ROKU Q2 2019 Earnings Update

Our Position

Roku is roughly a 4% position in our portfolio. Investors have liked this earnings report a lot as the stock is up 17% during after hours trading. Remember overreactions to the upside and the downside tend to happen after earnings and other big events so don’t feel rushed to jump into a Roku position. It’s also important not to “price anchor” and refuse to invest in an outstanding business just because the price has gone up. That mindset would have caused investors to miss a more than 286% gain YTD

Shares owned: 171

Average price: $91.60

Current price: $119.30

Unrealized gain: 30%

Position size of total portfolio: 4%

Earnings Takeaways

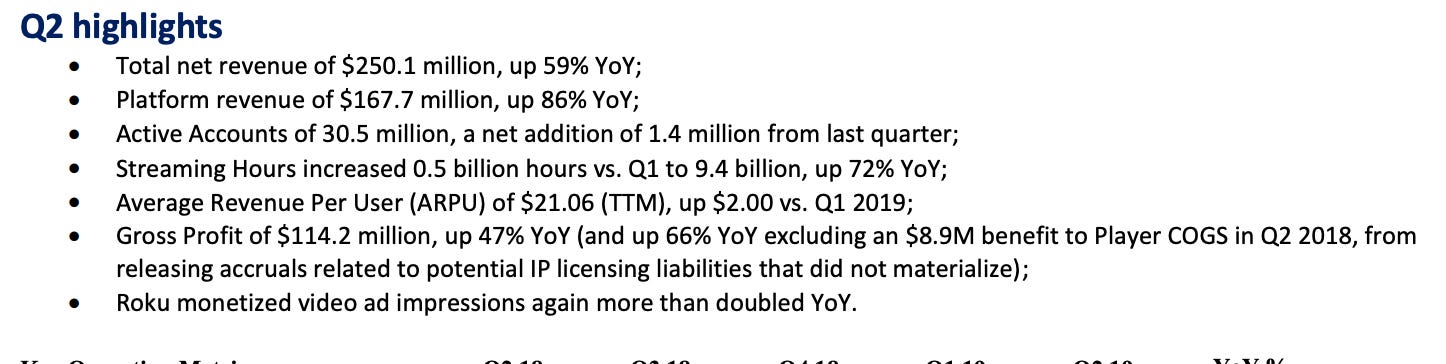

Roku posted another phenomenal quarter. Total revenue was up 59% this quarter compared to Q2 2018 which was their strongest year-over-year quarterly growth as a public company. Platform growth came in at 86% YoY and it is now 67% of total revenue.

This is important because Roku is expanding its platform and that’s where management sees the future. If we start to see platform growth falter, it would be reason for concern.

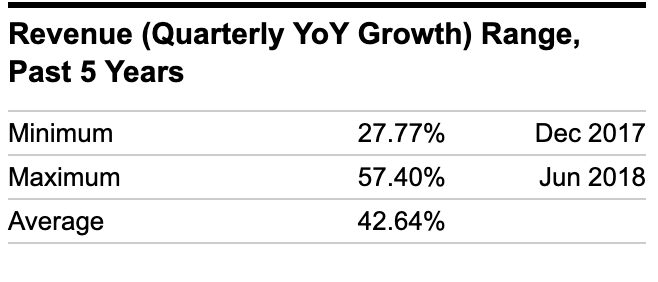

Here is a chart of Roku’s Quarterly YoY revenue growth since Q3 2017. I like the trend of improved growth off a larger base. I also like that revenue growth of 59%, 51%, and 46% for the last 3 quarters is over the average of 43% since Q3 2017.

Revenue, gross profit, and adjusted earnings above guidance + raised full-year guidance

Roku recorded another quarter of great execution beating their own guidance for revenue, gross profit, and adjusted earnings before interest, tax, depreciation, and amortization (EBITDA).

We achieved two significant milestones: active accounts passed 30 million and ARPU surpassed $20. We beat our outlook for revenue, gross profit and adjusted EBITDA. The industry-wide shift to streaming is accelerating. Our business momentum and ongoing investment in areas of competitive differentiation continue to drive growth and attract users, advertisers and content publishers. This resulted in a robust increase in Active Accounts, healthy growth of Streaming Hours and continued progress in monetization.

In addition to excellent results this quarter, management raised revenue guidance in the following areas:

Total for this year $1.085 billion which represents roughly 46% year-over-year growth. That's up from their previous outlook of 40% YoY growth.

