Welcome to The Growth Curve. My last deep dive was “CNX Resources: The Most Aggressive Buyback Plan I Have Ever Seen”. My next deep dive will be on Perimeter Solutions (PRM), a $1B company that provides fire safety equipment and oil additives. Here is a link to the Growth Curve portfolio.

Paid subscribers can see my full portfolio, receive all my transaction alerts and research reports by email, and comment directly on every post. Subscribe below so you never miss an update.

MMP 0.00%↑ is currently a 5.7% position in the portfolio with a cost basis of $54.13. The company has an annual dividend payout of $4.19 which is a dividend yield of 6.69%.

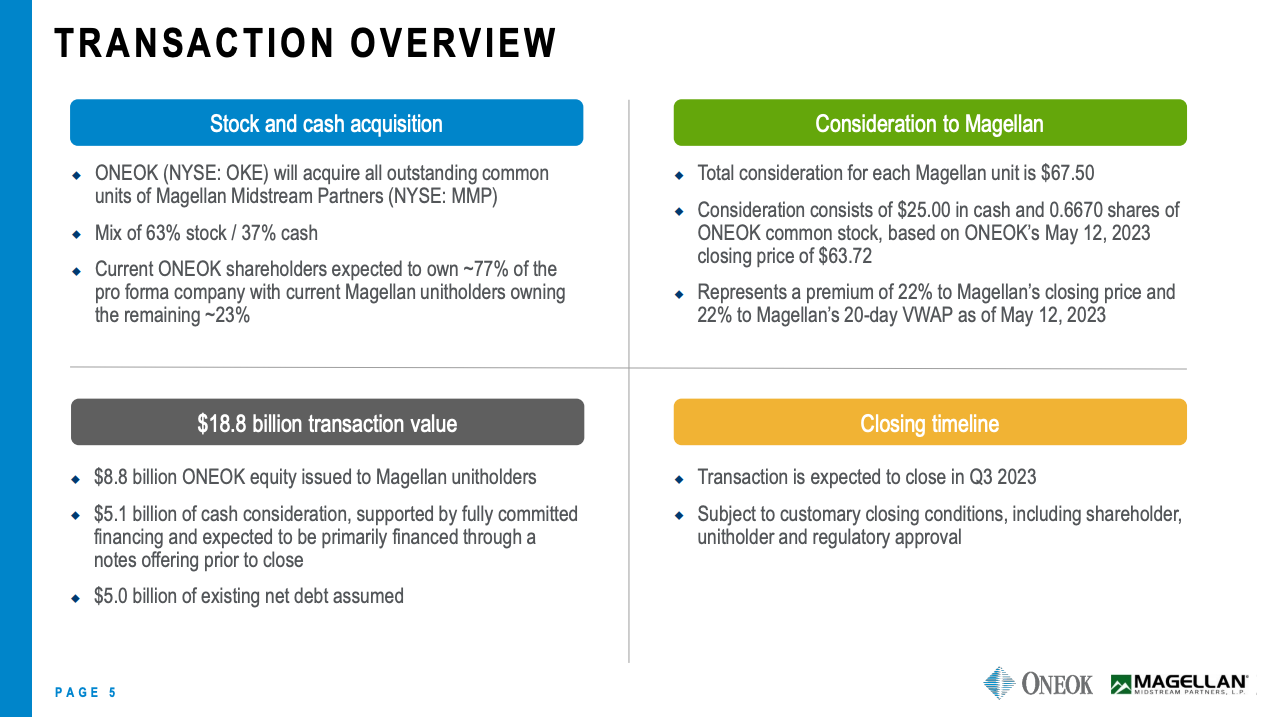

On Monday, May 15, 2023, ONEOK announced their plan to acquire Magellan for a mix of 63% OKE stock and 37% cash. The total “consideration” for each Magellan unit was $67.50 based on $25 in cash and 0.6670 shares of OKE common stock which were priced at $63.72 when the offer was made.

MMP ended Monday trading at $62.61, up 13% which is clearly lower than the $67.50 consideration cited above.

So why aren’t MMP shares trading at $67.50?

OKE shares traded down 9% to $57.95. So if we take the 0.6670 shares of OKE that is being issued for each unit of MMP , and multiply it by yesterday’s OKE closing price of $57.95, we get $38.65. Then we add the $25 in cash being paid for each MMP unit and we get a total value of $63.65 which is just above yesterday’s MMP closing price of $62.61. So the price of MMP shares will be correlated with the movement in OKE stock from now until the deal closes

It’s pretty common for shares of a company being acquired to trade below their acquisition price because there’s a chance deals don’t get approved by regulators.

