Trimming META

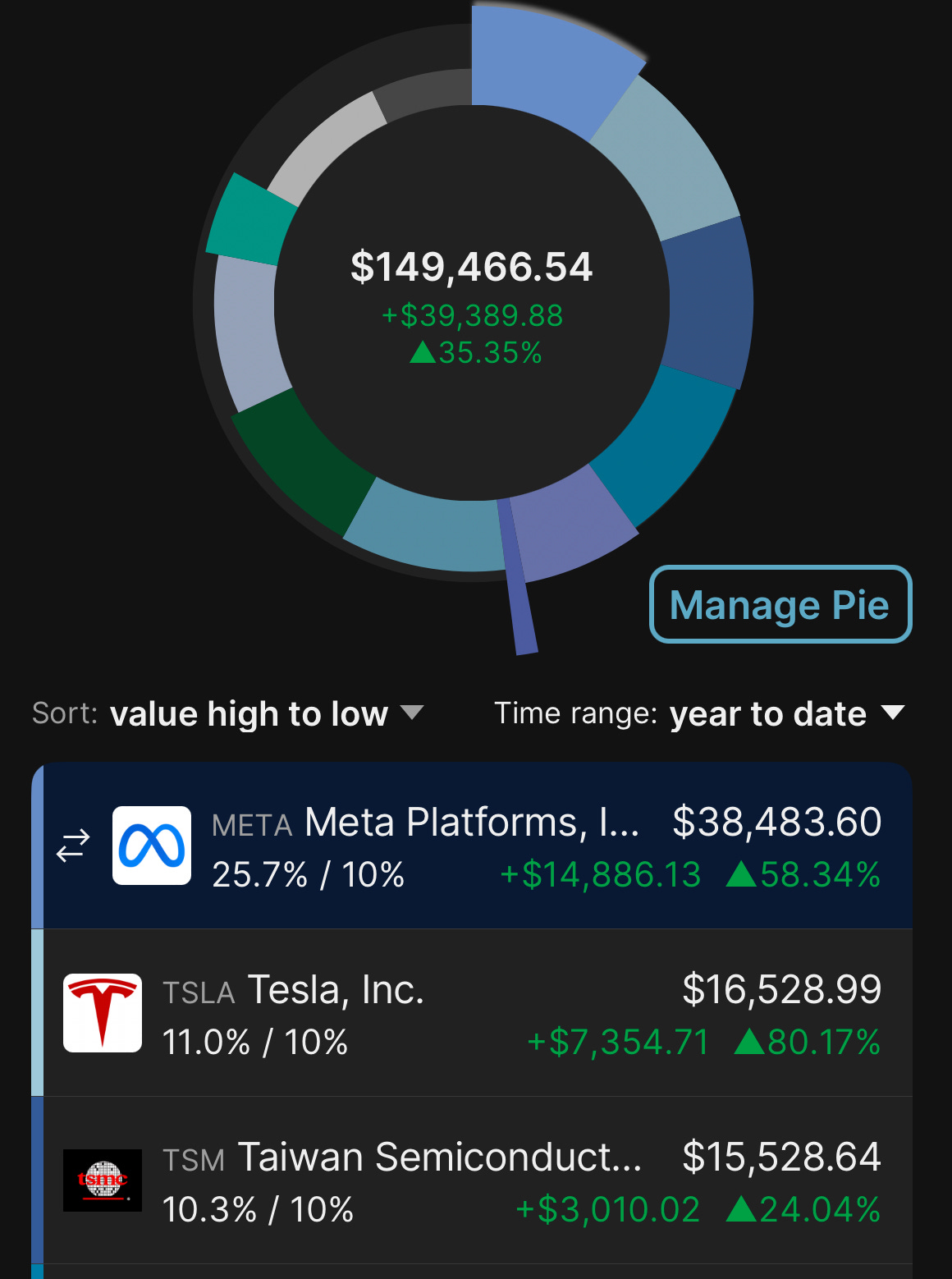

META has grown to a 26% position in the portfolio and although I’m still bullish on the company long-term, it makes sense to trim that down to roughly a 10% position.

Why?

Because I oversized the position since I thought it was extremely undervalued due to all of the negative sentiment from TikTok competition, and Zuckerberg investing so heavily in Reality Labs.

My thesis was that they’d overcome the TikTok competition (at least not die from it) and that Zuck would reign in spending a bit. Both of those things came true and I’m up 58% on the position.

More importantly for my reason to trim, there is still competition, there are still a lot of unknowns related to reality labs, I don’t want to be overexposed to any single position, and after the crazy gain, it now trades in line with other quality companies like GOOGL.

Buying GOOGL

Google is now entering a period of negative sentiment as ChatGPT is all the rage and people are saying it’s the death of Google search. Although Google isn’t trading at nearly the discount that I thought META used to be, it is now trading in line with META from a multiple perspective.

I believe both of these businesses have similar probabilities of success so it makes sense to own an equal-sized 10% position in both of them.

What I like about Google that I don’t get with META is the exposure to Google Cloud and YouTube. I personally believe the next 5 - 10 years are going to be when YouTube really starts to shine.

