META Cuts 11,000 Jobs. Thesis Broken?

Mark Zuckerberg released a letter to employees Wednesday morning

In this new environment, we need to become more capital efficient. We’ve shifted more of our resources onto a smaller number of high priority growth areas — like our AI discovery engine, our ads and business platforms, and our long-term vision for the metaverse. We’ve cut costs across our business, including scaling back budgets, reducing perks, and shrinking our real estate footprint. We’re restructuring teams to increase our efficiency. But these measures alone won’t bring our expenses in line with our revenue growth, so I’ve also made the hard decision to let people go.

What other changes are we making?

I view layoffs as a last resort, so we decided to rein in other sources of cost before letting teammates go. Overall, this will add up to a meaningful cultural shift in how we operate. For example, as we shrink our real estate footprint, we’re transitioning to desk sharing for people who already spend most of their time outside the office. We’ll roll out more cost-cutting changes like this in the coming months.

We’re also extending our hiring freeze through Q1 with a small number of exceptions. I’m going to watch our business performance, operational efficiency, and other macroeconomic factors to determine whether and how much we should resume hiring at that point. This will give us the ability to control our cost structure in the event of a continued economic downturn. It will also put us on a path to achieve a more efficient cost structure than we outlined to investors recently.

I’m currently in the middle of a thorough review of our infrastructure spending. As we build our AI infrastructure, we’re focused on becoming even more efficient with our capacity. Our infrastructure will continue to be an important advantage for Meta, and I believe we can achieve this while spending less.

Fundamentally, we’re making all these changes for two reasons: our revenue outlook is lower than we expected at the beginning of this year, and we want to make sure we’re operating efficiently across both Family of Apps and Reality Labs.

This is a hard day for anyone employed at META. Many others have already been impacted by layoffs. I don’t want to make light of them.

However, if I put my investor hat on, I believe this is a good thing. META 0.00%↑ is up almost 3% pre-market as I write this.

Zuckerberg ended his letter with the following statement (it summarizes my thoughts on the stock well):

I believe we are deeply underestimated as a company today. Billions of people use our services to connect, and our communities keep growing. Our core business is among the most profitable ever built with huge potential ahead. And we’re leading in developing the technology to define the future of social connection and the next computing platform. We do historically important work. I’m confident that if we work efficiently, we’ll come out of this downturn stronger and more resilient than ever.

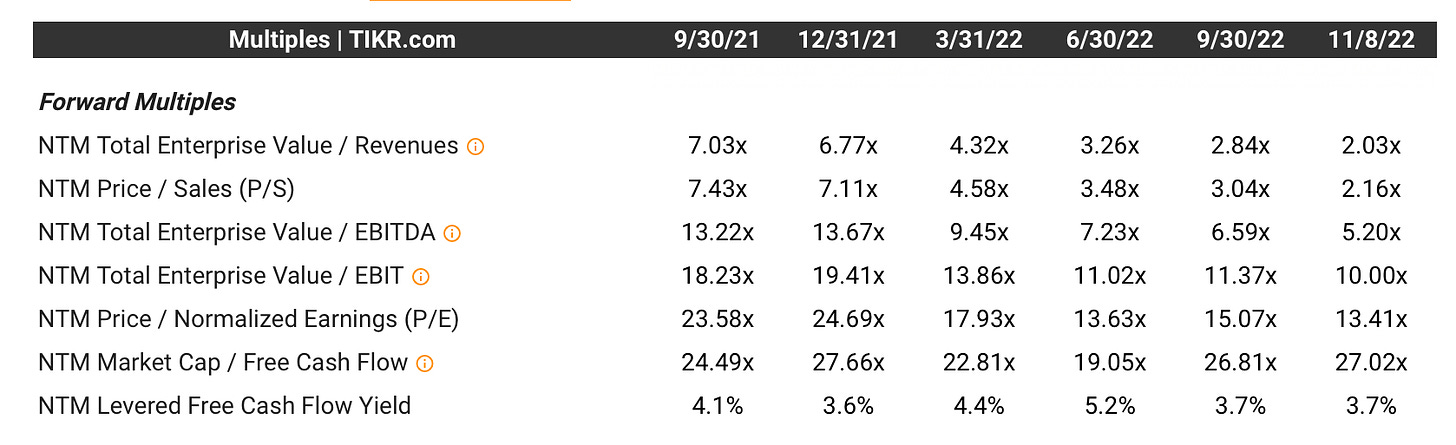

The stock is currently trading around the lowest forward P/E in its history at 13.41X. Since they’re investing so heavily into Reality Labs and infrastructure for their AI recommendation engine, Price to free cash flow is probably a better metric. As you can see below since December, the PE is down from 25x to 13x now, but price to free cash flow is basically flat at 27X.

