I’m fascinated with the world of micro cap stocks. For most of the last 10 years, I completely ignored them because of the reputation of penny stock pumpers and the amount of truly garbage public microcap companies.

I simply wrote off anything below a $500M market cap.

Thanks to people like Ian Cassel, MicroCapClub, and the team over at Planet Microcap, there are a lot of resources out there to find high-quality information and discussions about microcaps.

I highly recommend checking out MicroCapClub’s YouTube channel. A couple of my favorite videos are “Chris Mayer on 100-Baggers” and “Investing is Hard”.

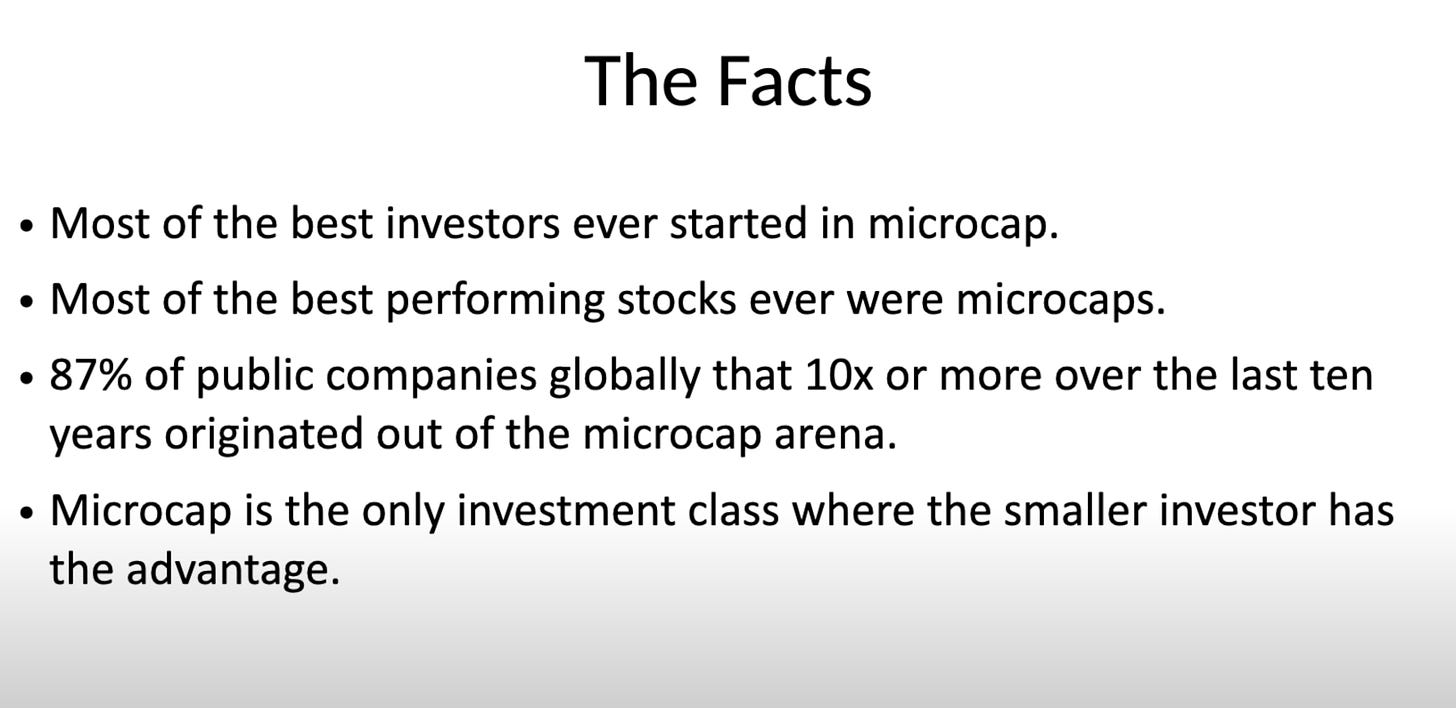

Here’s a slide from Ian’s opening remarks at the 2023 MicroCapClub Leadership Summit 2023. It summarizes the case for microcaps pretty well.

So there’s some background as to why I’m focused on microcap stocks right now. But let’s get to the question; Could you actually own a 100x stock?