Let’s put some numbers behind this decision

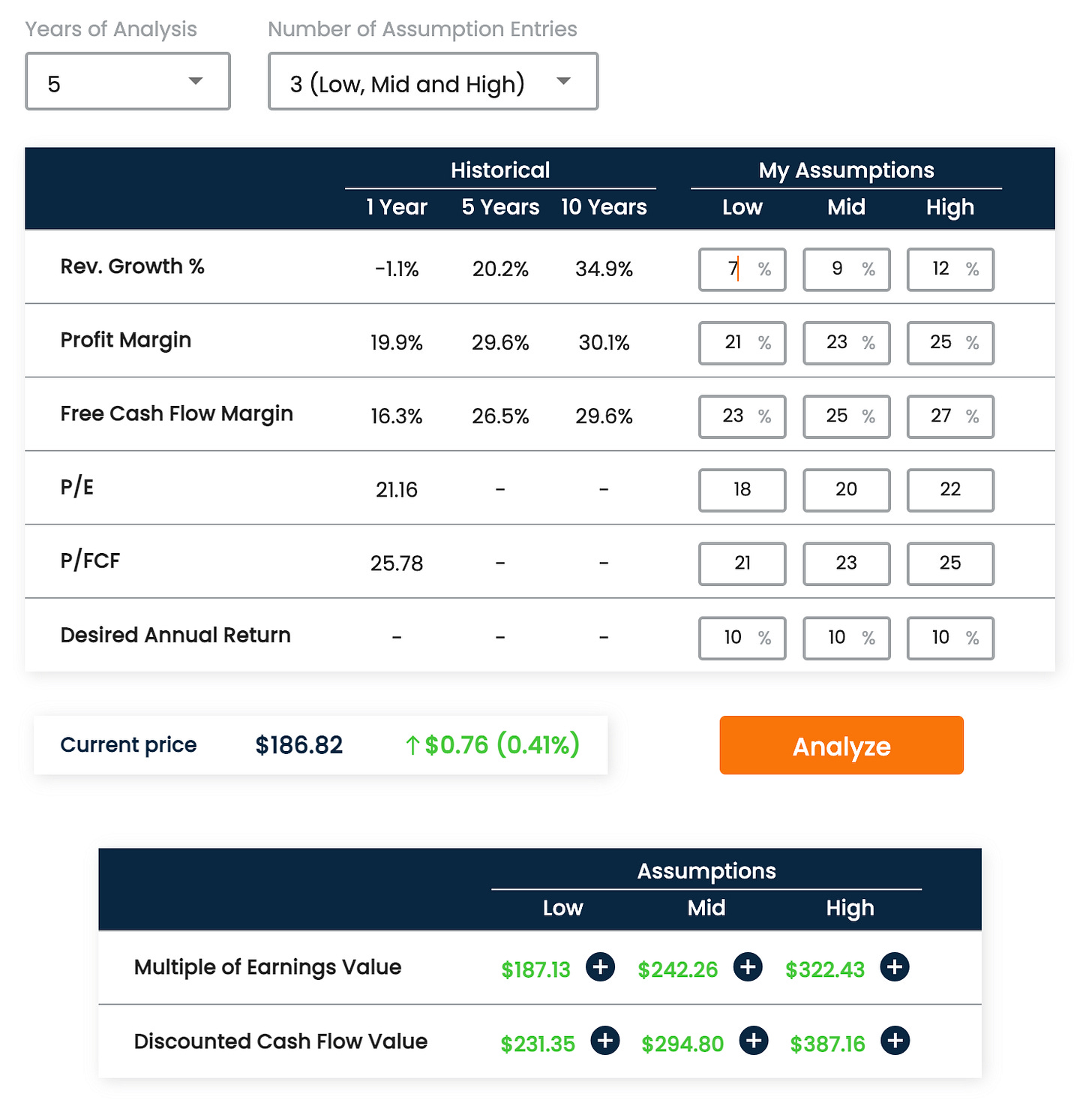

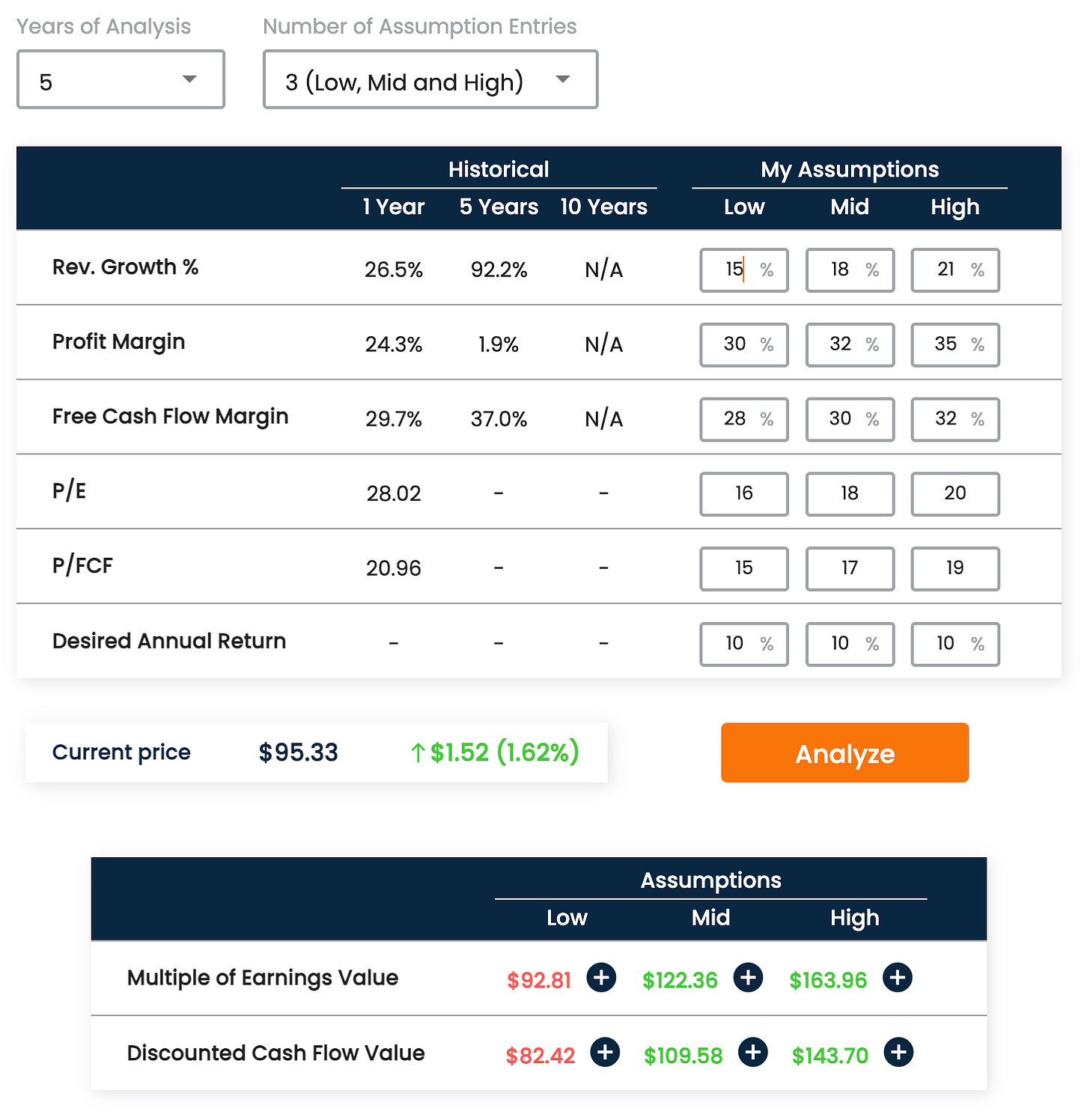

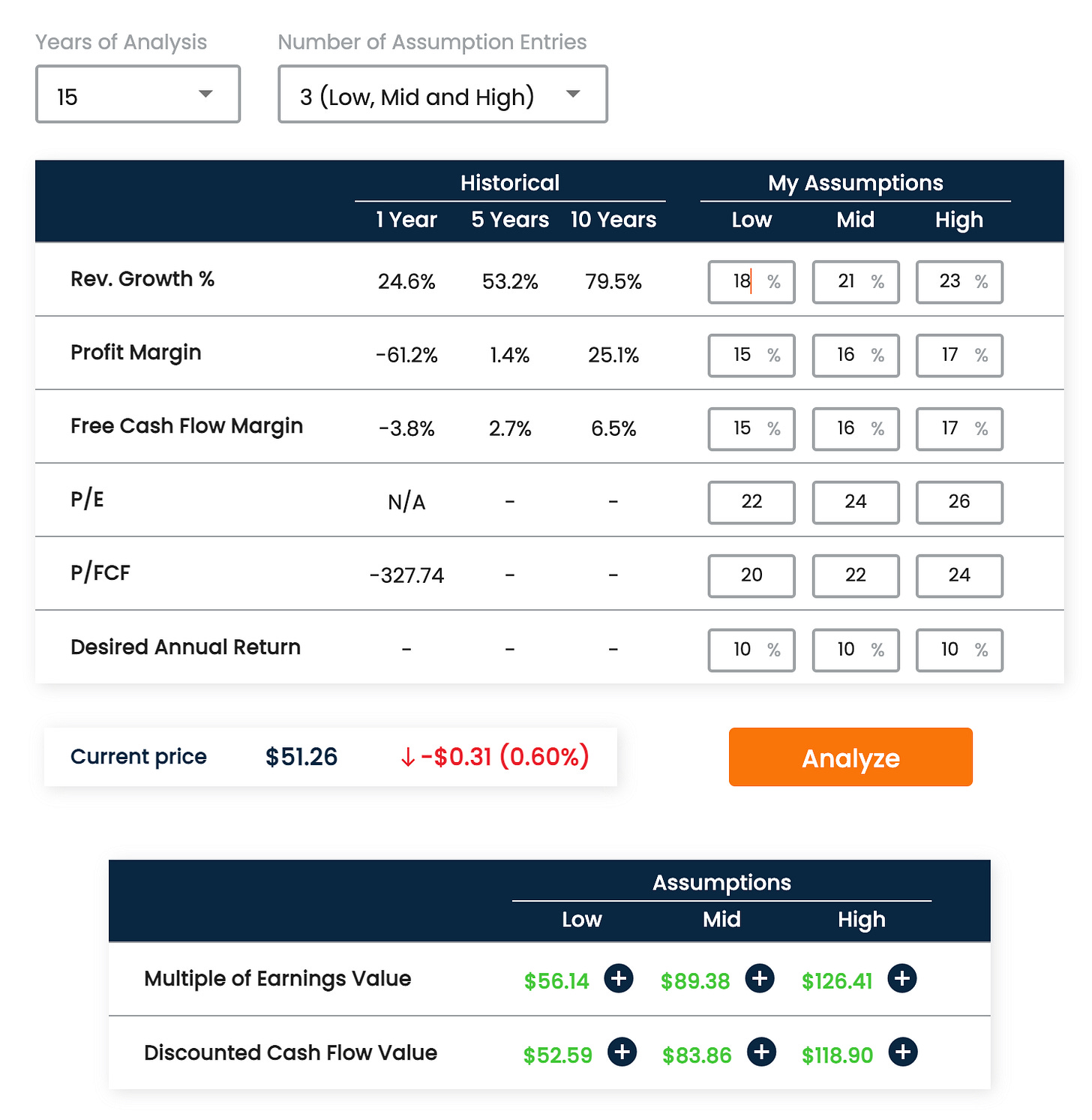

Here’s a low, middle, and high scenario that shows what price you’d buy META at right now if you believed the scenario to be true and wanted a 10% annual return.

