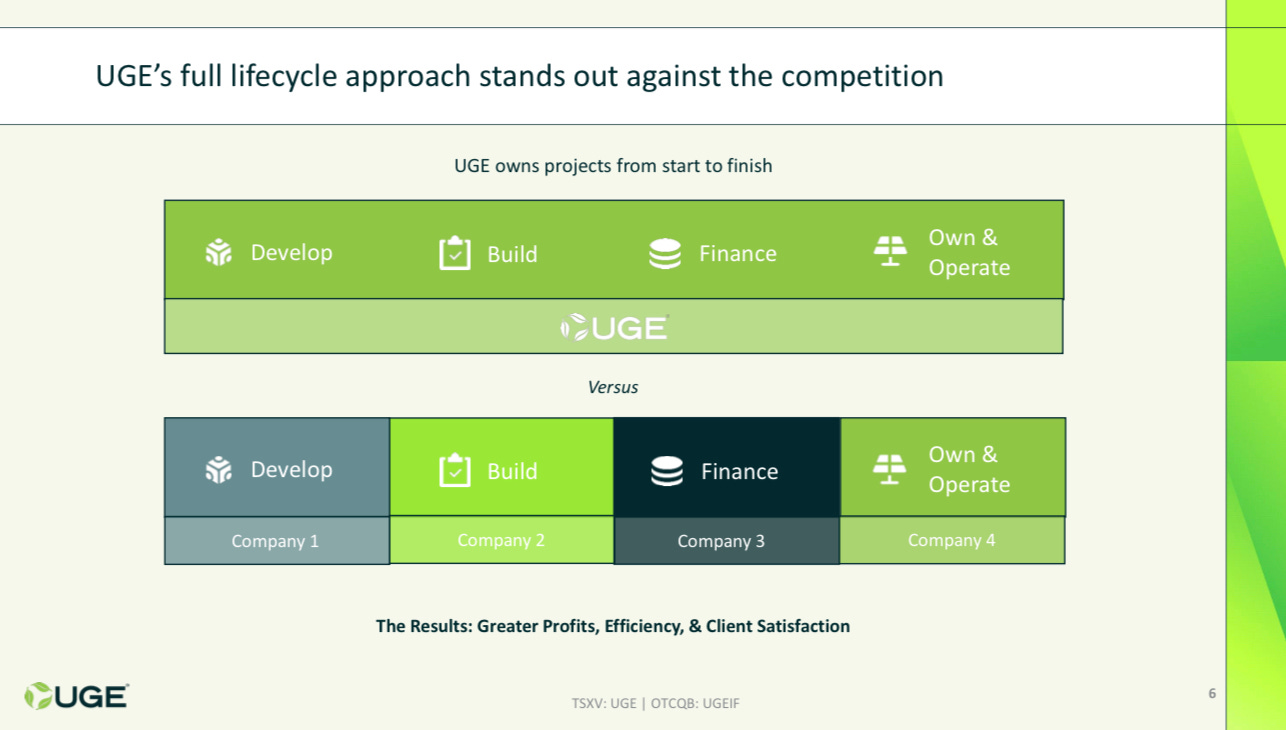

UGE International develops, builds, owns, and operates community solar projects. In 2020 Co-Founder/CEO Nick Blitterswyk transitioned the business away from the engineering, procurement, construction (EPC) to this full lifecycle business model which allows the company to collect developer fees up front, then recurring revenue for 20+ years.

This transition significantly increased the potential lifetime revenue and profitability of each project.