The answer is yes, but it’s extremely hard. You not only have to find stocks that go on to 100x, but you also have to hold them which is an entirely different challenge.

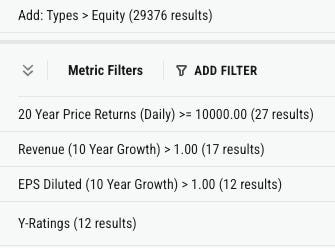

Over the last 20 years, how many stocks do you think have 100x’d?

27

But some of these are still very low quality, speculative companies so I added additional filters of 10 year revenue growth > 1% per year and 10 year diluted EPS growth of over 1% per year.

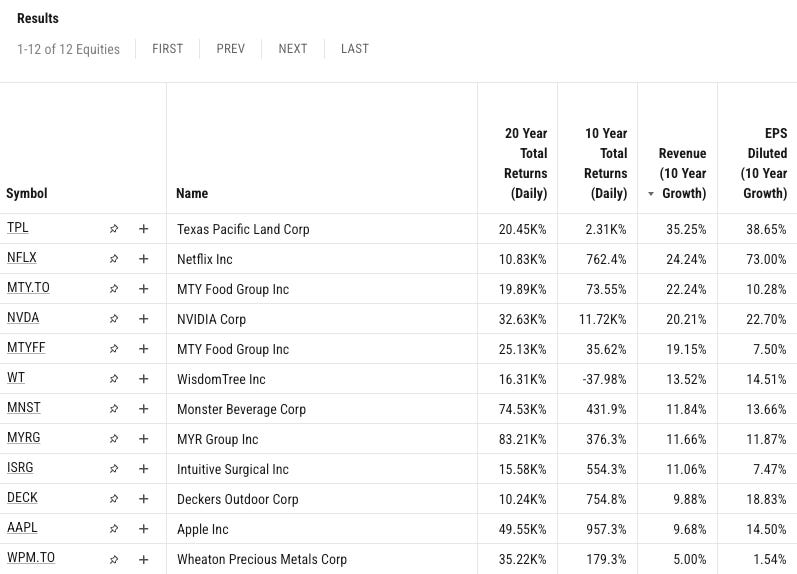

With those very simple filters, we’re down to 12 companies that have 100x’d over the last 20 years.

Here they are.

