SOFI explodes after earnings. Is it meme-stock mania again?

Quick housekeeping,

I have turned off all paid subscriptions and refunded around $12,000 to previous paid subscribers. I officially start at YCharts tomorrow and I couldn’t be more excited to spend my time studying markets and helping advisors and investors save time, do research, and communicate their ideas using beautiful charts.

Check out YCharts’ thorough Q2 Economic update for free.

Joining YCharts will also allow me to keep writing my newsletter and keep it 100% free. Investor education is something I’ve been passionate about for over a decade so I’m extremely excited to continue sharing my research.

Onto the email…

Why am I writing this and why should you read it?

I own 5 x SOFI $5.5 strike, January 17, 2025 expiration calls that I bought for $1.94 each. The calls cost me a total of roughly $1,000 and on 1/17/2025 if shares of SOFI are under $5.50 I lose my $1,000 investment. If shares are above $7.44 (the $5.5 strike + the $1.94 premium I paid), I make money. I’ll make $500 for every $1 over $7.44 shares trade at on expiration because I own five calls.

My calls are currently up 253% and worth $3,425. So I’m sitting on a profit of roughly $2,400.

I’m writing this because I have a financial interest in deciding whether or not I should continue to own my calls or close them for a profit.

You should read this if you want analysis and thoughts on portfolio allocation/ from someone who has skin in the game. This is not a recommendation for anyone to buy or sell anything. I’m simply sharing my research and thoughts.

Consideration #1: Options Mechanics

The following chart is a bit of an eye-sore, but it shows how much profit/loss I’d have at different share prices/dates. About halfway up on the right side, you’ll see $2,280 profit. That shows that to make roughly the profit I have now at expiration in January 2025, I’d need shares to trade at $12.00.

Shares are currently trading at $11.48. Looking at the top right corner, you’ll see that at $20/share in January 2025, I’d make $6,280 in profit or $4,000 more than my profit if I closed the calls today.

Conclusion #1: If I believe SOFI is a high-quality company with good fundamentals, then it does not make sense to close the position based strictly on the time-value decay of the options. Additionally, a $3,425 position is nice, but it’s not a major needle-mover for me. However, a $6,000+ position is more significant.

Today’s email is brought to you in partnership with Percent, a frontrunner in private credit investments that thousands of investors are using to help grow their wealth in today’s economy.

Percent offers exclusive private credit deals previously out of reach to most investors. If you’re an accredited investor, you get access to:

APY: current weighted average of 17.8% as of June 31, 2023

Shorter-term investments: many durations are between 9 months to several years, some have liquidity available after the first month

Low minimums: can invest as little as $500 to start

Welcome bonus: You can earn up to $500 bonus on your first investment

Diversification: access to small business lending in Latin America, European real estate, US merchant cash advances, and more

My readers can also earn up to a $500 bonus. The website also has a ton of great resources and research. Check it out here.

Consideration #2: Momentum & Volatility

SOFI 0.00%↑ reported earnings this morning, and the stock is up nearly 20% today. The stock has had a heck of a run this year, up 149% YTD, after a horrendous 2022.

