Schwab Q1 Review, Overpriced Tech Stocks, Portfolio Update

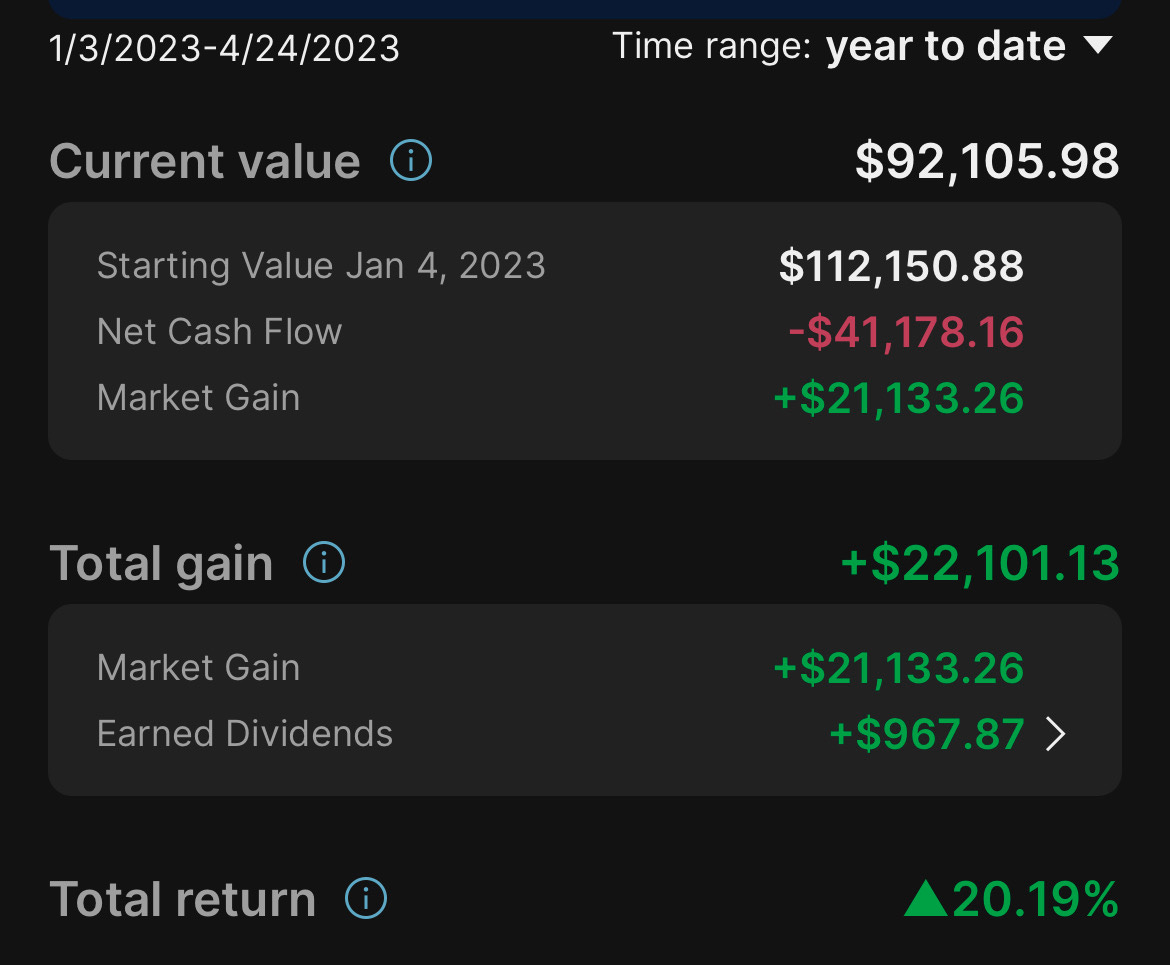

Performance: YTD: +20% || Since Feb 15, 2022: -4%

“For our long-term stockholders, we have great confidence, and our ability to deliver a combination of growth and capital return, just as we have for almost 50 years.” - Walter Bettinger, Charles Schwab CEO.

Investors,

Today we’re covering Q1, 2023 from Charles Schwab, why I think some popular tech companies are overvalued, and as always, I’ll share the full portfolio at the end of the email. I’ll cover Lithia Motors’ Q1 2023 results in an email tomorrow.

First, I want to apologize for my absence over the last two weeks. I had some unexpected commitments come up and failed to communicate those well with you.

