Shopify First Quarter 2019 Earnings

Shopify announced earnings before the market opened on April 30, 2019.

This was a strong report. The company continues to grow revenue at 50% year-over-year and more importantly is continuing to develop its ecosystem of software and now point of sale hardware to better support its merchants.

In the first quarter, Shopify launched Shopify Studios and a multi-currency feature, and saw continued success with Shopify Shipping and Shopify Capital. Details on all of these are below.

After the quarter ended, Shopify launched its new retail hardware collection which includes a Tap & Chip Reader, Doc and Stand to help merchants deliver the best in-store retail experience possible.

I like how Shopify’s business has performed and the way the company is innovating for the future. I’m also a huge fan of Co-Founders Tobi Lutke, and Harley Finkelstein who are Chief Executive Officer and Chief Operating Officer respectively and Amy Shapero, the Chief Financial Offiver (CFO).

I have copied & pasted some business highlights below and below that, I’ll come back with some details on what I’m planning to do with our position (leaving it alone for now).

First-Quarter Financial Highlights ( copied from the report)

Total revenue in the first quarter was $320.5 million, a 50% increase from the comparable quarter in 2018.

Subscription Solutions revenue grew 40% to $140.5 million. This increase was driven primarily by growth in Monthly Recurring Revenue1 ("MRR"), largely due to an increase in the number of merchants joining the Shopify platform.

Merchant Solutions revenue grew 58%, to $180.0 million, driven primarily by the growth of Gross Merchandise Volume2 ("GMV"), as well as by robust growth in Shopify Capital and Shopify Shipping.

MRR as of March 31, 2019 was $44.2 million, up 36% compared with $32.5 million as of March 31, 2018. Shopify Plus contributed $11.3 million, or 26%, of MRR compared with 22% of MRR as of March 31, 2018.

GMV for the first quarter was $11.9 billion, an increase of $3.9 billion, or 50%, over the first quarter of 2018. Gross Payments Volume3 ("GPV") grew to $4.9 billion, which accounted for 41% of GMV processed in the quarter, versus $3.0 billion, or 38%, for the first quarter of 2018.

Gross profit dollars grew 46%, to $180.3 million, compared with the $123.8 million recorded for the first quarter of 2018.

Operating loss for the first quarter of 2019 was $35.8 million, or 11% of revenue, versus a loss of $20.3 million, or 9% of revenue, for the comparable period a year ago.

Adjusted operating loss4 for the first quarter of 2019 was 0.4% of revenue, or $1.4 million; adjusted operating loss for the first quarter of 2018 was 0.1% of revenue, or $0.2 million.

Net loss for the first quarter of 2019 was $24.2 million, or $0.22 per share, compared with $15.9 million, or $0.16 per share, for the first quarter of 2018.

Adjusted net income4 for the first quarter of 2019 was $10.3 million, or $0.09 per share, compared with adjusted net income of $4.2 million, or $0.04 per share, for the first quarter of 2018.

At March 31, 2019, Shopify had $2.0 billion in cash, cash equivalents and marketable securities, compared with $1.97 billion on December 31, 2018.

First-Quarter Business Highlights

Shopify launched Shopify Studios, a full-service TV and film content development and production house, with the goal of redefining and inspiring entrepreneurship through accessible, relevant, and entertaining content, paving the path for future business owners and innovators.

Shopify launched a multi-currency feature for Shopify Plus merchants using Shopify Payments, enabling these merchants to sell in multiple currencies and get paid in their local currency.

Shopify Shipping adoption continued to climb, with more than 40% of eligible merchants in the United States and Canada using Shopify Shipping in the quarter.

Purchases from merchants’ stores coming from mobile devices versus desktop continued to climb in the quarter, accounting for 79% of traffic and 69% of orders for the three months ended March 31, 2019, versus 75% and 64%, respectively, for the first quarter of 2018.

Shopify Capital issued $87.8 million in merchant cash advances and loans in the first quarter of 2019, an increase of 45% versus the $60.4 million issued in the first quarter of last year. Shopify Capital has grown to approximately $535 million in cumulative cash advanced since its launch in April 2016 through the first quarter of 2019, approximately $107 million of which was outstanding on March 31, 2019.

Subsequent to the close of our first quarter:

Shopify launched its new retail hardware collection including the Tap & Chip Reader, Dock and Stand to help merchants deliver a better retail experience with the most flexible, seamless in-person selling solution.

Shopify launched its first integrated brand campaign, “Let’s Make You a Business”, in 12 North American markets aimed at raising brand awareness for Shopify and encouraging the next wave of independent business owners to turn their big ideas into businesses.

Shopify launched native language capabilities on its platform in Dutch and Simplified Chinese to merchants in a limited beta, bringing the total number of languages in which the Shopify platform is available to nine.

Shopify hosted its first Commerce+ event in Sydney, Australia, attended by several top local merchants to discuss how Shopify Plus provides a centralized commerce platform for today’s high-growth and high-volume businesses.Earnings release:

Our Position

Going into earnings, we owned 45 shares at an average purchase price of $175.98 per share. Our total cost of shares (cost basis) is $7,920.

As of Thursday, May 2 2019, Shopify shares are trading at a new all-time high of $245.16 and our $7,920 initial position is now up 39% to a total value of $11,000.

