June Review: +$60,043 Up 9.63%

It’s the last week in June (already) so here is our June 2019 portfolio review.

June felt like a volatile month in the market (or at least in my portfolio). At the end of last week, my portfolio was at a new all-time high. Then at one point this week I was down more than 10% from the highs.

I have a feeling today (Friday) will see another 1% or 2% move in my portfolio but I have no idea which direction. It doesn’t matter. What matters is staying focused.

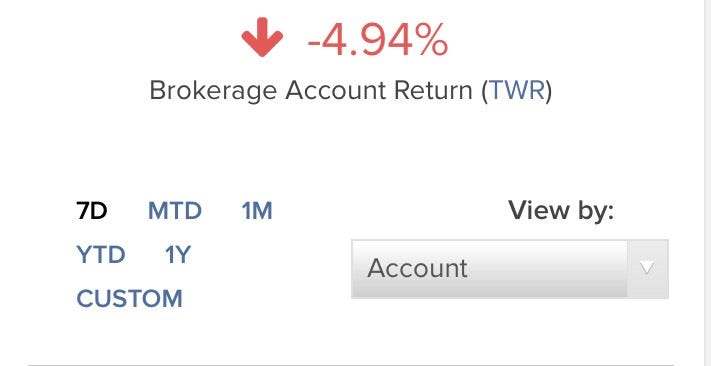

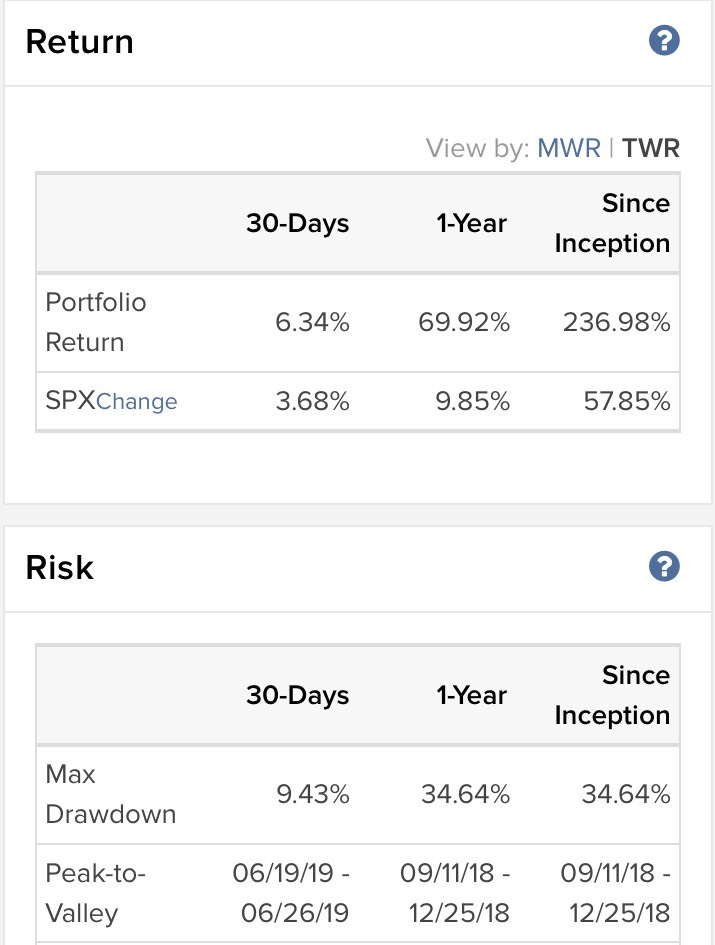

As of Friday before the market opens, here are our returns (taken & calculated from our brokerage)

Portfolio returns

7-Day Return: -4.94%

30-Day: +6.34% vs S&P 500: 3.68%

1-Year: +69.92% vs S&P 500: 9.85%

Since Nov 2014: +236.98% vs S&P 500: 57.85%

Risk (largest drawdown in my portfolio value):

Last 30-Days: 9.43%

Las 1-Year: 34.64%

How we invest

We want to own what we believe are the 10-15 world’s best Founder-led companies with the intent of holding forever. We will likely never actually hold a company forever, but if we can’t imagine doing so, we probably don’t want to own the company to begin with.