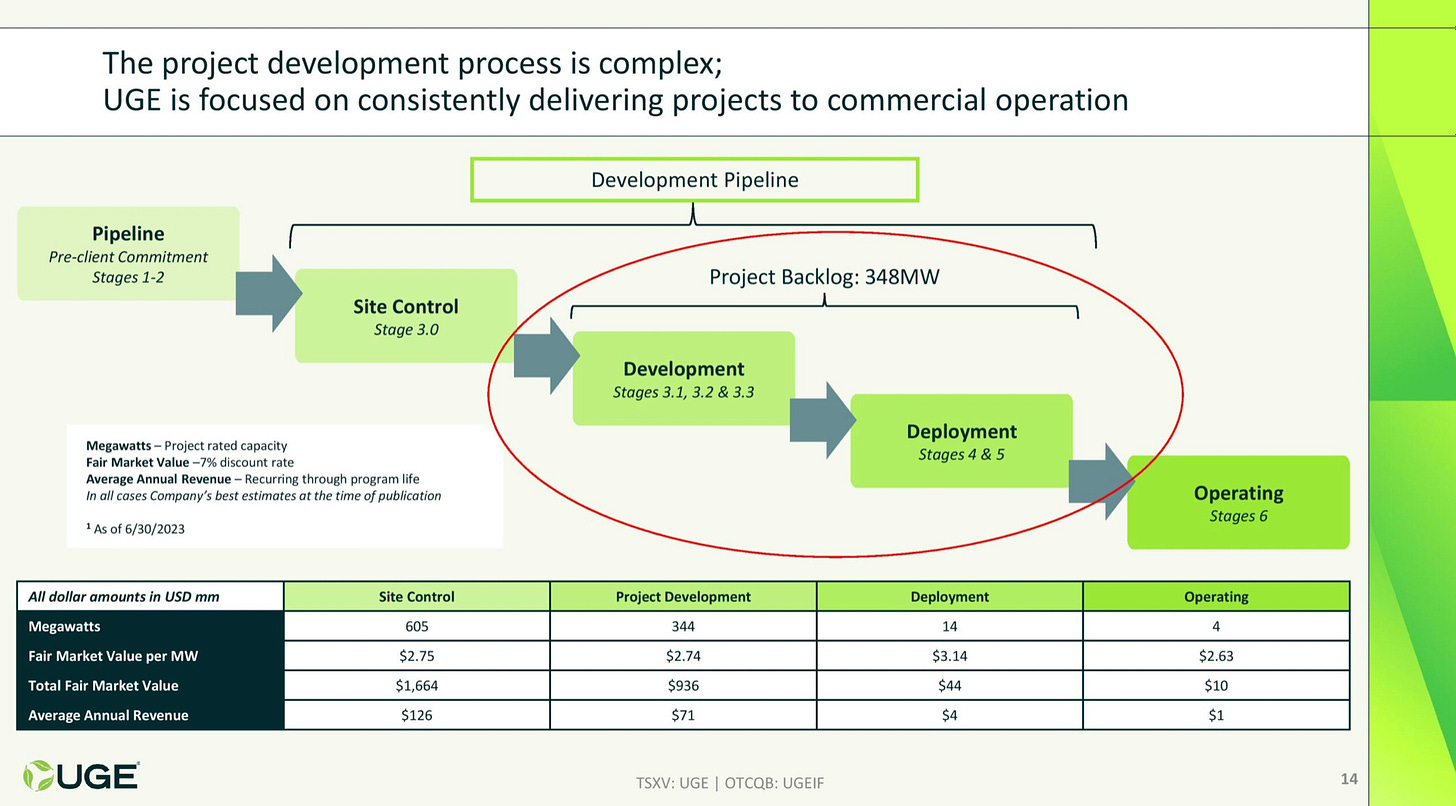

The company has executed 750+ projects (most under the far less profitable EPC model) and has a project backlog of 348MW. According to management, this back log alone represents $139M in one-time fee revenue and $73M per year in operating revenue.

