I added two new positions to the portfolio this morning. These are both underfollowed companies by Wall Street and retail investors and I believe they both have the potential to outperform the market for many years to come.

Position #1

This company manufactures and sells critical electrical infrastructure products in commercial and residential structures.

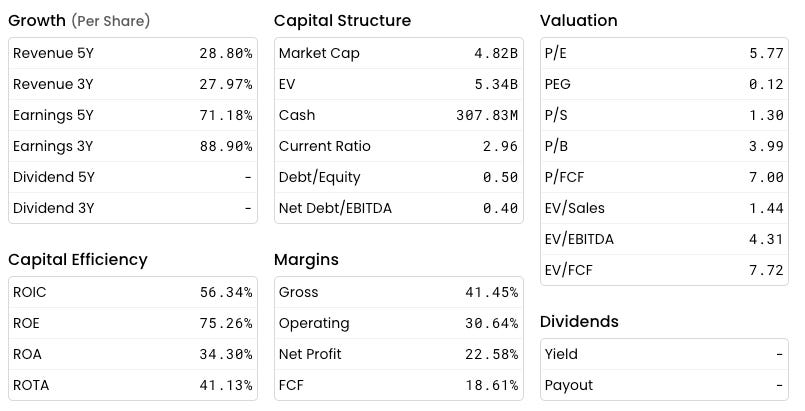

Over the last five years, they’ve grown revenue by 29% and earnings by 89% per year. Management has reduced the share count from 63 million shares outstanding in 2017 to 42.5 million currently.

The stock is up 698% since June 2016, and shares are trading at a trailing twelve-month P/E of 5.77.

Position #2

Makes pharmaceutical products for the over 8 million annual surgeries in the U.S. They serve over 10,000 doctors, hospitals, and ambulatory service centers and ship to over 1,500 institutional accounts each month.

Over the last five years, they’ve grown revenue from $27M to $89M and gross profit from $13M to $63M. The company is still investing heavily for growth, so they’re currently unprofitable but on a clear path to sustained profitability.

I’ll reveal the companies in just a second, but if anyone wants to throw their best guess into the comments section, I’d love to see your guesses (NO CHEATING!!)

I also think it’s interesting to look at the fundamentals of a company and write down your initial perspective, then confirm or change your perspective as you learn more about the company.

So I’m curious…. knowing only what I’ve covered so far, are these potentially investment-worthy for you?

Let me know!

A few more details on the new purchases & updated portfolio

Keep reading with a 7-day free trial

Subscribe to Growth Curve By Austin Lieberman to keep reading this post and get 7 days of free access to the full post archives.