The wild stock market, when Buffett lost 49%, Taiwan Semiconductor earnings

Portfolio value: $125,401. Up 10.3% this week

It’s the end of another week. I’m sending this Friday evening because I want it to hit your inbox when things have slowed down. Take time to relax and reflect this weekend.

Financial content tends to be fast-paced. It makes you feel like you constantly have to check notifications and make changes to your portfolio.

These behaviors are bad for your portfolio and your mental and physical health. This newsletter is the opposite of that. I encourage you to consume less, take fewer actions, and aim to improve the quality of each decision you make.

Do me a huge favor. After you read the email, reply and let me know if you enjoy this format.

1. Reflection from me

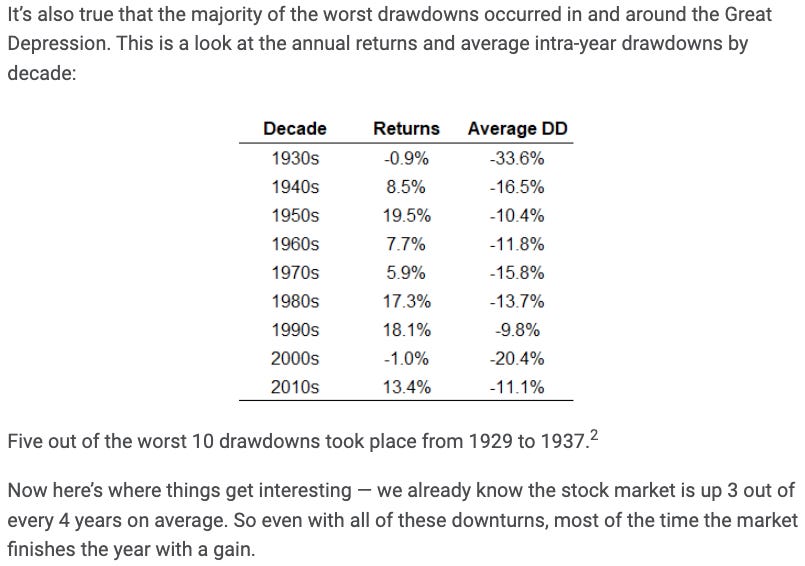

These last three years have felt wild for the stock market. Things still feel wild with inflation, rate increases, wars, and so on.

But wild is completely normal for the stock market. The S&P 500 is down 14% over the last year. If we zoom out five years, the S&P 500 is up roughly 42.5%, which is a 9.42% compound annual growth rate. Pretty normal.

Here’s a pretty wild snippet from Ben Carlson.

2. Lesson from a legendary investor

This is an excerpt from a Warren Buffett interview with Forbes in 1974. Berkshire was down roughly 49% in 1974, and inflation was soaring because of rising oil prices. I think it’s a great perspective on how hard it can be to stay focused when times are crazy.

“What good, though, is a bargain if the market never recognizes it as a bargain? What if the stock market never comes back? Buffett replies: "When I worked for Graham-Newman, I asked Ben Graham, who then was my boss, about that. He just shrugged and replied that the market always eventually does. He was right--in the short run, it's a voting machine; in the long run, it's a weighing machine. Today on Wall Street they say, 'Yes, it's cheap, but it's not going to go up.' That's silly. People have been successful investors because they've stuck with successful companies. Sooner or later the market mirrors the business." Such classic advice is likely to remain sound in the future when they write musical comedies about the go-go boys.

We reminded Buffett of the old play on the Kipling lines: "If you can keep your head when all about you are losing theirs … maybe they know something you don't."

Buffett responded that, yes, he was well aware that the world is in a mess. "What the DeBeers did with diamonds, the Arabs are doing with oil; the trouble is we need oil more than diamonds." And there is the population explosion, resource scarcity, nuclear proliferation. But, he went on, you can't invest in the anticipation of calamity; gold coins and art collections can't protect you against Doomsday. If the world really is burning up, "you might as well be like Nero and say, 'It's only burning on the south side.'"

"Look, I can't construct a disaster-proof portfolio. But if you're only worried about corporate profits, panic or depression, these things don't bother me at these prices."

Buffett's final word: "Now is the time to invest and get rich."

3. Portfolio Update

The Growth Curve portfolio ended the week at $125,401 with a gain of $11,711, up 10.3% for the week. Here’s a quick update on Taiwan Semiconductor TSM 0.00%↑ earnings and the current positions.

Keep reading with a 7-day free trial

Subscribe to Growth Curve By Austin Lieberman to keep reading this post and get 7 days of free access to the full post archives.