Sticking to The Plan & Earnings from Alteryx and Twilio

First up. I didn’t post a weekly update at the end of last week and I didn’t cover Twilio and Alteryx’s earnings. I apologize for that. We had a fever get passed around the house so that kept us busy. Everyone is better now so… I’m back!

Now onto the stock market. HOLY COW THE WORLD IS ENDING!!! CNBC is even doing special “Markets in Turmoil” reports.

Okay this isn’t something to joke about. Real people are losing real money and that hurts. But, I’ve seen no indications from any of the companies I own that lead me to believe their businesses are struggling.

I have not made any changes to my long-term positions and I don’t intend to unless I see something alarming from their earnings reports.

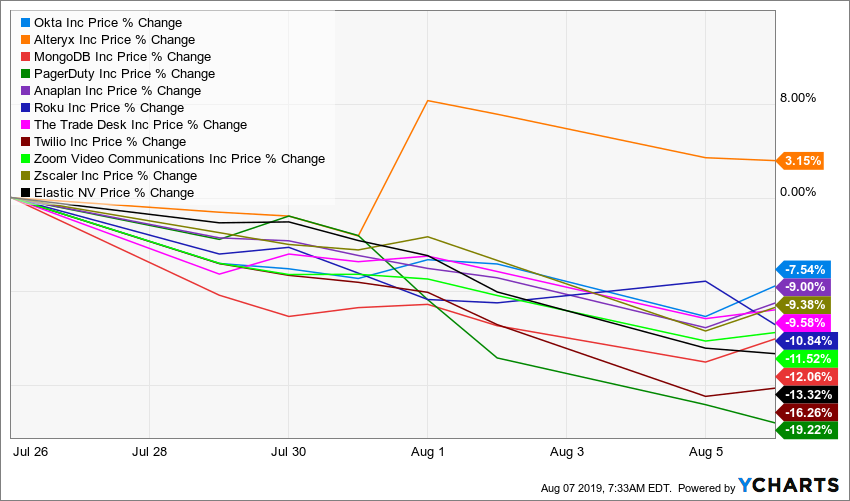

Here is a look at the performance of most of the companies I own since July 26. It’s been a rough couple weeks. Alteryx is fighting the tide and has managed to gain 3.15%. Stay strong my friend, stay strong. However, Twilio and PagerDuty are running neck and neck for the lead position to take my portfolio spiraling into the ground down 16% and 19% respectively. Thanks you two.

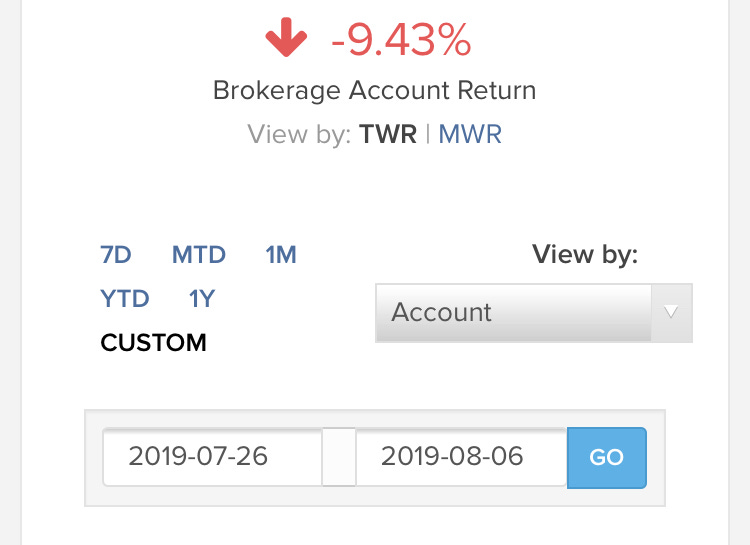

Here is a look at how my portfolio has performed since July 26.

Only down 9%. So why the difference? I’ve shared a few small options trades/gambles lately around volatile companies’ earnings reports. Those have probably helped my portfolio from dropping an extra 2-3% which is great.

However when you factor in the capital gains taxes and time it takes to monitor/execute those trades it is absolutely not worth while. So why do I do it? Great question. I guess because I want to learn and because I’m human. I’ve kept 95% of my portfolio invested in those long-term positions above, but for some silly reason I like to try these options out. One of these days I’ll stop.

