This week’s newsletter was going to be about why you shouldn’t let stock market crash predictions keep you from investing in the market.

There are always people predicting that the next crash is right around the corner, eventually someone is going to be right, but the best thing to do over the last 100+ years has been to continue investing through the ups and downs with the caveat that any money you might need for retirement or planned expenses in the next 5 years should never be invested.

That’s just a general rule of thumb and everyone’s situation is different, but that approach has worked for every 20 year period in stock market history.

But yesterday there was an assassination attempt on Former President Trump. This is a sad day no matter what your political affiliation is, or what you think of the former President.

It’s not just a sad day, it’s been a sad time for American politics for several years.

So it’s really easy to feel hopeless for America’s future. Not just as investors, but as citizens.

As disgusting and sad as yesterday was, my message in today’s newsletter is that there’s still hope. There’s still reason for you to be optimistic. America has been through many, many dark periods and events. Each time this country has eventually emerged stronger.

I believe America will eventually emerge stronger than ever from this dark period as well.

I don’t know what’s going to happen with the stock market, and I fully realize the clouds hanging over us may get darker before we emerge on the other side, but I’m confident we will prevail as a country.

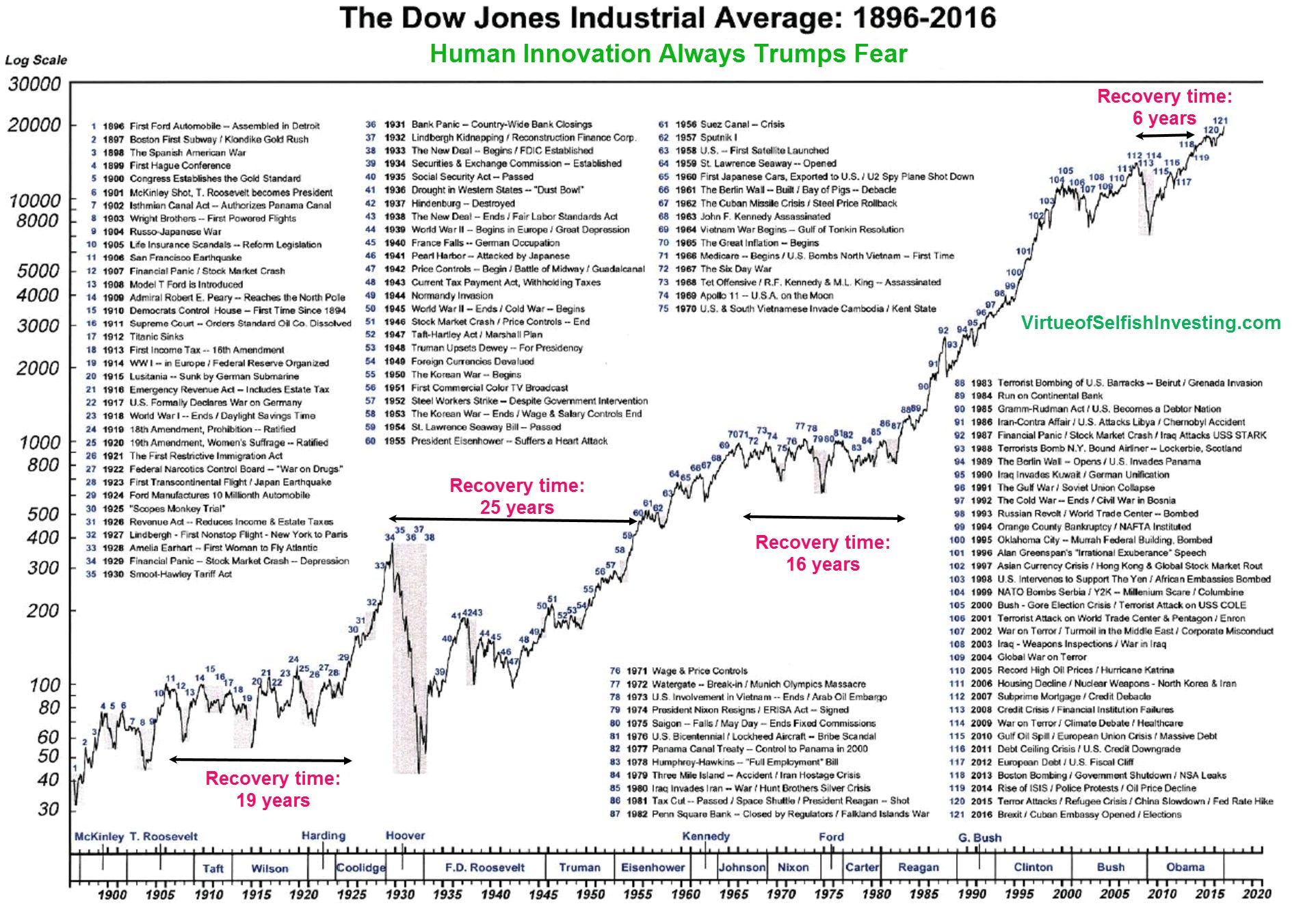

During times like this, I like to reference the chart below which shows all of the reasons you should not have invested in the Dow Jones from 1896 - 2016. Through all of those bad (some horrific) events, $1 in 1896 grew to $121 in 2016.

I have a long time until I plan to retire so my plan is to continue being conservative with my personal finances and “aggressive” or fully invested with my investment portfolio.

I know that means I’ll experience the next crash, which might start Monday, but it also means that I’ll benefit from the recovery and eventual new stock market highs as well.

