Let’s get straight to it.

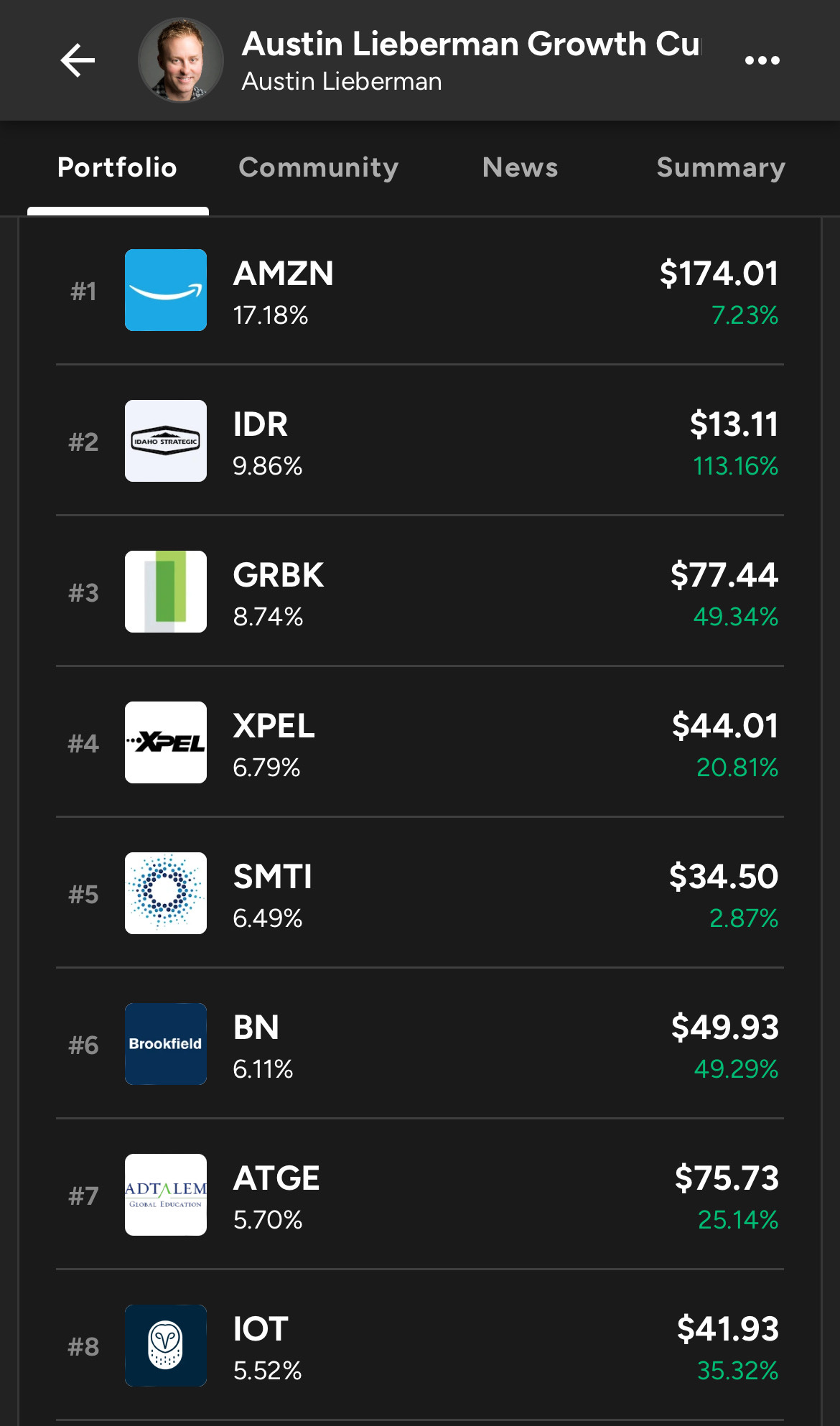

