The Trade Desk (TTD) Q1 2022 Results

After these results and the recent sell-off, I'm building my position

TLDR: The Trade Desk is currently a 3.8% in the portfolio. As of this morning, I have increased my target allocation of TTD to 10% which means it will get new money as contributions come in. TTD is such a high-quality business and Jeff Green is one of the best CEOs in the world. In his opening remarks this quarter, Green said

“I believe we are now firmly established as the default DSP for the open Internet and that we are very well-positioned to grow and grab share regardless of the macro environment.”

I agree with him. TTD is a dominant company in an industry with plenty of growth ahead and its been GAAP profitable every year since 2019. The P/S multiple is a bit high, but the recent sell-off has brought it down to much more reasonable levels (more detail on that below) so I’m willing to build it up to a 10% position.

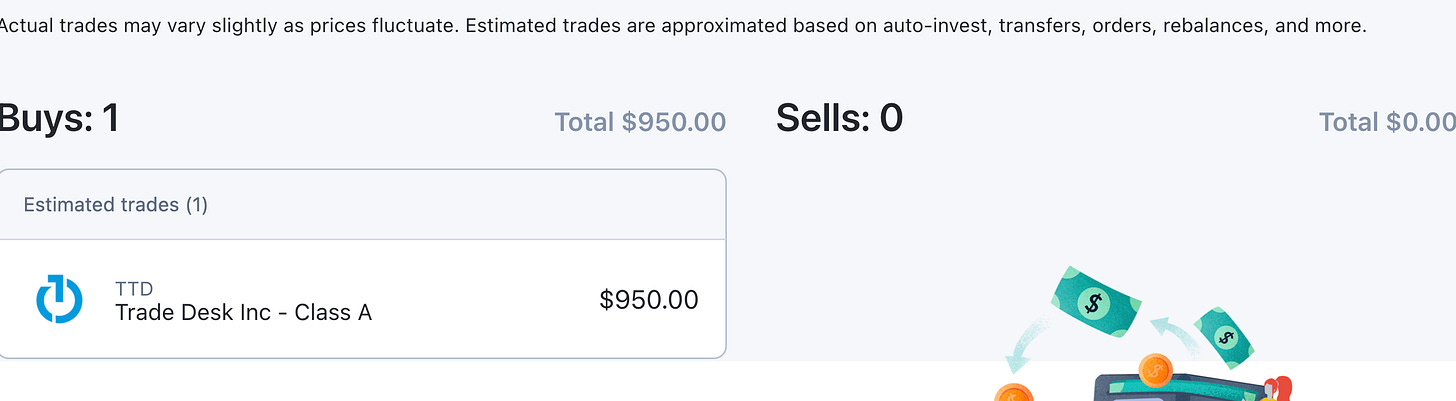

I will be buying $950 more between 9:30am EST and 10:30 am EST this morning.

Sections:

1. Q1 Results Summary & Q2 Guidance

2. Notes from the conference call

3. Potential return scenarios in FY 24 & FY 27

1. Q1 Results Summary

The company beat on Adjusted EPS and revenue but management says they expect $364 million in revenue for Q2, lower than the $364.72 million analysts previously expected.

The market currently hates anything related to growth so as of right now, the stock is down 5% pre-market to 41.3

Revenue: $315 million, up 43% YoY

Beat management’s guidance of $303 million

Beat analyst expectations of $304 million

Adjusted EPS: $0.21, up 49% YoY

Beat analyst expectations of $0.14

Adjusted EBITDA: $121 million, up 72% YoY, EBITDA Margin: 38%

Beat management guidance of $91 million

I pasted management’s Q1 Business Highlights below because I believe they’re important to understand as key indicators of TTD’s growing influence (dominance).

Customer retention remains very high, TTD’s Unified ID 2.0 (alternative to third-party cookies) continues to gain traction, and TTD continues to give ad buyers more control and access to inventory through partnerships and platform innovations.

Strong Customer Retention: Customer retention remained over 95% during the first quarter, as it has for the past eight consecutive years.

Continued Collaboration and Support for Unified ID 2.0: The Trade Desk is building support for Unified ID 2.0, an industry-wide approach to identity that preserves the value of relevant advertising, while putting user control and privacy at the forefront. The ID is an upgrade and alternative to third-party cookies. Recent partnerships and pledges of support include:

Collaboration with LiveRamp to create European Unified ID (EUID), a new privacy-first, interoperable solution for the European Advertising Market.

Partnership with AppLovin, marking the first mobile-native in-app exchange to enable Unified ID 2.0 signals for mobile publishers.

Expanded Partnerships:

In March, The Trade Desk announced a new integration with Adobe Real-Time CDP, a leading customer data platform. As marketers prepare for the deprecation of third-party cookies, the collaboration empowers the activation of first-party data to create more precise digital advertising campaigns.

In March, The Trade Desk launched a new certified service partner program for small and medium-sized businesses (SMBs). As part of the announcement, Goodway Group became The Trade Desk’s first certified service partner to help meet rising demand from SMBs as they increasingly turn to data-driven advertising to optimize budgets.

Launched OpenPath: Highlights include:

Ability for publishers to integrate directly with The Trade Desk, allowing advertisers direct access to their inventory.

Removes inefficiencies often present in the programmatic supply chain, including those propagated by walled gardens.

Second Quarter 2022 outlook summary:

Revenue at least $364 million

Adjusted EBITDA of approximately $121 million

My summary:

Keep reading with a 7-day free trial

Subscribe to Growth Curve By Austin Lieberman to keep reading this post and get 7 days of free access to the full post archives.