Weekly Update: Down $16,972 and 4.12%

Hey everyone,

Thank you so much for taking some time out of your week to read this. I’ve received some very valuable feedback. Please keep the likes, comments, and shares coming. It all means a lot to me!

It is Friday morning before the market opens in the United States so these numbers are through Friday May 10 at 7:00am Eastern time. I’m not one for predictions and I’m usually wrong…but if I had to guess, I would bet that we could see a decent little rally today in the market. Again, that’s totally a guess but if I’m right, give me all the credit in the world and if I’m wrong…well let’s never mention it again okay?

Performance:

Portfolio Value: $409,813.20

7-Day Change: -4.12%

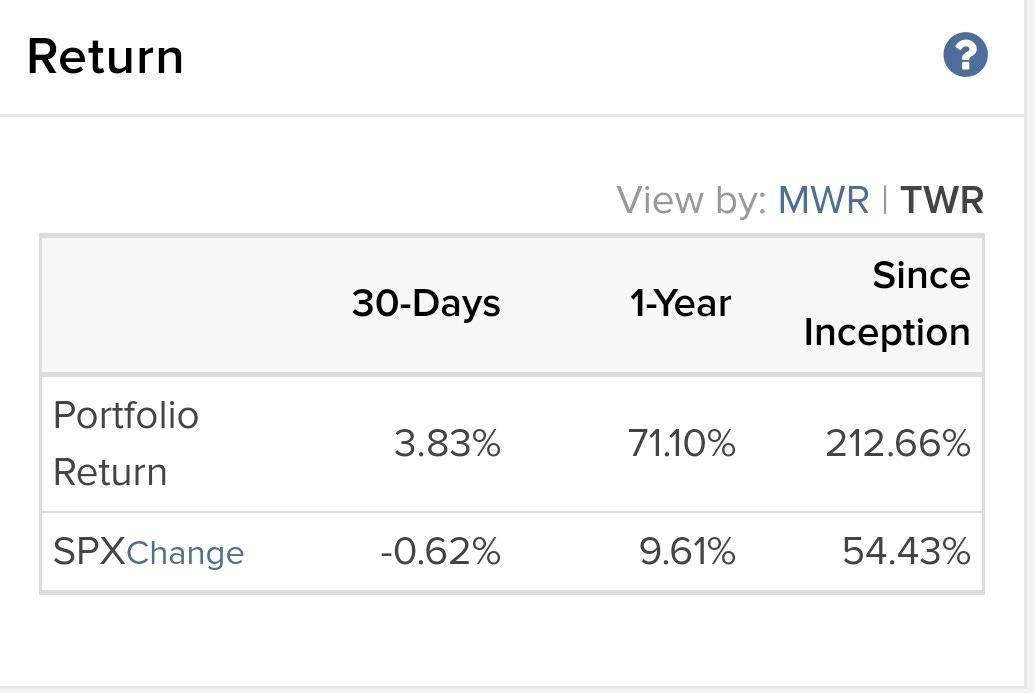

Here’s how the portfolio compares to the SPX benchmark, which tracks the performance of the S&P 500 (often called “the market”). Note since inception is since November 2014.

No matter how successful our investing has been over the last few years, it is hard to watch our portfolio lose value like that. I don’t care what anyone says. It’s hard. But being able to keep a level head, stay invested in great companies, and take advantage of sell-offs as buying opportunities is key to great investing.

But all of that is easier said than done. Let’s talk about the last point; taking advantage of sell-offs as buying opportunities. Doing that is hard because we don’t know when the selling is going to end. We also don’t know what event is around the corner that’s going to cause everyone to panic and sell again.

So the key for me has been try to stay invested in the best businesses which I believe will be larger in five to ten years than they are today and only invest money I won’t need for at least three (preferably five) years.

This week I tried to practice what I preach and bought shares during all of the market panic about the “trade war” (which we have known about for more than a year).

At the end of last week, we had $48,900 in cash. At the end of this week we have $21,800 in cash.

