Full Portfolio Update, Top Buys For June, & UGEIF 270% Buyout Premium

Portfolio update, what I’m buying lately, and what I plan to do with my UGEIF shares after the buyout offer

Hey everyone, I’m able to write weekly and share my portfolio publicly again so….I’m back!

I started investing in 2011/2012 when I stumbled across The Motley Fool and fell in love with David Gardner’s “Rule Breaker” style of investing. His approach appealed to me because it is basically like a Venture Capital approach to public markets. I also really loved how The Fool paid services (which I was a paying member of for years) never tried to time the market. They recommended buying every month (or every paycheck) regardless of what the market was doing and they don’t sell very often.

That style is so approachable for individuals who work full-time jobs, own their own businesses, etc which is exactly why it worked for me.

I started this newsletter because as much as I loved The Motley Fool, I felt their subscriber base had gotten so large that they were moving markets every time they came out with recommendations (you can see this happen still today). I don’t think they had any ill-intent with this. In fact I think it’s the opposite. They are aware of this and because of this, they are only able to recommend stocks with large enough market caps and enough trading volume that they won’t influence the share price too much.

So that left a lot of really great businesses off the table and I wanted to share my thoughts/research on under-followed companies.

I admittedly and mistakenly veered away from the long-term investing approach with this newsletter and I strayed too far off the core of the long-term Motley Fool approach that resonated so much with me as an individual investor.

So with the re-launch of The Growth Curve newsletter you can expect:

Me sharing my long-term investing approach that works for people who don’t stare at the market all day. I will buy companies with the intent of owning shares for years.

Sharing my portfolio weekly and the purchases I make every two weeks as I regularly contribute to my portfolio from my pay checks. I’ll share any sales as well although my goal is to sell very infrequently.

Weekly research & analysis of the companies in my portfolio and new companies I’m considering buying.

I’m mostly searching for stocks with a market cap between $100M and $10B but I won’t exclude stocks with a larger market cap (I currently own Amazon) or dividend payers (I own BN and BEPC) If I think there are great undervalued opportunities in larger market cap stocks.

Today we’re covering:

What I’m doing with my $UGEIF ($UGE.V) shares after the recent buyout offer at a 270% premium to where the stock was previously trading.

My top buys for June 2024.

Sharing my full portfolio and how I’m thinking about the overall market.

