My newsletter is now 100% free. Pay if you want. Full Portfolio Update

This is probably a bad idea but it feels like the right thing to do…

Update: Newsletter is 100% Free Now. Pay if you want.

I just made a big change to how I’m going to run this newsletter. The reason I write and share my perspective on investing is because I want to make investing more accessible to more people.

Having a paid service that costs $20/month doesn’t really do that. So I’m going to publish everything for free and give readers the option of subscribing for $5/month or $20/yr.

Everything will be free but if you want to pay to support my work. I am giving you the option for $5/month.

I think this is the best way to allow me to reach the most people possible while giving people the option to support my work if they can/want to.

I will be refunding all current paid subscribers 100% of what they paid and then they can decide if they’d like to support me under the new plan.

We have limited time and a lot of stuff to fill that time. There’s tons of finance/investing books out there and most of them aren’t worth reading. However, three that I’ve read multiple times that I think ARE worth your time are 100 to 1 In The Stock Market, 100 Baggers, and The Outsiders.

For me they opened my eyes to the idea that it’s possible to own a stock that goes up 100x. Saying that out loud or online just sounds ridiculous so seeing examples of those types of returns is very helpful.

These books don’t provide a formula for exactly how to screen for or find 100 baggers. It’s not that easy. But they do help you understand the traits an investor needs to have to even possibly own a 100 bagger and the traits a company need to have.

If you’re looking for investing books to read. I highly recommend these three.

Portfolio Update

We’re still trailing the S&P500 since August 2022. I made some very poor decisions and was over trading in 2022, but as you can see on the chart below, our performance has been much better since January 2023.

I’m also focused on returns over 10+ years which is when compounding really makes a difference. So while I admit 2 years is a fair amount of time, it’s not like we’re trailing the market by an insurmountable amount.

It’s also important to note that this is a portfolio mostly focused on small to mid cap stocks which in general have performed very poorly over the last few years. I expect more volatility in my portfolio than the S&P 500 but I also expect small and mid caps to eventually outperform the S&P 500 again (could be wrong).

If we compare to the Russel 2000 which covers smaller companies, the portfolio has strongly outperformed.

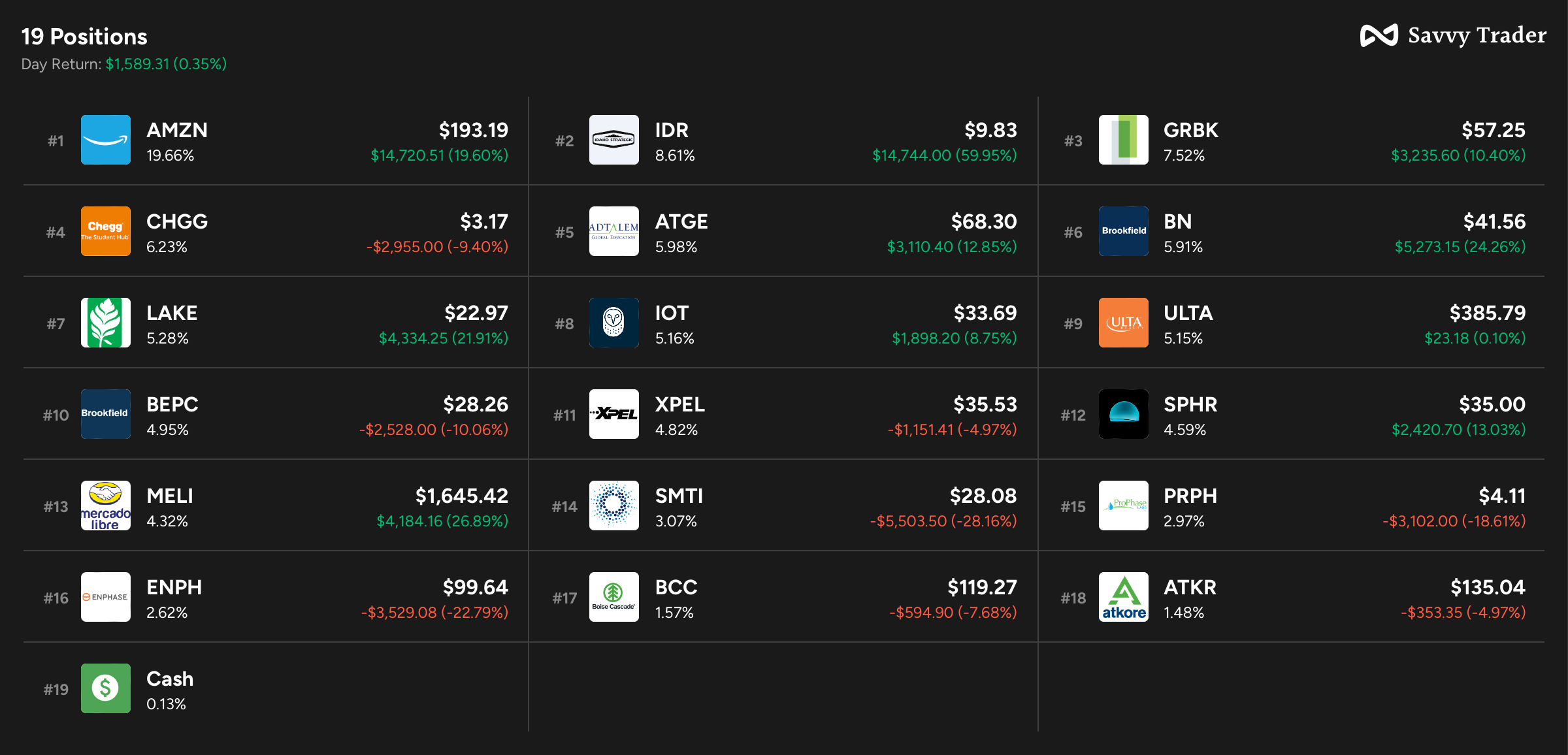

Here’s the current portfolio in order of allocation size. The % in parenthesis shows total return of each position.

As you can tell by my allocations, I think Amazon is one of the best opportunities in the market right now. The stock is as cheap on a Price to operating cash flow basis than it has been at any point in recent history.

No you can’t just buy cheap stocks and expect to do well, but Amazon is a stellar business, eCommerce is a growing market, Cloud Computing is a growing market, Advertising is a growing market….. and Amazon is a leader in each.

The company will save a ton of money in advancements in AI and automation and they’ll make a ton of money as their customers need more compute power to run applications.

So far, Amazon has been left out of the AI hype which is why we have such a great buying opportunity (in my opinion)

That’s is for today. I think I’ve pounded the table on Amazon enough, the next businesses I plan to cover in depth are Lake Industries and Xpel. These are both <$1B market caps that are more risky, but that have more potential upside than Amazon over the next 5 - 10 years due to how much smaller they are.

Thank you good idea