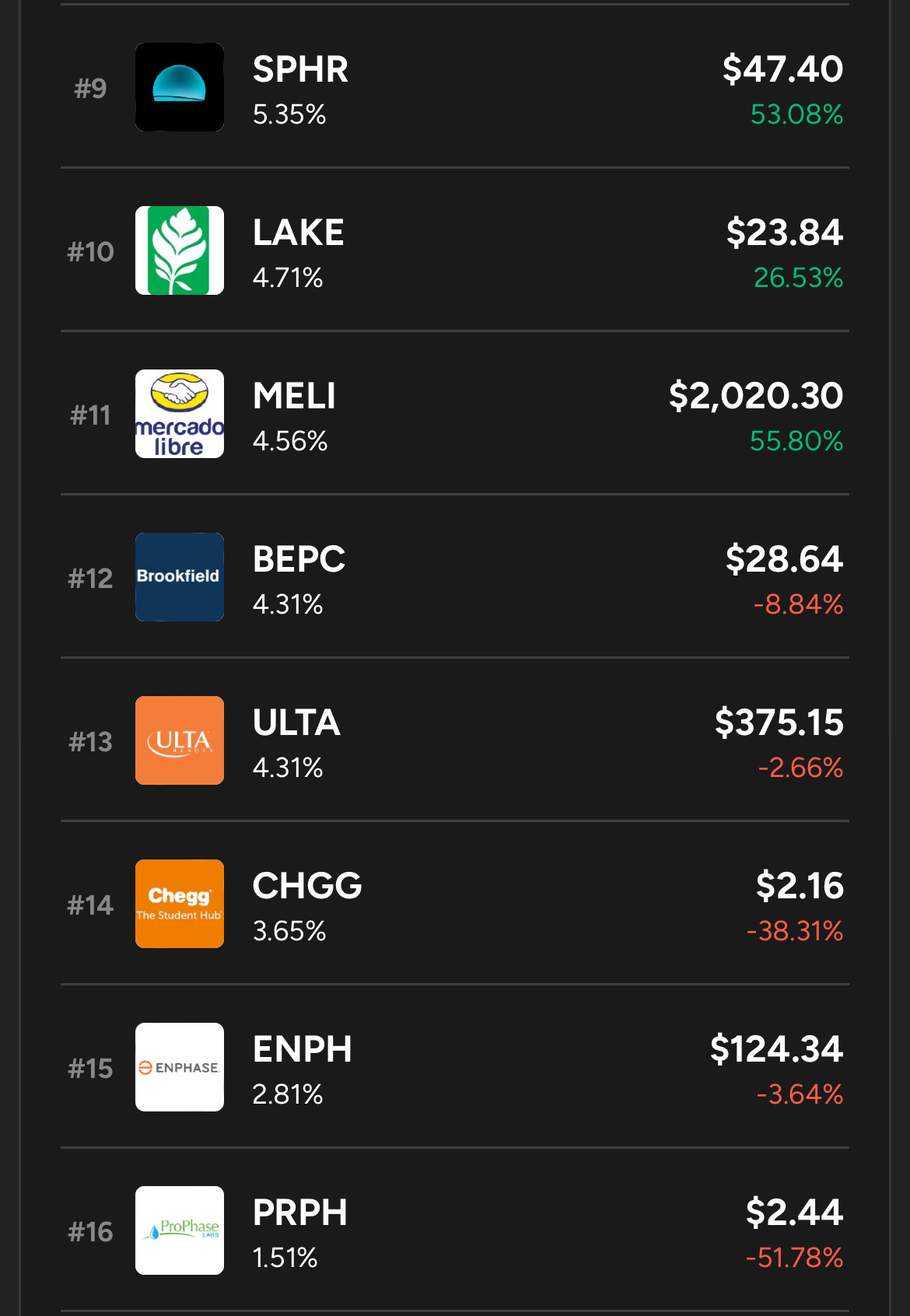

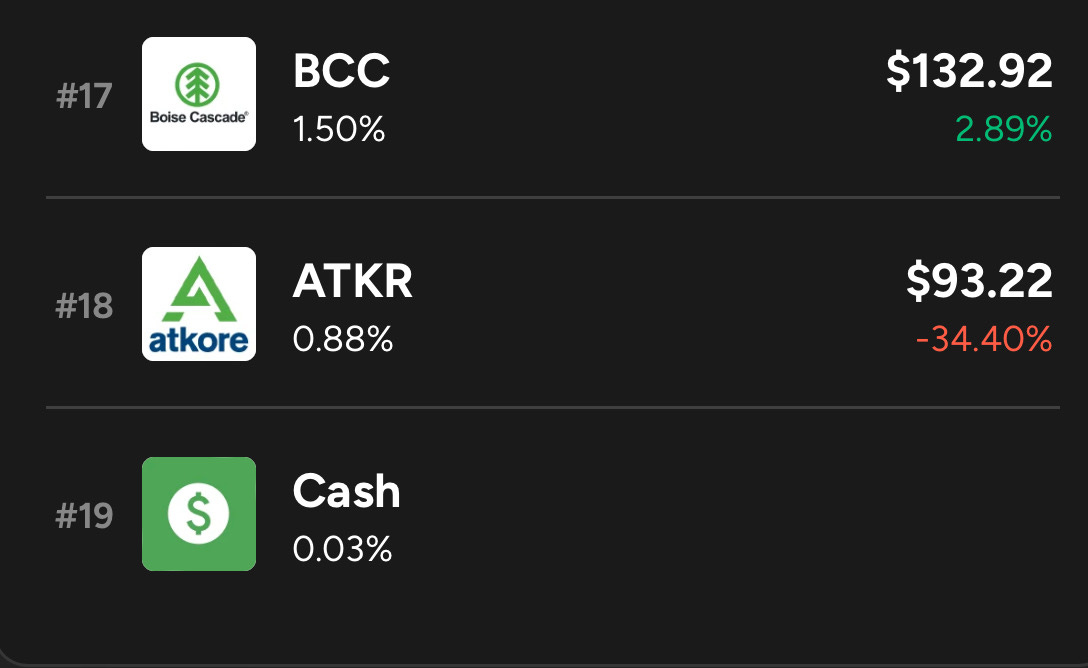

Here’s the current portfolio. No big changes from the last update.