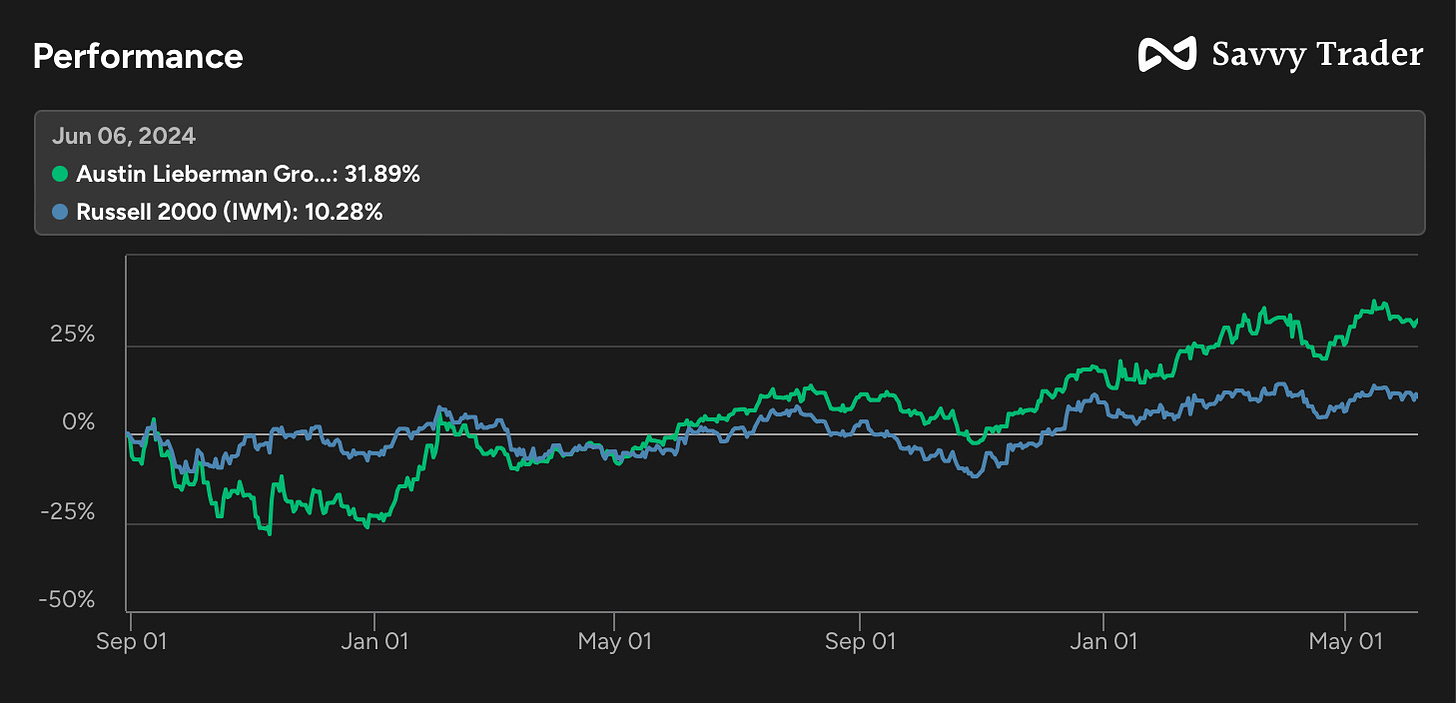

Let’s start with a quick performance review. I’ve used SavvyTrader to track my portfolio and performance since August, 2022.

The way I intend to share my performance is since inception, or in this case, when I started tracking on SavvyTrader in August, 2022. It’s tempting to focus on YTD and shorter time frames but all that really matters is long-term performance.

SavvyTrader lets me compare to SPY, QQQ, IWM, and DJIA. Sharing all four would take up too much room so I’ll compare against the best performing index out of those four (QQQ right now) and the IWM since my portfolio is mostly small/mid caps and that will give a good representation of how I’m performing vs the broader small/mid cap sectors.

QQQ + 54%

My portfolio +32%

IWM +10%

1. What I’m doing with my UGEIF/UGE.V shares after the buyout offer.

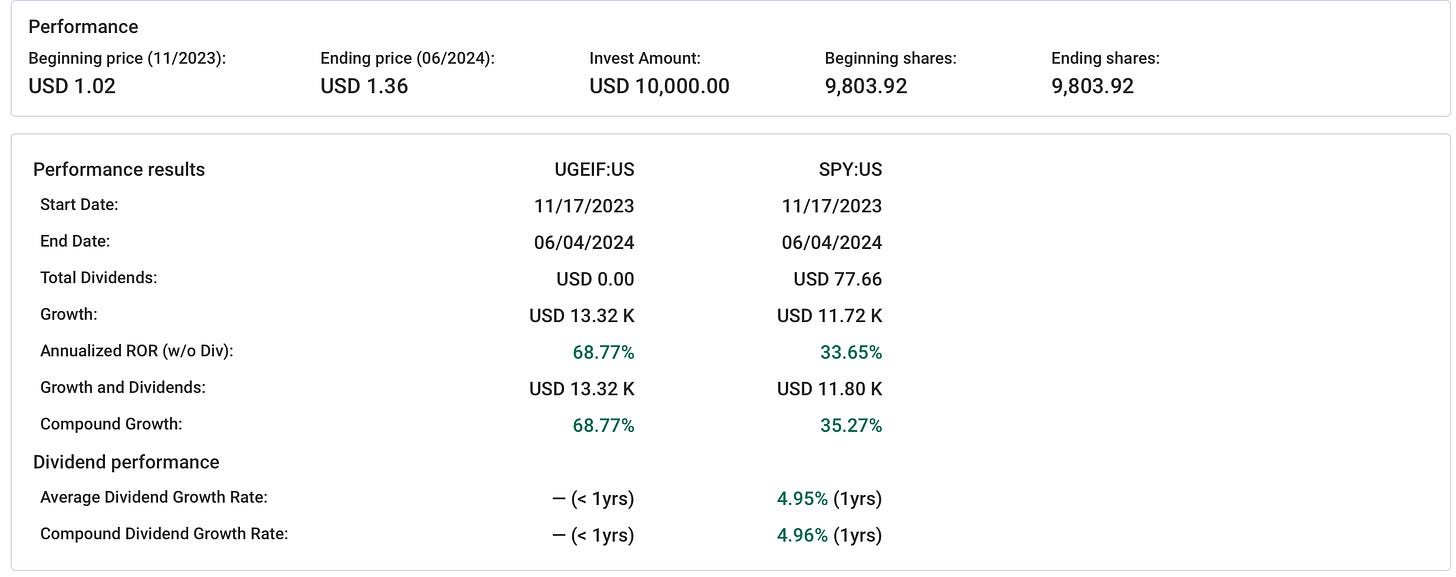

I wrote about the UGEIF in the November 21, 2023 newsletter when shares were at $1.017 (us). After the buyout offer, the stock is trading at $1.36. That’s roughly a 33% gain vs a 17% gain for the S&P500 in roughly seven months.

The screenshot from Fast Graphs below shows the difference of $10k invested in UGEIF and the S&P 500 since November 17 2023.

The stock was trading at around $0.42 before the buyout offer was announced so $1.36 is significant premium from that perspective. However, I think there’s a chance the company could get better buyout offers than its current offer so I’m going to hold onto my shares.

