As public investors, how do we digest opposing stories from credible sources?

I don't know for sure, but the best answer I have is that we need to pay attention to the numbers (not stories). But, we can't just pay attention to all the numbers. We must pay attention to the right numbers

The Slack Vs Microsoft Teams debate is a perfect example.

What is Microsoft Teams?

Here is a cool interactive demo that will let you quickly check it out. I tried to use Teams heavily for my professional work from June 2018 - May 2019 and I really wanted it to work. In my view, Teams is a communication platform that is supposed to connect & integrate all of Microsofts productivity products. So essentially, users should be able to have chat based or video based conversations, store & access files on Microsoft’s cloud storage, and easily collaborate with others. When I was using it, it was riddled with bugs and the teams I was working with wanted to use it…because it was included with Office 365, but it just wasn’t effective. So instead teams used thing like Slack, Trello, Google Docs, and others (Zoom didn’t have the mass adoption yet).

The above is my own opinion and I realize how small of a sample size and how biased my opinion could be. But I think it adds a bit of context to the debate below.

The Debate

The Microsoft corner…

On July 11, 2019, CNBC released this article: Microsoft Says Teams app is bigger than Slack and growing faster. Here are the high-points:

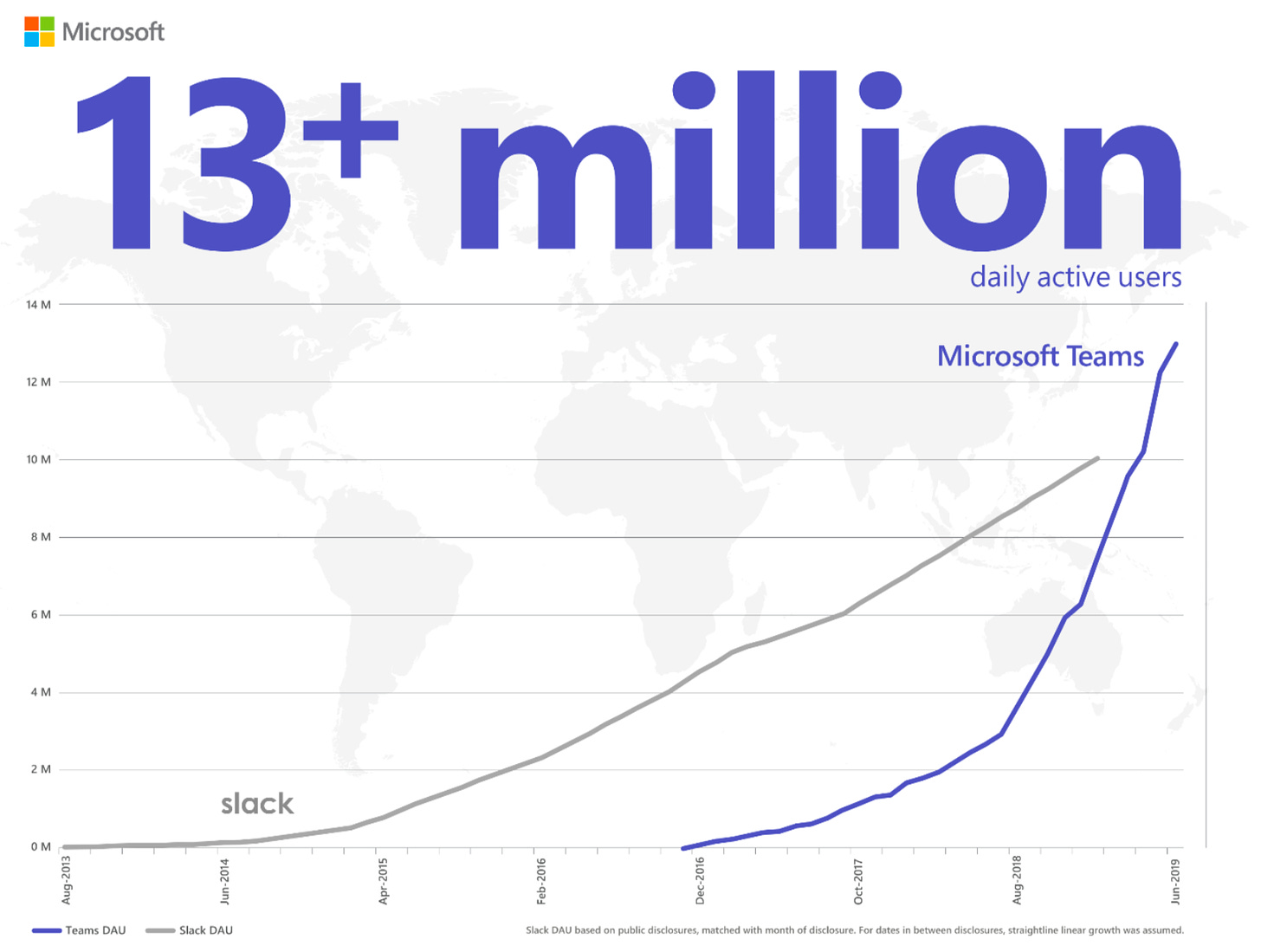

Over 13 million people use Microsoft’s Teams app for chat, meetings and document collaboration every day.

