I’m going to do absolutely nothing.

I have no idea if Amazon is going to beat or miss earnings today. I also don’t know if they’re going to raise or lower guidance.

And none of it matters.

Even if I knew what the results were going to be ahead of time, I still wouldn’t know how the stock was going to react.

It’s such a relief to accept the fact that as much as we want to feel like we can protect our portfolios (and our money) the truth is no one has any idea what’s going to happen with any stock over the short-term.

I’ve tried my hand at doing options into earnings. I’ve tried my hand at hedging my portfolio and trying to protect it from market-wide pull backs.

Some people might have better success but I can tell you that from my own experience, after factoring in time, stress, taxes, etc I am a FAR better investor and happier person when I just buy, hold, and add to great companies instead of trying to time market movements.

This isn’t just about investing. It’s about overall quality of life. For me, my best quality of life comes when my investing supplements my long-term financial goals.

So I know I’m going to earn stocks during a 10%, 20% and most likely 30%+ market-wide pullback and I’m completely fine with that.

The money I have invested in the stock market is for my long-term (5+ year) goals. I take anything I might need within the next 5 years out of the market. That’s the only way I’ve found to “time” the market and it works really well with living the highest quality life I can.

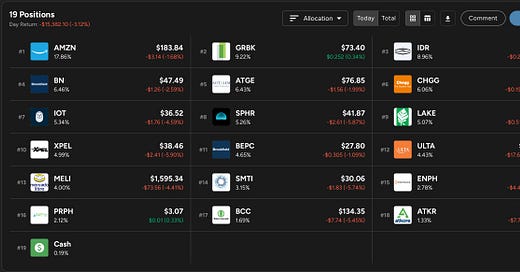

Here’s my current portfolio. No changes lately.