Ground rules (we reserve the right to break these at any time):

We live below our means.

We aim to invest 25% - 30% of our household gross income a month (this was not always the case. Start with 1% or 5% and slowly work your way up).

We don’t worry about macroeconomics. It is impossible to predict what will happen. We keep a running assumption that our portfolio is mis-priced (is that a word?) by 30% at all times. I just have no idea if it is under or overpriced.

Portfolio Positions

The image below shows

1. Position: Total number of shares we own

2. Avg Price: The average share price of all of my purchases of that company. Remember, I generally add over time as a company increases in value.

3. Unrealized Profit or Loss %: This number is not all that important. What really matters is the profit/loss of our total portfolio.

4. % of Market Value: This is the most important out of all these metrics. It represents how much of our total portfolio each position represents. As we get more comfortable with a company, we are generally willing to let it become a larger percentage of our total portfolio.

The Trade Desk (TTD), Twilio (TWLO), Alteryx (AYX), and Mongo Database (MDB) are all 15%+ positions and combined account for 67% of our portfolio.

This month we sold our position in Elastic Search (ESTC), added Anaplan (PLAN) and Zoom (ZM), and added to Roku (ROKU).

We likely won’t add to our top 4 positions. They are large enough that if the businesses continue to perform well, they will have a meaningful impact on the portfolio. If one of them pushes into the 20%-25% range or if the businesses begin to show signs of weakness, we will consider reducing or selling those positions.

Zscaler (ZS) and Okta (OKTA) feel about right between 7% - 10% of the portfolio. I love the businesses, but they feel very expensive on a P/S ratio compared to their historical averages. Right now, they are both sub $20 billion market cap companies and are performing well. I see no reason to sell out of a position because I think it’s overvalued.

Pager Duty (PD) and Anaplan (PLAN) are mid-sized positions. I see them as likely candidates for new money until they reach around the 10% threshold. I love that they are both under $7 billion in market capitalization. Lots of room to grow.

Roku (ROKU) is a company I go back and forth on. The business and the stock have performed fantastically. I personally am not convinced that management or their product is exceptional. However, it would be foolish of me to think I’m smarter than the business performance. So I want to own a piece of it. I trimmed Roku to start a position in Zoom (ZM).

Zoom (ZM) I don’t even know where to begin with Zoom. Have loved the potential of the company since before its IPO. I bought on IPO day, but then convinced myself I was falling for all the excitement and sold the next day for a loss. The company is seen as excessively overpriced by many. That’s concerning on one hand, but great on another.

I don’t really know what to say other than the fact that I believe Zoom is one of the best companies of our time. It’s up there with TTD, TWLO, AYX, and MDB in my opinion and will be FAR more than just a video communications company. In fact, it already is. This is the type of company that I want to own at least a small piece of. If the price comes down drastically due to a market-wide sell-off or what I believe is a one-time event. I’ll increase my position size.

Links from our companies this week:

TTD: The Future of TV at Cannes Lions 2019 w/Jeff Green & other marketing leaders

MDB:

A Plan to Stop Breaches With Dead Simple Database Encryption

Zoom:

Verizon Links with Zoom to Enhance Global Customers’ Business Communications Choices

Zoom Rooms are Now More Intelligent and Collaborative Than Ever

Acquired Podcast w/Zoom board member & partner Santi Subotovsky

Thank you!

Thanks so much for your time and attention. I appreciate you all. If you’d like to help more people find us, please hit the heart above, share on social media or with friends, and/or begin a paid subscription for $5 a month or $50 a year using the link below.