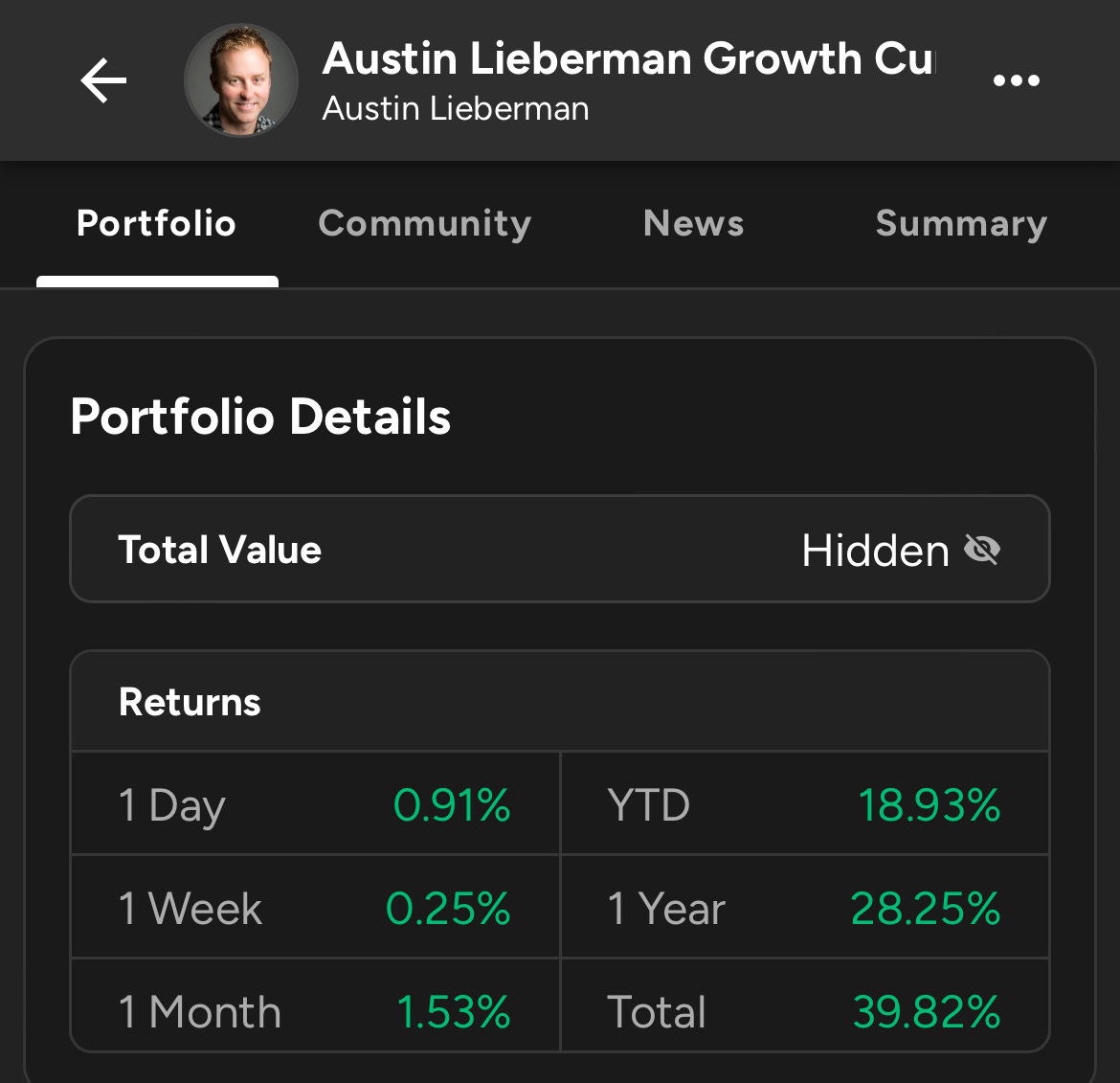

I’m sharing some performance metrics showing the portfolio returns since I started tracking it on SavvyTrader (September 2022) and comparing it to the IWM which I think is the best comparison.

Why? I’ve narrowed to focus of this portfolio to be what I believe are the best mid and small cap opportunities. My goal with this portfolio is not to convince anyone they should only invest in these types of stocks. Not at all.

In fact I don’t only invest in these stocks. I also own indexes in several 401ks and my military TSP which track the S&P500, QQQ, etc.

This portfolio is designed to be a tool to help you find and learn about small and mid cap stocks, then you ultimately decide what % of your total invested money should be in small and mid caps and which if any of the stocks I own or study you want to own.

so that’s why I will compare it to IWM. Because IWM is one of the most popular/easiest ways to get small and mid cap exposure.

Anyways, here we go.

This is ordered by position size. Largest to smallest. Yes, I own a ton of Amazon… which is not a small or mid cap stock. However, I feel the opportunity is just too good based on Amazon’s current growth prospects and valuation. So overtime I see myself trimming Amazon to add to small and mid cap opportunities.

So far I feel I’ve done well sizing my higher confidence positions a bit larger and they for the most part have performed well.

Towards the bottom I have some major losers but notice they’re my smallest positions. I’m fine with this. If they keep underperforming they’ll become even less meaningful.

This newsletter is 100% free with no ads. I want to keep it that way. If you’d like to support the newsletter you can start a paid subscription for $5/month. You don’t get anything extra other than knowing you’re supporting my work and keeping this newsletter free.

