Why I’m Buying more Chegg (CHGG)

Everyone hates this stock but I think it’s a buying opportunity

This one is pretty simple…the sentiment is about as bad as it could get with CHGG and they are facing some challenges. I think there’s too much fear surrounding the stock price and I think the business is set for a turnaround.

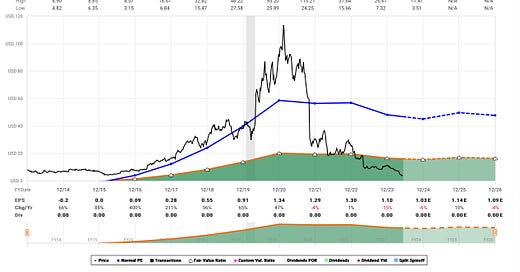

Look at that plunge from a pre-pandemic price of ~$40 to $3.70 today.

From 2014 - 2019 Chegg was a market-beating stock. During the pandemic, Chegg benefitted from the hype of everything else internet related and was up 200%+ in 1 - 2 years.

Post-pandemic as people are going back to doing things in-person Chegg has seen a dip in paid subscribers and the stock price suffered.

Now that AI and LLMs are becoming widely available, there’s fear that Chegg’s business is doomed.

It very well might be, but I believe there is far too much fear, the company will be able to pivot their model to embrace LLMs/generative AI and their database/subscriber base will be somewhat of a competitive advantage, and the stock is absurdly cheap.