I apologize for that and I’ll communicate better in the future. If I’m ever out for more than 2 weeks in the future, I have the ability to “pause” all paid subscriptions and then resume them when I return. That way it will extend all paid members’ subscriptions for the amount of time I was out with no charge.

I have not added or sold any positions over the last two weeks. One of the beautiful things about focusing on finding great companies that we want to own for years is that we don’t have to constantly watch the market and make changes to our portfolios.

Charles Schwab (SCHW) Q1 2023 Results

My thesis for owning Schwab is that the company has a strong track record of serving and growing its client base, a conservative approach to capital allocation, and has historically outperformed the market. The recent fear in the banking sector has driven the P/E ratio down to levels we haven’t really seen since the great financial crisis which has presented a great opportunity to buy shares.

This was a strong quarter in a challenging time and it reinforced my thesis. Management was clear and concise about the strength of the business and reassured investors that they’re going to stick to the same conservative approach to capital allocation that has worked for 50+ years.

During the quarter, Schwab’s revenue was $5.11B, up 10% YoY with organic asset growth was over 7%. GAAP Pre-Tax Profit Margin was 41.2%, up from 39.4% during Q1 2022. Net income was $1.6 billion, up 14% from Q1 2022.

The opening remarks from CEO Walk Bettinger show exactly why I want to own shares. I love his long-term mindset.

“When I drafted my first letter to stockholders 15 years ago in the middle of the financial crisis, I outlined four factors that helped distinguish Schwab from other financial institutions during a very challenging time for global markets: a strong financial foundation, a client-centric strategy, a disciplined operating approach, and a diversified business model. These characteristics remain every bit as relevant to our story today. We continue to consistently manage the business in a conservative manner, with an unwavering long-term orientation.”

A few highlights from the earnings call:

Management sees cost of funding coming down over the next 18 months.

“Although our near-term cost of funding are higher than recent historical levels, and as a result, will impact our near-term earnings. This cost is temporary and should diminish over the coming quarters and could wind down between now and the end of 2024.”

The Ameritrade customer conversion expense savings will be better than expected.

“We are well into the execution of the conversion of the former Ameritrade clients to Schwab. And as we progress through this conversion and beyond, we will ultimately realize substantial expense savings, well beyond the remaining $500 million to $600 million we originally committed to as part of the Ameritrade integration synergies.”

Ignore the fear-mongering headlines about clients moving bank assets from SCHW. Existing clients are just rotating into investment solutions. More importantly, new clients are bringing billions of dollars to Schwab.