Thank you all for reading!

ULTA EARNINGS PREP

$ULTA reports earnings today.

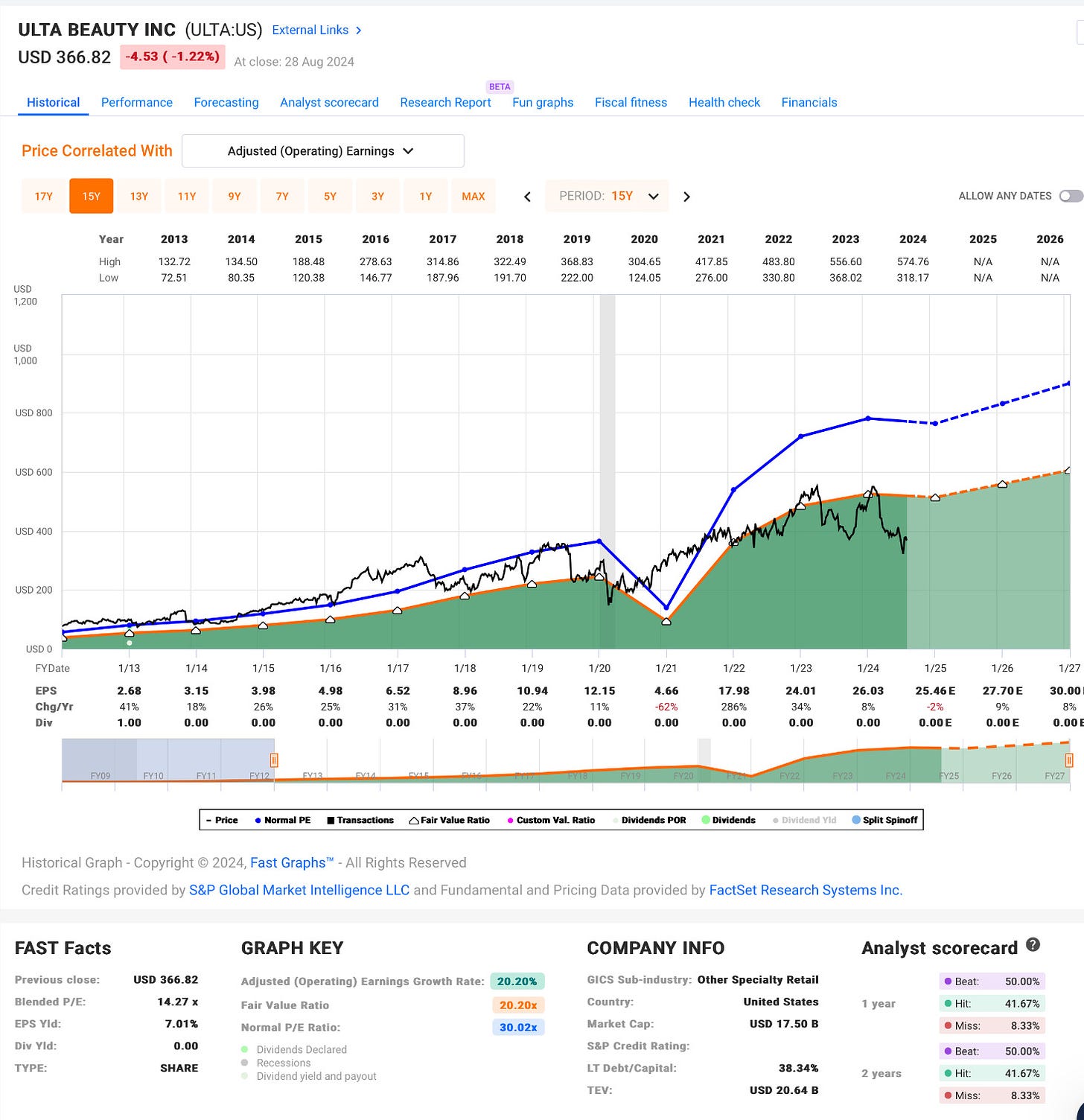

Current P/E around 14. Well below its 10 yr avg of 30 (Image 1 below).