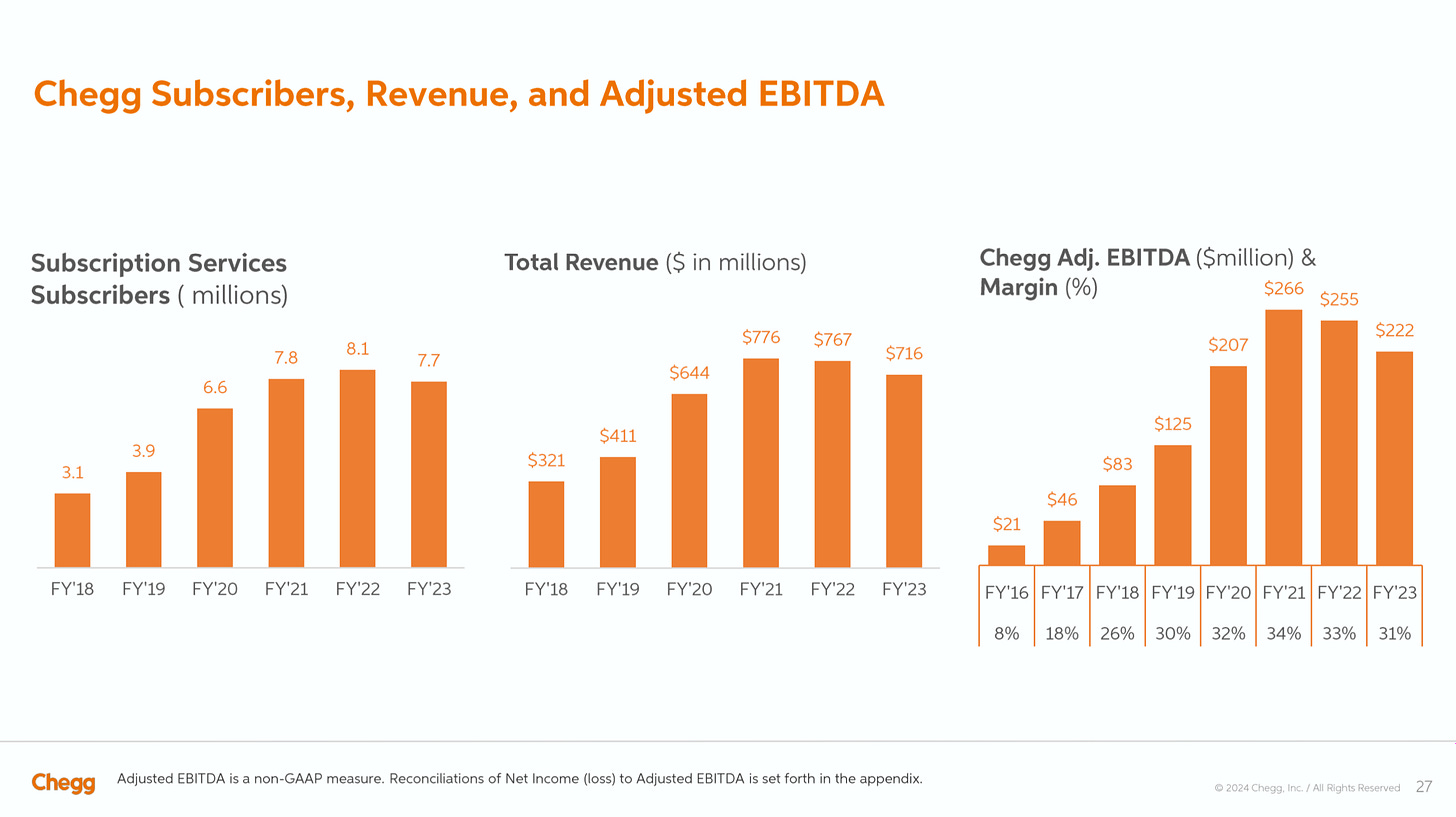

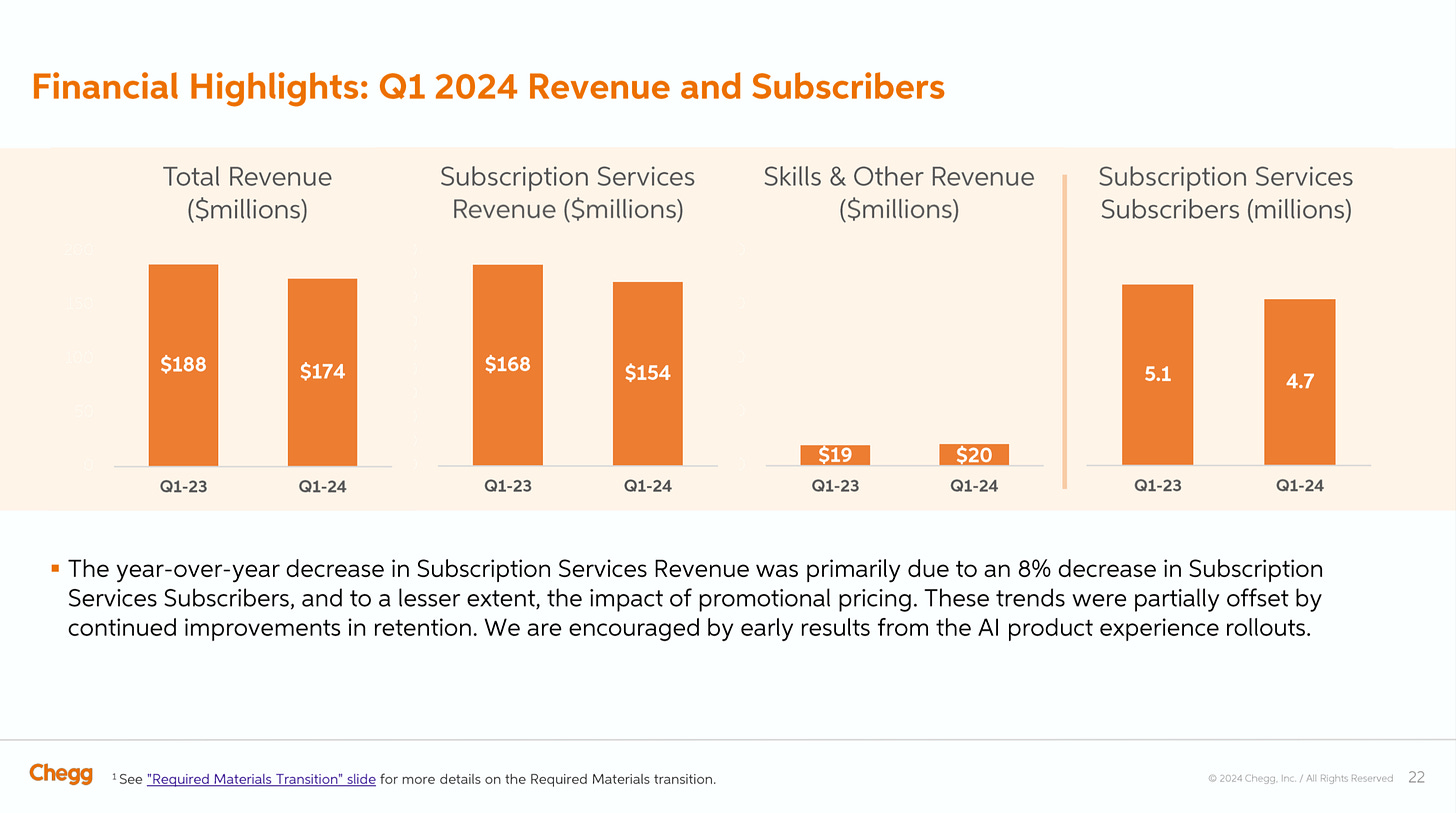

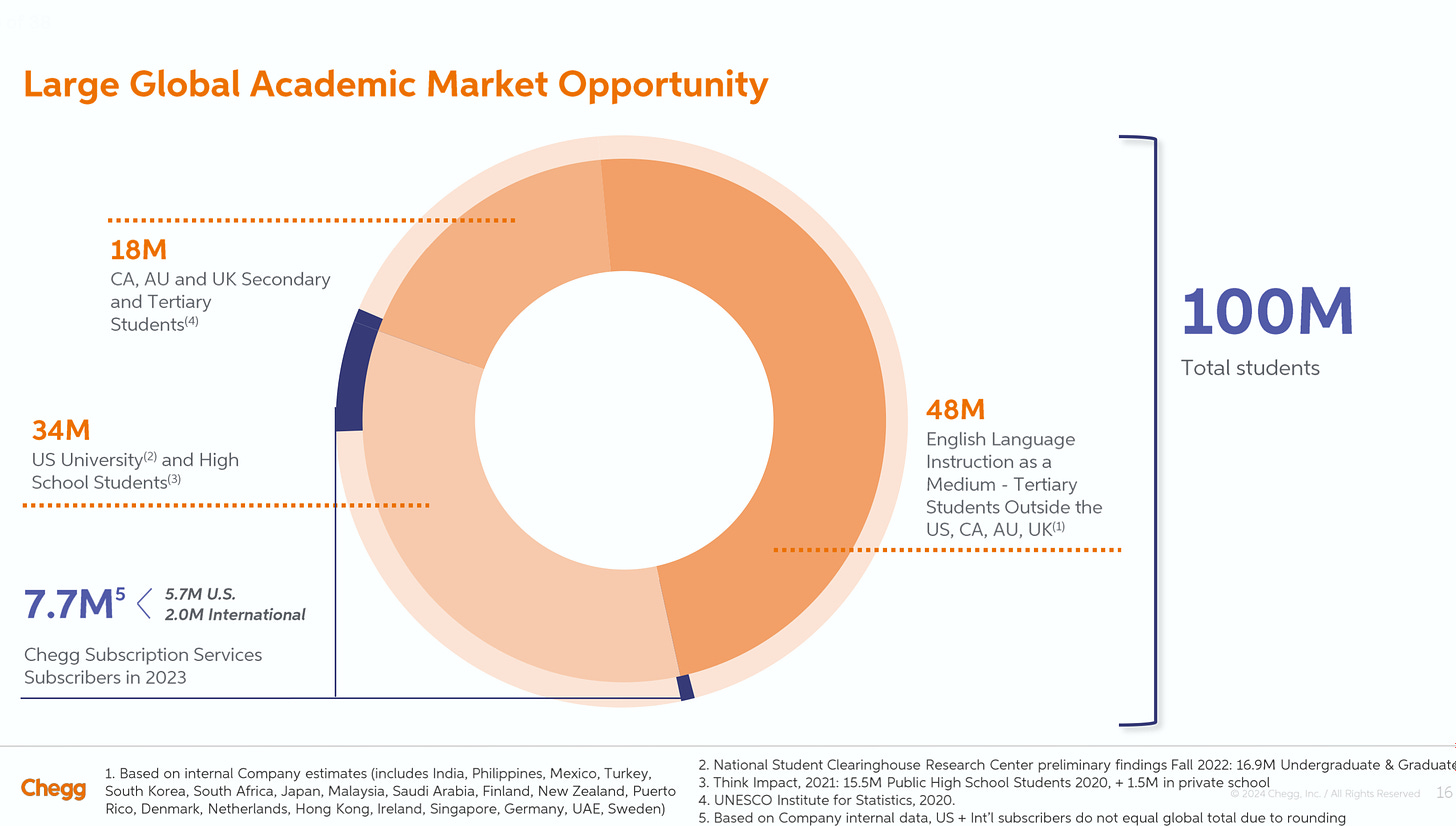

I’ve attached a few screenshots from their recent investor presentation showing their