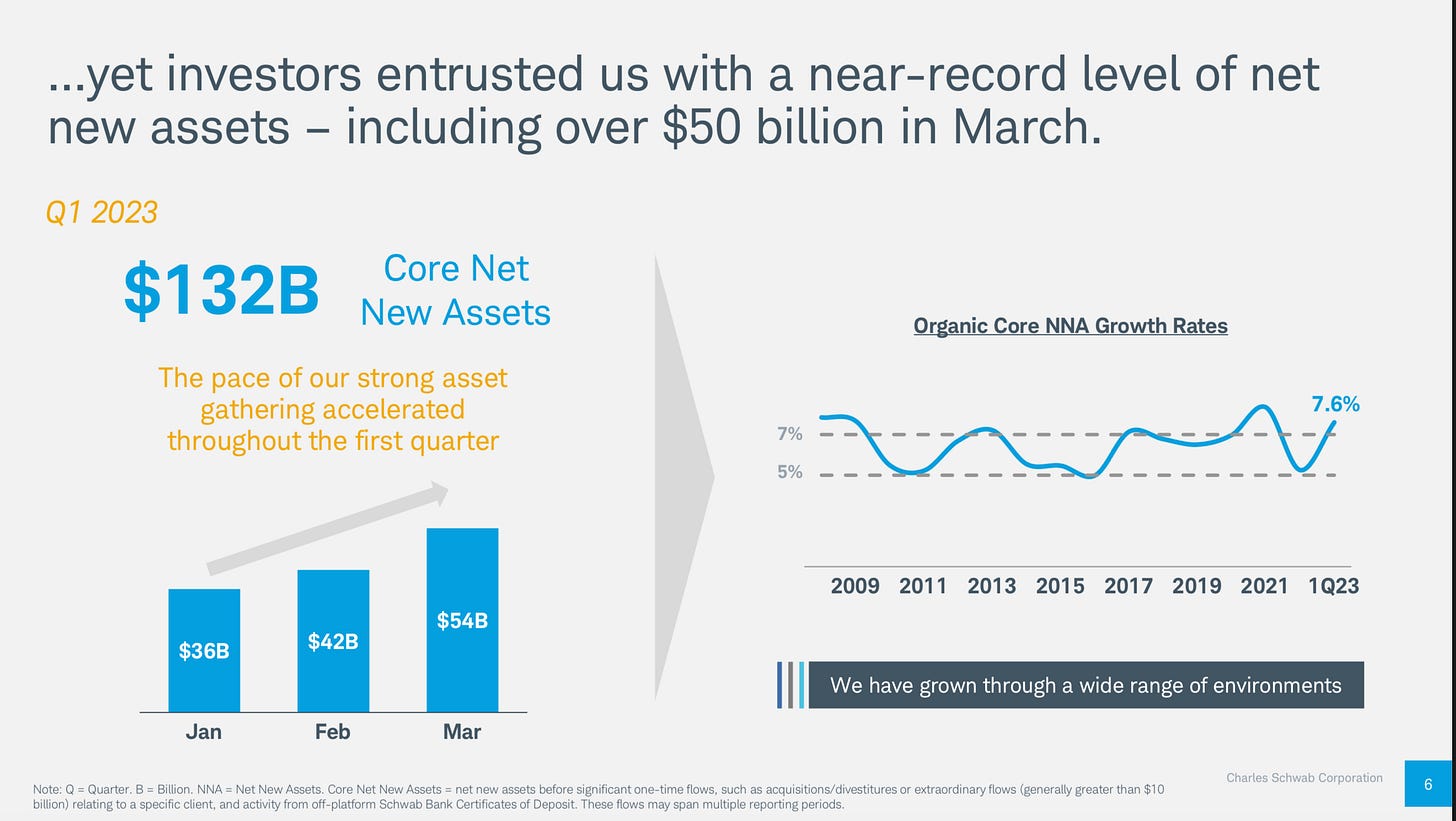

“Clients entrusted us with over $130 billion in core net new assets, with the monthly level increasing each of the 3 months of the quarter, peaking with over $50 billion in March and achieving an organic growth rate in excess of 7%, once again validating our long-term track record of growing client assets in every economic environment. In addition to growth in client assets, clients remained engaged with us in other areas with another quarter of over 1 million new client accounts, over 5 million daily average trades, a Client Promoter Score or Net Promoter Score of 66 and almost $9 billion moved into our investment advisory solutions.

I would certainly hope that by this point in time, the short driven speculation that we would find ourselves in a position where we would be forced to sell securities that have temporary paper losses has been put to bed. From a capital standpoint, we have solid levels today, well in excess of regulatory requirements. And we understand the possibility that the AOCI opt-out might well be eliminated and the questions that, that raises about the potential need for capital.

