Hi friends 👋,

Welcome back to The Growth Curve. I hope you’re having a great weekend.

Today I’m sharing:

1️⃣ Some quick reflections on the power of long-term investing

2️⃣ A portfolio update.

It should take you less than 5 minutes to read. My goal as always, is to be transparent with how I’m investing and share insights or lessons learned that will help you become a more informed investor. Nothing I write should be taken as advice.

1️⃣ The power of long-term investing

I haven’t written consistently since I started a full-time job on August 1st. I’m going to fix that now that I’m situated. I also have not paid nearly as much attention to my portfolio and the market's daily moves since I started a full-time job.

This has reinforced a formative investing belief I have. When it comes to investing, less is more. What do I mean by that? I firmly believe that for MOST people, your investment returns and overall quality of life are inversely related to the number of transactions you make (not counting regular contributions to your portfolio).

Less transactions = better returns and higher quality of life

The chart below does a great job of showing this phenomenon. If you invested $100k into the S&P500 in 1998 and just left it there through the .com crash, GFC, etc your portfolio would be worth $625,000 as of June 30th, 2023. If you had missed JUST the 10 best days over those 25 years by trying to time the market, your portfolio value is $286,590.

This doesn’t even include taxes, fees, stress, sleepless nights, lost family time because you’re stressed about when to buy or sell, etc.

The chart above is from YCharts’ Supercharged Asset Gathering: The Top 10 Visuals for Client and Prospect Meetings deck. It’s free and includes many other great visuals for long-term investors.

Over the last couple of years, I’ve either been focused on this newsletter or had investment-related jobs, which caused me to be “hyper-focused” on the market.

Reflecting on those jobs, I can see why people in the finance industry & financial media are constantly tinkering with their portfolios or recommending changes. They’re incentivized to. I knew this was the case before, but I hadn’t personally experienced the gravitational pull of “doing something” until my livelihood was tied directly to the market.

I want to be very clear. I’m not saying everyone does this. I’m not even saying it’s intentional (in some cases, it is). I think for most people, it’s just natural to feel inclined to “do something” when investing or the stock market is the central focus of your job.