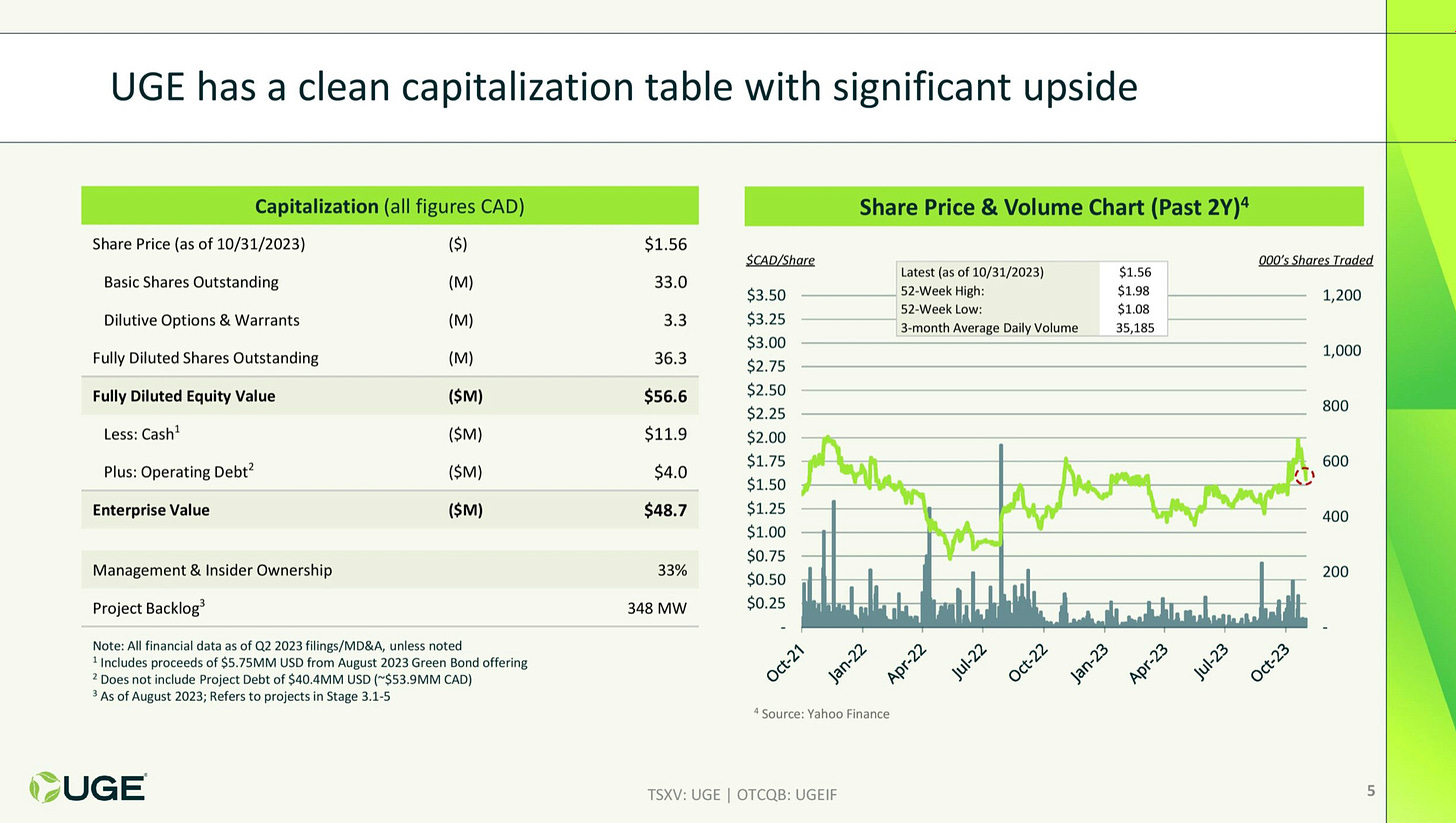

With a market cap of $32M, which is less than half of the annual operating revenue from IGE’s current backlog, I think the market is either saying “I don’t think management will execute” and/or does not understand the benefits of Nick transitioning to the full-life cycle model in 2020.

That’s the opportunity (and the risk).

Disclaimer:

I currently own shares of UGE International (UGEIF), I will buy more shares the day after this newsletter is published, and I intend to accumulate more shares through dollar-cost-averaging in the future. I might change my mind as the information about the company changes.

I can’t give you advice because I’m not a financial advisor. When I talk to close friends or family, I recommend that before they buy individual stocks (especially microcaps) they should have a 3-6 month emergency fund, invest at least up to their employer match in their 401k, and then max their Roth IRA. I tell them to keep 90% of their investments in simple, low-cost ETFs that track the S&P500. That way, if their individual stocks lose 50%+, they won’t destroy their financial future.

