealth, and I’m sharing my thoughts, decisions, and performance along the way.

I like it