Portfolio Update: Why I Just Bought More Amazon

Plus 3 new portfolio companies this week and 2 other positions I added to

There’s been a lot of craziness in “meme-stocks” again over the last couple of weeks and I’m proud to say I have no idea what’s going on with GameStop, AMC, RoaringKitty, or anyone else’s house pet.

I’m not criticizing people who participate in that stuff, but it’s just not for me and you won’t see any of that stuff in this newsletter. We have limited time and it’s just too distracting in my opinion.

So with respect to your time, let’s get right to this week’s update.

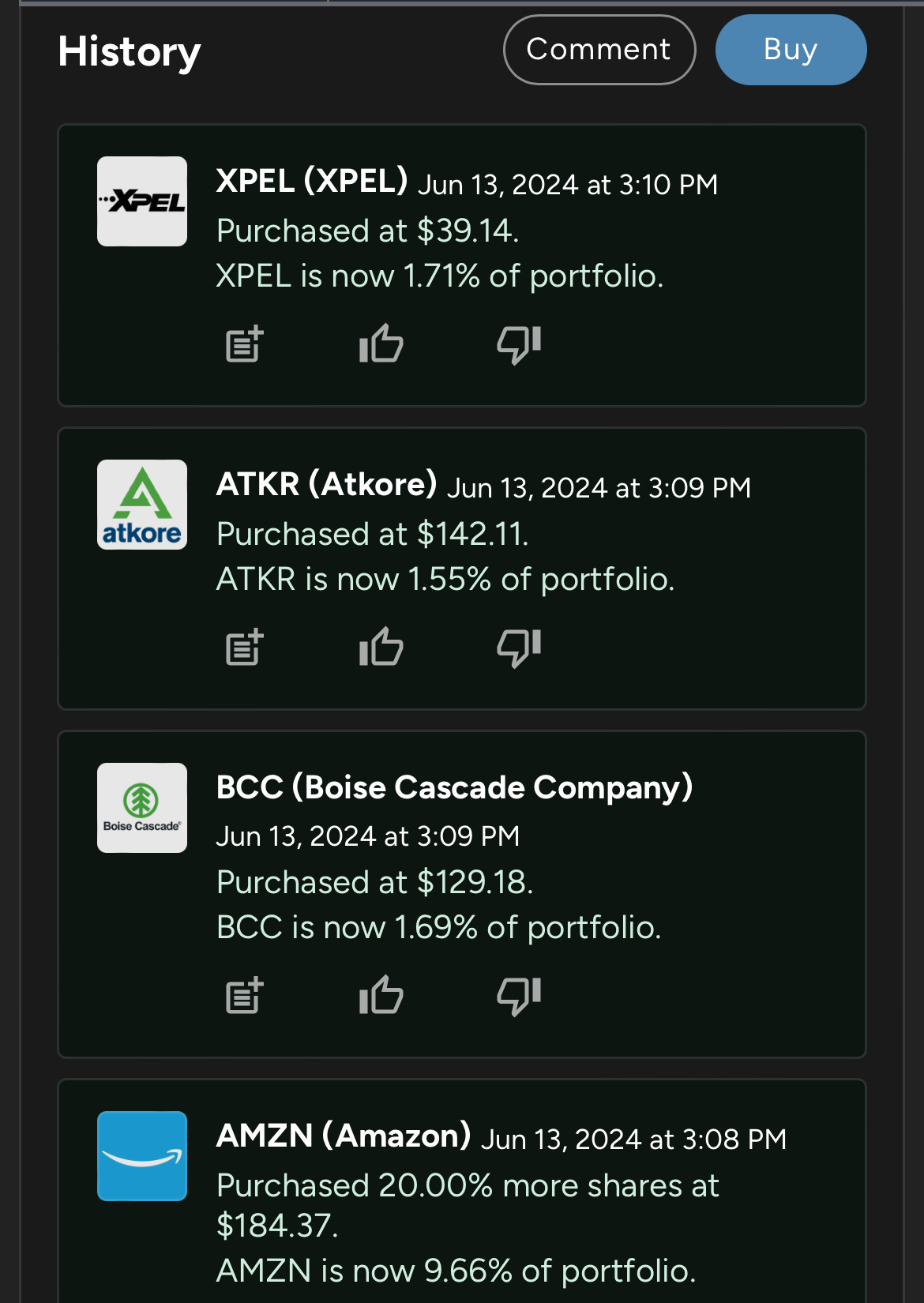

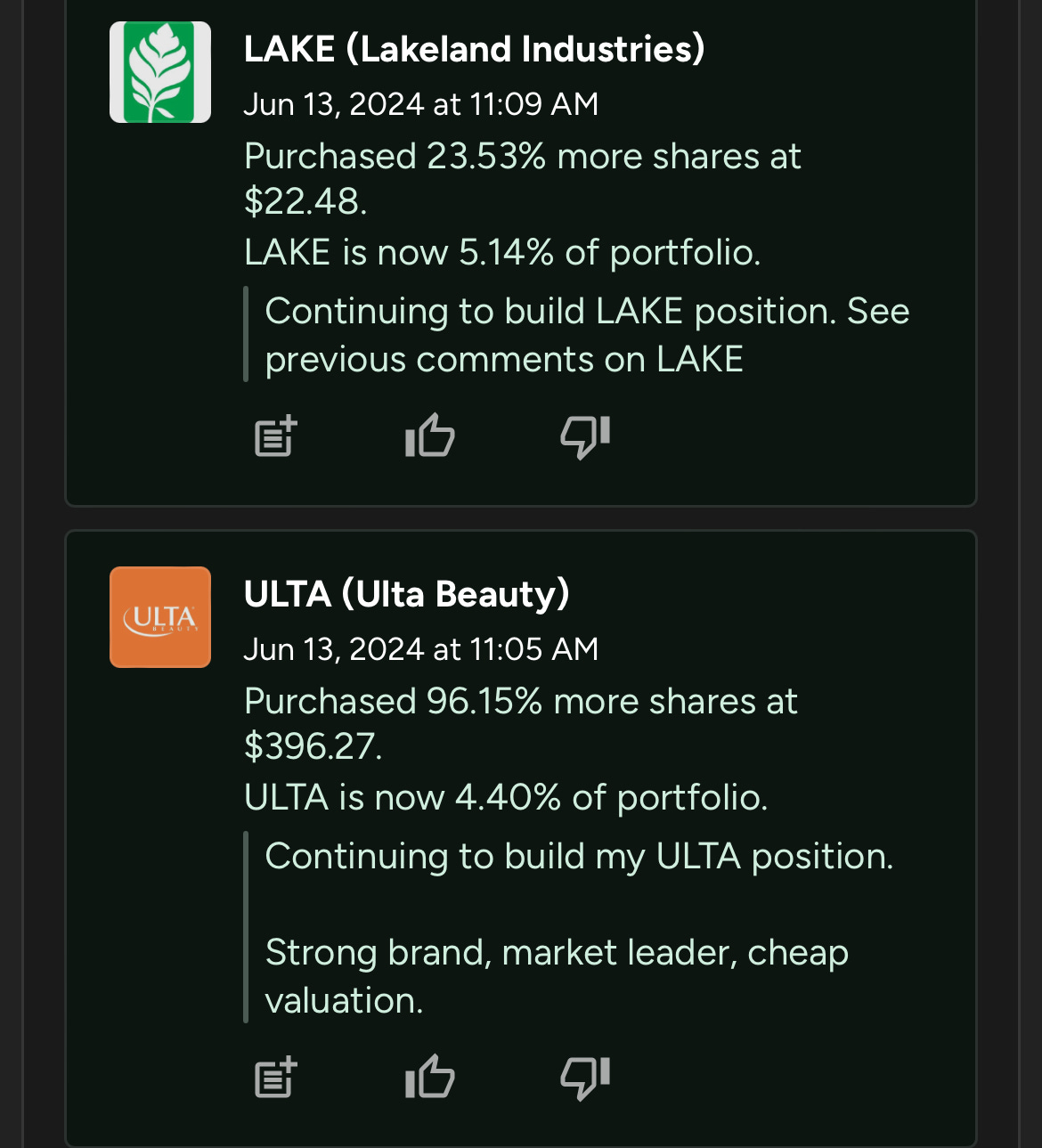

I added 3 new starter companies to the portfolio this week: Xpel XPEL 0.00%↑ Atkore ATKR 0.00%↑ , and Boise Cascade Company BCC 0.00%↑

I bought more of 3 companies I already owned: Amazon AMZN 0.00%↑, Lakeland Industries LAKE 0.00%↑, and Ulta Beauty ULTA 0.00%↑.

Here’s a screen shot of the portfolio below. As you can see, after the purchases this week our cash position is down to 10.5% (I’ll be adding cash every 2 weeks as well).

We’re now at 20 companies (including UGEIF which isn’t shown here). Here they are listing in order of position size. After the purchase this week, Amazon is my largest position other than cash. Since it’s such a large position in the portfolio, I want to spend time this week talking about why I’m comfortable buying more Amazon now. I’ll share more on the other positions in future posts. Remember there’s no need to rush into any positions or decisions. Long-term investing is about taking our time and building wealth over 5+ years.

Keep reading with a 7-day free trial

Subscribe to Growth Curve By Austin Lieberman to keep reading this post and get 7 days of free access to the full post archives.