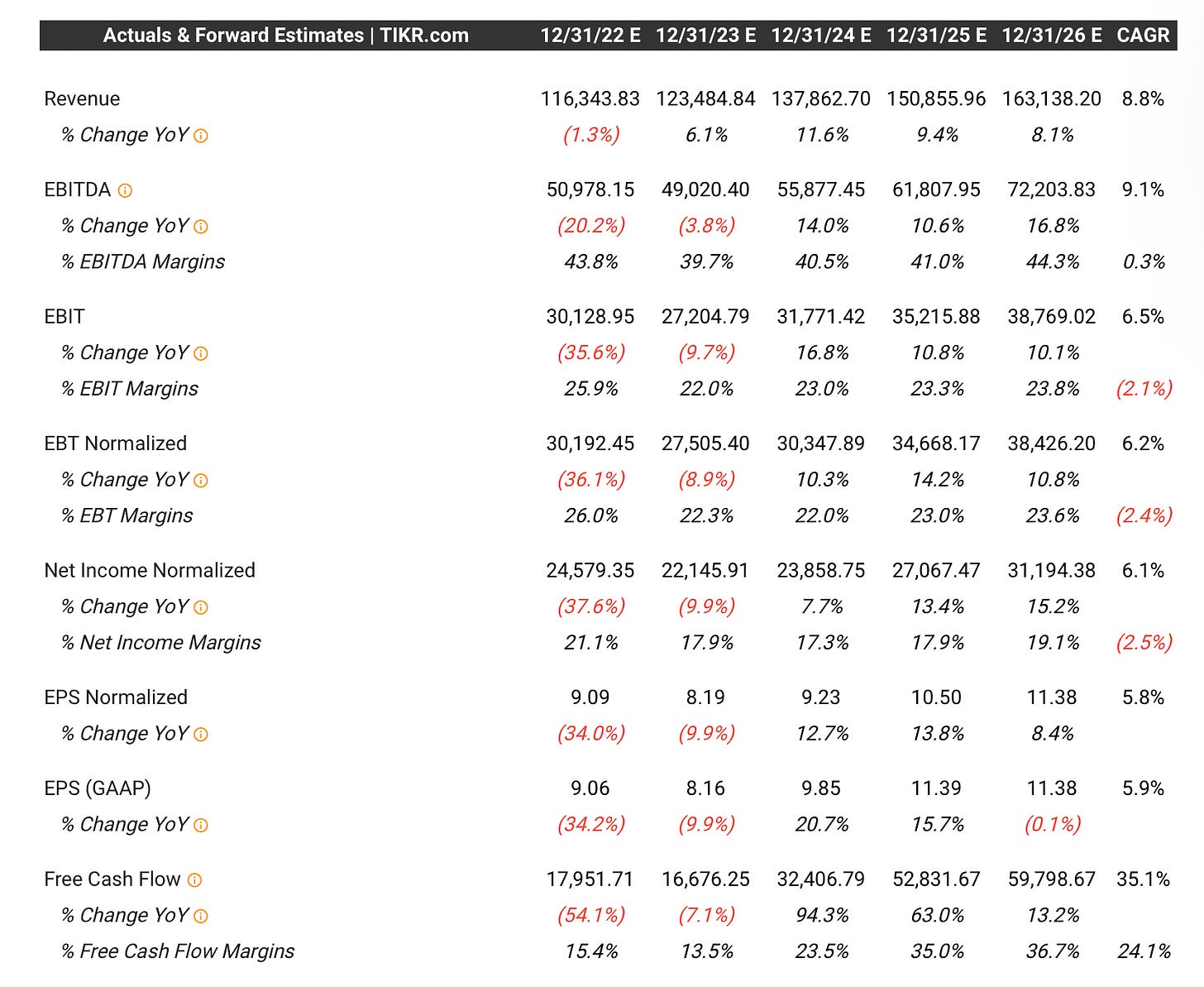

Analysts expect revenue to grow at a CAGR of 8.8% from FY 22 - FY 26 and free cash flow to grow at a CAGR of 35% over the same time period ending 2026 with 36.7% free cash flow margin.