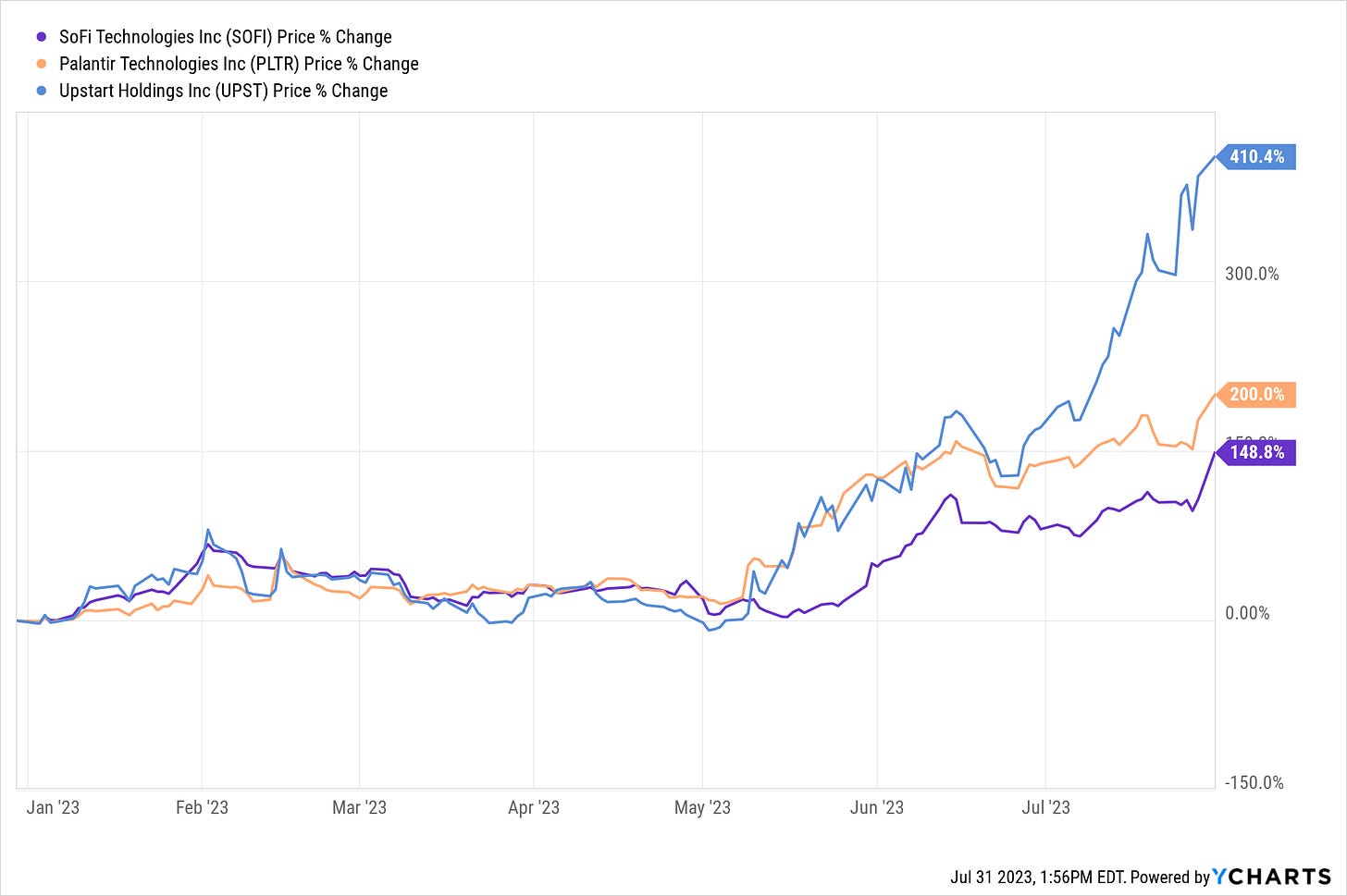

2023 has been a year where beaten down and what many argue are “meme” stocks like UPST 0.00%↑ and PLTR 0.00%↑ have bounced back strongly after 80%+ pullbacks in 2022.

So investors are likely wondering if we’re amid another “meme stock rally” or if any of these are good investment opportunities today.

First, I want to point out that even after 150%, 200%, and 410% YTD gains, SOFI, PLTR, and UPST are still down 55%, 51%, and 83% from their 2021 highs. Perspective matters.

As fun, as it is to look at these YTD returns and drawdowns, they still don’t tell us anything about the quality of these businesses. They indicate the volatility of their stock prices, which has important implications for the type of investors who own them, but even the best long-term compounders tend to have very volatile stock prices.