What I’m doing with my MMP shares.

Nothing. I’m going to keep holding them. I invested in MMP because I believe their ability to transport, store and distribute petroleum products will be a key part of U.S. energy infrastructure in the future, they have increased their dividend for 21 straight years, and the stock has significantly outperformed the S&P 500 from a price and total return perspective (includes dividends) since 2001.

None of that changes with this acquisition, and I believe the combination of OKE and MMP will lead to some benefits due to scale in the future.

Since ONEOK is acquiring MMP, I think it’s also important to consider their track record. OKE has also significantly outperformed the S&P 500. They’ve paid an uninterrupted dividend for 34 years.

Past performance is not a guarantee of future results, but when I see a company that has outperformed over a 20+ year time period and paid a dividend for 30+ years straight, that at least indicates that the business is somewhat durable.

If you like the chart above, you should check out Stock Unlock. I use it to track financials, analyst expectations, and create DCF’s on my companies. I also LOVE their portfolio tracking tool. Use my referral link to get a 30-day free trial (no credit card required)

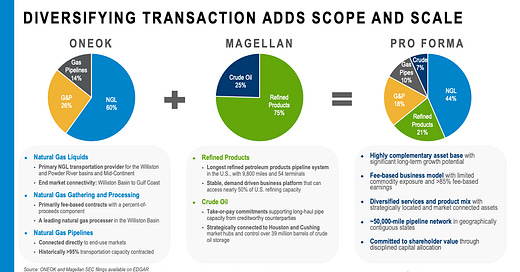

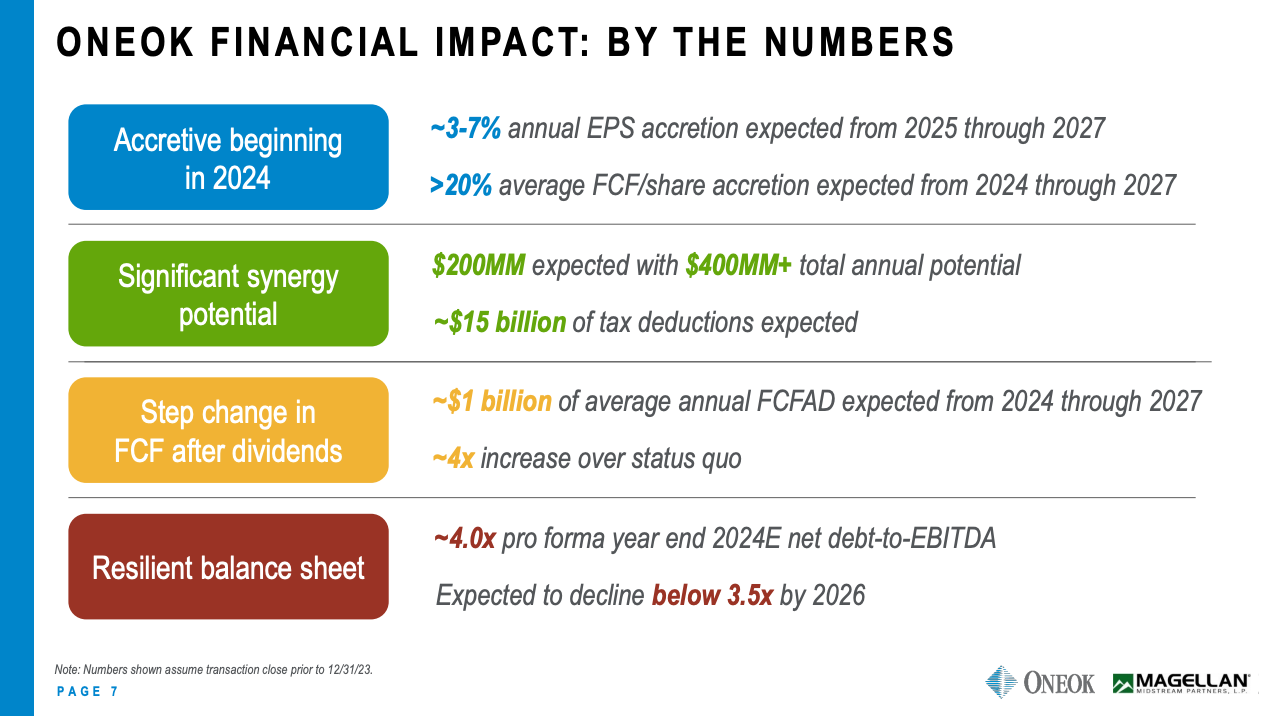

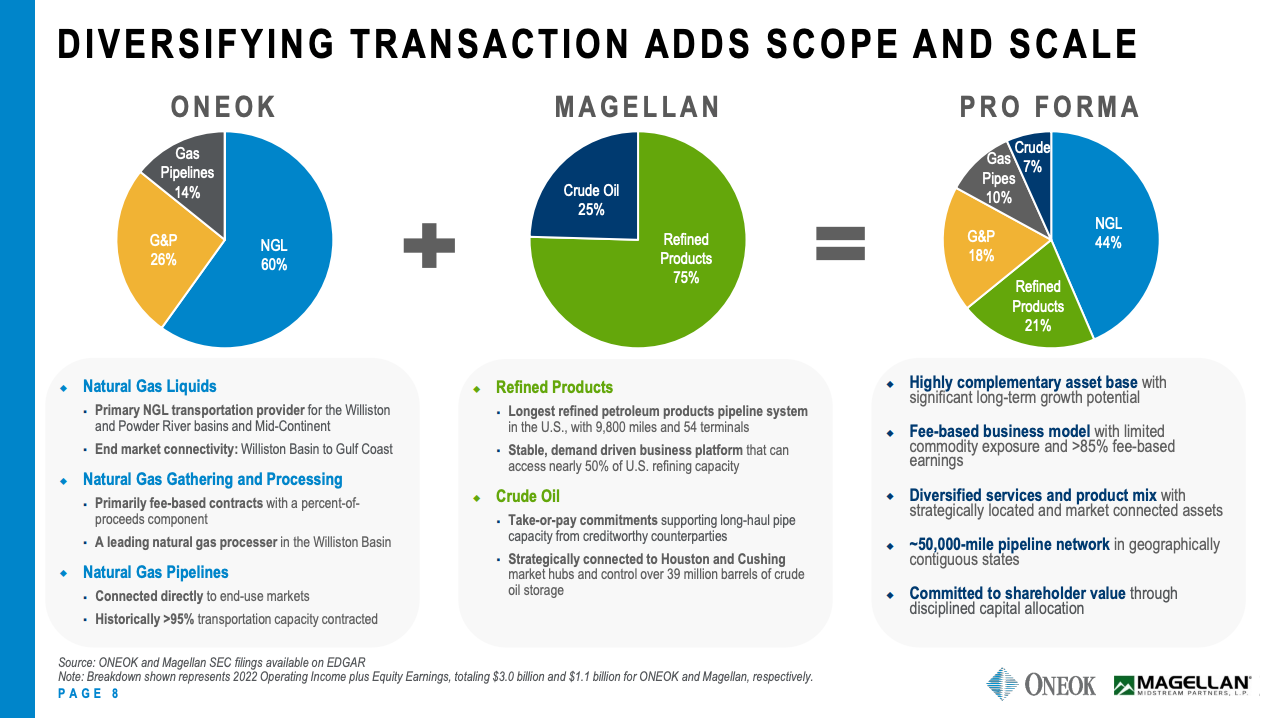

Management highlighted what they believe to be the benefits of a diversified product mix on the slide below and expect the acquisition to provide and additional 3% - 7% EPS growth from 2025 - 2027 and average annual free cash flow per share growth of 20%.

Conclusion

So that’s really it for me. Nothing changes about my thesis of wanting to own this cash-flowing business that is a critical component of the U.S. energy infrastructure and has a long track record of strong performance.

If anything, I believe the combined companies will be stronger and more durable.

If you’d like to learn more about the deal, I encourage you to review the full presentation or watch the merger webinar at this link.

Paid subscribers can see my full portfolio, receive all my transaction alerts and research reports by email, and can comment directly on every post. Subscribe below so you never miss an update. Here is a link to the Growth Curve portfolio.

Let me know what you think of the acquisition in the comments and if you’re a shareholder or plan to invest in MMP or OKE.

Were you going to post on perimeter solutions? Just curious. Thanks.

Thanks for sharing this info!