2️⃣ Portfolio Update

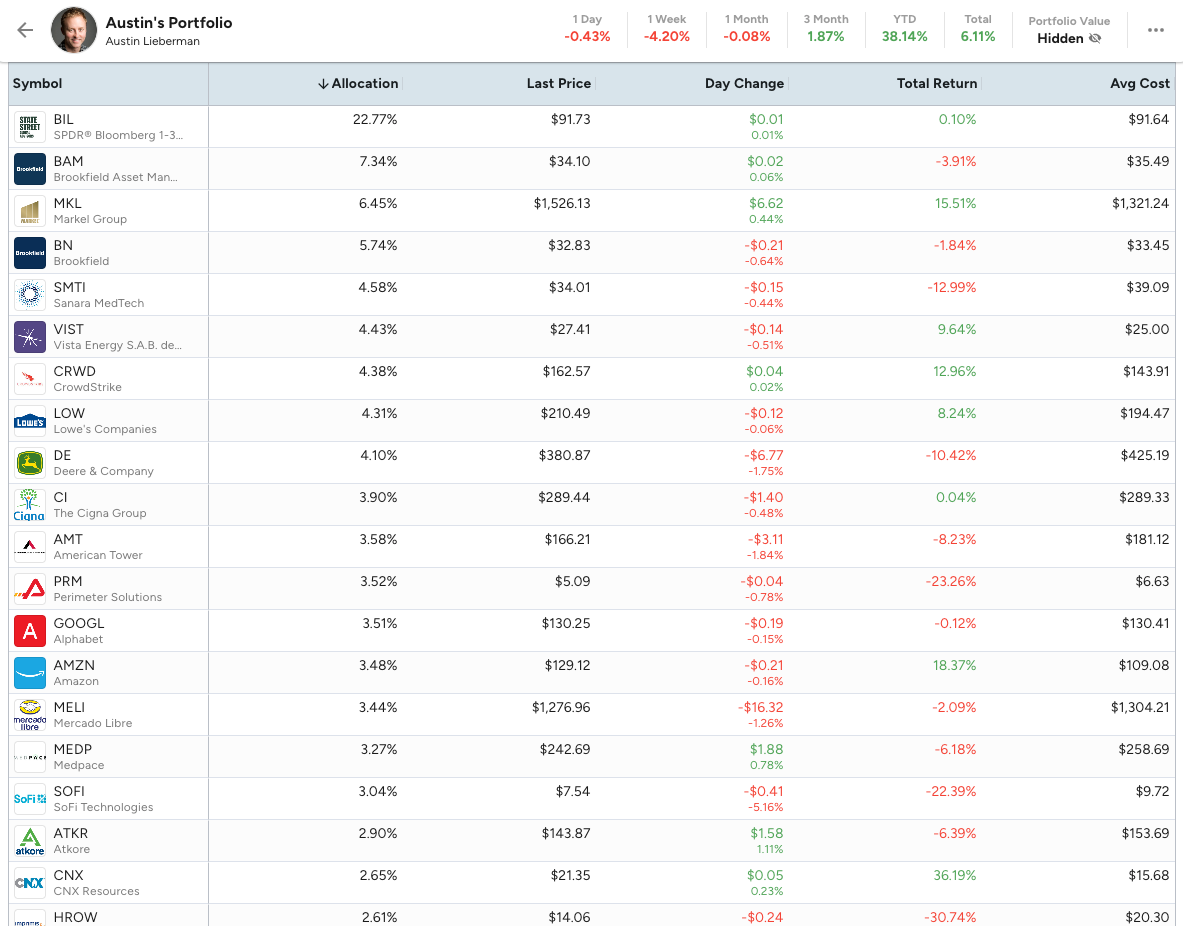

Here’s The Growth Curve portfolio, as tracked by SavvyTrader. I started tracking the portfolio on SavvyTrader in September 2022. You can see my total return of 6.11% at the top. SavvyTrader shows the S&P 500 up 8.37% and the Nasdaq 100 up 19% over the same period. I’m trailing both indexes.

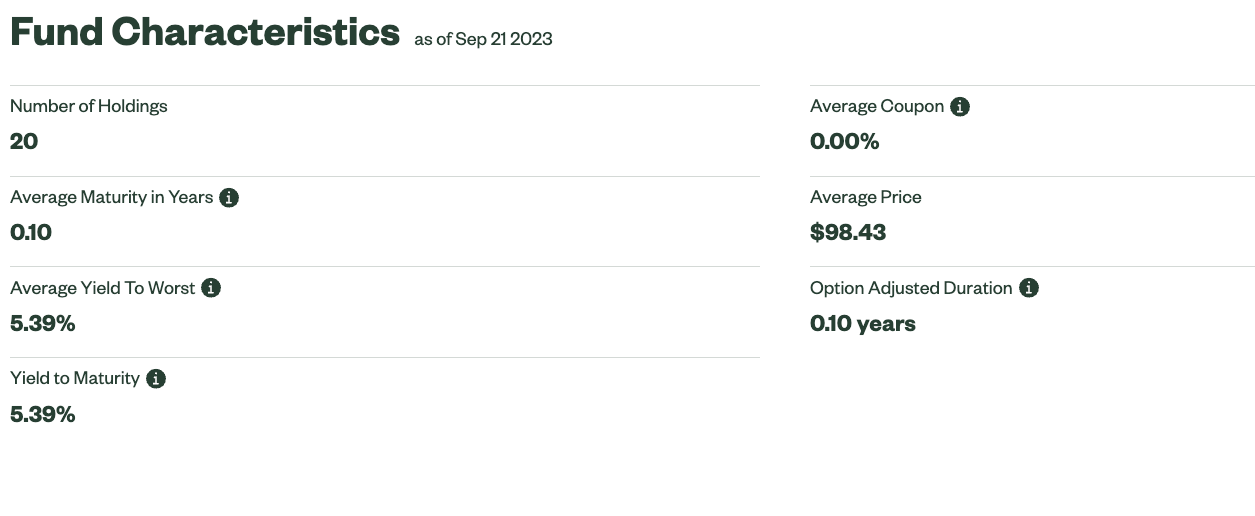

BIL 0.00%↑ is currently my largest position at 22.77%. It should provide around a 5% yield with very little risk. I’m happy to earn 5% on my “cash” position while waiting for the market to present a “fat pitch.” Here’s a link to the BIL fund summary page if you’d like to learn more.

That’s it for today. I hope you enjoy the rest of your day and wake up tomorrow ready to make the most of your week.

My next email will cover some updates on Brookfield Asset Corporation’s BN 0.00%↑ & BAM 0.00%↑ 2023 investor day. Combined, they are the largest holding in the portfolio and CEO Bruce Flatt shared a lot of interesting updates about what they’re seeing in the economy and some of their investments in India.

Thanks for reading. Share any questions or thoughts in the comments.