This has been an insane rebound and some of my companies have quickly surpassed my valuation expectations for the next 3 years.

I was bullish on the companies I owned, especially in the Software/Cloud space because I felt they had been punished too severely and were undervalued based on how I expected the business to perform over the next 3+ years.

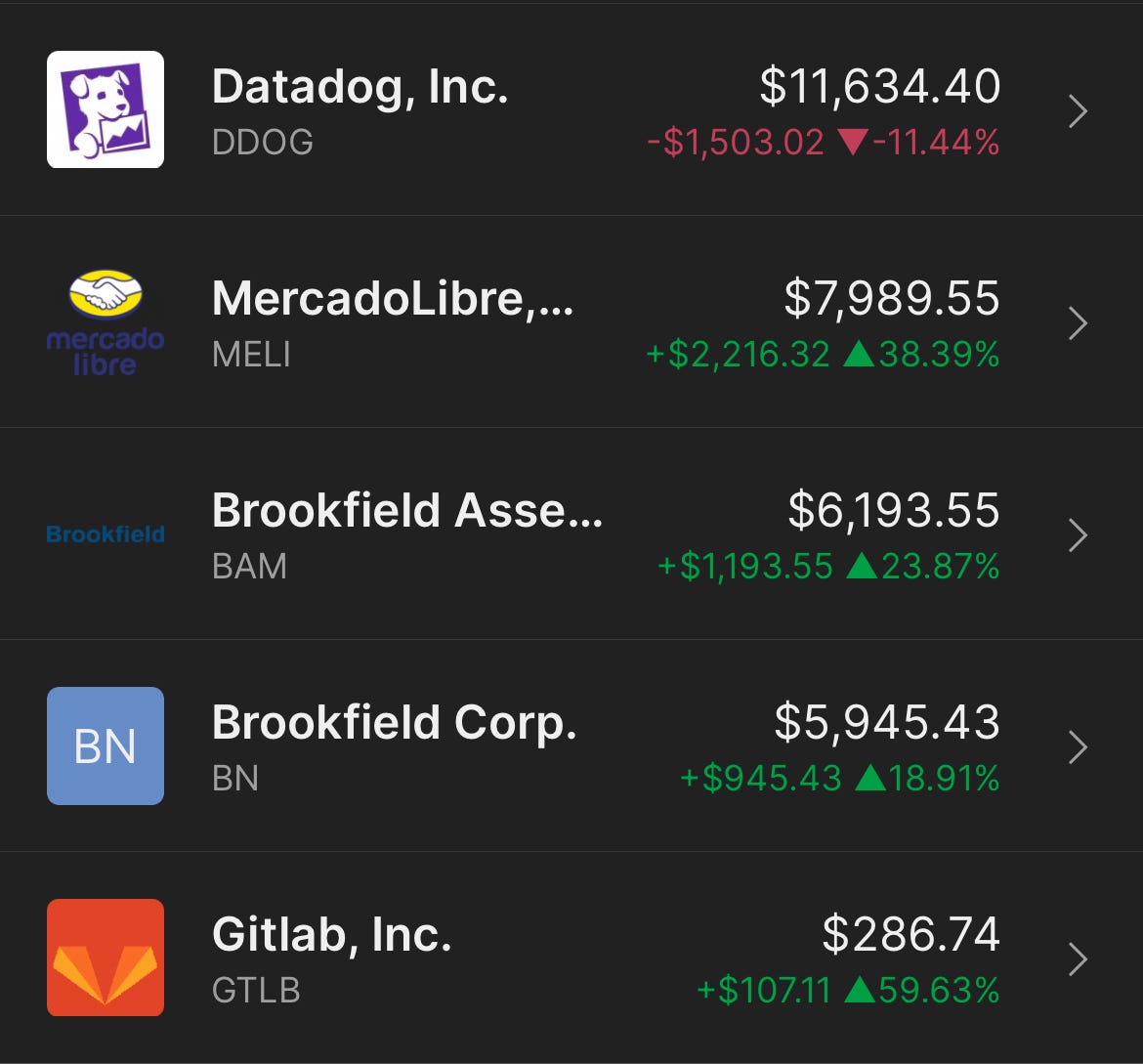

I sold Shopify after a 58% gain on January 30th and this morning I sold GTLB 0.00%↑ after a 33% gain YTD.

