Weekly Update + $4,060 (0.86%)

This was another positive week for the portfolio. We’re at a strange time in the markets which is probably always the case. On the one hand, there is a lot of pessimism. There are a lot of doom and gloom headlines about how the market can’t possibly continue performing well. Then there’s the rest of the common list of reasons people should never invest like the yield curve, trade, immigration, international conflict, oil prices, etc.

What I am trying to do is ignore all of that and make the conscious decision:

I am a life-long investor with many working years ahead of me.

I invest with the goal of becoming a part owner of the best founder-led companies I can find and never sell. I know I will eventually sell, but I shouldn’t own something if I don’t start the investment thinking it is a business I want to own forever.

I don’t invest any money I know I’ll need for big purchases in the next 3-5 years.

This is easy to say and hard to do but that’s why it works so well. There are some things (like marketing) that I really don’t like about The Motley Fool. David and Tom Gardner and their teams have proven for more than 20 years that investing using that style works for unprofessional investors like us.

I make a lot of mistakes investing. Most of them result from the scratching that inevitable itch to make some quick short-term gains or sell because the market is at an all-time high, my stocks are “overpriced”, and it can’t possibly continue. At some point those “predictions” will come true and my portfolio will suffer some very large losses.

It is impossible to know when that will happen and I’m confident that between taxes, transaction fees, not knowing if/when to invest again, and the distraction from my family/other life priorities it simply is not worth it.

So here are some guard rails I’m setting in place to improve my investing decisions and quality of life.

No more silly short-term options gambles. Too risky, not worth the time, and not what I consider investing or accessible to the people I am trying to inspire — unprofessional investors.

Limit checking my portfolio and buying/selling to twice per day. I’ll check at around 9:30am EST and 3:00pm EST. I will do my absolute best to only buy/sell from my computer during those times instead of from my phone when I’m waiting in line at the DMV or something silly. Decision making and discipline is HUGE in so many aspects of life. Investing is no different. How can I expect to make good decisions when I’m distracted.

Stick with founder-led companies I truly believe are exceptional and that I can see the potential of increasing 5x or 10x in value. This means no short-term bets on stocks that I think will rise because there is a lot of excitement around them.

Okay, I’ll layout my investment criteria to share what I look for in the companies I own in a later email. Let’s get to the results.

We finished the week up 0.86% which was an increase of $4,060. Although 0.86% feels like a much smaller amount then some previous weekly gains, $4,060 is still a lot of money. For me, this emphasizes the importance of long-term investing and compound interest.

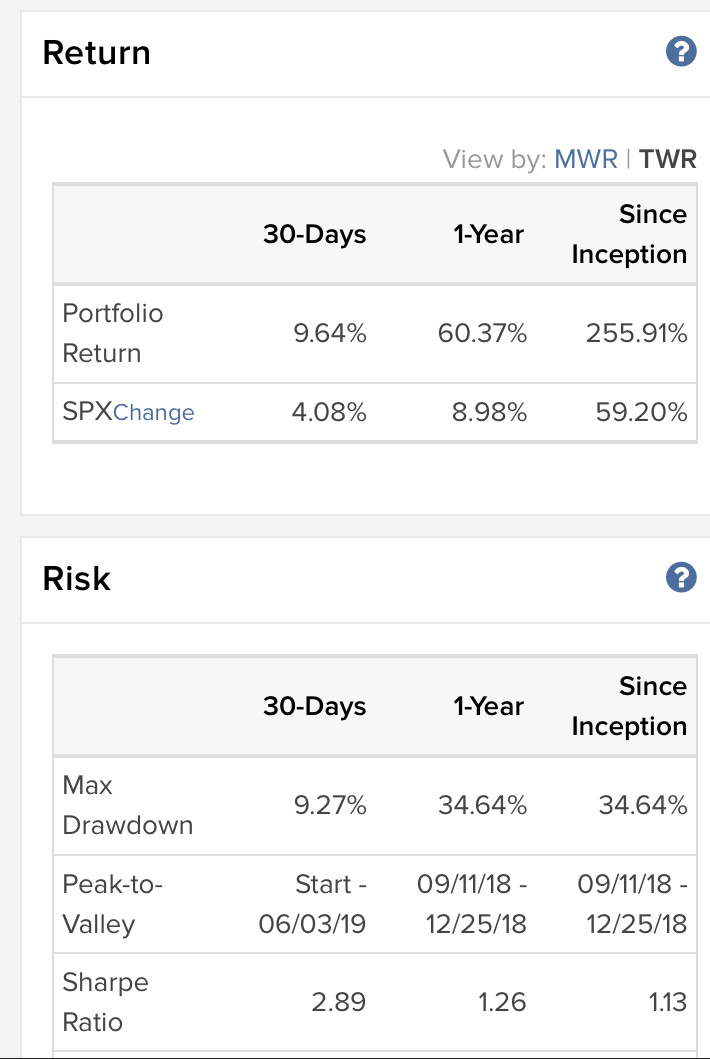

Here are the 30-Day, 1-Year, and since inception (Nov 2014) performance comparison of our portfolio compared to the S&P500. All significantly outperforming. Below the returns are two examples of the volatility we have to be prepared for when investing this way. The largest drop for our portfolio over the last 30-Days was almost 10% and over the last year was almost 35%. That is a lot of money and a substantial amount of our portfolio to see melt away. But I believe that’s part of the process and if we stay disciplined (and continue investing each month) during those times, we will do very well over the long term. Actually….I think weathering those types of drawdowns is a requirement for this type of out performance.

And here are our current positions. Position is how many shares (or options) I own. Average price is the average price per share of those shares. Unrealized P&L% is the amount that total position has increased or decreased. % of Mkt Vl is the % that position represents of my total portfolio.

I generally add to companies as they perform well which drives my Avg Price up and Unrealized P&L % down. So for AYX, I’ve bought shares as far back as more than a year at probably something around $40 or less a share. That’s off the top of my head so don’t quote me on it. But it’s an example of how it works.

See what I mean about options being risky? NTNX and NKTR will both probably end up being -100%.

Changes this week

I forget exactly when it was, but I sold my position in ESTC and added to PLAN and ROKU.

I also sold about 2% of my position in OKTA because it’s becoming a larger market cap company for my portfolio and is on the excessive end of its historical P/S spectrum and opened a position in Slack (WORK) at around $41 on Thursday when Slack did its direct listing. However I quickly sold the shares at around $39 for about an 8% loss because I realized I made the decision to buy on an impulse.

I believe Slack has a ton of potential. But it’s already around a $20B market cap, is trading at a price to sales ratio thats about equal to Zoom and growing much slower. Also, growth has slowed substantially for Slack, they decreased research and development spending, increased marketing spending, and have not improved losses as a % of revenue. Zoom is basically the opposite in every category.

So with that $7,400 in cash I intend to either open a position in Zoom next week or add to PD, PLAN, or ROKU.

Here are a couple great articles/podcasts on Slack and Zoom. I’d love to hear what you think about the two businesses and what decision you would make?

Article: Slack IPO: Pros and Cons

Video: Slack Direct Listing Video

Podcast: Acquired Podcast Zoom

Article: Zoom S-1 BreakdownIPO

Article: Benchmarking Zoom’s S-1: How 7 Key Metrics Stack Up

Thanks so much for your time and attention. I appreciate you all. If you’d like to help more people find us, please hit the heart above, share on social media or with friends, and/or begin a paid subscription for $5 a month or $50 a year using the link below.