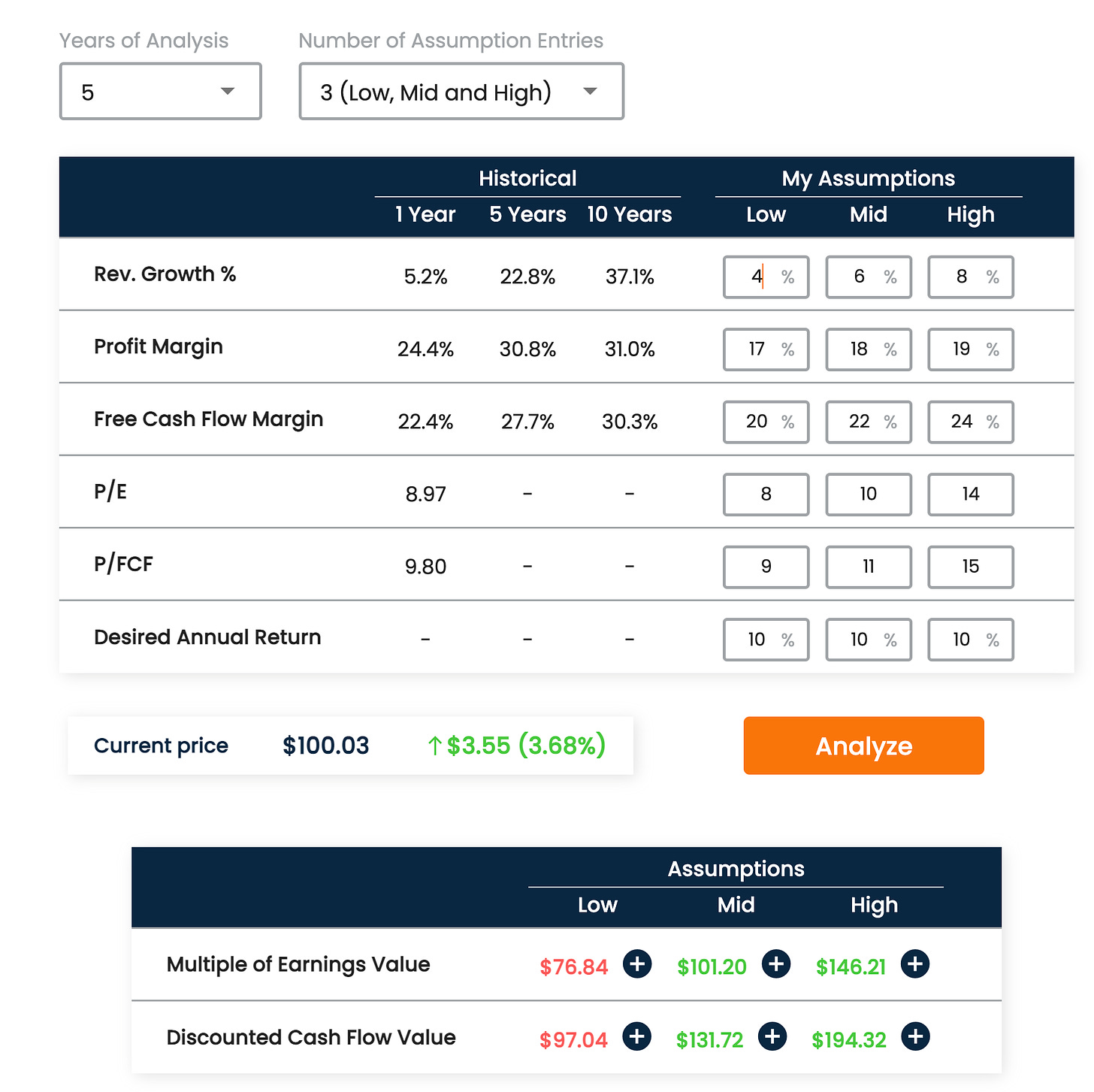

Below I’ve created a quick 5-year model using more conservative numbers than analyst estimates. Even with what in my mind are very conservative estimates for revenue growth, profit margin, free cash flow margin, P/E and P/FCF, Meta offers the potential for some great returns.

Many people hate this company, Zuckerberg, and everything it stands for and will never own the stock. I understand people who feel that way. Many other people believe they are burning cash away with Reality Labs and won’t own the stock. I understand that.

I think they have a remarkable userbase in the family of apps that they will continue to monetize for many years to come, with tailwinds from messenger + WhatsApp monetization and I believe they are well positioned to become a dominant player in the Metaverse which could provide some very nice upside to the conservative estimates in 5 - 10 years.

I added $1,000 to META 0.00%↑ last week and have no intention of selling any of my shares.