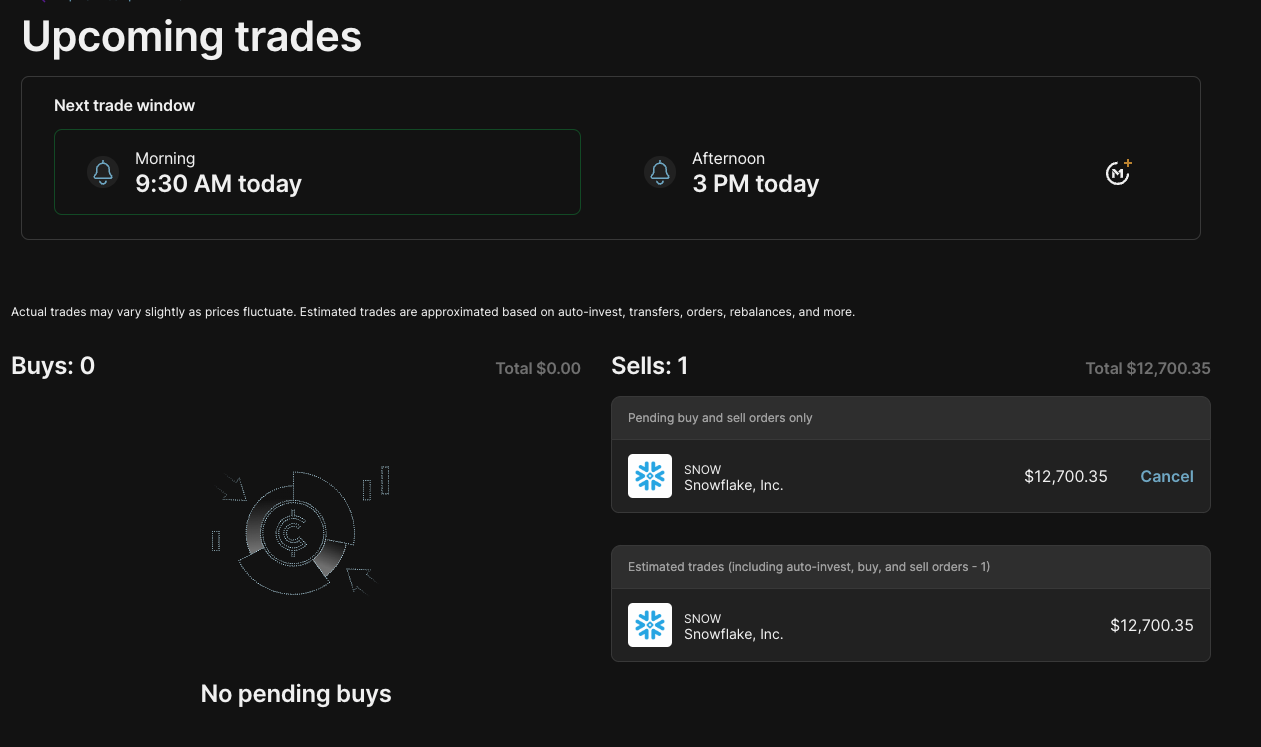

After seeing the Datadog quarter and their guidance for 25%ish revenue growth in 2023, the cloud spending slowdown is confirmed.

That means that my thesis that DDOG and SNOW are overvalued is correct.

I love these companies but in my opinion they are currently trading at too high of a multiple which leaves investors at risk of a multiple re-rating lower + slower revenue growth than expected.

That’s a risk that I’m not willing to take because I think the reward is pretty limited given the high multiples they trade at.

If this sounds confusing, I explained it with charts and stuff and compared it to ServiceNow’s history in this post.

Datadog update

I’ll get a full update out on the quarter, but

did a great job with his snapshot. You can easily see the problem… weak guidance.The stock is down 11% premarket to around $79. I’m not going to rush back in but I’d be very interested around $65.

