November Portfolio: Up 10.45%

Last week I shared some deeply personal news (link). That article received more email responses and views than anything I’ve ever written.

Thank you all so much for taking the time to read/respond. Many people shared their condolences and also that they had been through something similar and appreciated me writing about it.

Okay, Okay, back to our original programming: how to get rich overnight.

Just kidding.

November 2019 Review

This post was written mostly on Saturday November 30th. Returns are through Friday, November 29th.

This is how my portfolio felt from about August - October 31

This is how it feels going into December

Summary of the last few months:

August - October was a major drawdown in my portfolio and Software as a Service (SaaS)/high-growth stocks in general. My portfolio was down as much as 39%. I believed great companies would recover but definitely overtraded as I tried to minimize the losses. That was a mistake and a lesson I’ll keep in the memory bank for future downturns.

November was a much better month for my portfolio. I diversified my portfolio a little bit with about 5% exposure into a few biotech/pharma companies. This will probably work out terribly, but it felt like a good decision. You’ll see that most of my portfolio is still heavily concentrated.

I primarily aim to be a part-owner of fantastic founder-led companies. But I’m human and break my own rules, only to regret it later…..

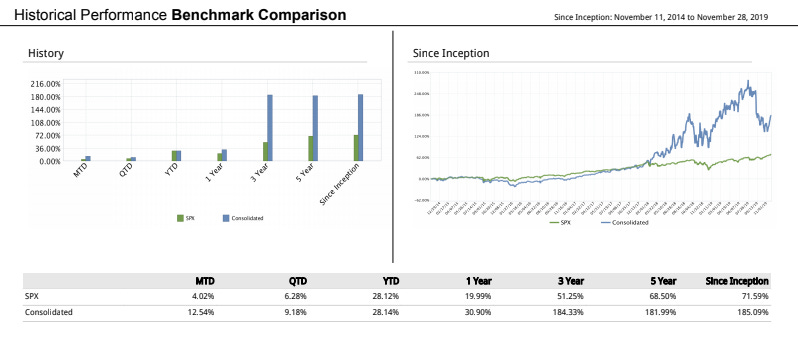

I found a better format for sharing my returns from Interactive Brokers. Since I’m only sharing monthly return updates, I like this one because it' provides a bit more detail and cool charts.

Consolidated = our three accounts (what I’ve always been reporting)

SPX = an S&P 500 benchmark which shows the return we would have if we invested in an S&P 500 index fund (think 401ks, Vanguard, etc)

Portfolio Return Vs SPX:

Month to date: 12% vs 4%

Quarter to date: 6% vs 9%

Year to date: 28% vs 28%

1 Year: 31% vs 20%

3 Year: 184% vs 51%

5 Year: 182% vs 69%

Since November 2014: 185% vs 72%

On the charts below blue is me, green is the bad guys (SPX)

Current Holdings:

The % is how much of my total portfolio is invested in each position.

This is the first of three screenshots. I’ll break them down one by one for simplicity. This one is by far, the majority of my portfolio.

You’ll see in my brief write ups that I’m not an expert in any of thes platforms or technologies. I have a basic understanding of what these companies do and believe that the demand for their products will grow in the future. Aside from that basic understanding, my investment decisions are driven by the way a company is executing, their management, culture (glassdoor reviews, blogs, etc), and some other really great investors I follow (The Motley Fool Stock Advisor/Rule Breakers & free forums, Twitter, etc).

Alteryx (AYX) has grown to be 23% of my portfolio. The company’s software makes it easier for their customers to analyze data from all kinds of inputs and make key business decisions. We hear all kinds of talk about Artificial Intelligence, Machine Learning, VR, AR, 5G, etc. I have no idea when all of that stuff is going to become mainstream, but I do know there’s more data now than ever before and that trend is increasing. Alteryx stands to benefit from more data.

As of their Q3 2019 earnings report, revenue growth was 65% year-over-year, dollar-based net expansion was 132%, GAAP gross margin was 91%, and net GAAP net income was $10.8 million.

This business is executing very well and I’m a happy shareholder.

Mongo Database (MDB) is 16% of my portfolio. MongoDB is a leading general-purpose data platform. The way I understand it is that this type of unstructured database is a much-needed update to 40-year-old structured Oracle databases that allows today’s and tomorrow’s software to be built.

As of their Q2 2020 earnings report, revenue growth was up 67% year-over-year, MongoDB Atlas (cloud offering) Revenue was up 240% year over year, Non-GAAP gross margin was 72%, and non-GaaP net loss was $14.7 million compared to -$17.5 million the year prior. The company is disrupting an industry, growing fast, and showing a path to profitability.

If I need to trim a position, I may decide to trim MDB down to a 10% position. I think there’s a huge opportunity for them to continue disrupting the database industry, but their net losses cause some hesitation in thinking about it as a 16% position. I’ll send out an update if I make any changes.

Q2 2020 Earning Release

Datadog (DDOG) is a 15% position for me. I added 300 shares since last month’s update and I’m super comfortable with it there. I wrote about it recently (here). They recently announced security monitoring which makes their platform even more complete/sticky. Link here.

The Trade Desk (TTD) is a 12% position for me. Last month it was battling to be my largest position around 20% of my portfolio. I sold half of my shares after they announced 3Q 2019 earnings. I’m still a fan of the company and management, but with revenue growth slowing to 38% year-over-year, I didn’t feel it deserved to be a 20% position. Additionally, I have an 8% position in Roku which gives exposure to many of the same benefits/risks of the movement to connected TV and digital advertising as The Trade Desk does. I’m more comfortable with around 20% of my portfolio in these two companies vs 30%.

