Happy Monday Investors,

Read this first, then watch the video… it’ll make more sense that way!

We were on vacation last week so I didn’t get a chance to share my end-of-week review…and it was a wild week for the portfolio. We ended the week up over 20% which isn’t a victory lap. It was one week. I’m sure we will give some of that back.

However, I did intentionally oversize the “growth” stock bucket of my portfolio over the last few weeks because I believed the long-term risk-reward was very favorable due to the drastic pullback we’ve seen in basically anything associated with “growth”.

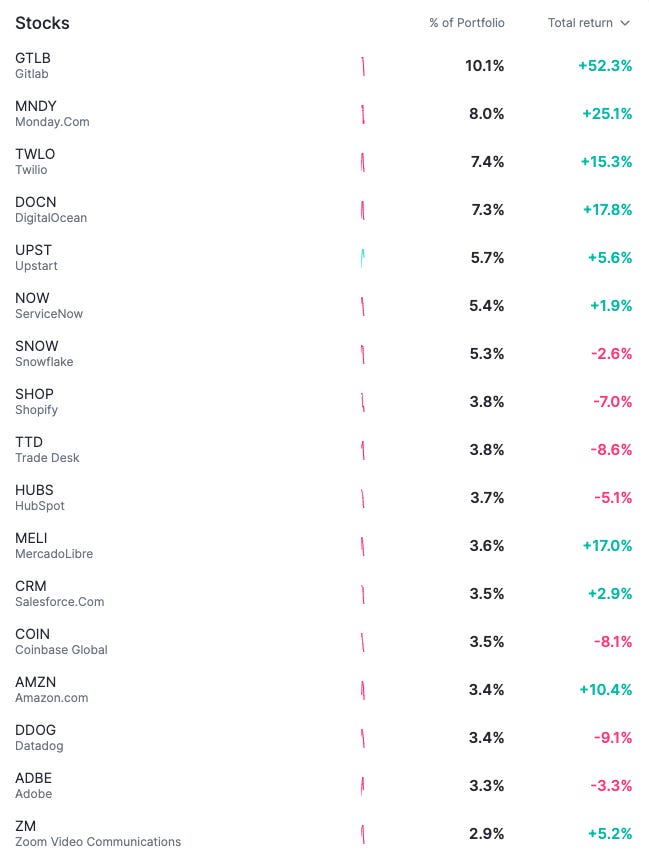

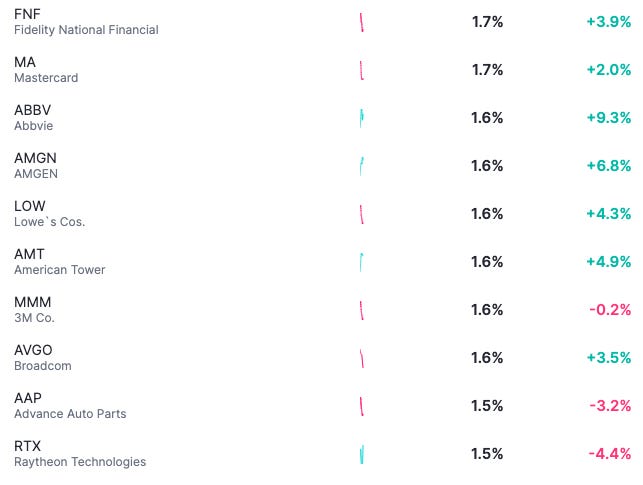

Here’s a look at my current position sizes after the craziness last week.

You can always use this link to view my current portfolio on Commonstock

On March 13th, I wrote about what I’d be buying last week (link). I did that because I had new contributions coming into the account last week and my target allocations were set. Once the money hit my account, the cash would be auto-invested according to my target allocations.

Then on March 14th, Gitlab (GTLB) reported incredible earnings and gave FY 2023 guidance for $388 million in revenue, well ahead of the $335 million analysts were expecting. So I sent another email out saying I would also be buying GTLB (Link)

