Preparing for The Trade Desk's Q3 2019 Earnings Report

The Trade Desk reports Q3 2019 earnings today after the market closes. That’s roughly 1.5 hours from now.

I currently own 382 shares at an average purchase price of $138.44. Shares are currently at $192.38 which makes for an unrealized gain of 39% and a total position size of $73,300. 20% of my portfolio.

This report stands to have a large impact on my portfolio. Every high-growth company I own seems to be getting crushed after reporting so one may wonder why I don’t just fold my cards and stop the pain.

Good question… I’ll let you know when I figure that out.

I’m kidding. Here’s my short answer. These continue to be fantastic businesses and as long as they are, I intend to hold. Eventually this rotation or high-growth plague will go away and as long as the companies I own continue growing at or near their current paces, the stock price will inevitably catch up.

In all seriousness, if we are adding to our portfolios every month, we should hope this sell-off continues for 5 or 10 years so we can accumulate a ton of shares in wonderful businesses at lower prices. That would be hard to stomach, but anyone who stuck it out would stand to benefit greatly over the long term.

Okay so onto The Trade Desk. I’m not big on charts and fancy calculations. But this chart is interesting. It’s going to take some explaining though….

It shows the % off all-time highs for TTD since 2017. According to Ycharts, on average, TTD trades 13% off its all-time high (middle dotted line). The lowest its ever been was 36% off all-time highs.

That was February 9th, 2018 when the share price was $42.80. If you bought that day, you’re up 352% in 2.5yrs. Before this most recent sell-off, you would have been up 550%. I’ve posted a chart showing this below the chart showing percent off all-time highs (which I’m now way off topic for).

So what does all this mean? I have no idea what’s going to happen after earnings. But I can clearly see that The Trade Desk has only traded more than 30% below its all-time highs a few times and every one of those times was a great buying opportunity.

If the business continues to perform well I don’t see why this time is any different.

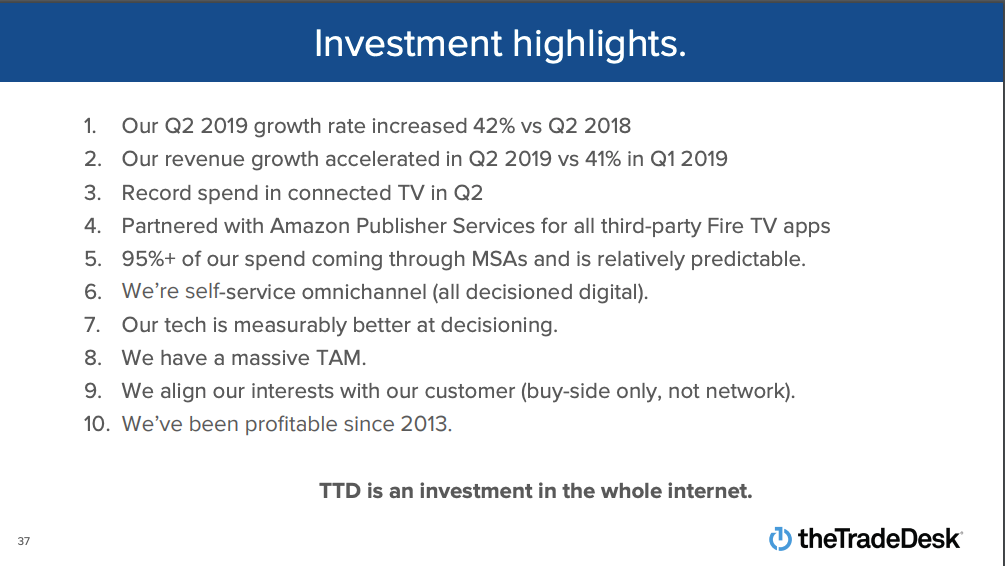

Here is a look at some key slides from their previous report: They guided for 37% FY2019 revenue growth, but I’m looking for something closer to 44% or 45%.

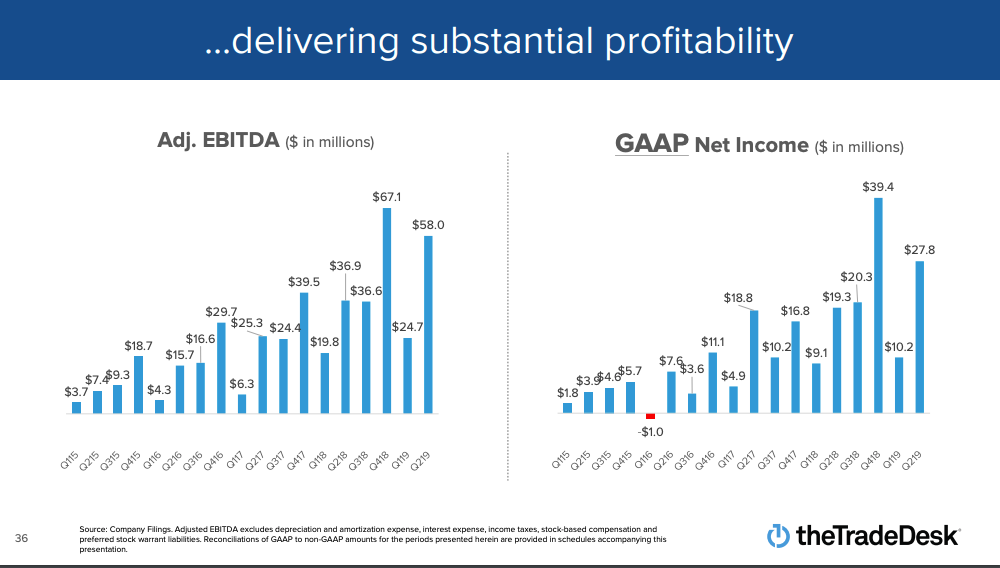

What makes TTD unique among these high-growth style companies is that they are profitable on both a GAAP and Non-GAAP basis. They have been profitable since 2013.

Some Highlights from last quarter: The Amazon Publisher Services announcement was a big deal and I’m interested to hear more details on that this quarter.

Guidance for Q3 and FY 2019.. and I gotta go

For Q3 of 2019, we are expecting revenue of $163 million, and Adjusted EBITDA of $45 million. For the full year 2019, we now expect revenue to be at least $653 million, revised upward from $645 million last quarter. Adjusted EBITDA is now expected to be $201 million, also revised upward from last quarter, or about 31% percent of revenue

Good luck!