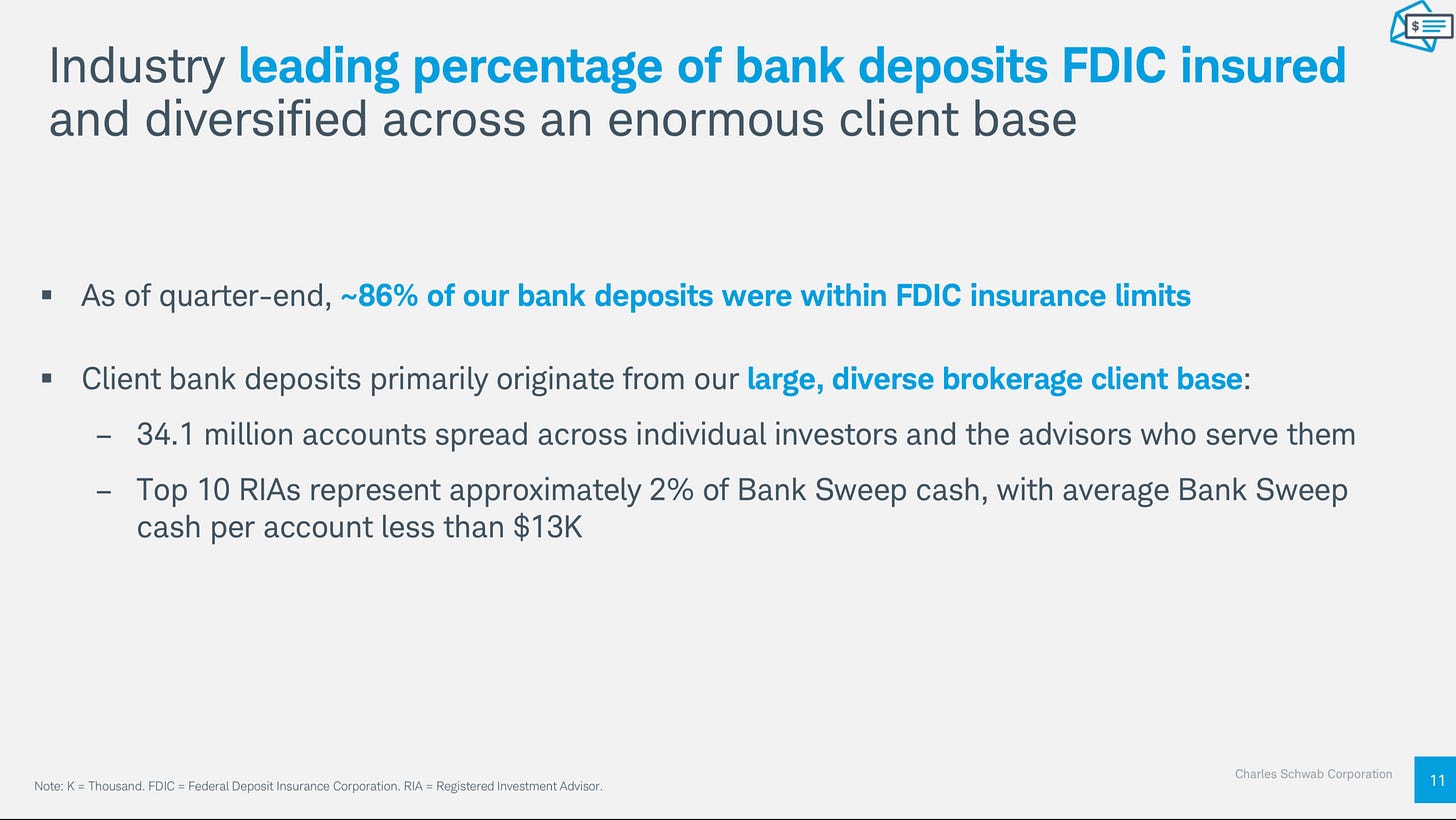

At this point, if this scenario does play out and a reasonable time frame is afforded to build the capital to support this change, we feel confident today in our ability to build the necessary capital organically, given our strong profit margins. Even in the stressed market environment this past quarter, we achieved an adjusted pretax margin of almost 46%. And even under some of the most pessimistic scenarios for the future, we are at least 40% pretax. And of course, our unrealized marks on certain securities decline over time, and they've also declined as interest rates have modestly moderated, declines that you'll see happening when you review our first quarter 10-Q. The conservative nature of our bank management is also reflected in the very high percentage of deposits insured under the FDIC limit. At quarter end, approximately 86% of our bank deposits were under the FDIC insured limits.

In addition, these deposits are spread among tens of millions of investor accounts. And lastly, there are no groups of investors or advisers who directly influence or encourage collective behavior. The 10 RIA firms whose clients hold the greatest amount of cash on our bank balance sheet, account for barely 2% of total bank deposits and the average transactional cash per account for those RIA firms is less than $13,000. I hope these facts remove any concerns about some sort of ordinated action potentially happening that would meaningfully impact our bank deposits.

This is a very important slide. I'd like to dive deeper into our clients' cash behaviors. I know this is a critical area of interest, particularly as it could apply to future levels of bank balance sheet cash and client cash realignments. As I've discussed in the past, when interest rates are near 0, clients tend to co-mingle their transactional cash and their longer-term investment cash together. Of course, there's very little incentive during times like that to move their investment cash into solutions that offer higher yields than bank sweep.

But when interest rates rise, we reach out to clients and suggest they consider realigning their investment cash into other solutions, whatever the client sees fit, whether that would be a purchase money fund -- a purchase money market fund, a CD, a treasury security or another appropriate cash solution that the client is interested in. And of course, this has been taking place, predominantly inside Schwab, as rates have been rising over the past year or so. The rate, pace and ultimate level of this realigning has a large impact on our near-term financial results. So not surprising, we study it closely, and we have models that estimate how it will unfold.