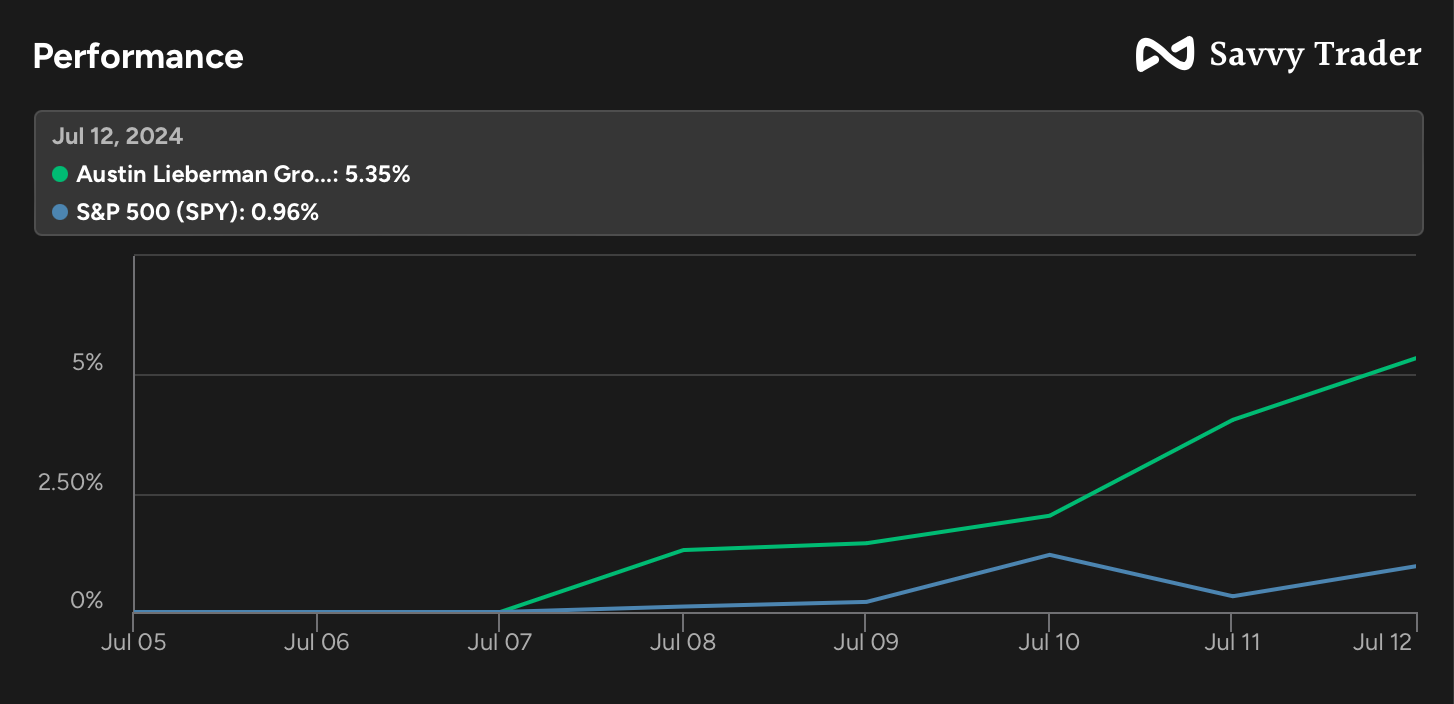

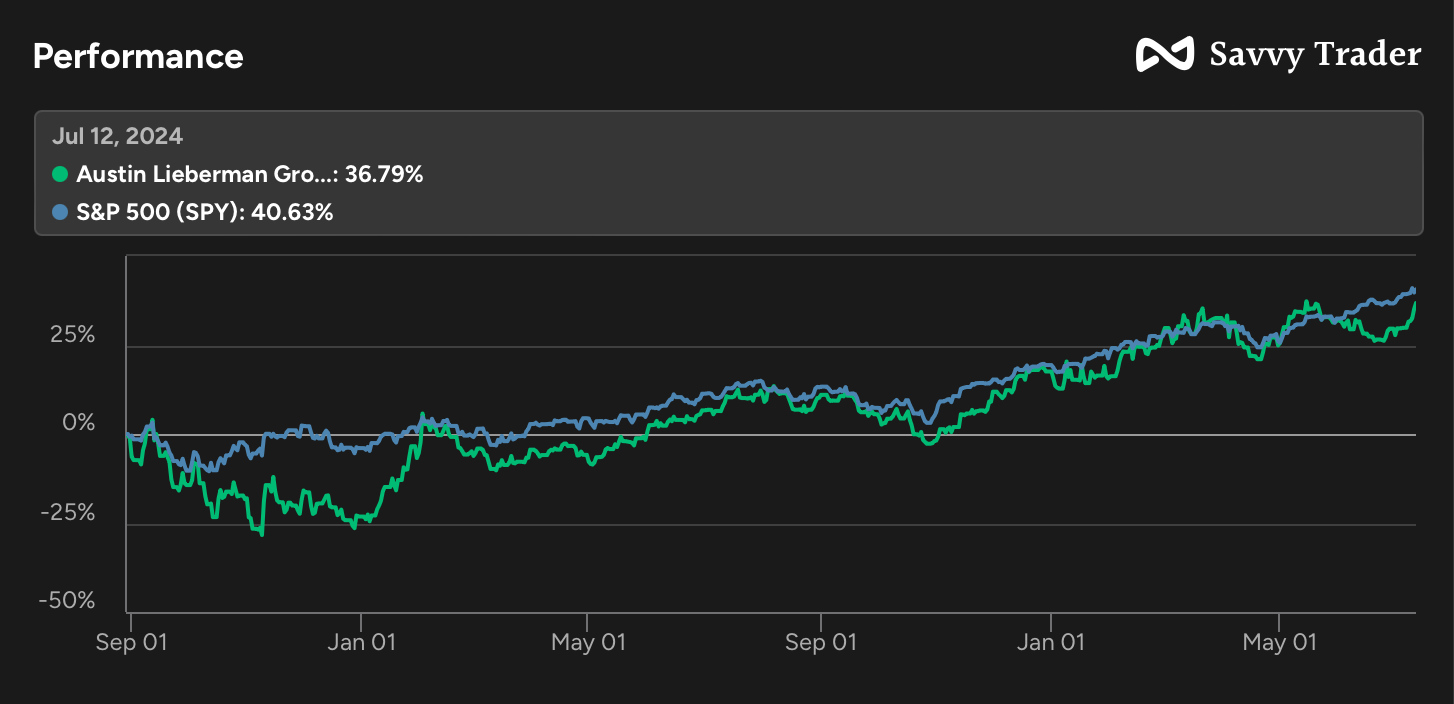

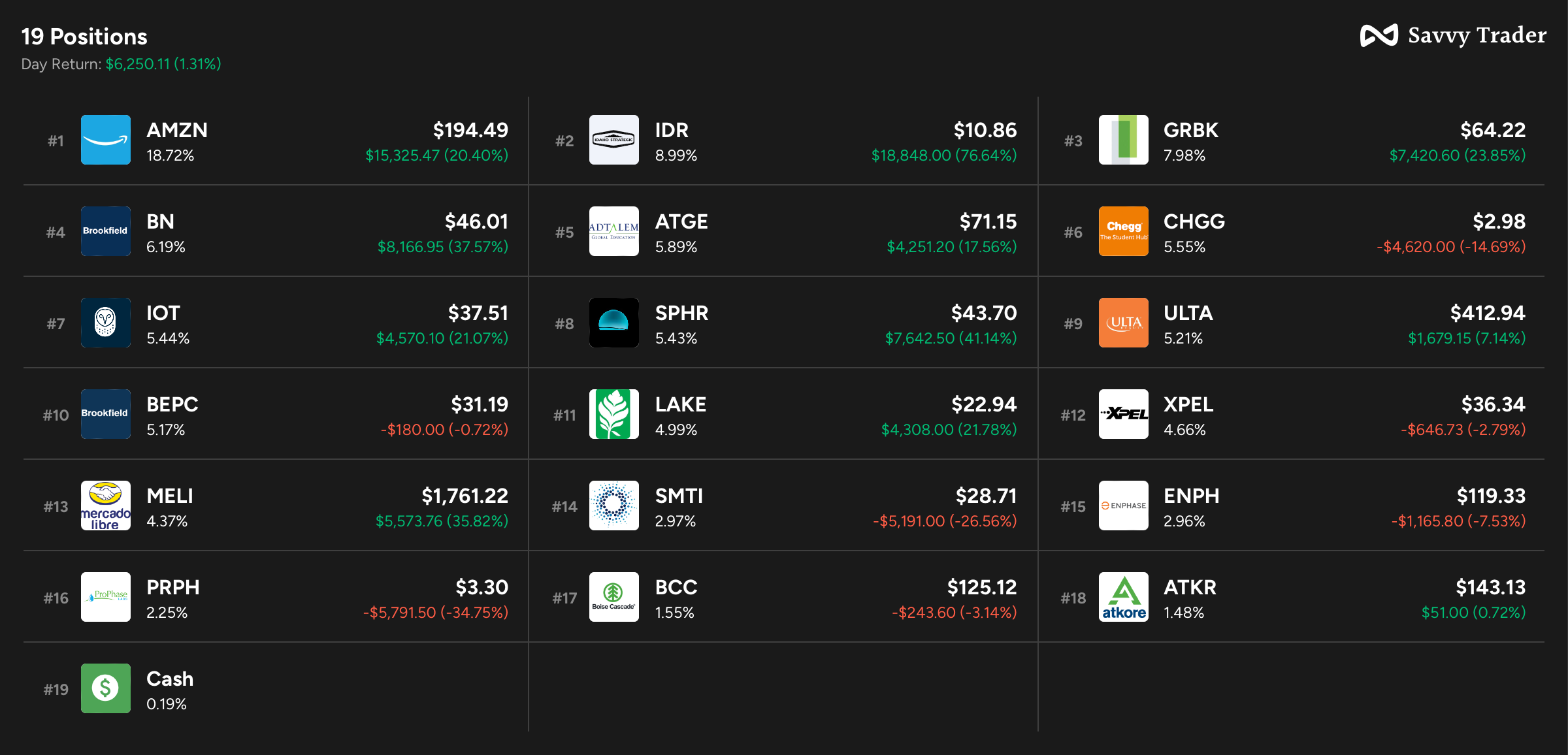

Here’s a look at The Growth Curve portfolio’s performance and current allocations. I’ll be back with a full update and comments about current holdings + stocks I’m currently studying next week.

Words of wisdom, Austin. Very timely post and much needed at a time like this. Cheers!