Weekly Portfolio Update: Down 0.23% (Up 55% YTD)

Note: I started this on Saturday Aug 24 and finished Monday morning Aug 26. So the commentary below is based on closing prices from Friday… this morning is looking a little better, but who knows what is going to happen!

This week was looking great for the portfolio until @Oddstats Tweeted this on Thursday:

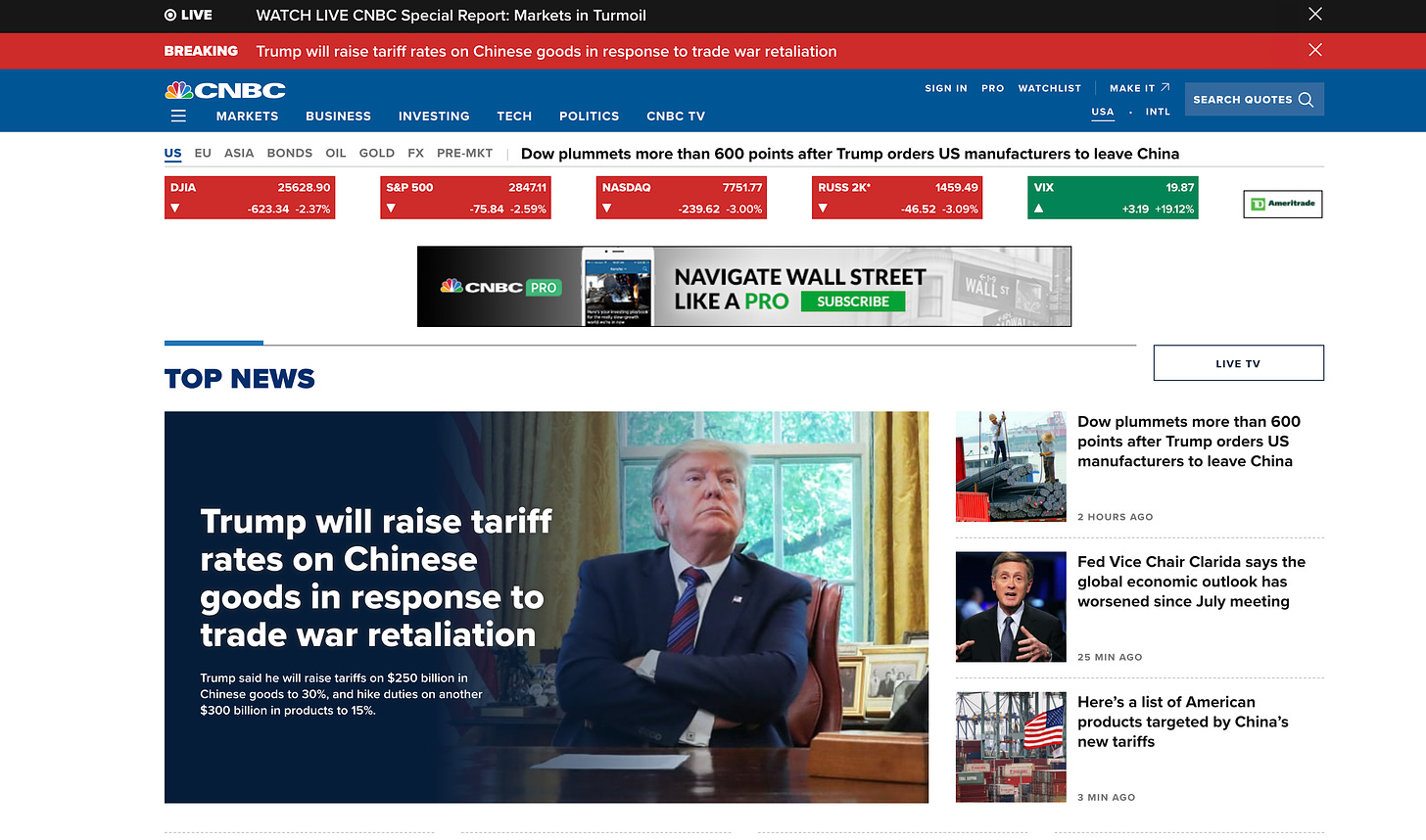

This caused the market to melt down, which led to these head lines from CNBC.

So clearly:

OddStats works for CNBC and intentionally made the market drop so CNBC could air another “Markets in Turmoil” show because the financial entertainment industry was struggling for views with the market going up again.