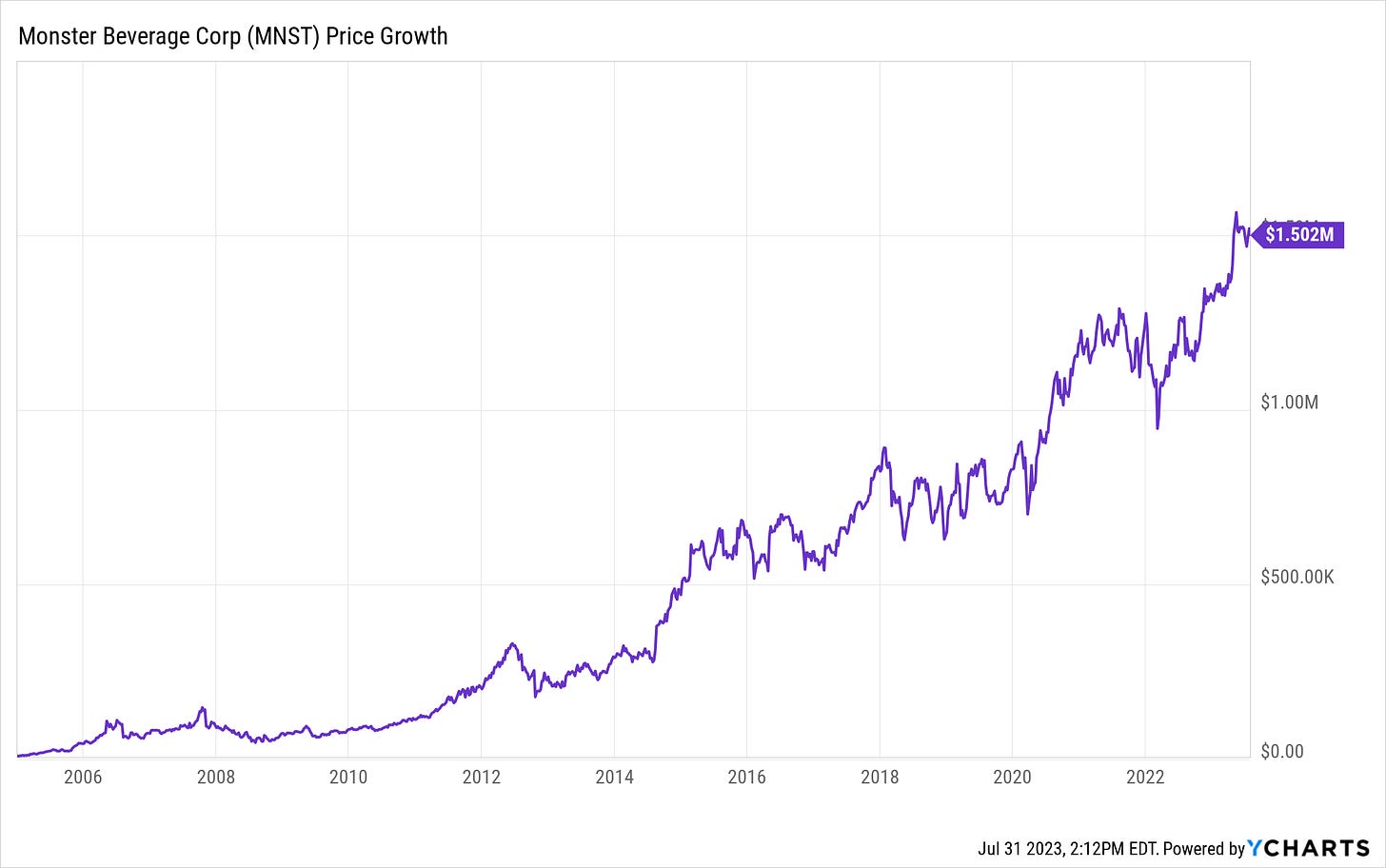

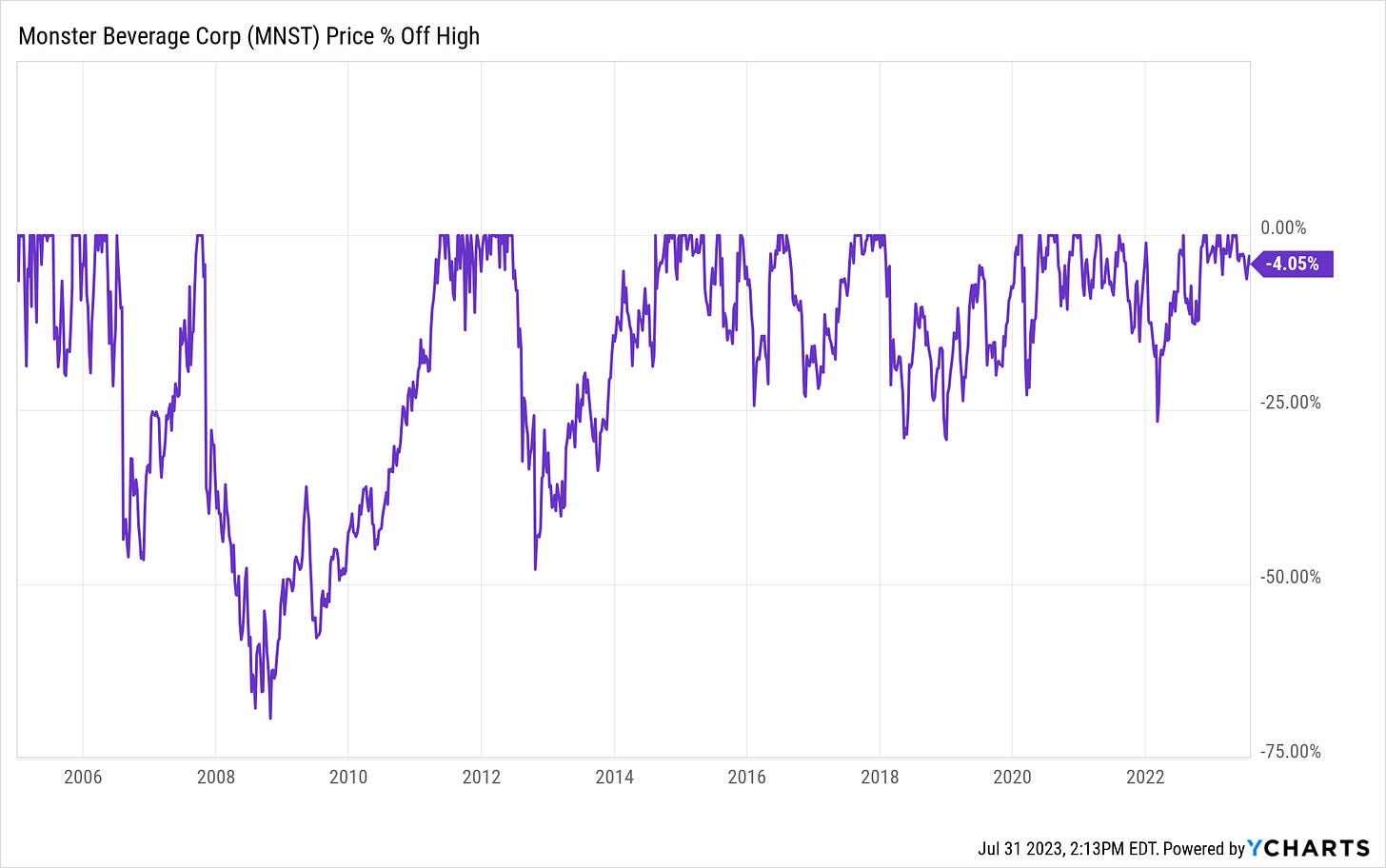

MNST 0.00%↑ is up nearly 15,000% since 2005, turning a $10,000 investment into $1.5 million in less than 20 years, and it’s dropped 40% from its all-time high six times.