On a P/E basis this means I’d be willing to be at $187, $242, or $322 depending on if I believed the low, middle, or high scenario to be true over the next 5 years.

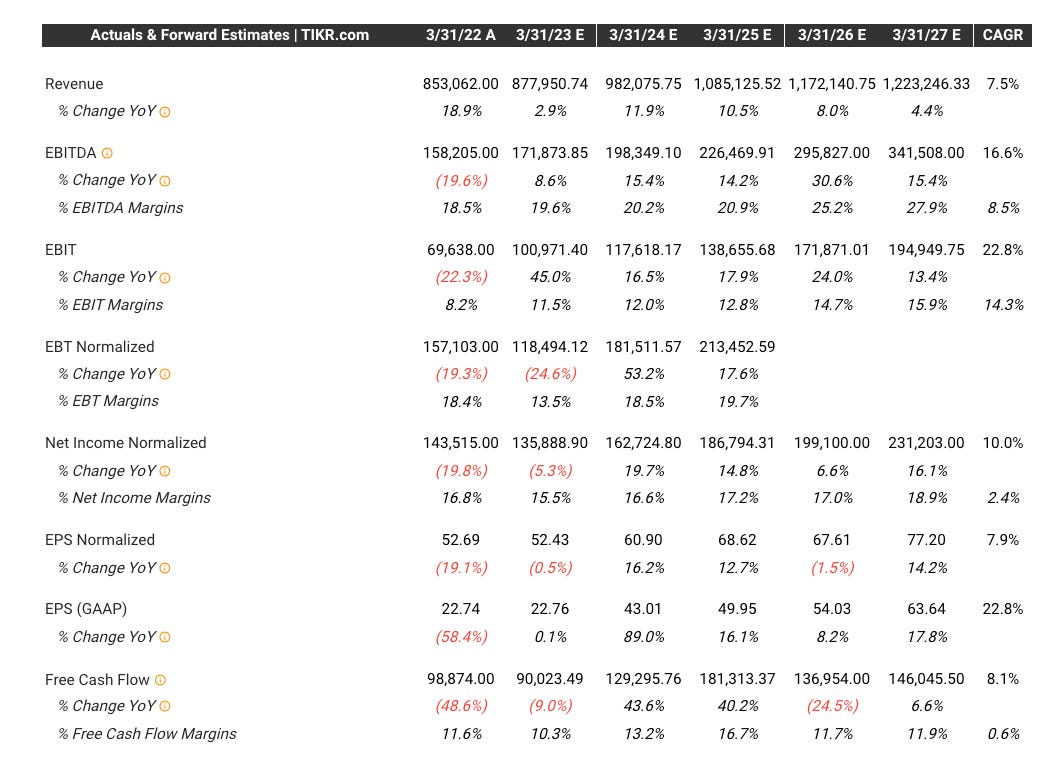

I don’t just make these scenarios up on my own. I used analyst estimates and historical performance as a base line, and then add a little of my own bias in while trying to stay “conservative”