Now it’s safe to buy again because CNBC did their “Markets in Turmoil” segment Friday.

Bonus: All of this is a joke, but isn’t it silly how often people associate certain events with the market going up or down AFTER they happen? Then people react to that news and the wealth destroying circle continues for investors.

Alright, let’s get serious for a minute. It’s not funny when the market goes down and hard working people lose hard earned money. BUT, if we stick to our foundation and rise above the daily headlines, we will grow tremendous wealth over time.

Here’s our foundation and the super power that I believe each layer gives us. Remember my wife and I are in our early thirties (she is actually 1.5 years older than me 😆) and we enjoy our jobs so we intend to keep working for many years.

Automatically contribute to our investments each month (ideally 20-30% of pre-tax income).

Super Power: Ignore sensationalistic headlines & predictions.Don’t invest money we know we will need for big purchases in the next 5 years.

Super Power: We won’t be forced to sell at the worst time.Invest in the world’s best Founder-led companies and plan to hold for 5+ yrs.

Super Power: The best companies generally get better over time. A long-term mindset forces us to find our “best ideas” and let them compound. *We aren’t afraid to sell if the business performance or outlook changes.

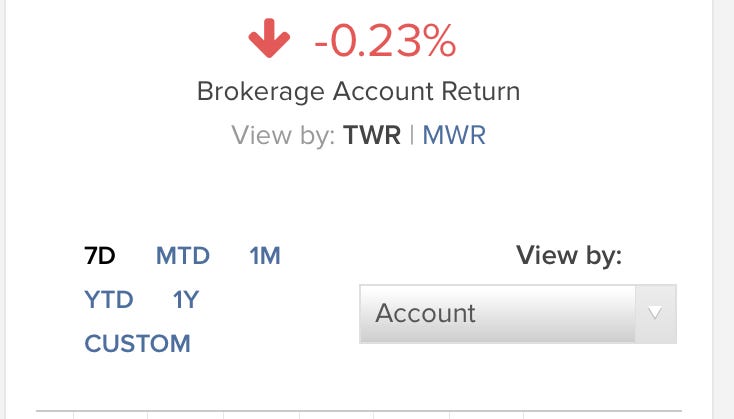

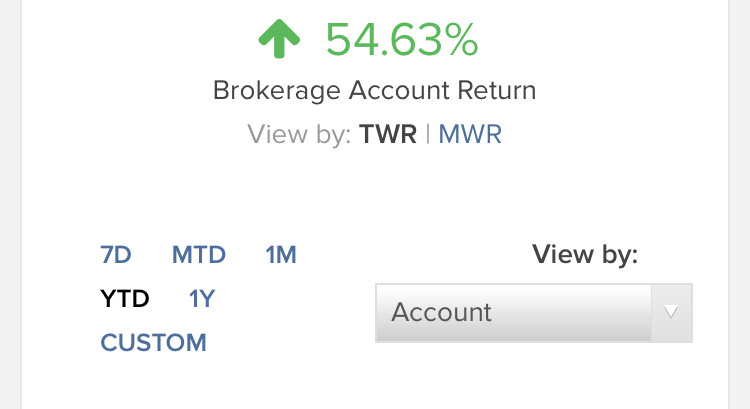

Founder Stock 2014 Fund

This is roughly 90% of our investments so this is what I base the weekly and monthly portfolio update numbers on.

7-Day: -0.23%

Year-to-Date: +55%

I didn’t make any changes in this portfolio this week.

