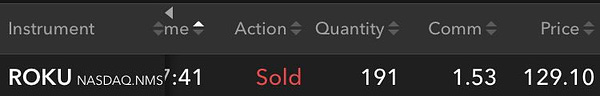

Hey everyone. Quick note because I’m on the road but wanted to share the latest portfolio change. ROKU out DDOG In.

Roku is now down about 15% since that trade but that doesn’t make this a good decision. That would be “resulting” which Annie Duke covers in her awesome book “Thinking in Bets”.

I judge my decisions based on whether Or not they align with my process.

I sold ROKU because I was no longer confident in my original thesis. I lost confidence in their ability to maintain their leadership position as profitably, I don’t like their reliance on hardware companies (TV makers), I am not super comfortable with the Founder and CEO, I already have an ~18% position in TTD, and I wanted money available to invest in Data Dog (DDOG).

This doesn’t mean I think a ROKU is a bad company or that I would short the stock. I just don’t currently want it to be one of my 10-15 holdings.

One last note. I apologize for the delayed notice on this, but please know this is not a stock recommendation service. I certainly appreciate all of the free and paid subscribers, but in its current form, this newsletter is basically my investment research and return journal where I share all of that stuff transparently.

I hope that can educate and inspire others to invest, but I want to be clear that I am not recommending these stocks to anyone other than myself.

Here’s my Tweets about the changes below. If you click on the Tweet you can see the thread which shows my stream of thought on it all.

Thank you so much for your time and attention. I really appreciate your support. Click subscribe below if you’d like to contribute $5/mo or $50/yr to help keep this newsletter running. I’ll try to get a more formal update out this weekend. Have a great day!

Hi Austin, I'm looking for a review you may have done on Z Scaler in the past. I searched 'Archives' but did not find anything. Could you pls send me a link where I can read your evaluation of ZS please? I'm short Jan 40 Puts and quite comfortable to take delivery at a net cost of $37 if assigned. SYMC and PANW seem to be their main competitors? CEO Chaudhry did not mention any other names during the last conference call. Given their close links to Office 365, is it likely MSFT will consider acquiring ZS at some point? The bulk of future expenses seem to be on marketing. If ZS is intergrated into the MSFT network, that expense will drop considerably. So, the value of ZS to MSFT may be much higher than it is to us in the public markets.