I’m a big fan of both of these companies, but I can’t justify owning them at current multiples when there are other great companies trading at lower multiples I can own instead.

Another option is holding 10% - 20% cash which also isn’t a bad idea now that there’s a lot of speculation and exuberance in the market again.

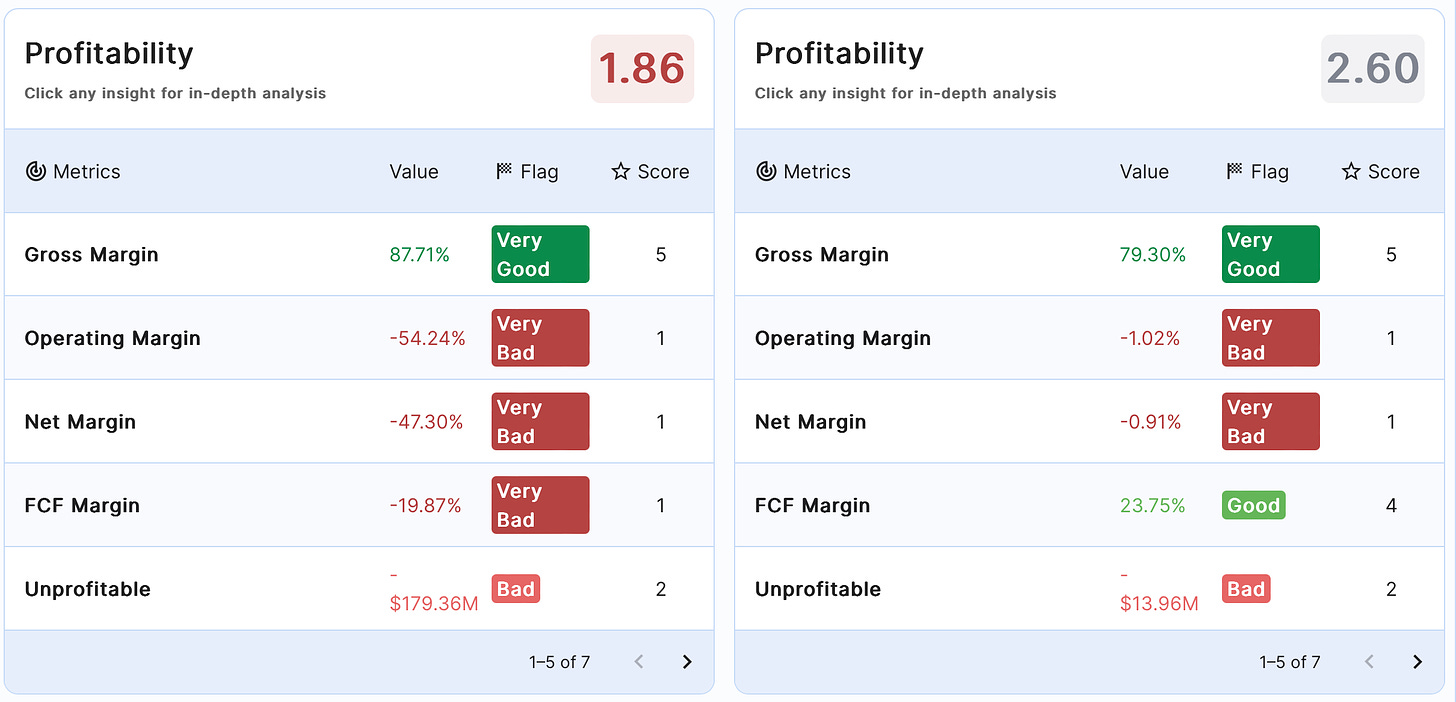

Let’s take GTLB vs DDOG. The left side below is GTLB and the right side is DDOG. GTLB is growing slightly slower and is far less profitable than Datadog.