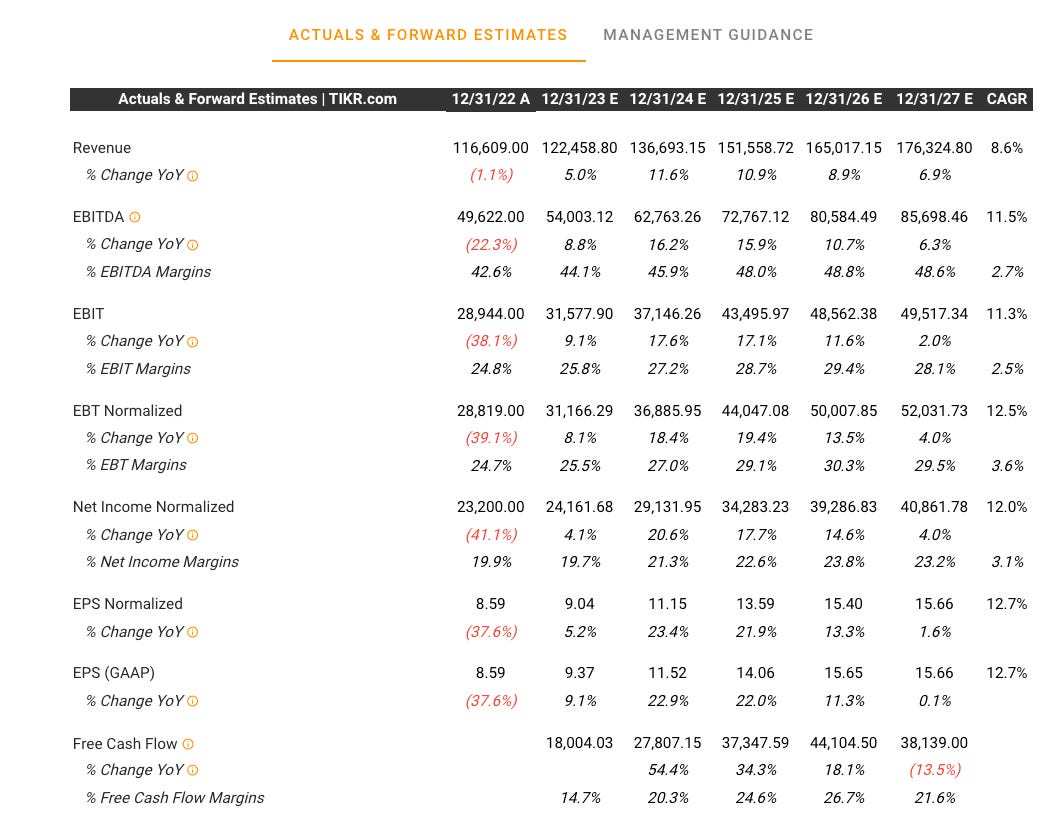

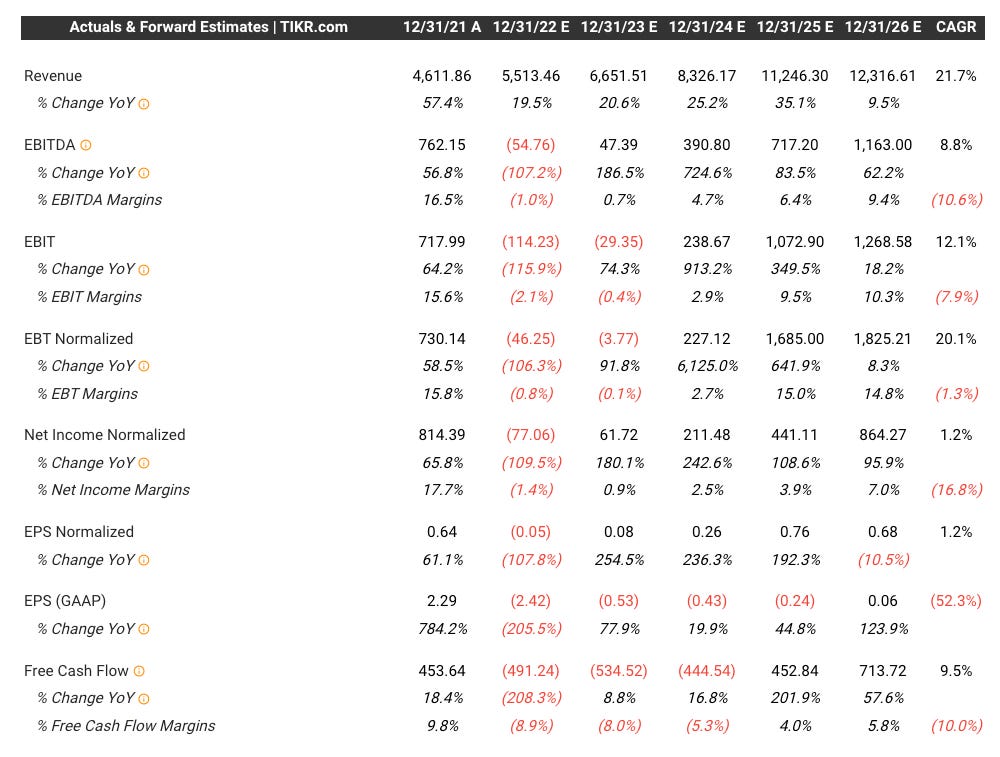

Here are the analyst estimates for META through 2027

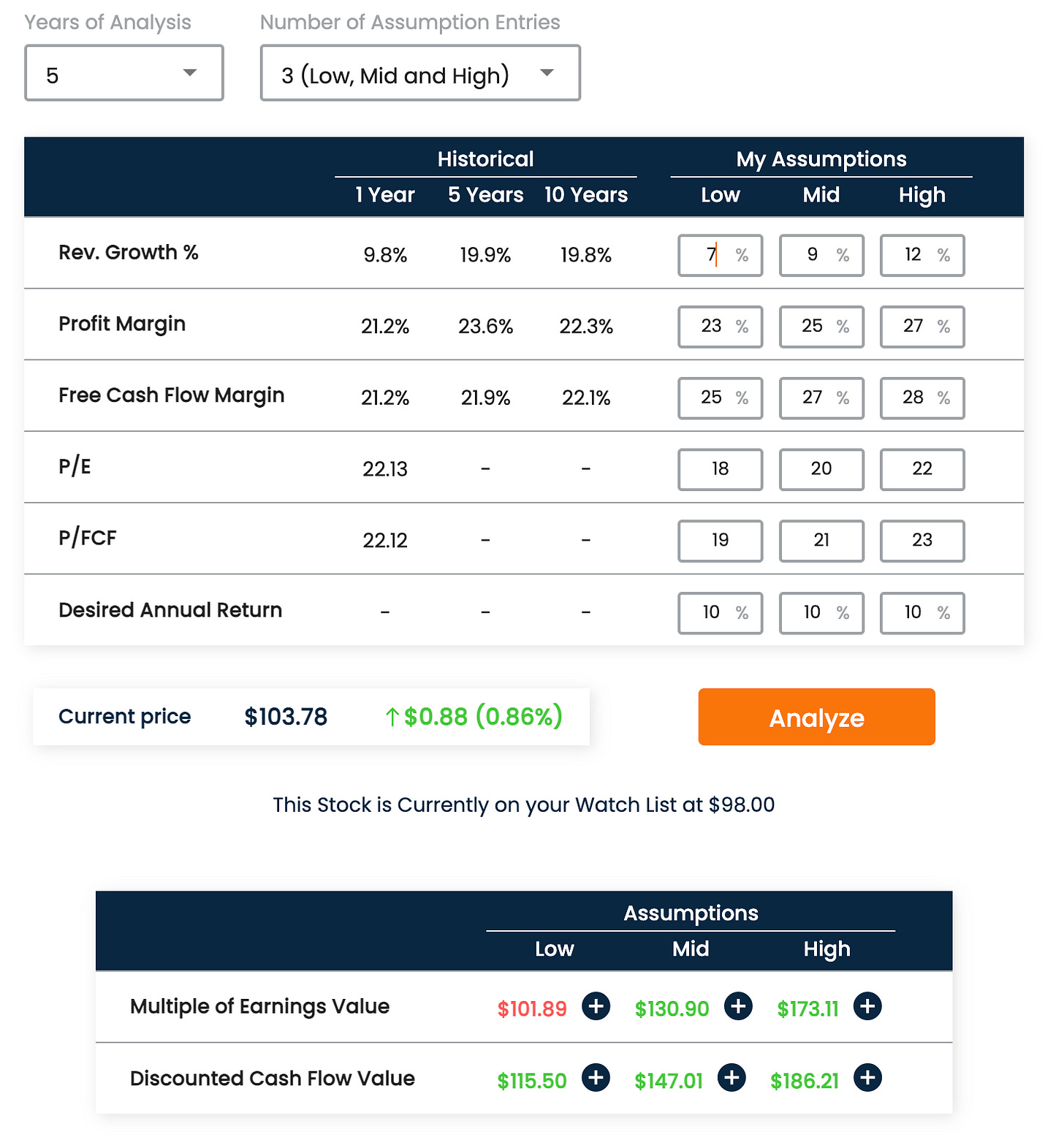

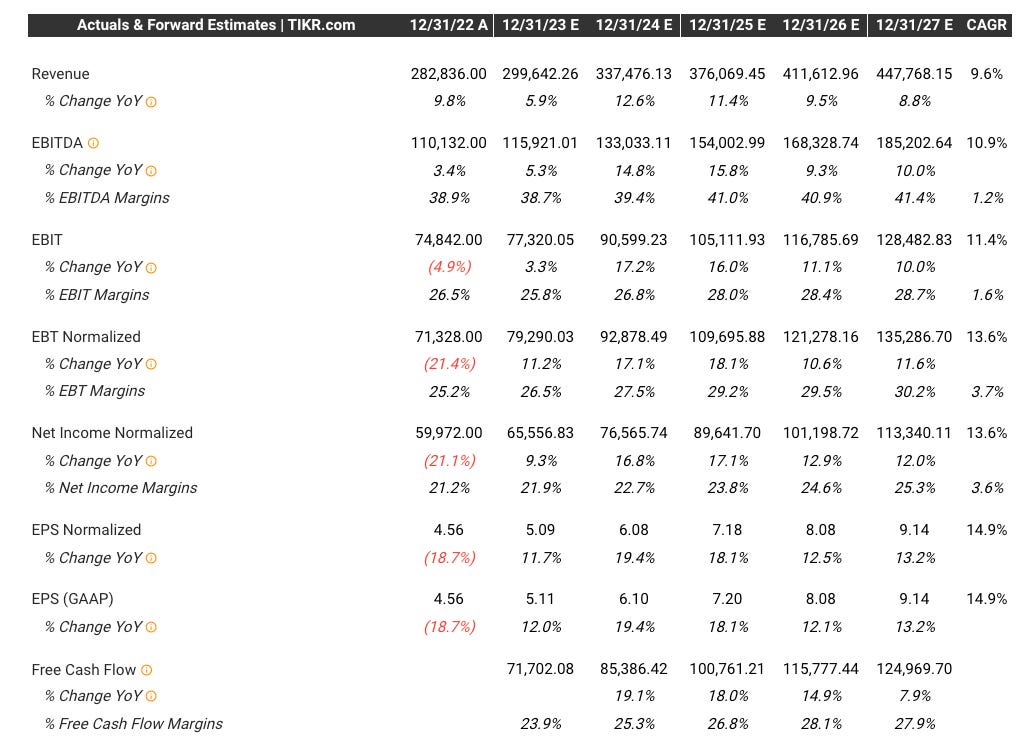

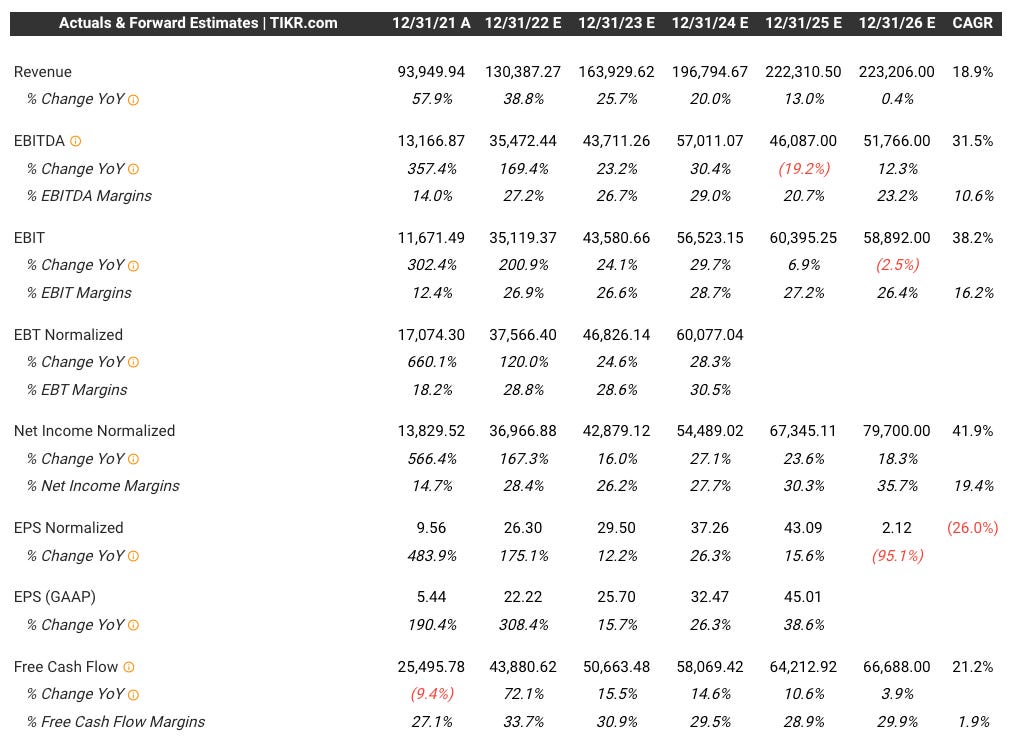

Now for GOOGL

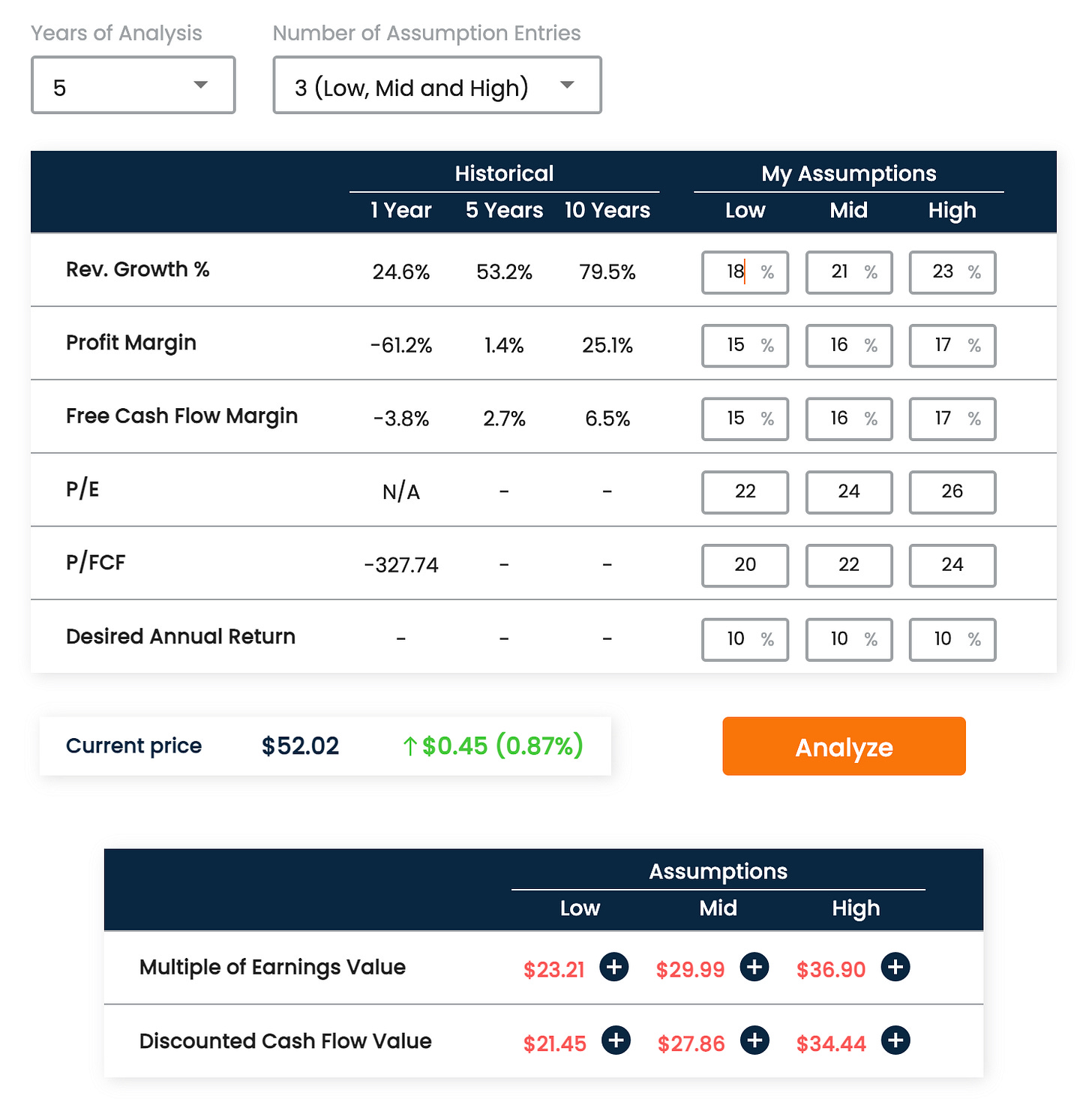

The low, middle, and high buy prices would be $101, $130, and $173 which is slightly less of a discount than what META is showing.

But here’s the thing.. these are all just estimates. If I had to guess, over the next 5 years, there’s more confidence around Google’s future than META’s and Google would like trade at a higher multiple than META. I have them at the same multiple in these scenarios.

But again… everything here is an assumption and no one has any idea what will actually happen.

So both these companies are great companies and these numbers are close enough that I want to own an even position in each. Simple as that.