By several measures we study, we believe that this cash realigning process is now slowing and getting closer to its endpoint, which should then likely reverse to a stage where bank balance sheet cash begins to grow as a result of our organic net new asset growth as well as new accounts that we attract. Now in terms of the slide, we've included a chart that goes back to 2004, and it illustrates multiple time frames where interest rates were relatively high as well as several time frames where interest rates were near 0, often referred to as ZIRP periods.

Despite the banking turmoil, management is sticking with their sustained organic growth expectations of 5% - 7% and it appears more new clients are coming to Schwab because of their reputation

In the winter business update, I described how well Schwab is positioned to sustain our organic growth rate of 5% to 7% over the long term through a combination of growth from existing clients, attracting new clients and growth from our strategic initiatives. First quarter was a great example of this as we grew net new assets by over 7%. As I shared with you our business results, I'd like to leave you with 3 takeaways.

First, our business is thriving, and we again delivered strong organic client growth. Second, through the volatility in March, we saw an increase in net new assets and client engagement and asset flows that the bank remains steady. We emerged from a crisis not weaker, but stronger. Third, our strategic initiatives are paying off and lots of opportunity remains. Let's dive into the results in more detail. To put it simply, we are winning across all fronts. We're winning with existing clients, with new clients and on both the retail and RIA sides of our business.

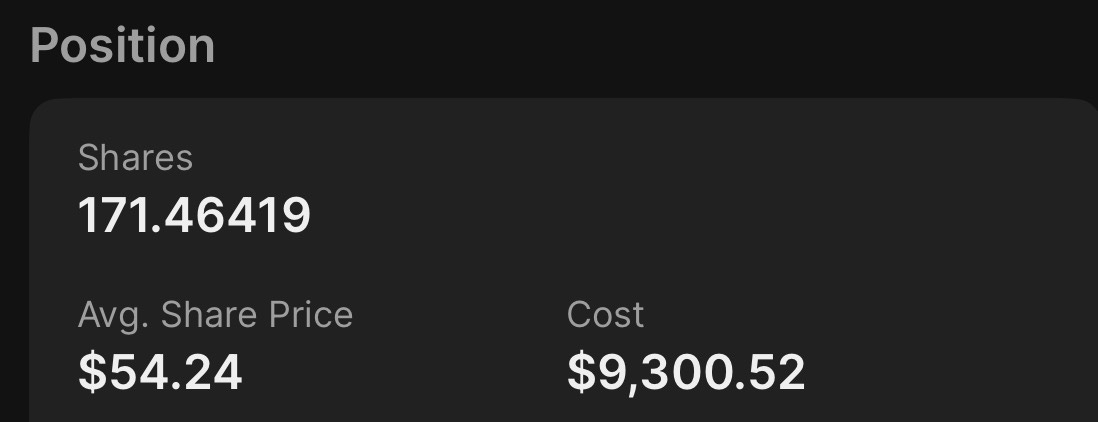

What I’m doing with my position

Although I believe we’re headed into some type of a recession or at least an economic slow down which is not a positive for investment firms as a whole, I believe Schwab is positioned to get stronger through a downturn as more clients turn to them instead of less-reliable, gamified investment solutions. I am not making any changes to my position at this time.