Nothing I write is a buy or sell recommendation for anyone else. I am sharing my own research and my own decision-making. You should consult a financial advisor and take full ownership and accountability of your own financial decisions before blindly following anything you read online.

I first discovered UGE International on MicroCapClub.com, where I am a paying member of their community.

The Business

UGE was incorporated on March 18, 2011 by Founder and current CEO Nick Blitterswyk and is headquartered in Ontario, Canada.

Nick keeps a pretty low profile as you’ll see by his LinkedIn. He’s not positioning himself as a thought leader across social media platforms or at speaking events. His entire professional focus appears to be on running UGE.

The data below is pulled from YCharts. Click on any of the metrics below to pull up the historical chart of that specific metric.

November 17, 2023 Valuation:

Market Cap 32.13M

Enterprise Value 62.02M

Share Price 1.017

Shares Outstanding 33.13M

PS Ratio 7.951

PS Ratio (Forward 1y) 6.159

Here’s the business description from a prospectus they filed on November 10th, 2023.

The Company is a solar and energy storage project developer focused on developing commercial and community solar energy solutions that deliver cheaper, cleaner and more reliable electricity. We develop, build, own and operate solar and energy storage projects predominantly in the United States. Community solar is a construct within the solar industry that permits a solar installation to sell energy to end users at utility rates less a discount, thereby allowing people who do not have the ability to install solar of their own accord to participate in green energy production.

The Company has a long history in the mid-scale renewable energy sector and has over 500 megawatts (“MW”) of solar project experience. In 2020, it focused its business to the develop/build/own/operate model and pivoted away from providing engineering, procurement and construction (“EPC”) services to other developers. The Company’s business objectives are to develop, build, own and operate a portfolio of long term, stable, and geographically diversified solar and storage renewable energy facilities to provide shareholders with capital appreciation.

The Company’s long‐term objectives are expected to be achieved by:

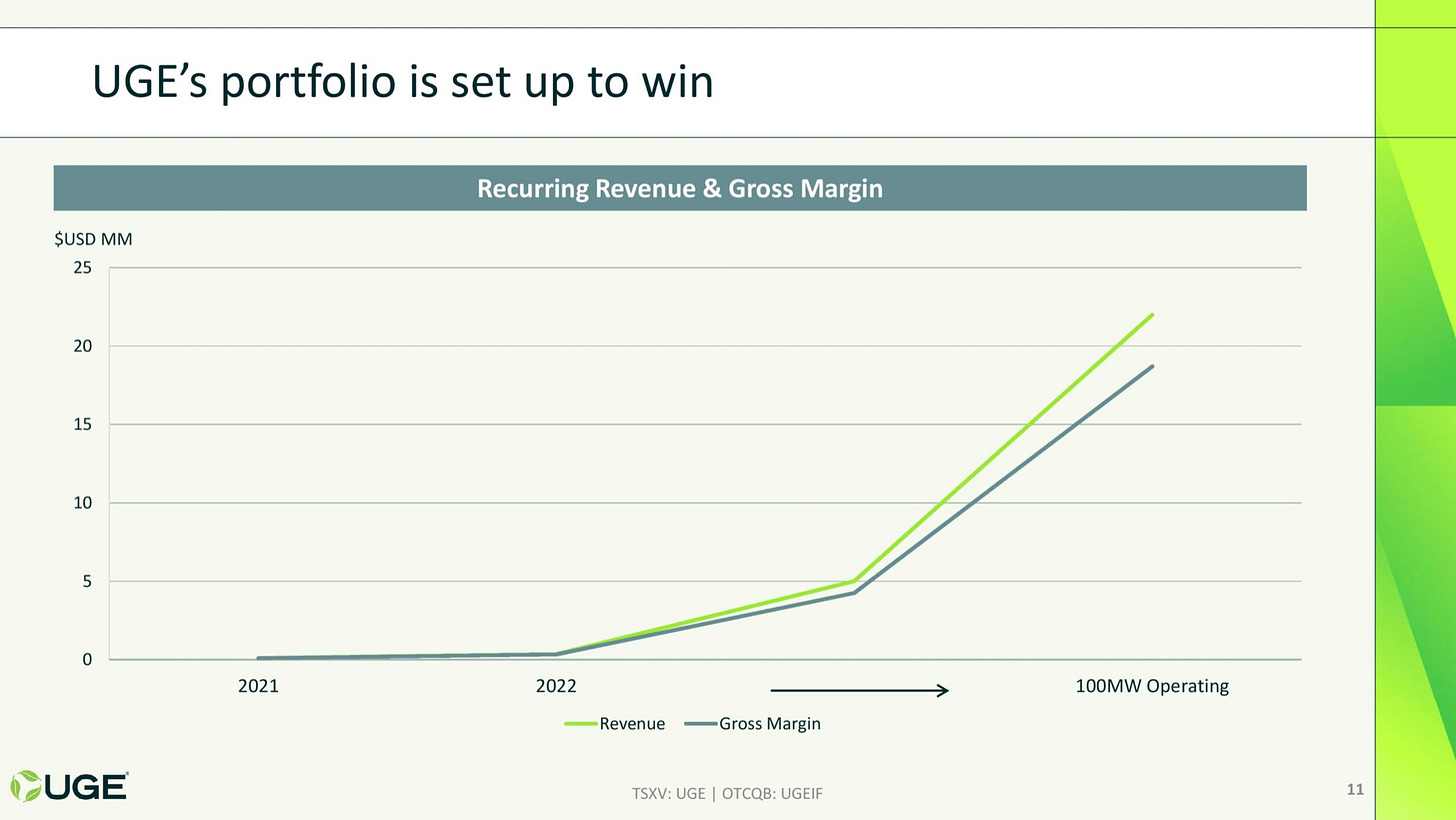

Building a portfolio of operational assets, with a medium-term goal of exceeding 100MW in rated project capacity;

Continuing to add to this portfolio through organic project development and accretive project acquisitions;

Reinvesting capital once the operational assets provide a steady cash flow stream; and

Maintaining a low operating cost structure to support both continued growth and operations.

Management/Investor Alignment

Two critical questions. Is management diluting shareholders by issuing significantly more shares outstanding and do insiders have “skin in the game” meaning they own 10%+ of shares outstanding.

Management is not issuing a lot of stock and insiders own 33% of shares outstanding which means they will benefit greatly from long-term sustained performance.