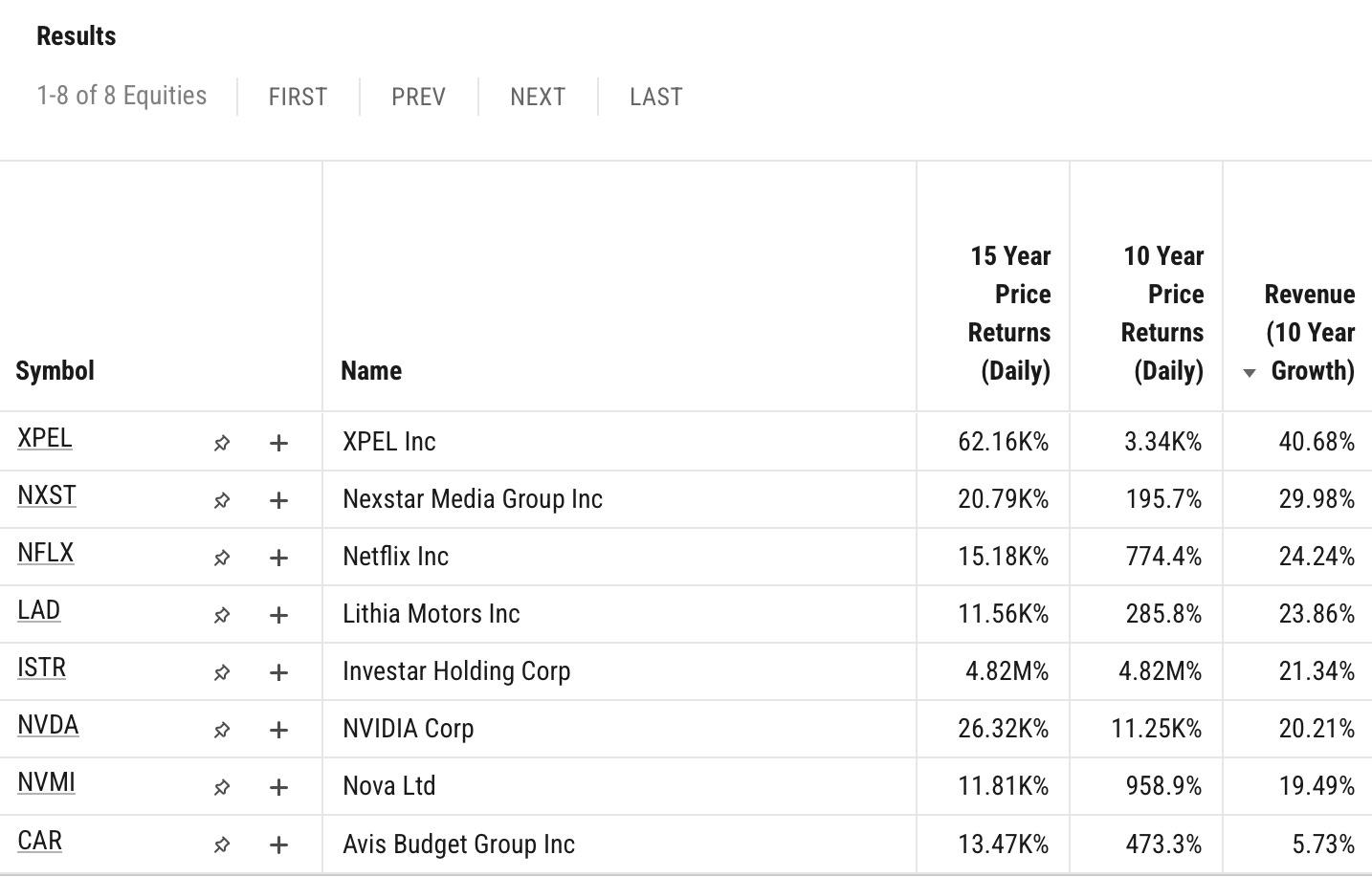

Just for fun (and because I wanted to include $XPEL) here’s a list of stocks that have 100x’d over the last 15 years

So let’s take a look at the stocks from the first list and see what their market caps were in 2003 at the beginning of their 100x journey to glory.

On the chart below, I’m showing the market cap at the end of each year starting with 2003 on the right through 2008 on the left.

Two things should stand out.

#1 Only 3 stocks had a 2003 market cap above $1B with the largest being Apple at $7.8B.

Most stocks that go on to return 100x start as microcaps.

#2 In normal markets, the opportunity to earn a 100x return is pretty short. Most of these stocks had doubled or tripled in just 3 years from the start date.

For an oversimplified example, if a $1B market cap company doubles to $2B, you now need it to become a $200B market cap company instead of a $100B market cap company to earn 100x.

But there’s also a third thing. Holding a stock long enough to earn 100x is extremely hard to do.