However, earnings per share have grown 20%/yr for the last 10 years.

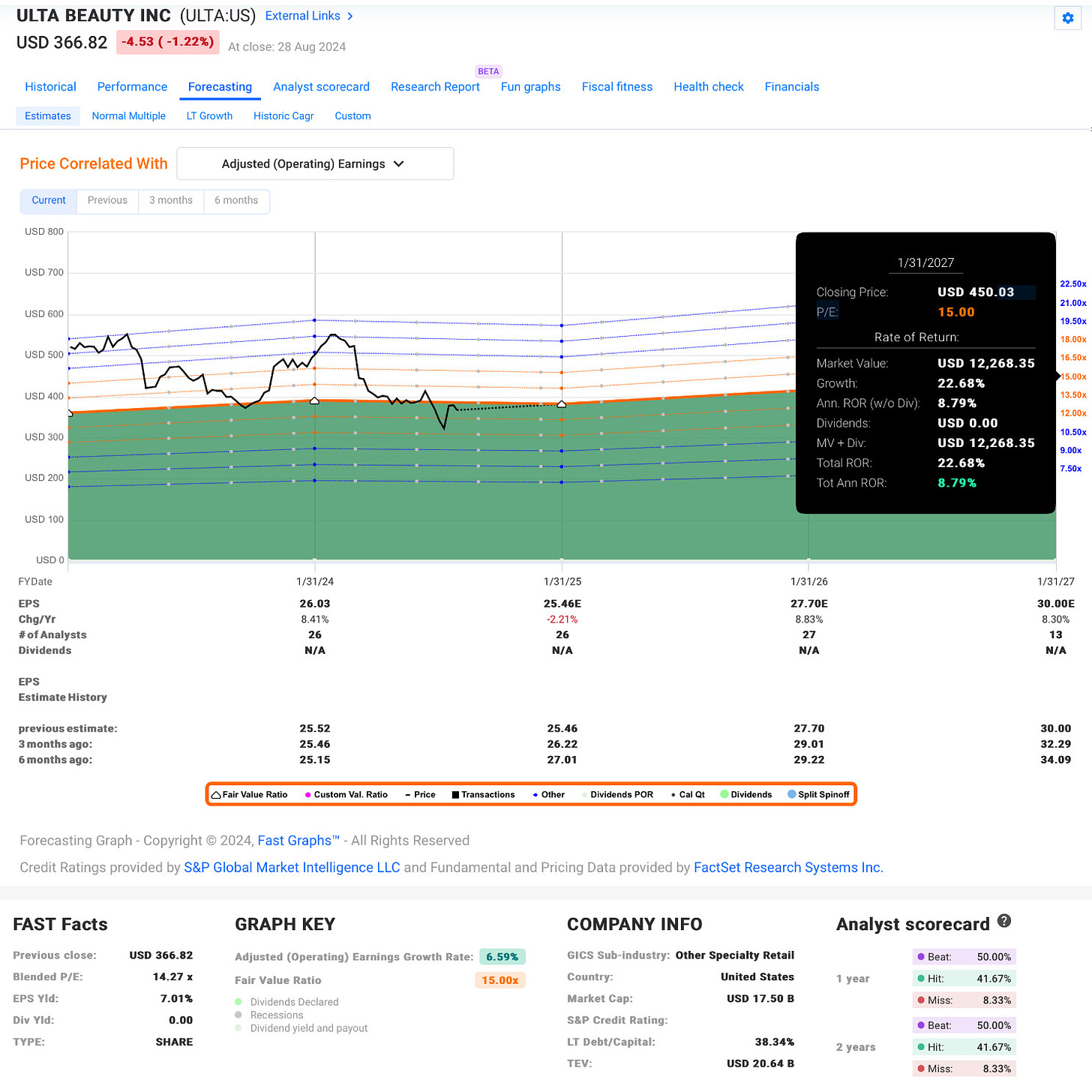

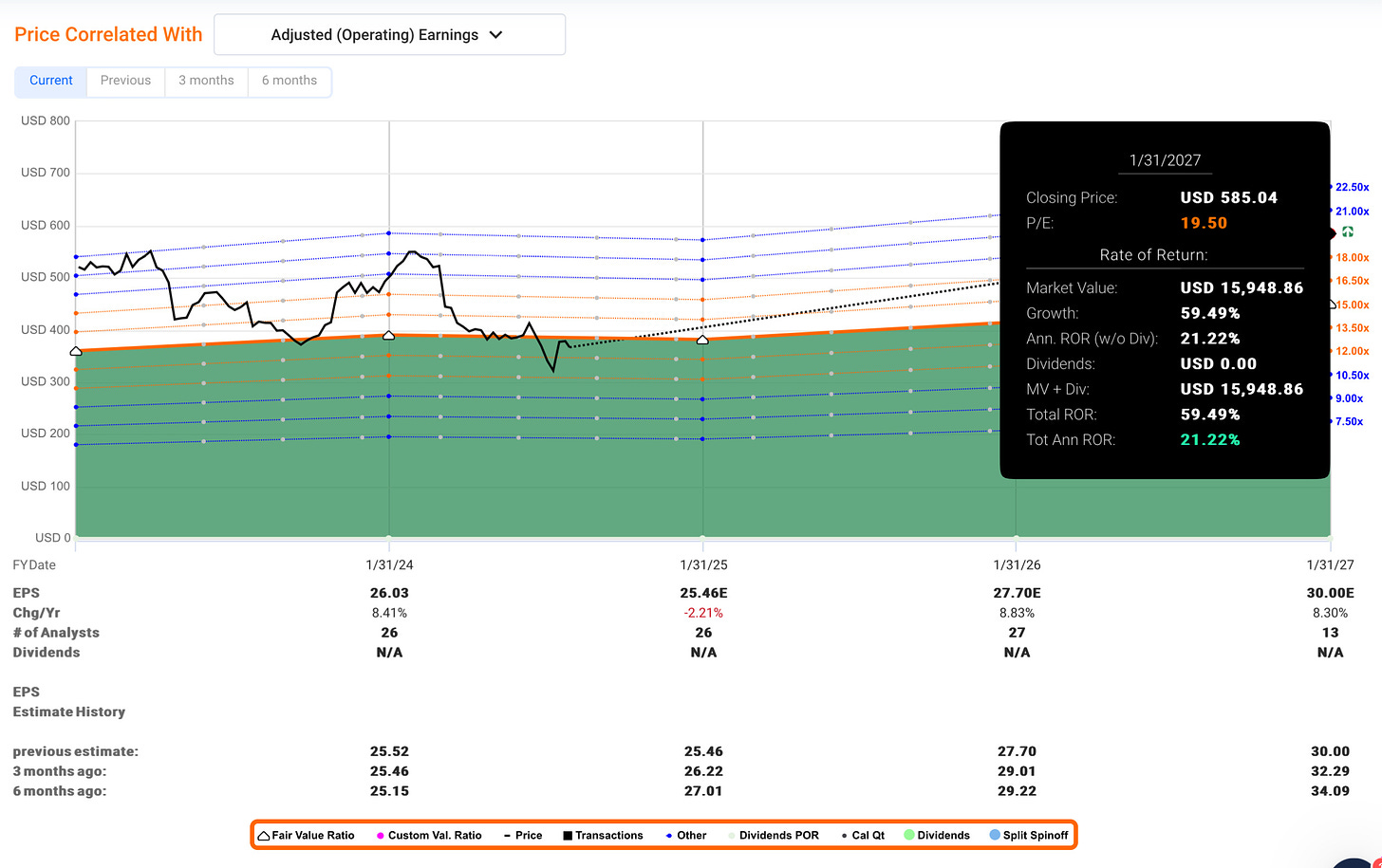

Over the next 3 years analysts expect 6% EPS growth/yr. If it trades at a P/E of 15 in 2027 then the annual return is roughly 9% (image 2 below)