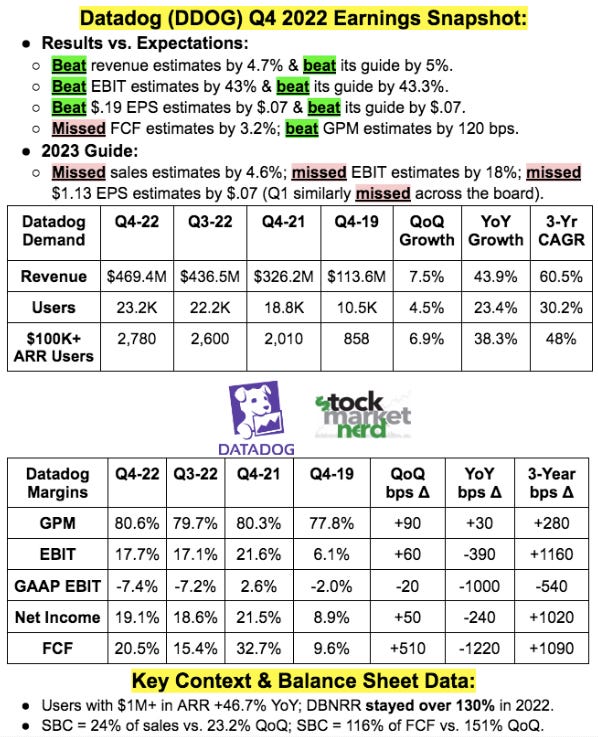

SQQQ Hedge

As I shared in this update, I’m shorting the Nasdaq 100 using SQQQ. There’s a ton of risks associated with this and the vehicle is only designed to be used for daily shorting so I fully intend to keep this open for less than a week. I may even close it today or Friday depending on what happens.

My average buy price is $34.39 so we’re up slightly. If I had to guess, I think the market takes a pretty decent dive today/tomorrow and since this is 3x leveraged, the return would be roughly 3x inverse to QQQ.

I could totally get torched here if I’m wrong.

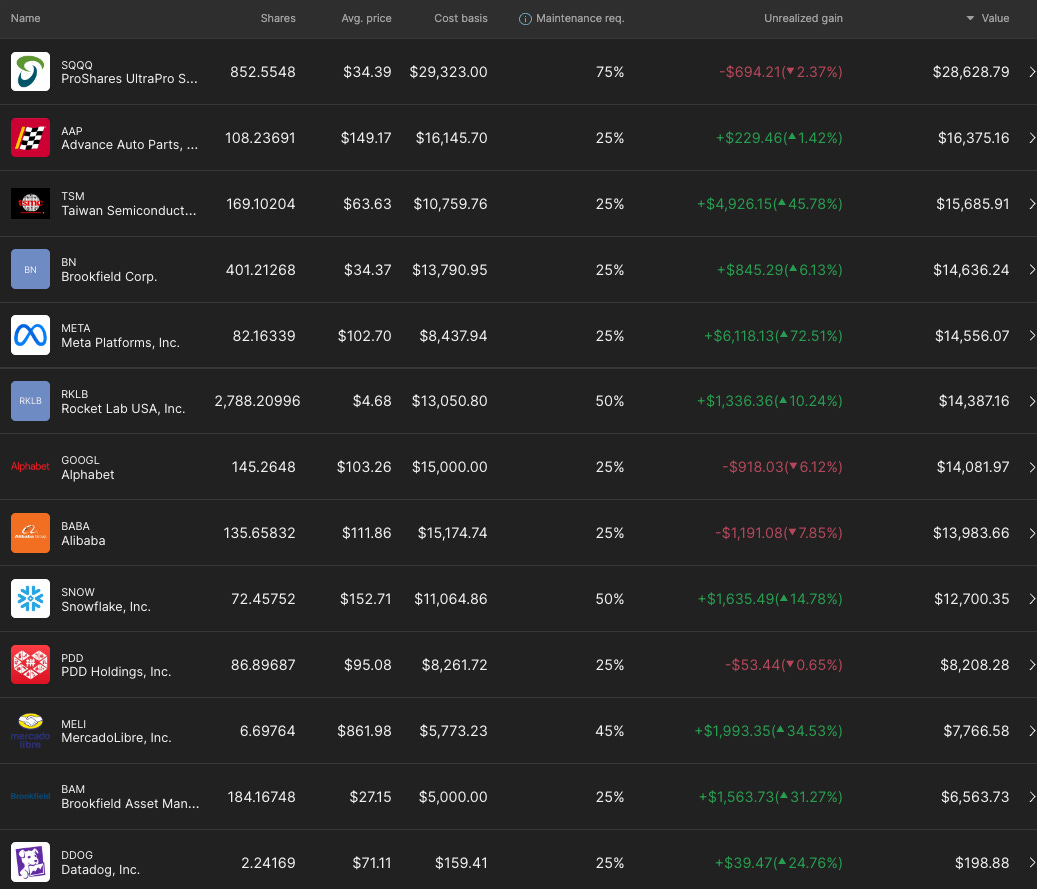

Here’s a full look at the portfolio as it stands. Just remember I’m selling SNOW when the market opens so I’ll have $12,700 in cash and then when I close the SQQQ positions, I’ll have another $30k or so in cash.

I do believe there are some bargains in the market… I recently about Advance Auto and Google is trading at what I think is a pretty fair valuation due to all of the ChatGPT fear.

This is a big change from my 2022 strategy… I get that. I thought my stocks were cheap last year and after a huge rally + new information about the global economic situation, I’m being a lot more careful about owning overvalued/unprofitable stocks.

I’m managing money for my family and making the decisions I think are best for our own future. Simple as that.

Portfolio below.

Thanks. I'm going to have a look at the data space as well. I recently did a review of robotics - both Symbotic and Autostore look interesting. Happy to discuss.

hi Austin,

I would like to talk to you,where can i best reach you ?

basu