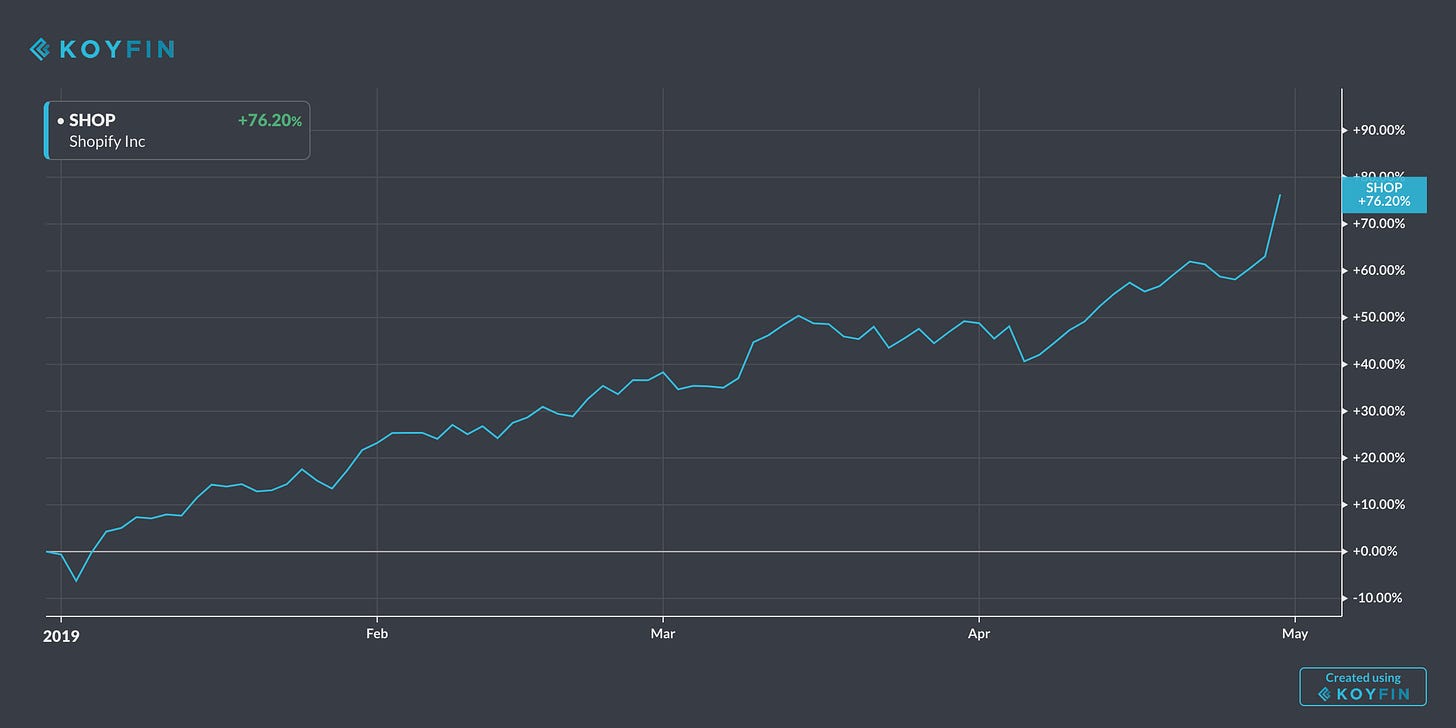

Year to date, the share price is up 76% and I have no intentions of selling.

The earnings report was very strong. I’ll cover the report below but I want to take a moment to highlight why I believe we have an advantage as long term investors focused on owning 10-15 of the best companies we can find.

Our advantage is that we can deeply understand these companies, get to know management, and even take advantage of some of the irrational movements that happen from short-term focused traders.

After Shopify’s strong earnings report, shares actually traded down by 2%. There’s no way to know exactly why but my gut tells me it was a combination of algorithms driving transactions based off of specific keywords from results and/or specific price targets. This often spooks normal investors like you and me out of stocks, which makes the move even more drastic (this can happen to the upside too).

So that’s what I think happened, but I really don’t know. Anyways, I tweeted about it at the time, which has now turned into a timely Tweet so I’ll share it because it shows how much of a genius I am. If I was wrong, clearly I would delete the Tweet and never talk about it (sense my internet sarcasm).

The point I’d like to hammer home is that we need to know the companies we are invested in and know why we are invested in them.

I own shares of Shopify because I believe and trust the co-founders and management. I believe in their purpose of enabling small and large businesses to reach customers with a simple and reliable online store (and now in physical stores with a point of sale system). I also believe they will continue to innovate and focus on the long-term.

I didn’t even consider selling when the shares were down 2%. I considered adding, and I’m still considering adding because I think this business will be larger and more important in 5 and 10 years than it is now.

That’s a little insight into how I think about my portfolio and the companies I own.

That’s all for now. To avoid sending you all a bunch of emails, I will probably combine Twilio, Alteryx, and Square’s earnings reviews into our weekly review email.

Here’s a very quick review. Twilio and Alteryx were strong. I would have added to Twilio if it wasn’t already such a large position and I added to Alteryx. Square is a different story. Growth was fine this quarter, but I’m starting to feel some weakness in the business (especially as Shopify begins selling point of sale hardware). I sold all of our Square shares.

Thanks for your time and have a great end to your week.

Best,

Austin