revenue, margins, subscriber base, and what management believes the market opportunity to be.

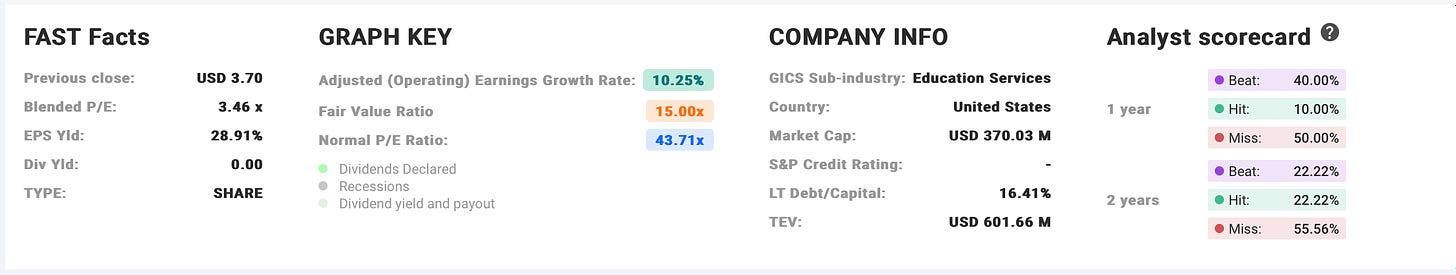

We will certainly see some declines in subscribers and revenue, but the stock is trading at a P/E around 4 with plenty of cash flow and a plan to restructure the business + return cash to shareholders (see buybacks).

I’m willing to hold a ~5% position in the stock and bet on a turnaround over the next few years.