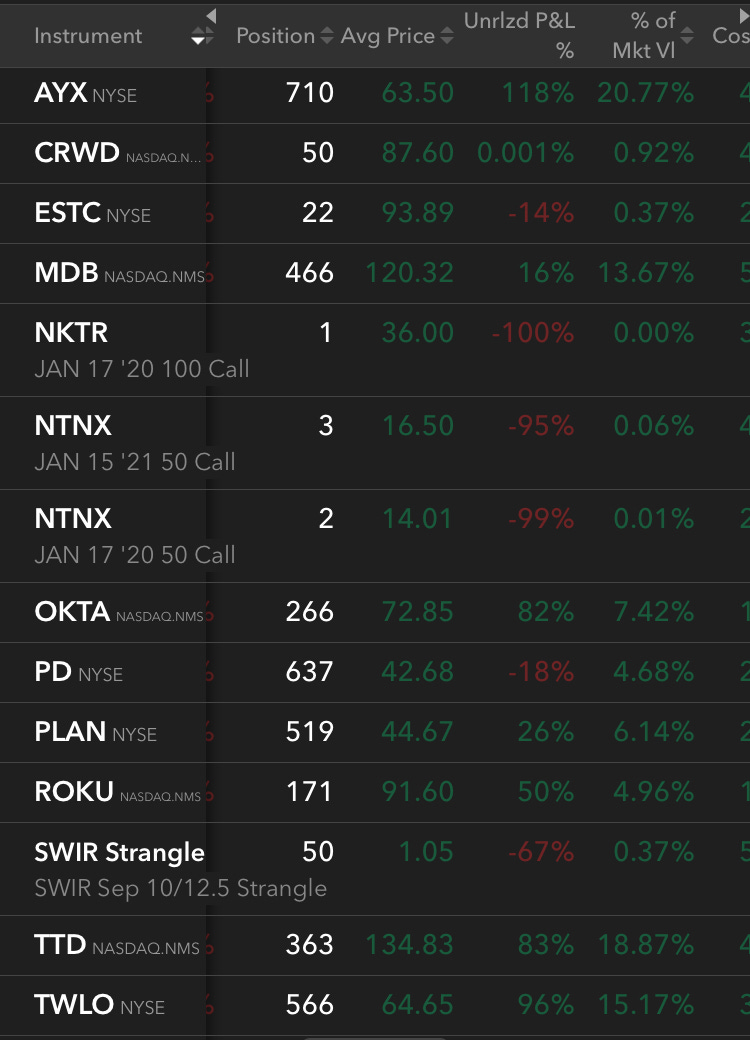

Here is a bit more detail on the positions in our portfolio. I have decided to share this level of detail because I think it helps to have context around the value of these positions as people manage their own investments and because it’s easier than typing it out. Laziness wins.

As you can see, Alteryx, The Trade Desk, Twilio, and MongoDB are still my top 4. AYX has jumped to almost 21% of the portfolio (% of mkt vl) due to the stock outperforming and not being hit as badly as the others lately.

You’ll notice my leftover options positions. Last year, I bought long term calls (LEAPS) on NKTR and NTNX. Check out the average price for each, number of options (remember to multiply the “position” by 100, then multiply the average price by that to get the total original cost of each options position). That’s around $12k down the drain.

This is the risk with options. For long-term investors like us, they are unnecessary and probably destructive to building wealth the way we are.

I’m feeling comfortable with the position sizes for now. It feels like there might be something going on with Pager Duty that I’m just missing. However, I intend to wait to make any changes until after they report earnings on September 5th.