Transactions this week:

The first two I’m going to share are options transactions. I strongly recommend against using options, especially for newer investors because they are an awesome way to lose a bunch of money and potentially expose yourself to bankruptcy. I don’t even want to share these, but I will because 1. I lost money on them and 2. You are all responsible for your own financial decisions.

Wednesday May 8th:

Bought 5 ETSY May 17, 2019 expiration $65 strike calls for a total cost of $2,850

Bought 5 ROKU May 10, 2019 expiration $65.5 strike calls for a total cost of $2,225

Thursday May 9th:

@6:59 am Eastern: Sold 50 shares of TTD at $220

@7:00:44 am Eastern: Sold 50 shares of TTD at $210

Those shares were in different accounts so I couldn’t do it all at once…sold the first 50 pre-earnings and the second 50 right after they released.

Why did I sell? Well, TTD was sitting at about 23% of my portfolio and as much as I love the company and its future, it just made me too restless. Also, by having 15% - 18% of my portfolio in the company, if it continued to do well and drastically beat the market, I would own enough to where it makes a huge impact.

The idea of “enough” is so, so important in investing and life. I’m learning that more and more.

@9:33 am: Sold 5 ROKU May 10, 2019 expiration $65.5 Strike calls for a total price of $3,500.

I made roughly $1,300 or 50% overnight. Cool! Except that later in the day I could have sold them for a total price of $7,000 because the stock continued to go up. But that’s the challenge with owning calls. If the stock would have traded below $65.5 by the expiration date, they are worth $0 which is probably how those ETSY calls will end up. So all in all, I will likely lose about $1,600 with those two options gambles.

I don’t want to make investing seem overcomplicated. It’s not. But it’s easy for us to make it complicated by using fancy formulas, options, etc. I shared all of that to say investing is common stock (just owning shares) of the best companies for really long periods of time is the best way to grow long term wealth for most people…including me!

Bought 30 shares of TTD at $188

Huge fan of this business, didn’t see anything alarming in the report and my position was down to the 15% range. It is now in the 15% - 18% range which is right where I’m comfortable keeping it.

Bought 125 shares of ROKU at $80.74

This one hurts. I owned shares of ROKU previously, but sold at a significantly lower price than what shares were at yesterday. They were up something like 25% on the day when I bought them.

So why the heck did I sell and then buy much higher? Previously, I wasn’t confident in the product. I used Roku to watch TV a bit and felt it lacked in user experience. I also wasn’t as confident in management. However, they have now reported two outstanding quarters in a row and I think they are a great compliment to TTD in what the world of advertising will look like in the future.

I decided to open a starter position. We will call that “Tier 3” which is a term I just made up and means a roughly 5% position. I’ll look to add to these if I continue to get more confident over time.

Bought 82 Shares if TEAM at $123 (Tier 3)

Yup… another one I sold at a lower price in the last couple weeks. I was concerned that TEAM was trading at a higher Price to Sales ratio than many of the other companies I own that are growing faster.

However, I want to be invested in the best companies I know of and TEAM is certainly one of them.

Bought 60 shares of ESTC at $84.85

Company growing extremely fast with very innovative products

Only thing I don’t like about it is the price so it’s currently a tier 3 position

Bought 100 shares of ZS at $68.98

Love this company and think it’s at the beginning of a massive shift in security.

Wanted to bump it up to a Tier 2 position.

Current Holdings:

Tier 1 (15%ish)

TTD

TWLO

AYX

MDB

Tier 2 (10%ish)

OKTA

ZS

Tier 3 (5%ish)

PD

ESTC

SHOP

ROKU

TEAM

Let me get back to my day already Austin…

That’s all for this week. As always, thank you for your time and attention. I would love your feedback on these updates. Are they too long and what else would you like me to talk about? Email or comment and let me know.

Also, if you want to support the newsletter, please like, share with friends, or change to a $5/month or $50/year “subscription” which includes the exact same content you are currently reading for free.