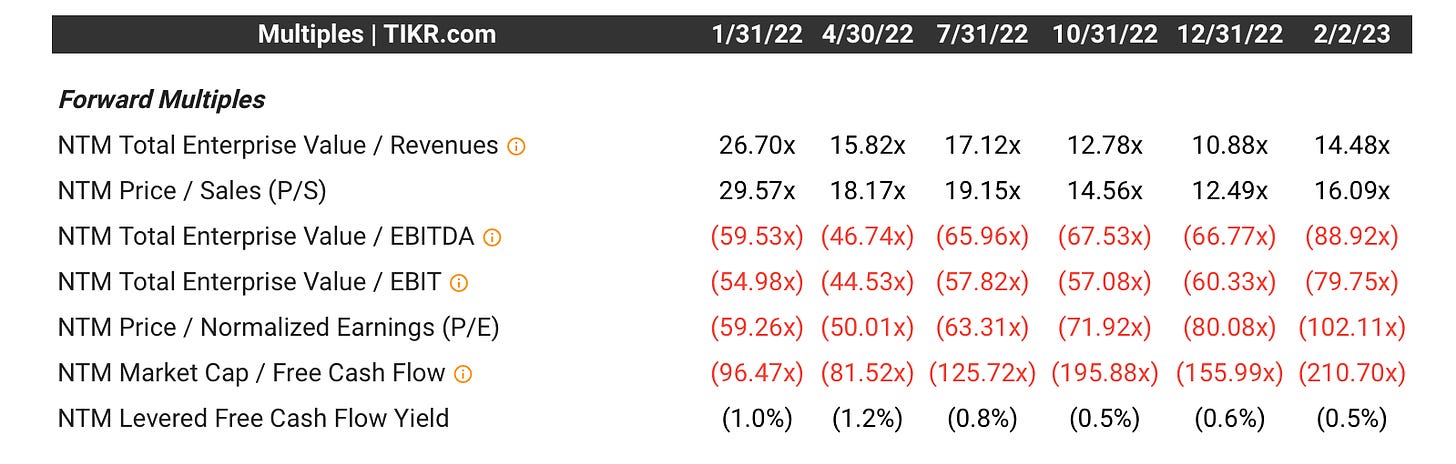

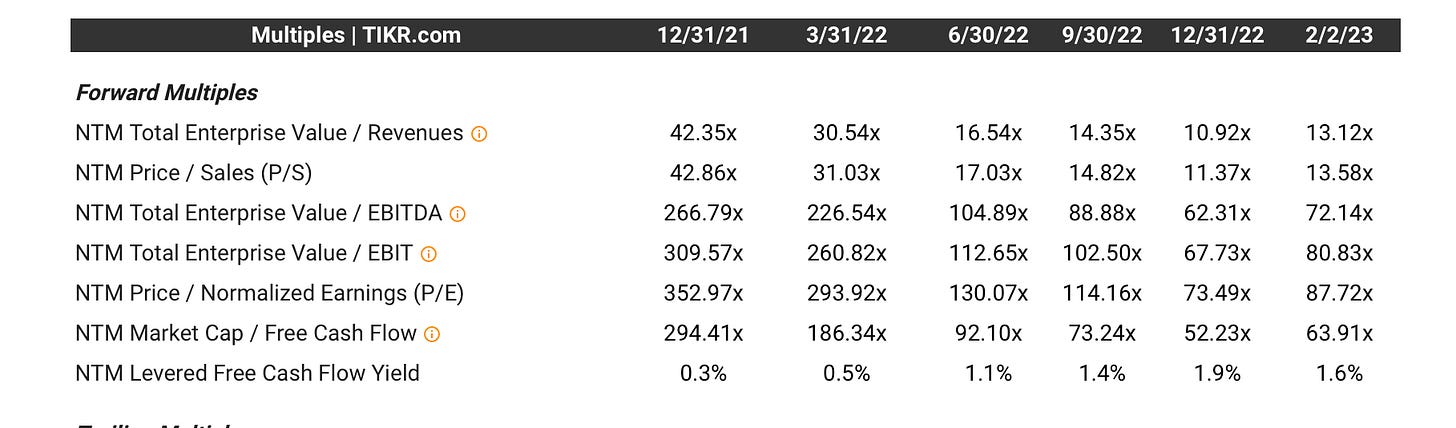

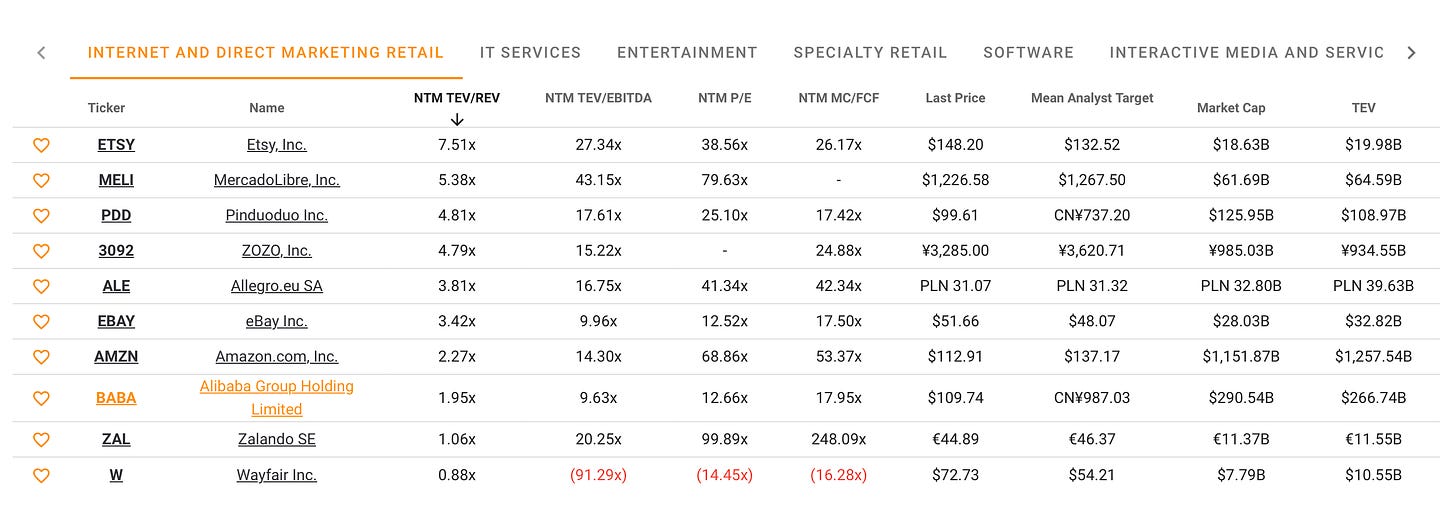

With the growth and profitability metrics in mind, let’s take a look at next twelve months enterprise value to revenues.

GTLB is trading at 14.48 (the first image below) and DDOG is trading at 13.12 (the second image below).

I think Datadog is a more impressive company than GTLB with less competition and a larger total addressable market.

I see no reason to own GTLB now that DDOG trades at a lower multiple.

Why I bought Alibaba (BABA)

Pretty simple. It’s extremely cheap. Yes, it’s risky because of all the reasons I generally don’t want to invest in companies headquartered in China.