Platform revenue guided to be 66% of total revenue

Gross profit guidance raised to a midpoint of $485 million from previous guidance of $470 million

Industry Trends

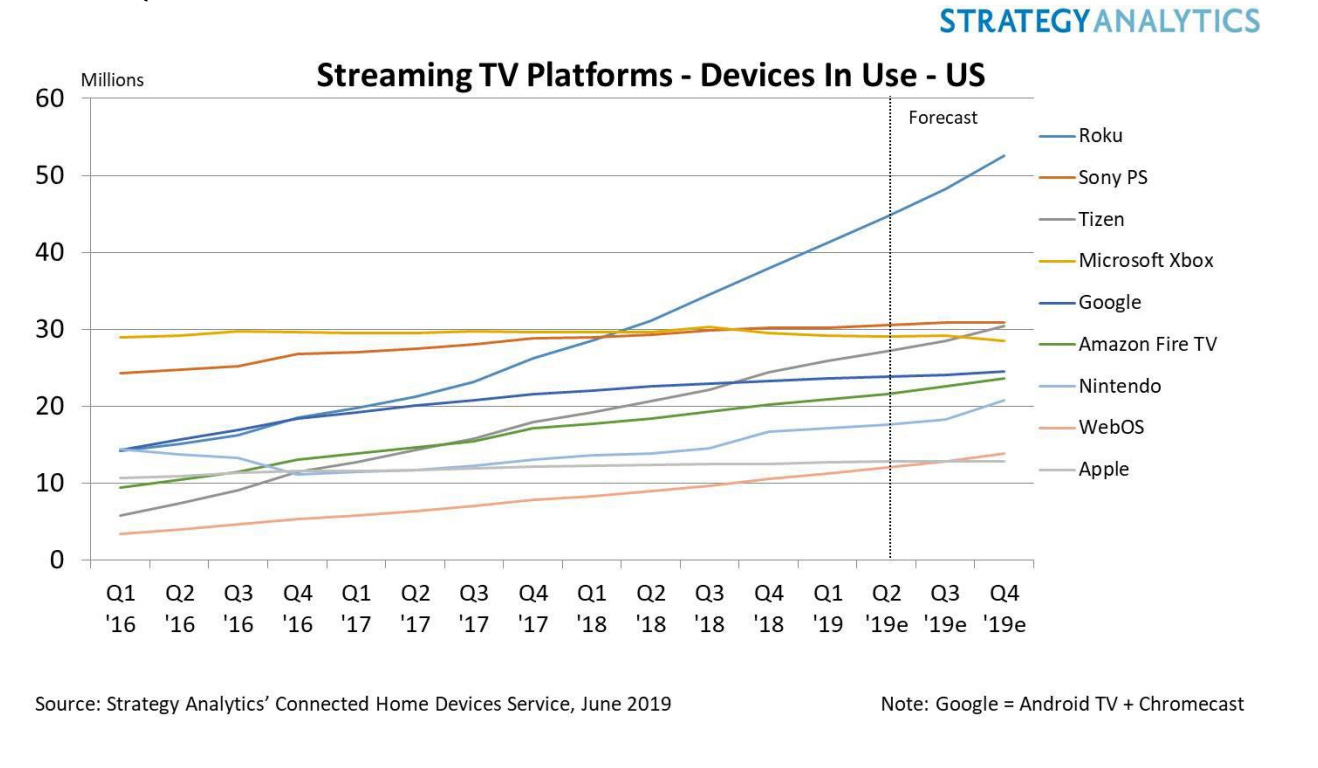

One of my reasons for not having a larger position in Roku is fear of competition. In our home, we use Amazon FireTV and whatever platform in on our Samsung TV (I think it’s Samsung’s platform). However, data from third-party firms shows that the Roku operating system powers 41 million OTT devices in the U.S. which is 36% more than the next competitor and expected to grow. Another study showed that Roku had 39% of the streaming media player installed base as of Q1 2019.

With Roku already owning 39% of the installed base, it brings to question how much growth potential is ahead. I think there is plenty for three reasons.

1. Every T.V. or video watching device (whatever those become in the future) sold in the U.S. will basically be a “smart T.V.” from now on. This should exponentially increase the market size

2. Roku can continue expanding the quality of the experience and average revenue per user as long as their platform continues to offer premium content. There will be a cap to this at some point, but if we monitor average revenue per user growth, we can likely catch it if it begins to slow.

3. These are just U.S. numbers and Roku has an opportunity to expand internationally. It’s not a given, but if they execute well, there is plenty of opportunity. International growth is something I will monitor closely.

Conclusion

This was a very strong quarter. Roku is on my short list of consideration for adding to. I have my own reservations about the platform, but their results speak for themselves.

Here is how management concluded the release

Links:

Shareholder Letter

Earnings Call Transcript