Roku (ROKU) is an 8% position for me. I added an additional 40 shares to my position this month (see above). The company announced a strong Q3 2019 and the shares immediately tanked which is why I bought more.

Revenue growth was up 50% year-over-year, platform revenue growth (their focus) was up 79% year-over-year, active accounts streaming hours, and average revenue per user are all growing strongly. Additionally, the company has started international expansion and a little company called Disney launched Disney + on Roku which is a good indicator of how valuable their platform and user base is.

Elastic (ESTC) is 7% and basically untouched since last month. I’ve been waiting around for them to show signs of improving profitability and accelerating revenue growth for a while.

The company reports on December 4th and if there aren’t signs of these improvements, I’ll likely trim all or most of this position.

Anaplan (PLAN) is now a 7% position. They are basically creating an industry of their own called connected planning. The company reported a very strong 3Q 2020 results and I’m happy with the size of this position.

Zscaler (ZS) is down to a 5% position from a 7% position last month. I trimmed shares that were down in my taxable account to take advantage of tax-loss harvesting which lowers capital gains taxes from selling stocks that were up.

The company reports earnings on December 3rd. Last quarter, management referenced longer sales cycles, and lowered guidance to give their new Chief Revenue Officer some breathing room. This gives me a lot of hesitation, but so far management has been very straight forward so I’m giving them the benefit of the doubt and keeping my 5% position into earnings.

If the results are poor or we see unexpected weakness, I may sell the rest of my shares.

Okta is still around a 5% position. I feel like shares are pretty pricey, but they’re the leader in a massive market and we could see their revenue growth actually accelerate in future quarters. I’ll likely leave these shares alone.

Pager Duty is still around a 3% position. The company reports earnings on December 5th and the gambler in me thinks they’re going to crush it and the stock jumps higher. But the rationalist inside me thinks I’m probably wrong and if we don’t see a strong quarter, this one could be a goner in my portfolio too.

Virgin Galactic (SPCE) is around a 2% position and has been an epic disaster so far. Really cool idea and a ton of future potential. But I own most of my shares in a taxable account and since they’re down around 40% I’ll likely sell on Monday to chip away at more capital gains. I can rebuy shares in 31 days if I decide I want to own them. Plenty of time to get back in IMO.

Going to break here and share those two other screenshots. They’re going to need some explaining and some of you might want to yell at me…. but let me explain.

HOLY CRAP WHAT THE HECK IS A “SYNTHETIC” AND A “RISK REVERSAL”?!?!?! You said you were done with these options nonsense….

I’m going to define them in my human, Florida Public College graduate terms (yes, I went to a mediocre public university in Florida).

The Synthetics

If you look at the first EDIT Jan 2021 $25 Synthetic. That means I sold a Jan 2021 $25 Put and bought a Jan 2021 $25 Call for a total cost of $1.50 per contract. This means if the stock is below $25 in Jan 2021, I am obligated to buy 100 shares at $25 (per contract) and if it’s above $25, I can either buy 100 shares at $25 or sell my call for profit.

If the stock is at $30 in Jan 2021, my profit is roughly $3.50 per contract or a roughly 125% gain from a 20% movement in stock price.

The same applies to each different “synthetic” contract.

The Risk Reversals

The risk reversals are the exact same thing. A sold Put and a bought Call, except the Put I sold is at a higher strike price.

Let’s take a look at the WORK 25/22 Risk Reversal. I sold a Jan 2022 $25 Put and bought a Jan 2022 $22 call and was paid $0.22 per contract. If the stock is below $25 in Jan 2022, I’m obligated to buy 100 shares per contract at $25. Ideally I want the stock to be above $25 in Jan 2022 so those Puts expire worthless (I keep the premium I was paid for selling them) and I can either buy shares at $22 or sell my calls for profit.

The companies I chose to do this with are companies I’d be happy to own at their expiration date at the strike price of the puts and also companies that I think could be up 50% - 200% or more over the next 1- 2 years.

This sounds outrageous and it’s definitely not for everyone. But it seemed like a good idea for my own portfolio at the time.

Most importantly, I have to make sure I will have enough cash in my portfolio to purchase all of the shares I am obligated to buy if these stocks are below the strike prices of the Puts I sold at their expiration dates.

This is what tends to get people in trouble with options. Overleveraging themselves.

I used these strategies on the pharma/bio companies (EDIT, CRSP, NTLA) because I think 1-2 could become mega, mega winners and erase the losses from the other ones.

You also may have noticed I own a Jan 2022 ARWR $50 call. That’s a company I found in my Deloitte Fast 500 Technology research study (link). I think it could have tremendous upside over the next two years or it could go to 0. So I made a small bet. Small enough that if I lose it, it won’t matter but big enough to where if it’s a mega-winner, it’ll be worthwhile.

I used them on CRWD, WORK, ZM, and PD because I think they’re all solid companies with stocks that have been beaten down lately. All four of these companies report earnings this week so I’ll get some quick short-term feedback on these soon.

I used the strategy on FSLY because the company reported strong earnings and I think they’re a good bet on edge computing and the desire for digital content to be delivered faster with reliable security.

What you will likely see over the next 1 - 2 years is a lot less tweaking of my portfolio. I’m invested in a core set of companies I really believe in and have some smaller bets on companies using these options strategies that introduce some risk, but offer big potential upside.

Thank You

Thank you so much for your time and attention. If you love these updates hit the heart at the top of the page, share on social media, and if you really love these updates, start a paid subscription to help support the newsletter. You get the same exact newsletter as the free one, but you also get a special (completely worthless), virtual (100% made up), Subscription Coin.