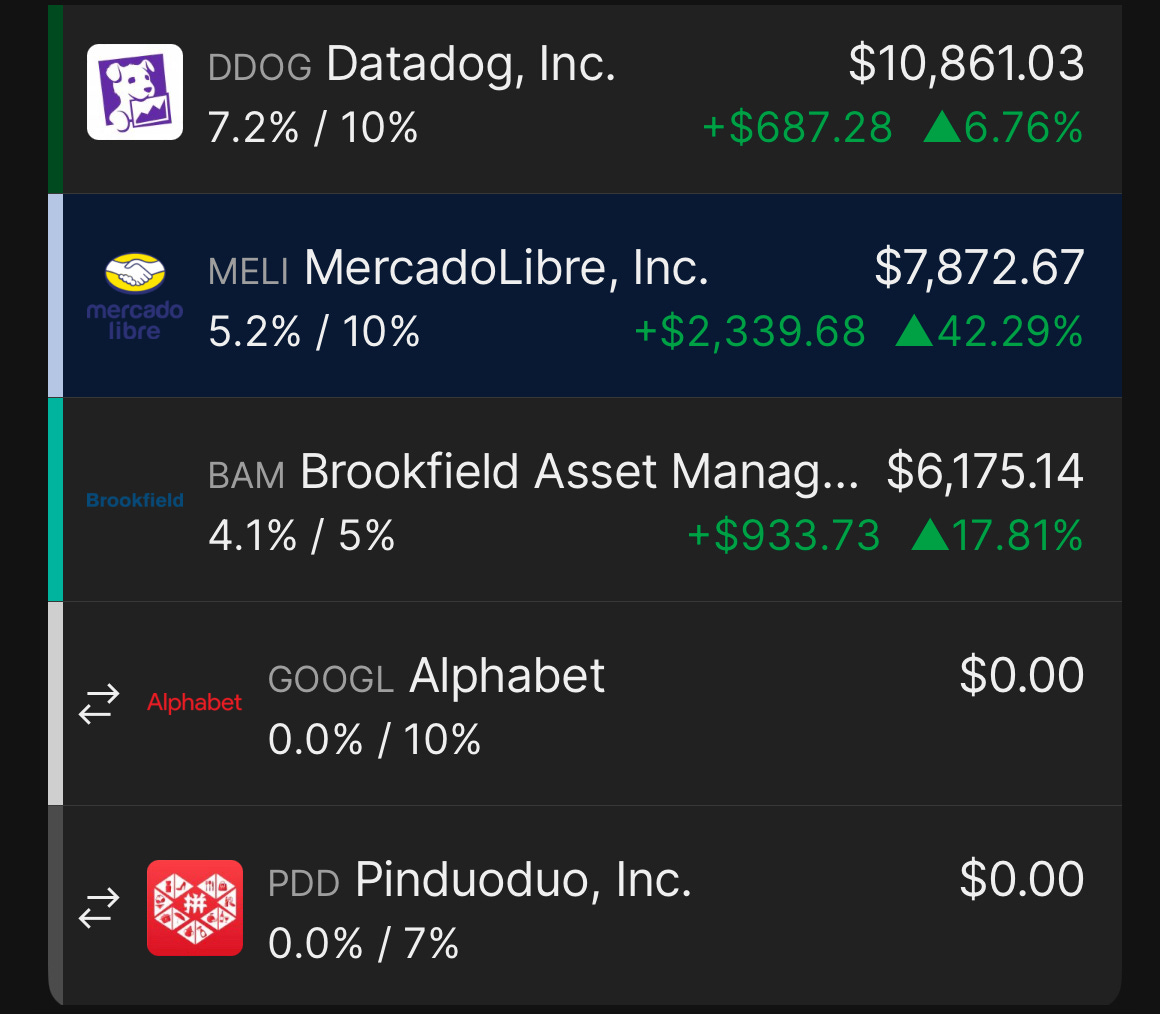

Full portfolio and why the heck I’m buying BABA and PDD

Let’s cover BABA and PDD then I’ll show the whole portfolio

I need to start by saying that it might just be better to own Amazon, Google, or Meta instead of either of these because it eliminates the China-risk. These are certainly riskier than those companies.

My reason for buying them…. They are super cheap because of fears around Chinese-related equities and I think they are two premier internet-based companies in China that still has a ton of growth for eCommerce ahead.

In the price scenarios, notice I use a discounted P/E multiple compared to Google and Meta. I think they’ll always trade at a “discount” to U.S. peers due to the China-risks. I also tried to use what I think are very conservative revenue growth and profit margin assumptions so there’s a chance they significantly beat these assumptions.

I don’t see myself holding these for longer than 3 years. If I do, I’d probably trim them to 5% each, so I would only have 10% of the portfolio in Chinese stocks at that time.

BABA low, middle, and high buy prices: $123, $164, $206

PDD low, middle, and high buy price: $92, $122, $163

Why the heck did you sell SHOP for these risky Chinese companies?!

As much as I love Shopify, it is EXTREMELY expensive. In the 5-year scenario, the low, middle, and high buy prices are $23, $29, and $26.

I know this will get criticism because I used P/E but check it out… I also kept 18%, 21%, and 23% revenue growth with 15%, 16%, and 17% profit margin (way higher than analyst estimates) out to 10, and 15 years.

Basically, to get a 200% over the next 15 years, you need 23% annual revenue growth over the next 15 years, a 17% profit margin, and a P/E of 26 (15 years from now). I don’t like my chances there (especially when I can own META, GOOGL, and others way cheaper).

Portfolio update

After these changes, the portfolio is going to be much more balanced. I heavily invested in Cloud/SaaS and META in 2022 because I thought they were trading at discounts.

Many of the companies I owned recovered significantly back into what I think is overvalued territory so it made sense to rebalance the portfolio so I don’t get hurt by my own overconfidence.

I fully intend to hold positions for 3+ years, but when you get 2-3 years of gains in 3 months, it’s silly not to make some adjustments.

In the screenshots below, the % you see under each company is the current position size, then my target size. The target size is where I intend to keep them. So META is currently 25.7% but I’ll be keeping it at 10% moving forward.

Happy to answer questions in the comments. Remember, there’s a difference between questions/sharing opinions and being a troll. If you’re a troll I’ll just ban you from the newsletter because I don’t want your money.

2013 Raptor teammate here, love the videos, subscription, and analysis. Following for the long term! Thanks man

What do you think about $hood