In a worst-case scenario my investment could be worth $0 overnight. That scenario is extremely unlikely, but it is possible.

A more realistic scenario is that BABA will always trade at a discount to U.S. based companies with similar fundamentals.

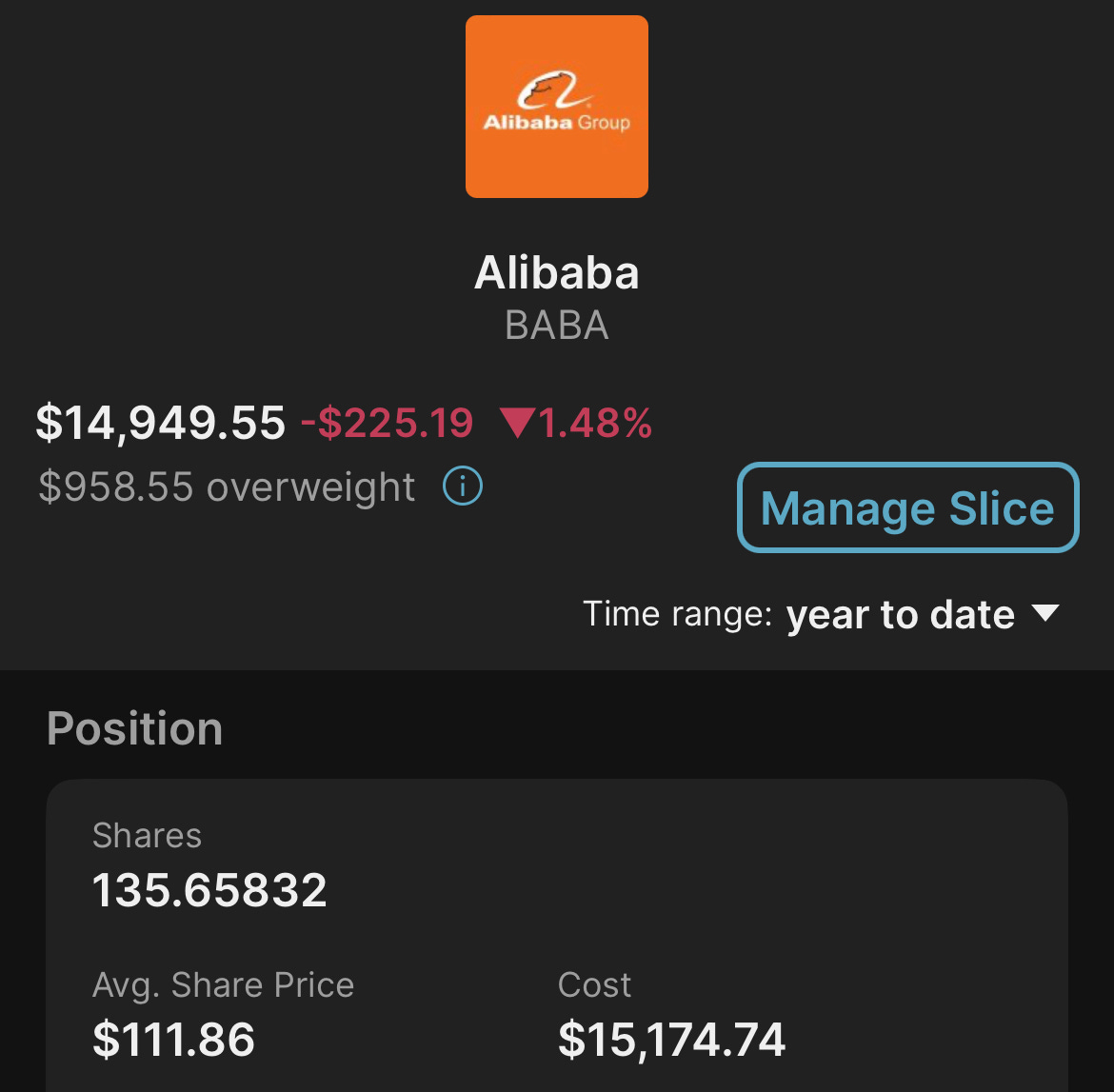

Here’s my position details then I’ll get into what I mean about trading at a discount.