I have no idea what’s going to happen with earnings today but I currently own shares because I think they’ll be able to maintain or beat 6% EPS growth over the next 5+ years and potentially benefit from a bit of multiple expansion.

At a P/E of 19.5 in Jan 2027, the return would be roughly 20% annualized.

Something between that 9% and 20% annualized return is what I’m hoping for over the next 3+ years. Obviously no guarantees.

I’ll send out an earnings review this weekend once I’m able to digest Ulta’s earnings. I’m guessing not much will change in the long-term thesis.

Finally, the microcap I’m buying next. This one is risky and it’s a stock that’s already in the portfolio. Generally I don’t like adding to losers because that’s a great way to lose more.

However, I think the stock is misunderstood and I’ll keep it at a very small position size so I won’t be hurt if it keeps going lower.

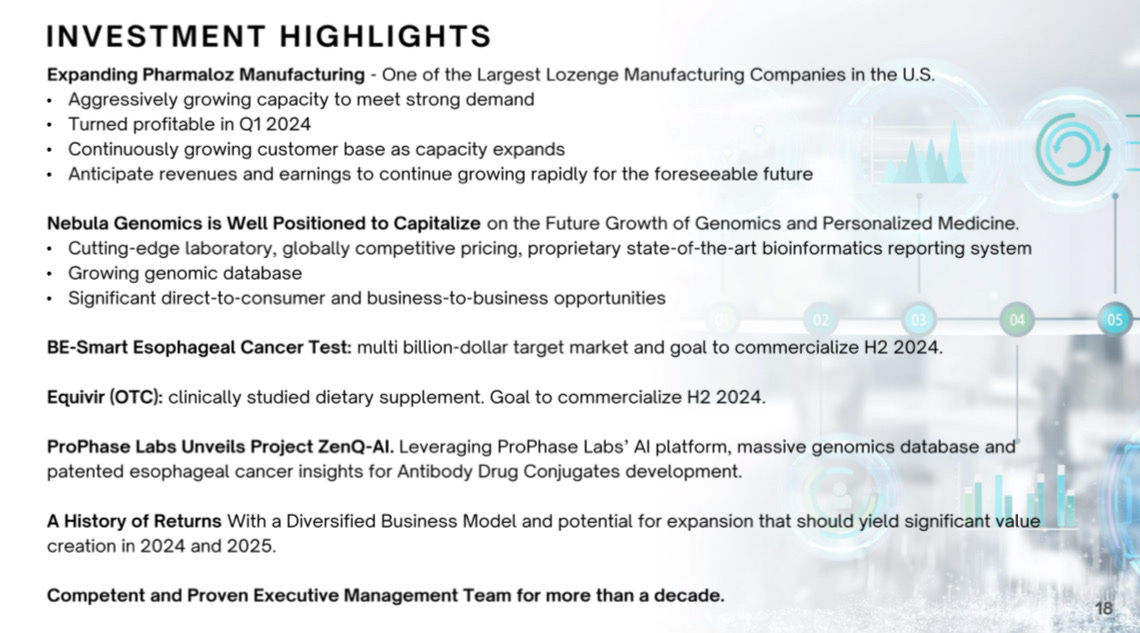

The stock? $PRPH Prophase Labs

For now, I’ll share this Investment Highlights slide from their recent earnings. Next week, I’ll do a more in depth write up on the company.

Thank you, Buffet is on ulta so he probably see something.amazon is very interesting but too stretch lately to enter