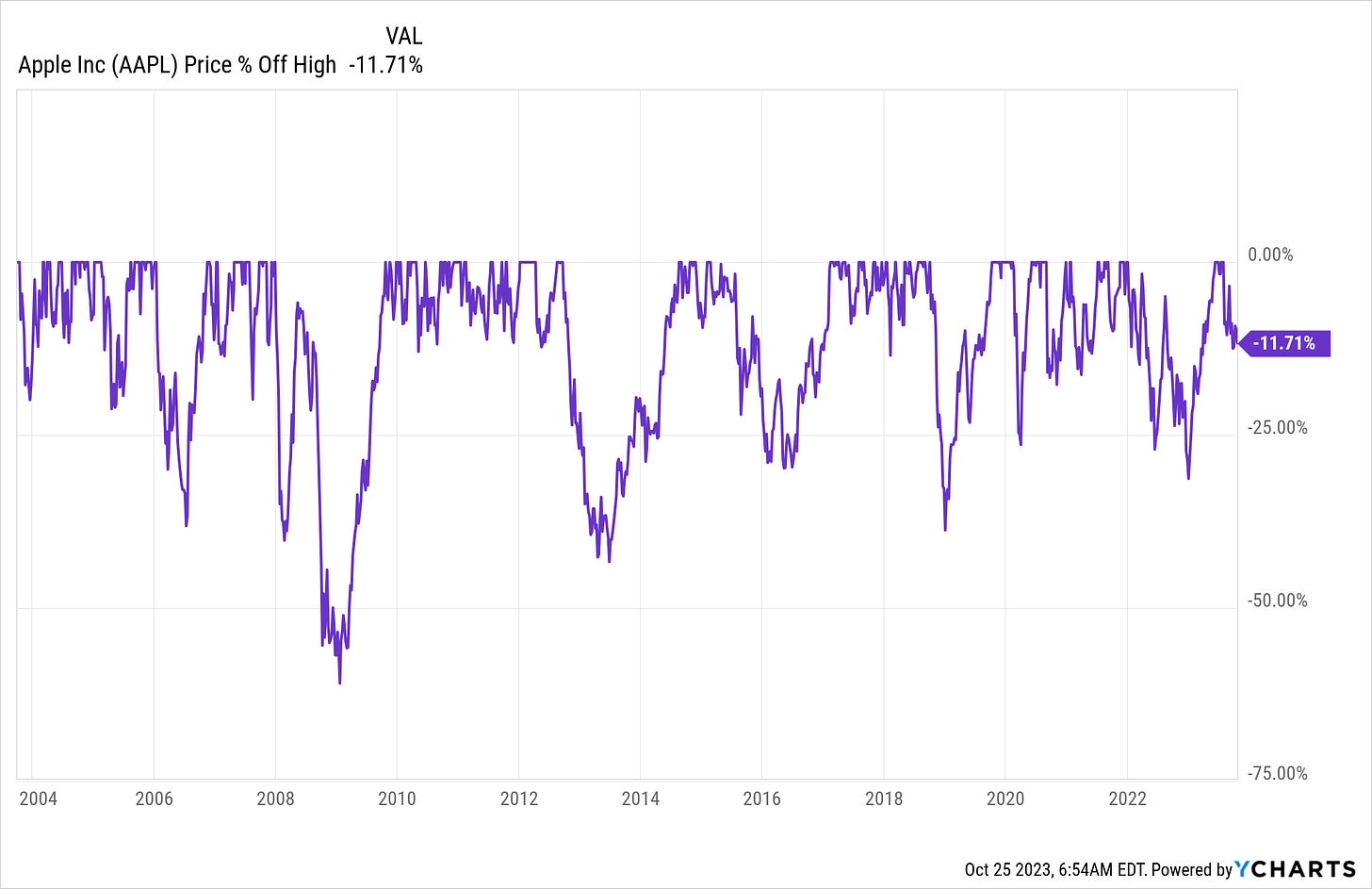

Here’s a chart of AAPL 0.00%↑ since 2003. You can easily see one 50% drawdown and at least four 30% drawdowns.

If that doesn’t seem bad, imagine investing $10,000 into Apple in 2003, seeing it grow to $500,000 just to watch it drop by $150,000 (more than 15x your initial investment).

Apple is probably one of the tamer 100x rides.

Owning a 100x stock is really, really hard. You have to find it, invest in it, and then the hardest part is you have to hold it AFTER you could lock in life-changing returns by selling.

The Individual Invest Advantage

In Ian’s opening keynote slide above, the last line says individual investors have an advantage in microcaps.

There’s a few reasons for that. Most professional investors can’t invest in micro caps because they are too small, there’s not enough daily volume, and they’re too volatile.

As an individual investor, you don’t have any of those restrictions.

But that doesn’t make it easy to separate the winners from the losers. So as an individual investor, I think it’s important to take a conservative approach to investing in micro caps.

That’s going to be different for everyone, but I think micro caps should only represent a small amount of someone’s total portfolio. Especially until someone has a few years of experience investing in them.

Fortunately, small investments can have life changing results.