Consideration #3 Q2 2023 Financial Results

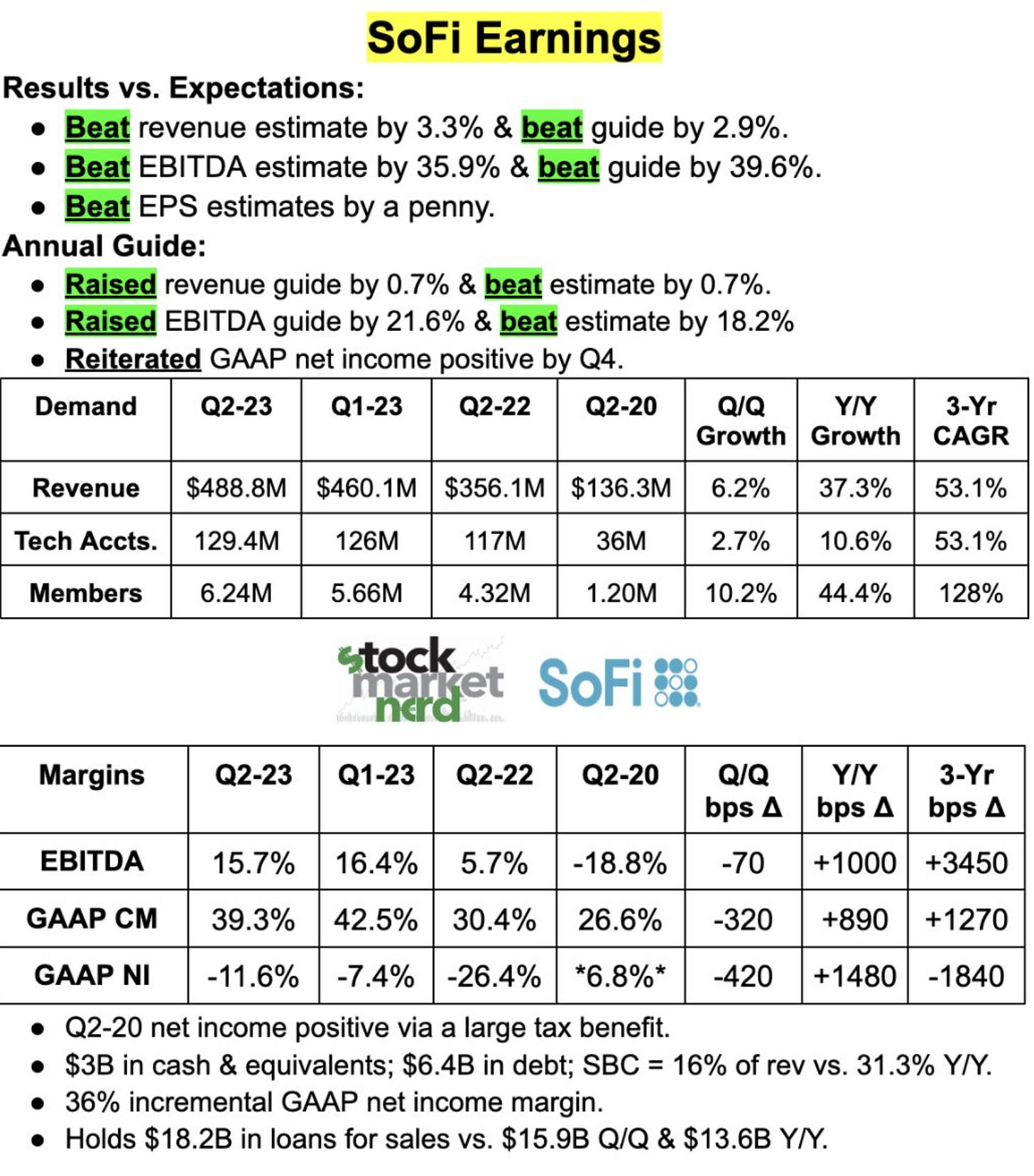

does a great job with his earnings snap shots so I’m sharing his SOFI snapshot below. The quarter was a beat all around with guidance that also beat analyst expectations.Notes from the company press release

“Our record number of member additions and strong momentum in product and cross-buy adds, along with improving operating efficiency, reflects the benefits of our broad product suite and unique Financial Services Productivity Loop (FSPL) strategy. We added over 584,000 new members during the second quarter, and ended with over 6.2 million total members, up 44% year-over-year. We also added nearly 847,000 new products during the second quarter, and ended with over 9.4 million total products, a 43% annual increase.”

“Total deposits grew by $2.7 billion, up 26% during the second quarter to $12.7 billion at quarter end, and over 90% of SoFi Money deposits (inclusive of Checking and Savings and cash management accounts) are from direct deposit members. For new direct deposit accounts opened in the second quarter, the median FICO score was 747. More than half of newly funded SoFi Money accounts are setting up direct deposit by day 30, and this has had a significant impact on debit spending, with continued strong cross-buy trends from this attractive member base 1 into Lending and other Financial Services products. With our launch of offering FDIC insurance of up to $2 million, nearly 98% of our deposits were insured at quarter end.

As a result of this growth in high-quality deposits, we have benefited from a lower cost of funding for our loans. Our deposit funding also increases our flexibility to capture additional net interest margin (NIM) and optimize returns, a critical advantage in light of notable macro uncertainty. SoFi Bank, N.A. generated $63.1 million of GAAP net income at a 17% margin.”

This was a very strong quarter all around and as CEO Anthony Noto highlighted in the press release, the median FICO score of new direct deposit accounts opened during the quarter was 747 with the majority of newly funded accounts setting up direct deposit within 30 days. That’s a very “sticky” decision which is great for SOFI because it allows them to be more profitable with each new account.

I’m trying to keep these emails value filled but relatively quick to read so I’ll break this into two parts and cover the Investor Q&A session in Thursday’s email.

Subscribe for free to make sure you get Part 2.

If you have any questions, things you want me to cover, or thoughts about the quarter let me know in the comments.

Thank you for wonderful update. As a lifelong learner, I appreciate you including your insights with mechanisms with option strategy in the newsletter. Looking forward to see more your informative content. Good luck with Ycharts!

Next Time I will buy your options positions as well!!Good luck for your Ychart