Shareholders will vote in July on whether or not to approve the offer so we should know by then.

One last note on UGEIF. It’s a microcap stock and because of the risks inherent in low volume/microcap stocks, I invested money I was comfortable losing. So if somehow, this offer falls through and the stock drops back to $0.40, I’m fine with that outcome. Others might look at the $1.36/sh and want to cash out now. I don’t blame them if they do.

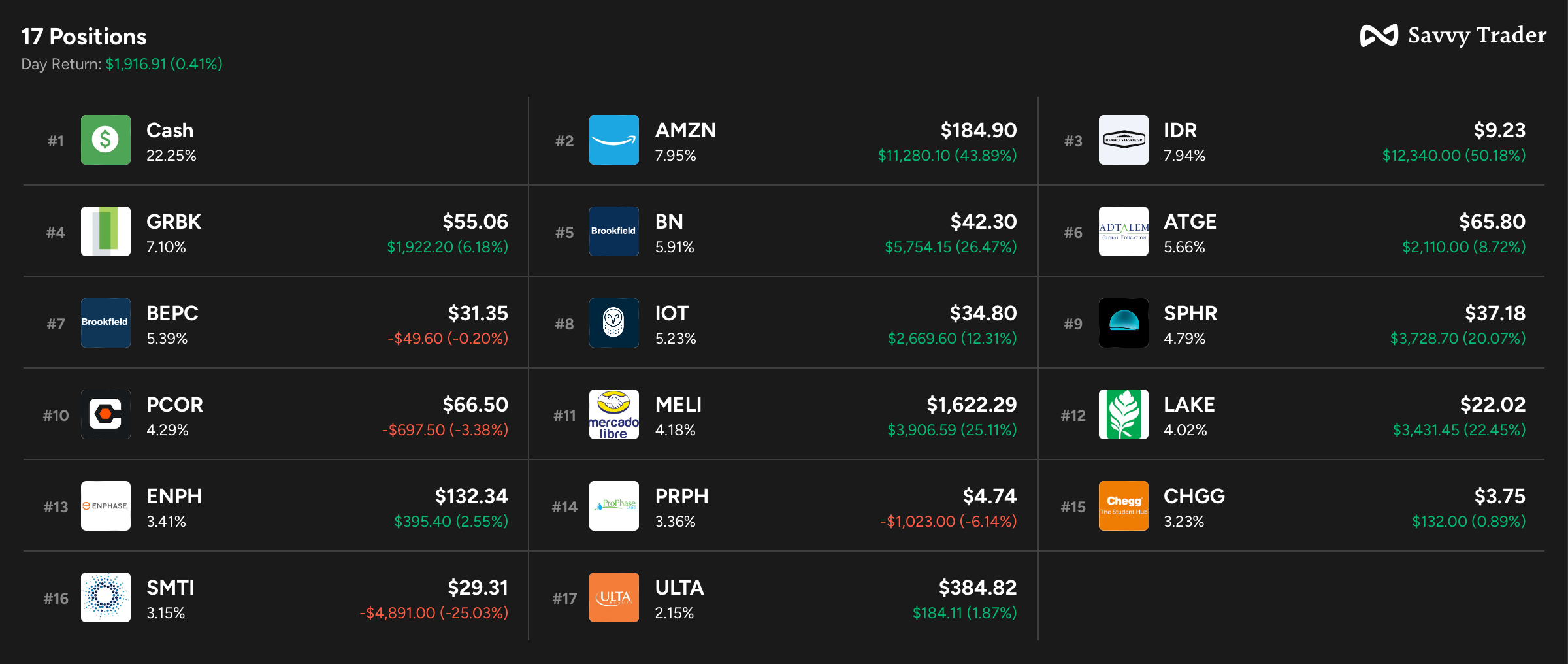

2. My Current Portfolio

One quick note. SavvyTrader is a great way to build and track portfolios but they currently only have data for stocks that trade on larger U.S. exchanges. So I can’t track some stocks like UGEIF/UGE.V on SavvyTrader. But this is still a good representation of my overall performance and the types of companies I want to own long-term.

If I ever have a 100x+ stock that I own that can’t be tracked in SavvyTrader I’ll tell you about it…trust me 😁

Here are the 16 companies listed in order of position size. UGEIF makes 17 and it’s roughly 2% of my overall holdings.

Cash is my largest current position at 22%. I evaluate opportunities on a company by company basis and I’ll invest that cash into new opportunities or add to current positions.

3. Recent Transactions

If you align with this type of investing and want weekly portfolio updates, access to my transactions each week, and to be the first to hear about new, under-followed companies I’m researching you should consider starting a paid subscription.

You can get 25% off a paid subscription if you sign up before Tuesday with this link.

Keep reading with a 7-day free trial

Subscribe to Growth Curve By Austin Lieberman to keep reading this post and get 7 days of free access to the full post archives.