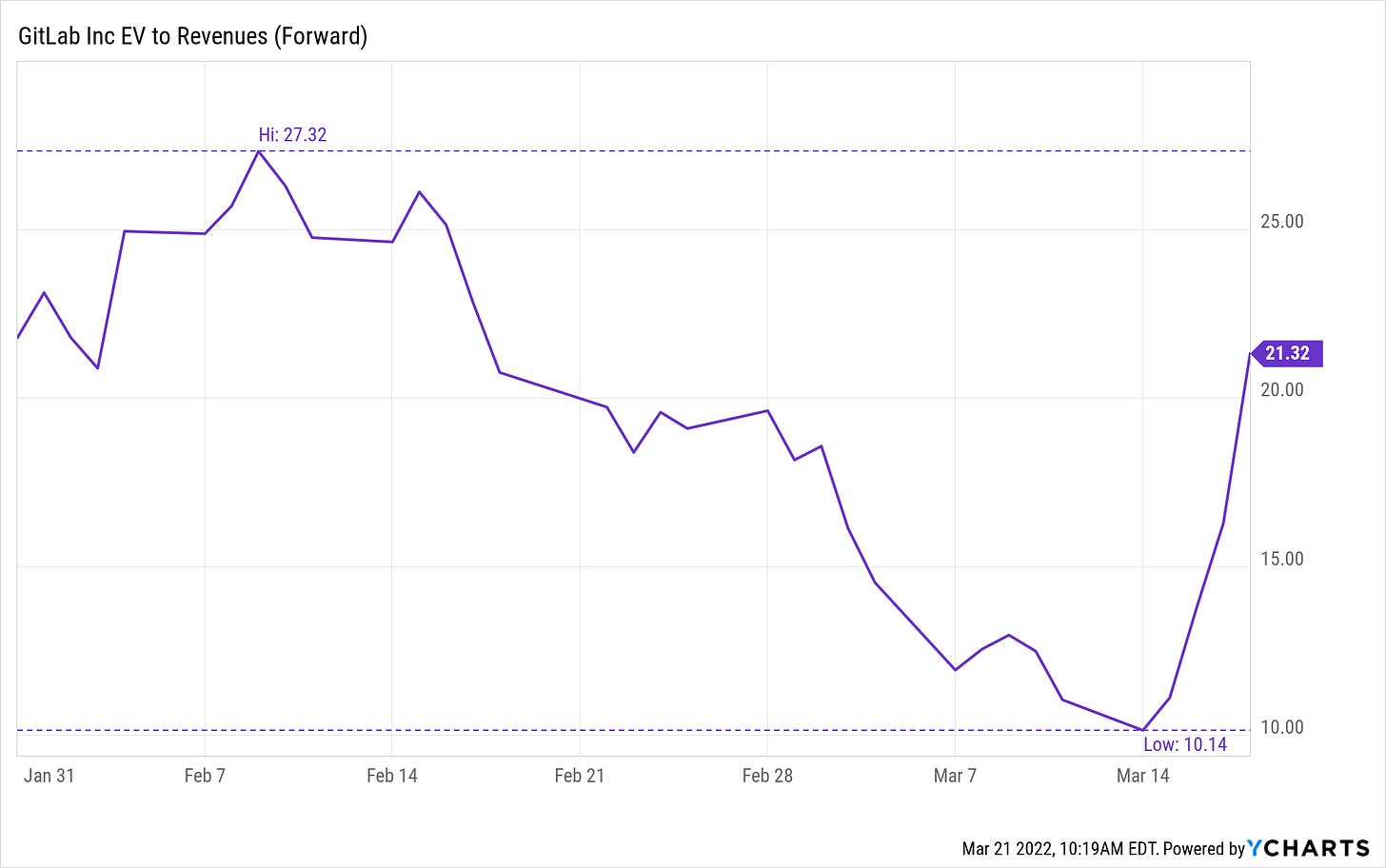

It had dropped down to an enterprise value to forward sales (FW EV/S) multiple of under 13 with expected revenue growth of 54%, 39%, 35%, and 38% for FY 23 - 26.

The image below shows how far the FW EV/S ratio had fallen on March 14th… and unfortunately, how fast it rose last week.

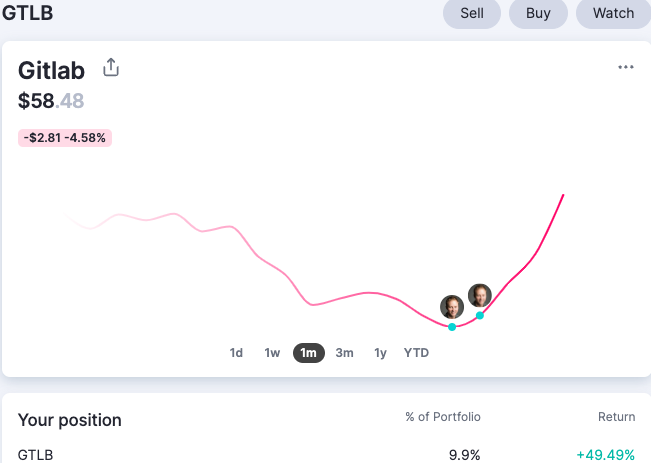

The next screenshot is from Commonstock with my pretty little face on the GTLB chart twice last week where I bought shares (after I told you I was going to). I made GTLB a significant position very quickly because I believed it was a screaming buy for someone with my time horizon and risk tolerance given its current multiple and forward growth prospects.

Gitlab is currently a 10% position in my portfolio and after its very strong rebound last week, I won’t be adding more for the time being.

My next contributions hit the account on March 1st.

Here’s a list of the companies I will be buying with new contributions. I’m sharing this update because of how drastic of a swing some of my growth companies have had in the last week or so. I’m a long-term investor but 20% - 50% swings over a week or two changes the risk-reward of adding to a position with new contributions.

In the video above I share more details (graphs with fundamentals) about why I’m adding to what I am. but let’s face it, I know some of you just want the list.

THIS IS NOT ADVICE AND YOU SHOULDN’T BUY STONKS JUST BECAUSE SOMEONE ON THE INTERNET SAYS THEY ARE GOING TO BUY THEM.

Watch with a 7-day free trial

Subscribe to Growth Curve By Austin Lieberman to watch this video and get 7 days of free access to the full post archives.