Competing app Slack had more than 10 million daily users in the three months that ended on Jan. 31.

Microsoft Executive VP Rajesh Jha, who oversees Office (including Teams), says the app has started helping Microsoft use email for what it’s best for, instead of as a default.

Microsoft also released this chart showing Teams’ growth outpacing Slack's growth. I have no idea where they got Slack’s growth numbers for this.

One note. This article was released on CNBC (at least the one I am citing) and feels like it is at least in part, an attempt to get some attention using two popular companies. The article didn’t cite a whole lot of data.

The Slack corner…

On July 22, 2019 Okta released “Best-of-Breed vs Suites: Growth of Slack and Zoom Across Okta Integration Network. Which attempted to “bring a different perspective based on the trends Okta is seeing across their network of thousands of companies, applications, and technology integrations, and millions of daily authentications and verifications.” So…very data driven.

The article was written be Okta COO and Co-Founder Frederic Kerrest. Here are a couple highlights.

The success of best-of-breed apps has led to a number of successful IPOs over the past few years, yet software giants continue to argue that their all-in-one solutions negate the purpose of specialized apps like Slack and Zoom.

We dug into the data and found that organizations are increasingly deploying best-of-breed apps alongside suites, and that adoption of best-of-breed is growing much faster.

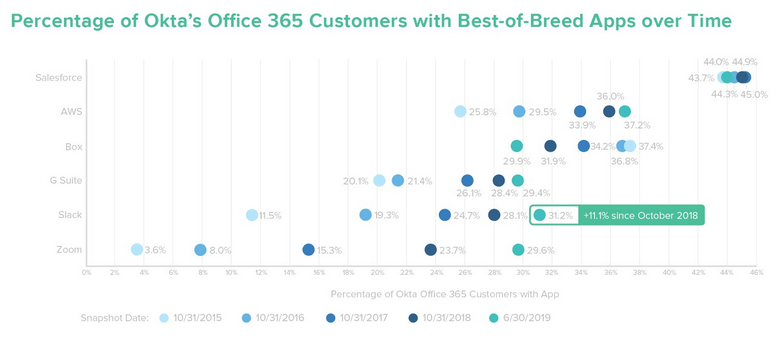

Our 2019 Businesses @ Work report shows that Office 365, Box, G-Suite, Salesforce, AWS, Slack, and Zoom are seven of the top 10 most popular apps in the enterprise. So the question became, “Do Office 365 customers go all in on Microsoft's offerings?” As of January 2019, the answer was resoundingly no.

As of this June, more than 77% of Okta’s customers with Office 365 had also adopted best-of-breed apps, such as Slack, Zoom, Box, AWS, Salesforce or G-Suite, and these numbers have been steadily growing. Between October 31, 2018 and June 30, 2019, Zoom saw a whopping 25% increase in Office 365 customers adopting its solution, the most of any best-of-breed app we analyzed within Okta’s customer base. Slack’s growth among our Office 365 customers was also in double-digit territory, up 11% to 31%, which indicates the race is on for collaboration apps in the enterprise.

The image below shows specific apps (Salesforce, AWS, Box, G-Suite, Slack, and Zoom) on the Y-axis and their growth in terms of Office 365 users on the X-axis. The bottom two are Slack and Zoom which are still growing double digit annually even though Microsoft is actively trying to compete.

This sums it up for me

Best-of-breed apps are growing in popularity, with their user base outpacing their customer acquisition. Over the past nine months, the percentage of Okta’s customer base adopting Zoom grew 58%, and its unique users grew 98% across our network. In the same period, Slack has grown 39% in terms of customers, and boasts a 72% increase in unique users. Meanwhile, Office 365’s customer and user growth numbers both hover around the 28% mark.

My Conclusion

First, I have to say how valuable Okta’s data is for investors, for Okta’s customers, and for Okta as a company. Data like this is the competitive advantage (moat) of the future. I believe Twilio is very similar in this way as well.

I’m not alarmed by Microsoft Teams’ numbers, was underwhelmed by the platform when I used it professionally, and believe Microsoft will continue to struggle with these productivity products as the advantage from their pre-installed O365 user base continues to be less and less important as more apps work together.

I’m not saying I would short Microsoft, but it’s such a big company that I have no interest in investing in it.

I own shares of Zoom and Okta and I’m strongly considering starting a small position in Slack this week or next.

If you love this newsletter do me a favor and hit the heart at the top so people can find it, share it with friends, and if you really really love it start a $5/month or $50/yr paid subscription where you’ll get absolutely nothing extra from the free version. Other than a virtual hug from me of course.

Thank you so much for your time and attention.