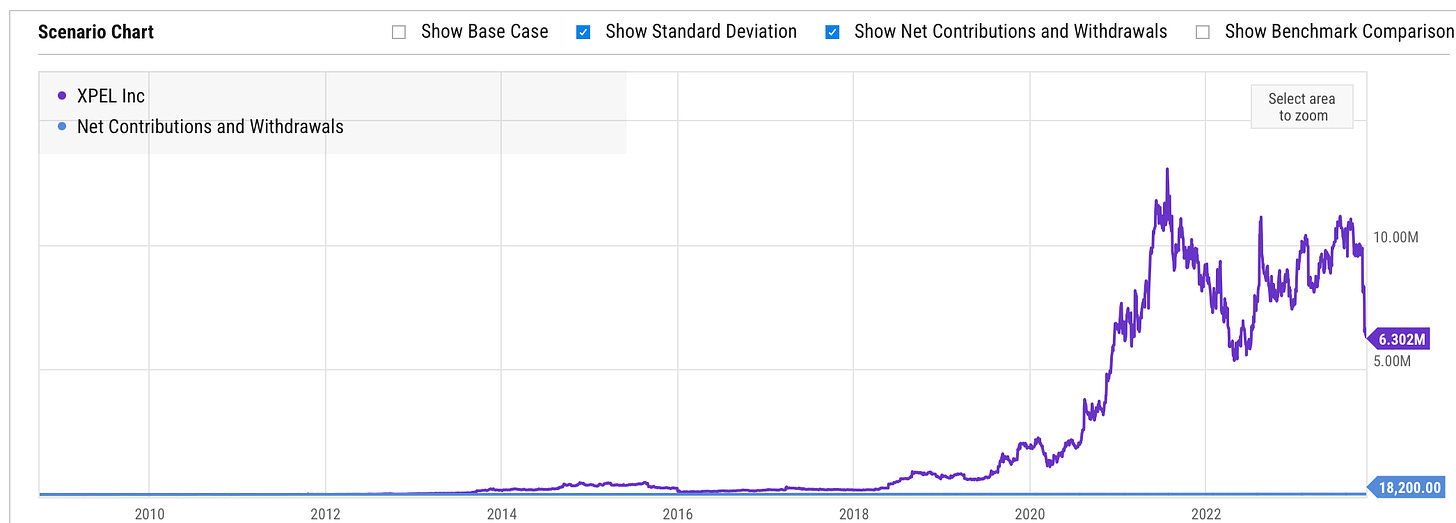

I talked about Expel XPEL 0.00%↑ above. Here’s a scenario showing someone investing $100/month into Expel over it’s 15 year 100x journey.

In total, the investor would have contributed $18,200 and it’s current value would be $6.3M. At one point it had grown to over $12M…. Insane.

But just think about that. The investor could have invested $500k - $1M into stocks that literally went to $0 and still be up over $5M.

That’s the power and potential of micro cap investing.

So What’s Next?

I’m going to start doing deep dives into microcap stocks. I’ll cover anything up to a $2B market cap which is technically a small cap, not a micro cap.

I’ll clearly disclose if I own or don’t own the companies I write about up front and I’ll track the performance of the micro caps I think are good opportunities. I might even track the ones I don’t think are good opportunities just for fun… or torture.

Why the Change?

I have to write about what I’m interested in or else this isn’t any fun for me. I also believe there is the potential for a lot more upside and life-changing returns in micro caps than large or mega caps.

I’m not saying large or mega caps are bad. Not at all. But there are thousands of people covering them and writing about them. Additionally, you can enjoy the benefit of large or micro cap stocks by owning very low cost ETFs like SPY, VOO, SCHG, SCHD, VGT, etc.

As I mentioned above, microcaps are under covered and there are unfortunately still a lot of schemes trying to scam people.

I want to provide another great resource along side Micro Cap Club, Planet Microcap, and some others to expose people to the potential (and realistic challenges) of microcap investing.

If you have any small or microcap stocks you follow, let me know in the comments and I’ll check them out.

Holding Is more difficultà than buying,I was long tesla at 60$ and sold at 110 thinking I was a Genius..

This article really resonated with me... I have small positions in these sub $1B companies: $WELL, $VCI, $SYZ, $PNG, $MI.UN, $IQ, $CTS, $HOM.UN, $GSI, $AEP, $LMN, $ADEN, $ISV and a more significant position in $BELFB. I know you've written extensively on $ISV... your deep dive was very validating for me.😆 Curious to hear your thoughts on any of the others... but no pressure!

Keep up the great work!