Overvalued Tech Stocks

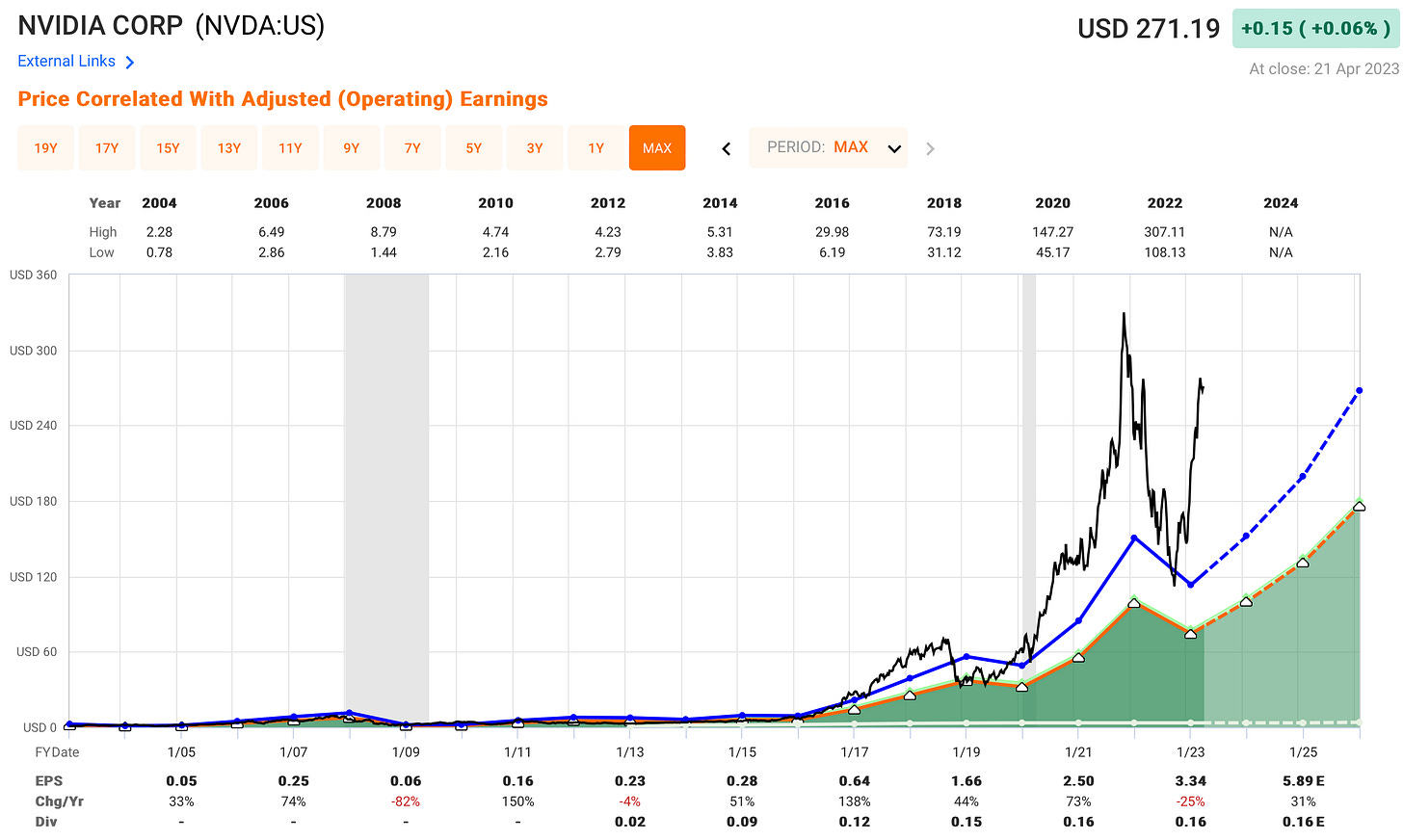

If you follow me on Twitter, you’ve seen me complain about how overvalued stocks like Nvidia and the Nasdaq as a whole is compared to historical valuations. Especially considering we are now in a higher interest rate environment than we have been over the last 15 years.

I think this presents an unfortunate situation where investors who jump into stocks like Nvidia due to fear of missing out on the most exciting AI stocks (or whatever the recent hype is) are going to get hurt.

I don’t mean to insult anyone and I genuinely wish the best for anyone invested in Nvidia or other stocks. I simply want to point out how insanely valued Nvidia is compared to anytime in its history (especially considering it is a much larger company and growing a lot slower than in prior years).

You can see the stock is trading at a blended P/E of 75 compared to its historical average of 34. You can see how crazy overvalued the stock is with just a quick look at it’s chart below. The black line is the current stock price and p/e and the blue line is its historical average P/E.

The real problem comes if the company starts to grow earnings slower than expected (like during a recession) and/or the P/E multiple re-rates down from 75 to something more in line with its historical average of 34.

I could of course be wrong and I have no intentions of shorting the stock. But for me, I see no reason to own the stock unless it gets down to a blended P/E of under 40. At that point I would consider it.

Portfolio Update

Here’s the current portfolio. The left % under each name is the current position size. The right % under each name is my target allocation. If I was starting this portfolio today, I’d focus on building positions up to my target %.

Keep reading with a 7-day free trial

Subscribe to Growth Curve By Austin Lieberman to keep reading this post and get 7 days of free access to the full post archives.