I told you all to stop trying to time the market. When will you learn your lesson?

I’m kidding, I’m obviously talking to myself not you.

I closed SQQQ for a roughly 1% loss on the position this week. It was up roughly 5% - 6% until today when the market jumped after the jobs report.

Bought $29.06

Sold $28.77

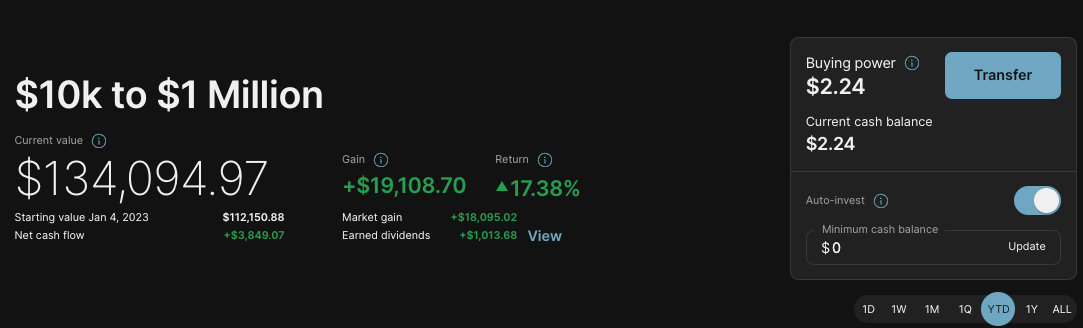

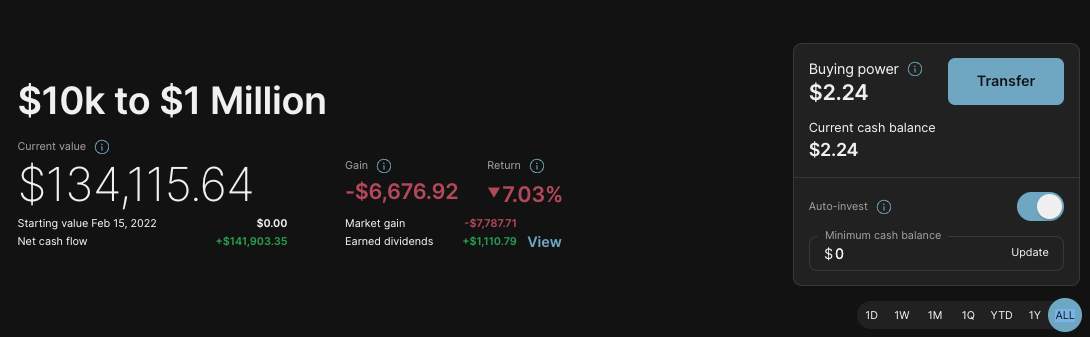

We’re still up 17.4% YTD and down 7% since starting the portfolio on Feb 15, 2022.

All joking aside, I know many of you are questioning my judgment and wondering how I can be so indecisive. I don’t blame you.

I’m not making any excuses and I take full accountability for my decisions. I know and believe that long-term investing is the best way to invest and I also know that in general, the best way to improve returns is to lengthen your holding period.

But I’m human and sometimes humans do dumb shit.

It’s also interesting to think about the added pressure of deciding to go full-time on this newsletter meaning my income relies on being able to grow and retain paid subscribers.

So I think I put the added pressure on myself of not wanting to be wrong. First, because I didn’t want to lose money and second, because I wanted to grow/keep subscribers.

That basically back-fired because my portfolio would be better off if I had just left things alone and I lost 20 - 30 subscribers because of my stupidity…so there’s that.

At the risk of losing even more subscribers because of my indecisiveness, I’m re-aligning my newsletter to provide what I think is the most valuable service to subscribers.

Do research and write deep dives to help people identify and learn about great companies

Teach people who don’t spend all day staring at the stock market good investing habits and how to grow wealth over the long term in a way that aligns with prioritizing what matters most in their life (family, jobs, health, etc)

Run a real-money portfolio alongside the research service. This can help people with idea generation but also forces me to have my skin in the game and be transparent about my own returns.

So with that, and with everything I’ve learned about investing since I started in 2011 and taking into account how emotional I’ve been about the markets lately, I am more convinced than ever that DIY investors need some basic rules that help us not screw ourselves.

I’m not going to focus on maximizing returns in any given year. That leads to making foolish outsized bets and trying to time the market…at least for me.

I’m going to focus on being able to stay in the game, not being stressed about the market, having a portfolio that allows myself and others to sleep comfortably at night, AND I think this will still outperform over the long-term.

So I will hold 20 stocks in the real-money portfolio at a 5% cost-basis each. Meaning I won’t add more than 5% of the portfolio value to any single position. I will let a position grow to 15% of the portfolio at a maximum if it is a significant outperformer at that point, I would begin trimming the position.

I’m going to keep it roughly 50/50 between dividend growth stocks and “growth” stocks. I think this will provide a great mix of capital appreciation and dividend growth which should provide some great returns with less volatility than being 100% “growth”.

I will continuously research the companies in the portfolio and new ideas, but my goal is to hold positions for 3+ years and have less than 10% turnover in any given year. Meaning at most I’d sell/replace 2 out of the 20 stocks in a given year.

That’s the goal and things can obviously change if the thesis completely breaks for a stock.

In terms of the number of emails I send, I want to truly keep it to 2 emails per week. I want to ensure I’m respectful of your time but also keep you informed. I will send out an email if anything absolutely time-sensitive comes up but if we’re investing properly, that shouldn’t happen often.

This means if the market “corrects” I’m going to be caught up in it. I don’t want to put added pressure or expectation on myself to try and avoid a market downturn. They happen and are impossible to time. As I hope I have shown you, more money and time is wasted trying to avoid “corrections” than when they happen… as long as you’re not invested in bubble stocks or using leverage and can hold for 3+ years. I’ll do my best to avoid bubble stocks.

The best way to avoid being hurt in a market downturn is to only invest money you don’t need for at least 3 years.

So anyways, I’m going to start using Stock Unlock to track and share my portfolio because it allows me to share a lot more insights than brokerage screen shots.

They have a pretty awesome platform for researching stocks that is 100% free with the option to upgrade to premium for $10/month. This link will give you a free 30 day trial. That’s a referral link so I’ll get a free month if you sign up.

Last bit of housekeeping here. We got some unfortunate news related to my wife’s health this week….she’s okay and I’m not prepared to share any more details, but I’m exhausted so I’m going to share the current portfolio, then get the newsletter back on track next week providing you all more value and not being a doomsday bear anymore (cue the market crash).

Updated Portfolio

Keep reading with a 7-day free trial

Subscribe to Growth Curve By Austin Lieberman to keep reading this post and get 7 days of free access to the full post archives.