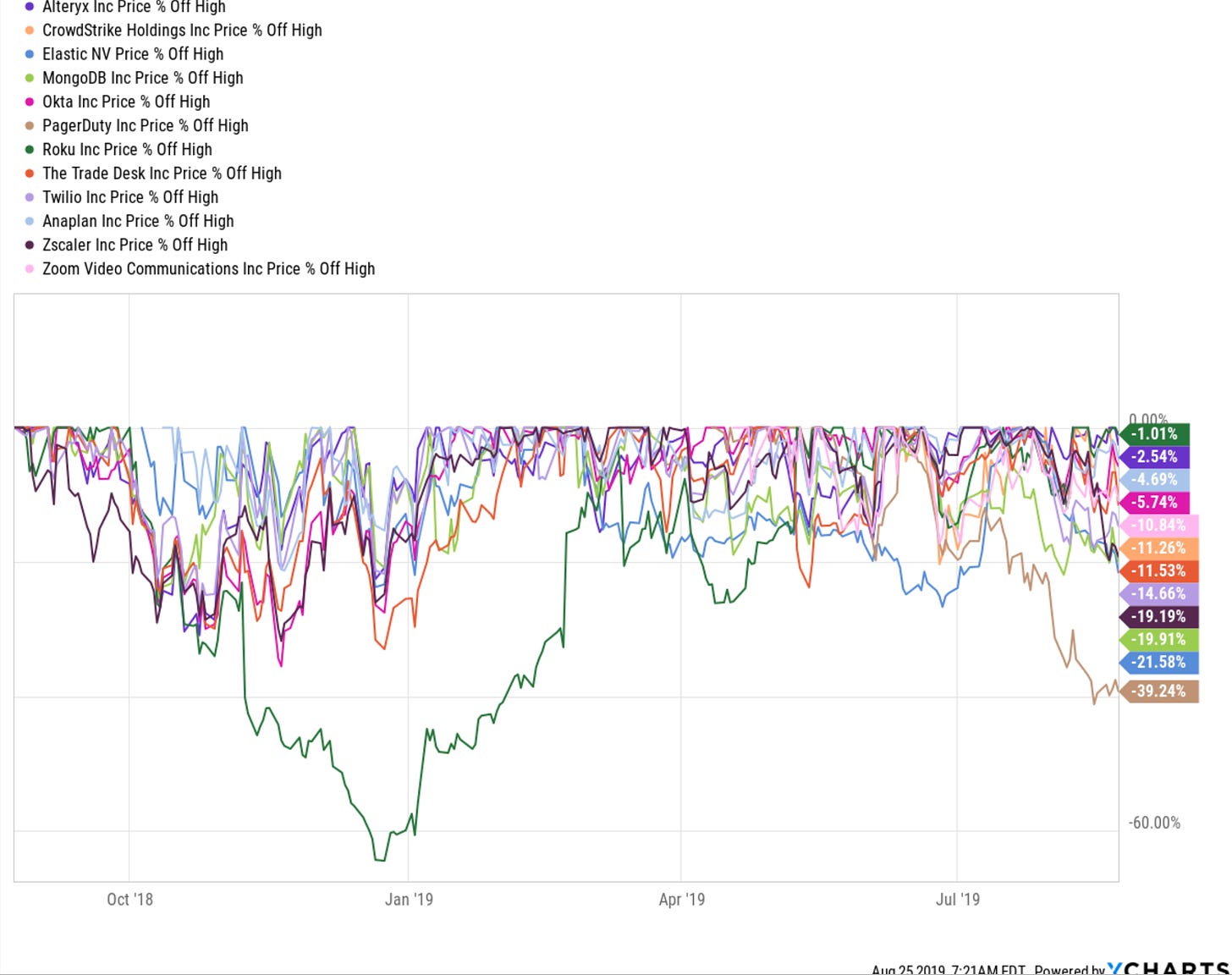

Here is a chart of % off all time highs for my companies (forgot Slack (WORK)). Roku is only 1% off its ATH with Alteryx and Anaplan following closely at down 3% and 5% respectively.

On the opposite end, Pager Duty is down 39%, Elastic is down 22% and MongoDB and Zscaler are down 20% and 19% respectively.

So what does this mean?

I prefer adding to winners, not losers. BUT, when there are market-wide sell offs that are not based on poor operational results from companies, I will often use that as an opportunity to make adjustments.

