March 22 Weekly Review

Our performance for the week, what I'm reading and listening to, and a look ahead to next week

Hey everyone,

Thanks so much for subscribing and reading. My goal is to make this worth your time. I want you all to know, I fully intend to keep this newsletter completely free. However, I’ve also added the option to sign up for a paid subscription - $5 a month or $50 a year. There is no difference in the paid vs free versions. It is simply an option for people if they find this valuable and want to help support me sustaining this newsletter, that it. No pressure at all. I greatly appreciate the fact that you are signed up at all.

I’ll also add a view comments section at the bottom. If you have questions, topics you’d like me to cover, or stocks you’d like to research and share (or that you want me to research) please let us know in the comments. I want this to be a collaborative learning experience!

Performance update

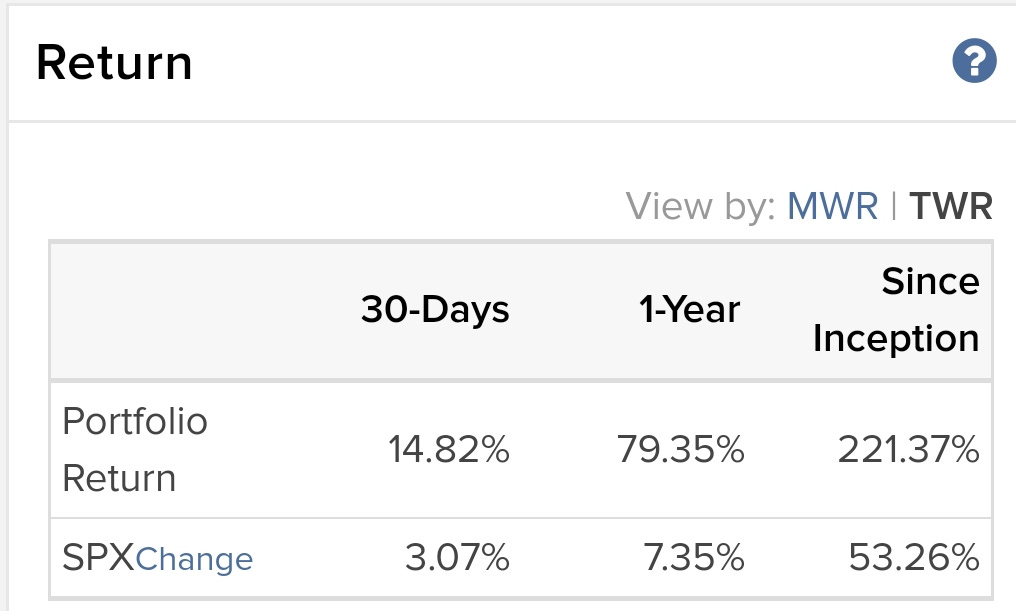

Here’s a snap shot of our performance versus the SPX which represents the performance of the S&P 500. So this is comparing my portfolio results to the results I would have had if I were invested in a S&P 500 index fund and not managing my own portfolio. Let me know if you’d like a further explanation of this in a future post!

This has been a very good 30-Days and 1-Year for our portfolio. I personally don’t expect this type of performance to continue and I know for a fact at some point there will be a 10% or 20% drop in the market, a recession, or some bad event that happens that makes the market drop.

However, I don’t know when these things are going to happen and instead of waiting to invest until they do, I’m investing the money I won’t need for 3+ years and have decided I won’t sell when that type of panic comes up. That’s just what works for me. Everyone will be a little different here, but it is impossible to time the market. No matter what anyone says.

Companies we own

Here are the companies we own listed in order of position size with the ticker symbol in parenthesis (what you would search on CNBC or Yahoo finance to find the stock), followed by the country the company is headquartered if outside the USA. So the first company listed is our largest position down to the last which is our smallest. We currently own 18 companies which is a bit high. Ideally this number will be 12-15. However, with all of the fears about China trade and in South America, I wanted to take advantage and buy some great companies in those regions. In total, those international companies make up 20%-25% of my portfolio.

At the end of each month I’ll go into a bit of detail about each of the companies, my reason for investing in them, and how I’m feeling about them currently.

The Trade Desk (TTD)

Twilio (TWLO)

Mongo Database (MDB)

Alteryx (AYX)

Okta (OKTA)

ZScaler (ZS)

Square (SQ)

StoneCo (STNE) - Brazil

Shopify (SHOP) - Canada

Elasticsearch (ESTC)

MercadoLibre (MELI) - Brazil

Huya (HUYA) - China

Baozun (BZUN) - China

IQIYI (IQ) - China

Roku (ROKU)

Guardent Health (GH)

HDFC Bank (HDB) - India

Abiomed (ABMD)

The best of what I read and listened to this week

Podcast: Invest Like the Best Podcast with host Patrick O’Shaughnessy and guest Annie Duke. Annie is the author of Thinking in Bets (a great book) and an incredible decision maker. They talk about the process of making decisions and how to properly evaluate the quality of the decisions we make.

Podcast: The Knowledge Project with host Shane Parrish and guest, Basecamp CEO and Co-Founder Jason Fried . Jason has a very different take on life and success than most people these days. He’s not focused on accomplishing the most in life or business, but instead “doing the enough thing”. I really appreciate that view and want to adopt it in some aspects of life and work.

Article: Death, Taxes, and a Few Other Things by Morgan Housel from the Collaborative Fund.

Article: Yes, It’s all Your Fault. Active vs Passive Mindset by Shane Parrish

Coming up next week…

On Monday March 25 I’ll be releasing a new podcast episode (after a long hiatus) which is an interview with Meagen Eisenberg. Meagen is an incredible leader in tech and a fantastic person. She’s currently the Chief Marketing Officer (CMOS) at TripActions, was previously CMO at Mongo Database (MDB), and before that was the VP of Customer Acquisition and Marketing at Docusign (DOCU). I really enjoyed our conversation. I’ll send an email out on Monday when the podcast is released and it will be available on any podcast platform you use. Just search “Founder Stock Investing” and subscribe!

On Friday March 29 or Saturday March 30, I’ll send an email out with our March end of month portfolio review.

Would love to hear your feedback on these newsletters. What do you enjoy most? What topics are you NOT interested in? What would you like to see me cover in the future? Either reply to this email, or share your thoughts in the comments.

Thanks so much for your time. Have a great day.

Austin