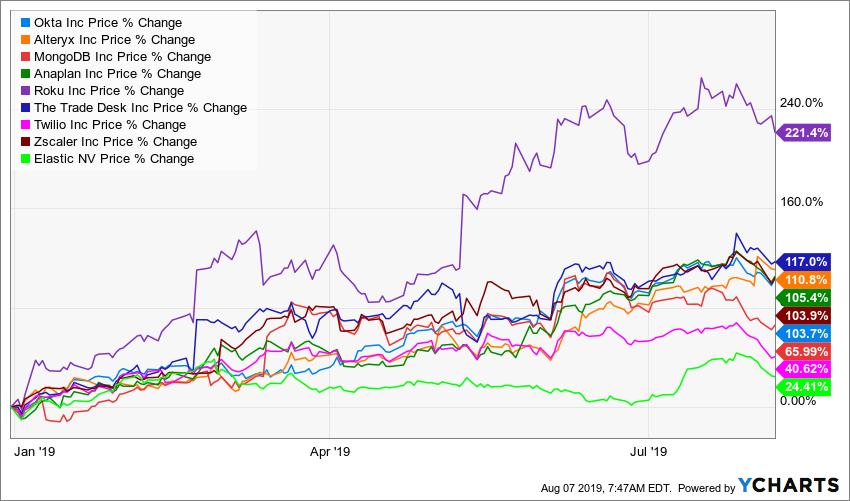

I think over the long term, it’s a losing game (for me at least). Here’s why. Take a look at how well these companies have performed Year-To-Date. I had to remove the companies that IPO’d in 2019 so I could show YTD performance.

Roku is up 221% and five other companies are up more than 100%. So I’m over here tinkering with options which takes time away from evaluating long-term winning companies, increases capital gains taxes (unless in a retirement account), and takes time away from my other priorities when I have these incredible long-term investments sitting in my portfolio saying “let me take care of this for you. You go spend time with your family.”

One day I’ll listen to myself and let these great Founder-led companies compound.

Twilio Earnings

Twilio reported Second Quarter, Fiscal Year 2019 earnings last week. Here is a link to the conference call transcript.

Q2 Total Revenue of $275.0 million, up 86% year-over-year

Q2 Base Revenue of $256.7 million, up 90% year-over-year

Q2 Dollar-Based Net Expansion Rate of 140%

The numbers looked very good but the stock is down since they reported. If it was not such a large position already, I would have added shares by now. My wife and I are actually in the process of rolling over 401Ks from our previous employers into a self-managed account. Twilio, MongoDB, and Elastic are three companies that we are likely to add to with those funds.

I’ll get to an earnings write-up once I’m caught up, but this Seeking Alpha article does a good job laying out many things I like about Twilio’s growth potential.

Alteryx Earnings

Alteryx also reported Second Quarter, Fiscal Year 2019 earnings last week and the stock is up since the report. They also reported strong numbers.

Second Quarter Revenue of $82.0 Million, up 59% Year-Over-Year

GAAP gross profit was $72.7 million, or a GAAP gross margin of 89%

Dollar-Based Net Expansion Rate of 133%

Here’s a good earnings write-up on Fool.com

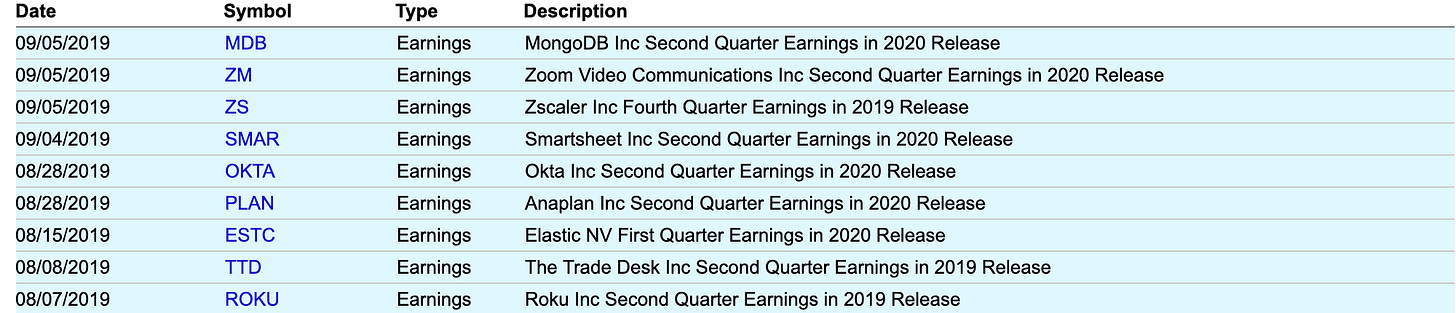

Upcoming Earnings

This is in reverse order. Roku reports today, The Trade Desk reports tomorrow August 8th, then more in the coming weeks.

Wrapping Up

I’m doing my best to ignore the panic-inducing headlines and stick to my plan. I will eventually get away from these silly options gambles which will give me more time to actually pay attention to the companies I currently own and will likely result in far better long-term results and less stress. I have not seen anything alarming from the companies that have reported so far and I’m looking forward to the rest of earnings season.

If you enjoy these and want a virtual hug, hit the ♥️ at the top of the page, share it with friends & family, and for two virtual hugs, start a subscription for $5/month or $50/year.

Thank you for your time and attention. I love getting your questions so keep them coming!