Project Example

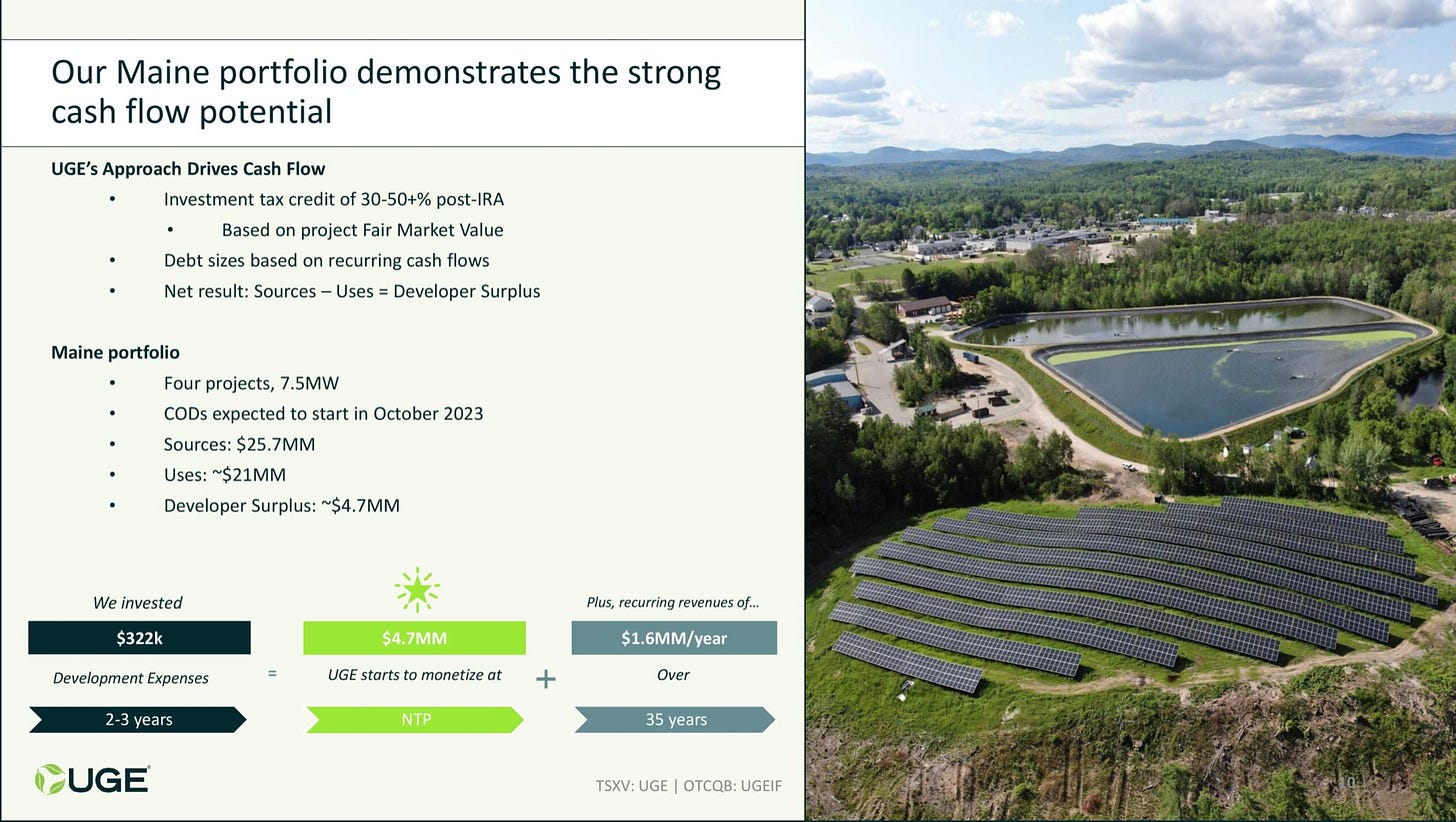

Here’s an example from UGE’s November 2023 investor presentation that shows the expenses and monetization of the company’s Maine portfolio.

The company invested $322k to fund 7.5MW of projects that will earn $4.7M in one-time fees. Then the projects will earn $1.6M per year for 35 years.

This is a best-case-scenario and UGE will have operating expenses during those 35 years so that‘s not pure profit. According to management, gross profit margin is roughly 80% on recurring project revenue.

So lets do some math using the Maine portfolio above.

The $322k initial investment earns $4.7M in revenue from one-time fees. Then using our conservative 70% gross margin number for recurring revenue. UGE will collect $1.12M gross profit per year from operating the projects. Then lets use 25 years for the lifetime of the projects instead of 35 years. That’s $39M in gross profit + the $4.7M in revenue so that’s $44M in gross profit over 25 years from a $322k initial investment.

That’s a very rough view of a single set of projects. Now let’s zoom out and look at UGE’s current backlog of 348MW. It represents $75M of annual revenue but lets only count 75% of that because some of these surely won’t go to completion. That’s $56M in annual revenue x 25 years = $1.4B in total recurring revenue. Subtracting out operating expenses, gets us to $1B in gross profit from the recurring revenue of their current backlog over 25 years.

The market cap is $32M and I can see a viable way for the company to earn over $1B in gross profit over the next 30 years.

There are execution risks, there are interest rate risks, and there are all kinds of risks completely out of management’s control. But that’s enough for me to start a position.

Next week I’ll send Part 2 of our UGE deep dive which will get into the risks, the balance sheet/financials, and other company fundamentals.

Any thoughts on a higher bid?

https://ceo.ca/@newsfile/uge-international-ltd-enters-into-arrangement-agreement