Here’s a list of BABA vs its “peers” from TIKR.com. BABA currently trades at a next-twelve month enterprise value to revenue ratio of 1.95 and a next twelve month market cap to free cash flow ratio of 17.95 vs 2.27 and 53 from Amazon and 7.51 and 26 from ETSY.

Alibaba is extremely “cheap” and I believe the china risk is more than baked into the stock price.

I never thought I’d own Alibaba and this could end up being a huge mistake. I won’t let the position get too large to where a 50% drop would be stressful. For me, that’s around $30,000 so I have plenty of room.

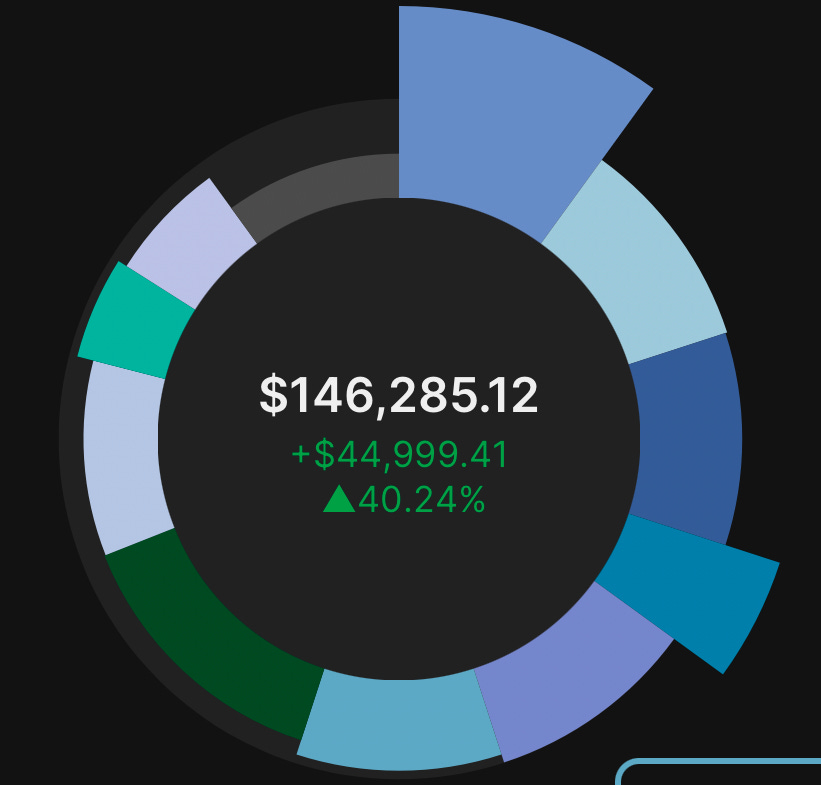

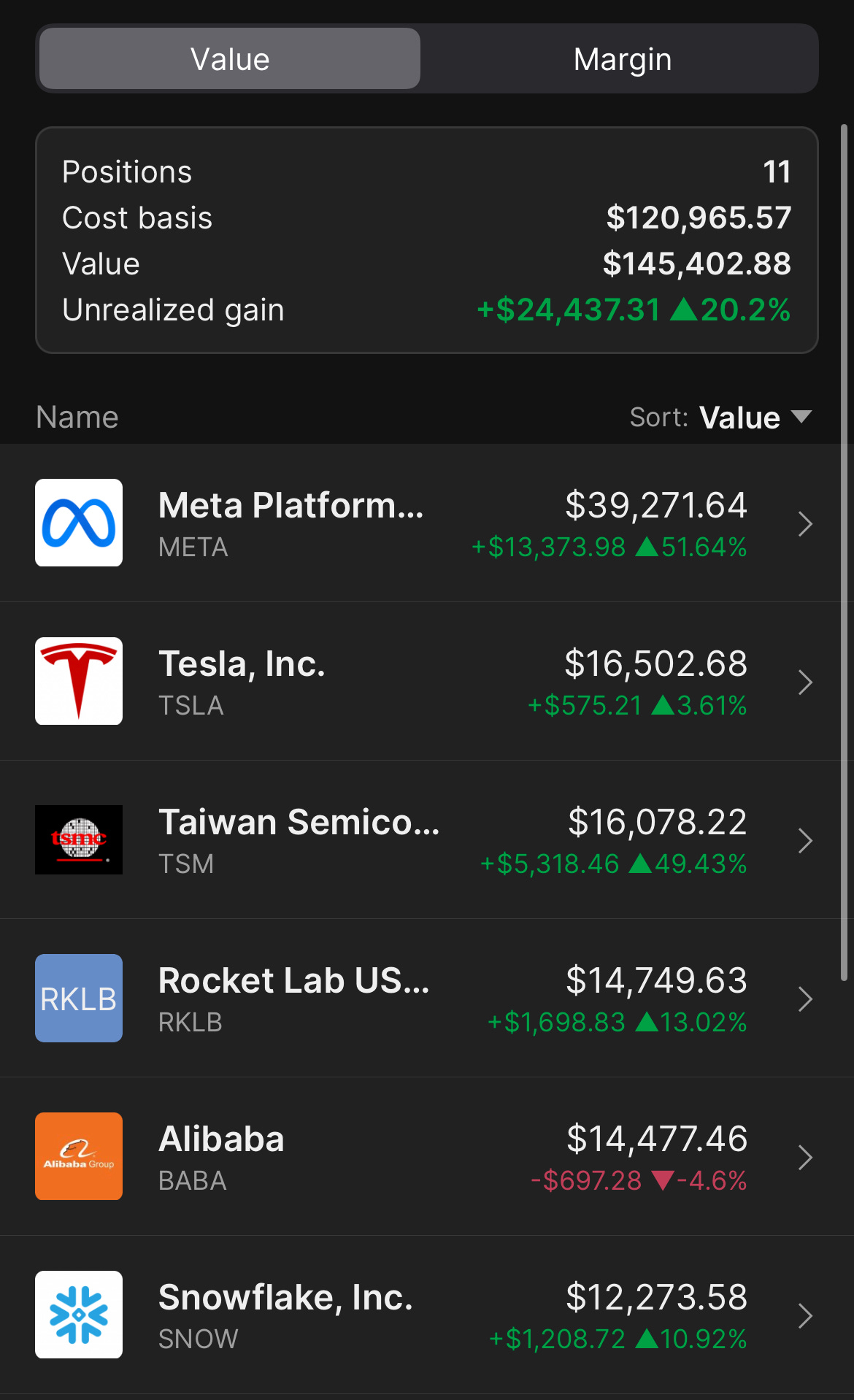

The current portfolio

META is up 50% for me, but it’s still not trading at an excessive multiple based on the future prospects of the company. For anyone thinking I sold SHOP because it was up 58% and not because I think it is now overvalued… well there ya go. I’m not selling META.

I’m putting a share/comment button down below these screenshots. So drop me a question in the comments and if you want to help more people find the newsletter, share it.

I appreciate every single one of you!

Hi everyone,

I've just joined substack and this is my first post.

I'm just wondering what approach should I take if I want to create a portfolio that is similar to Austin's current one?

For example, do I just buy everything that is in the portfolio already?

Do I only buy the stocks mentioned in buy alerts from now on?

Thanks a lot

I like these quick summaries! What software is the DDOG GTIB growth/profitability comparison from? I like the simplicity of it.