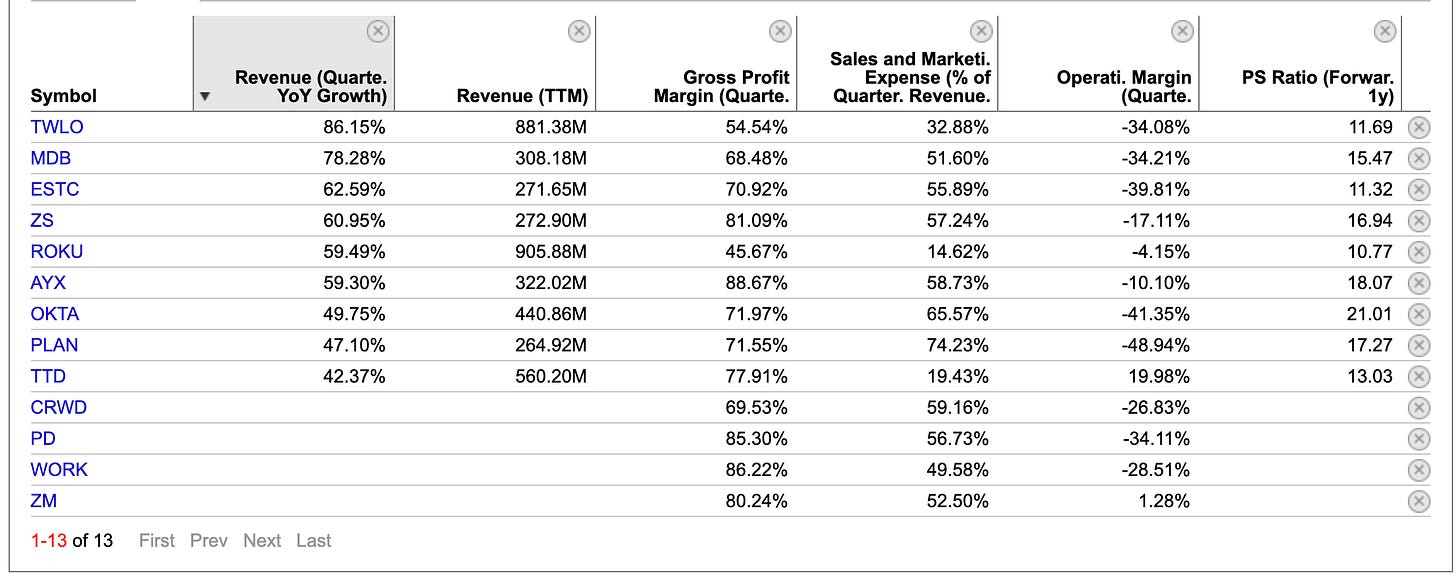

I’ve posted a data view from Ycharts I like to use to keep a high-level view of my companies. Please refer to our Terms & Definition page for detailed definitions and formulas for each term (Gross Profit, Operating Margin, PS Ratio (Forward 1y).

With this view, it’s really easy to see where the best opportunities might lie. Quick note, TWLO’s revenue growth of 86% was boosted by the Sendgrid Acquisition so it’s not as impressive as it looks. I’ll go into how I think about each of these metrics and how the tie together (in my mind) in a future post.

Here are my conclusions after combining the % off all time highs, this data, my current position sizes, and my thoughts about each company’s opportunity.

I am most likely to trim PD and WORK if their quarterly results show weakness. They are new IPOs and need to prove themselves before I add more to the positions. Don’t chase unproven companies lower.

With new funds and any funds from trimming other companies, I will look to add to ZS, MDB, ESTC, and ROKU. However, ROKU and TTD combined make up about 25% of my portfolio and they are both in the advertising/entertainment industry so if I add to ROKU I will probably need to trim TTD. I’m a big fan of both companies and believe they have huge opportunities. I’m going to give TTD another quarter before I consider trimming.

Earnings & Events Coming Up

These next couple weeks will be busy for our companies. As an investing nerd, I love having a concentrated portfolio because it allows me to deep dive into each company’s earnings reports and investor presentations/events to truly understand our companies. Knowing what we own is a major advantage because most people have trouble even remembering which companies are in their portfolios.

Aug 27 - Before Market Opens: Anaplan (PLAN) Q2 FY20 Earnings

Aug 28 - After Market Close: Elastic (ESTC) Q1 FY20 Earnings

Aug 28 - After Market Close: Okta (OKTA) Q2 FY20 Earnings

Sep 04 - 8:45am ET: Citi 2019 Global Technology Conference (AYX)

Sep 04 - 10:15am ET: Citi 2019 Global Technology Conference (ESTC)

Sep 04 - 2:00pm ET: D.A. Davidson Technology Conference (ROKU)

Sep 04 - After Market Close: MongoDB (MDB) Q2 FY20 Earnings

Sep 04 - After Market Close: Slack (WORK) Q2 FY20 Earnings

Sep 05 - After Market Close: Crowdstrike (CRWD) Q2 FY20 Earnings

Sep 05 - After Market Close: Pager Duty (PD) Q2 FY20 Earnings

Sep 05 - After Market Close: Zoom (ZM) Q2 FY20 Earnings

Sep 10 - 2:05pm ET: Deutsche Bank 2019 Tech Conference (ZM)

Sep 10 - After Market Close: Zscaler (ZS) Q4 & Annual FY19 Earnings

Thank You

Thank you all so much for reading and helping to support my goal of making investing accessible to anyone with an internet connection. We are now at 677 total subscribers and 39 paid subscribers. If you enjoy this please hit the ❤️ at the top of the page (this helps others find us on substack.com), share with friends, and/or start a paid subscription for $5/month or $50/year.

I’m considering creating some type of Slack group or community forum to build a little bit of camaraderie and social interaction. It would be a quiet little corner of the internet where people from all different backgrounds and beliefs could come together to share ideas, learn, and have respectful discussions.

I don’t plan to charge anything for that (unless it costs money per user, then I would charge whatever small fee that would be and nothing more).

Would you join a Slack group for our readers or are these email updates enough for you? Please let me know by replying to the email, or commenting on this page!