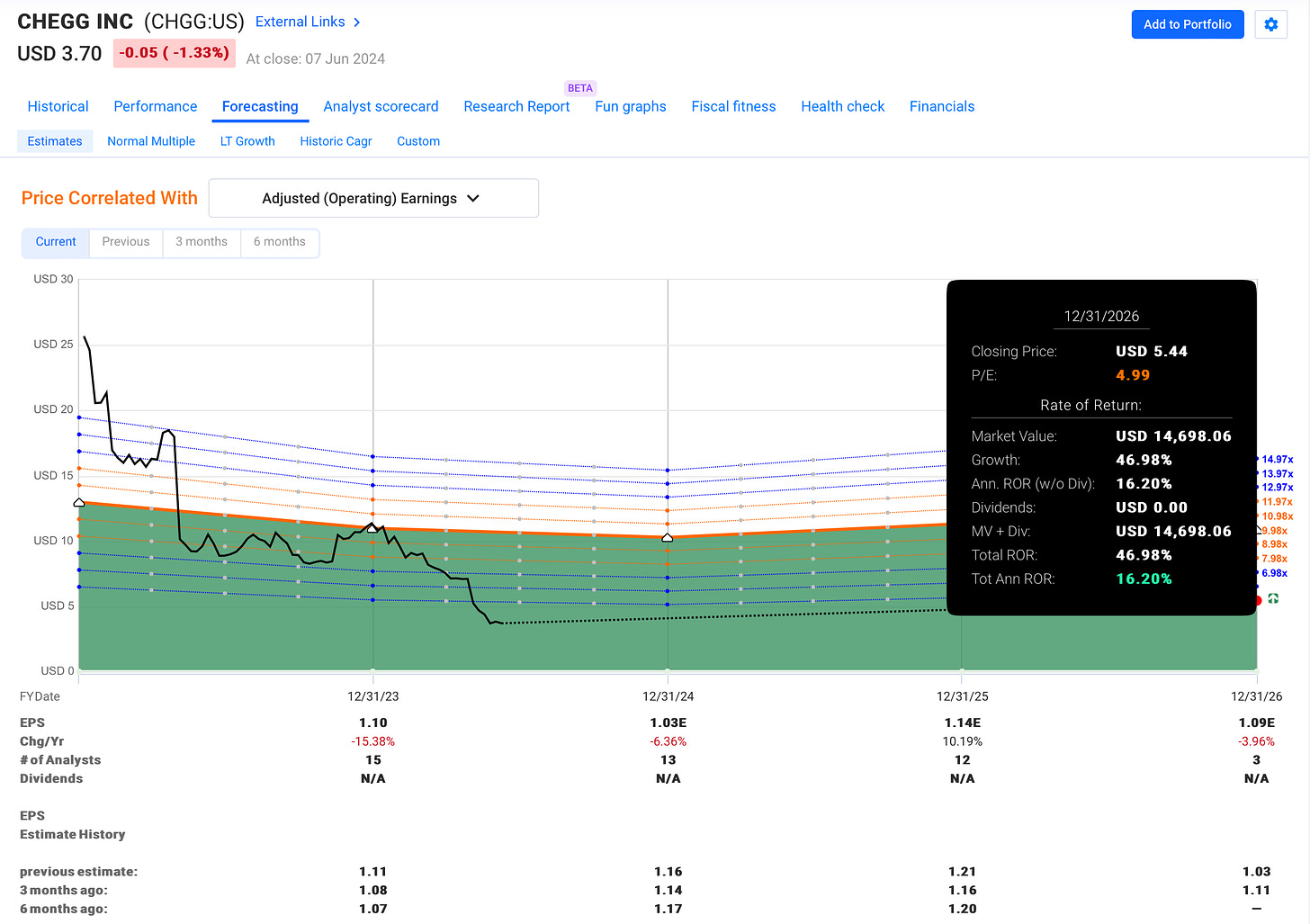

Here’s a look at how CHGG would perform from now until 2026 if earnings are basically flat and the stock trades at a P/E around 5. That would get us somewhere around a 16% annualized return. I’d take that all day.

But if the company buys back more shares, or grows earnings ahead of expectation, or gets re-rated to a higher P/E (the market overall trades at a P/E of 18+) then we could see significantly more upside.

I’ve attached a couple of slides below from the company’s recent earnings release. In FY23 Chegg had 7.7 million paid subscribers and $716M in revenue. For reference, its market cap is currently $378M and enterprise value is $604M.

The market has left this company for dead.

Current Portfolio After The Purchase

You can see this bumped CHGG up to a roughly 5% position. Here is the rest of the portfolio for your reference:

Keep reading with a 7-day free trial

Subscribe to Growth Curve By Austin Lieberman to keep reading this post and get 7 days of free access to the full post archives.