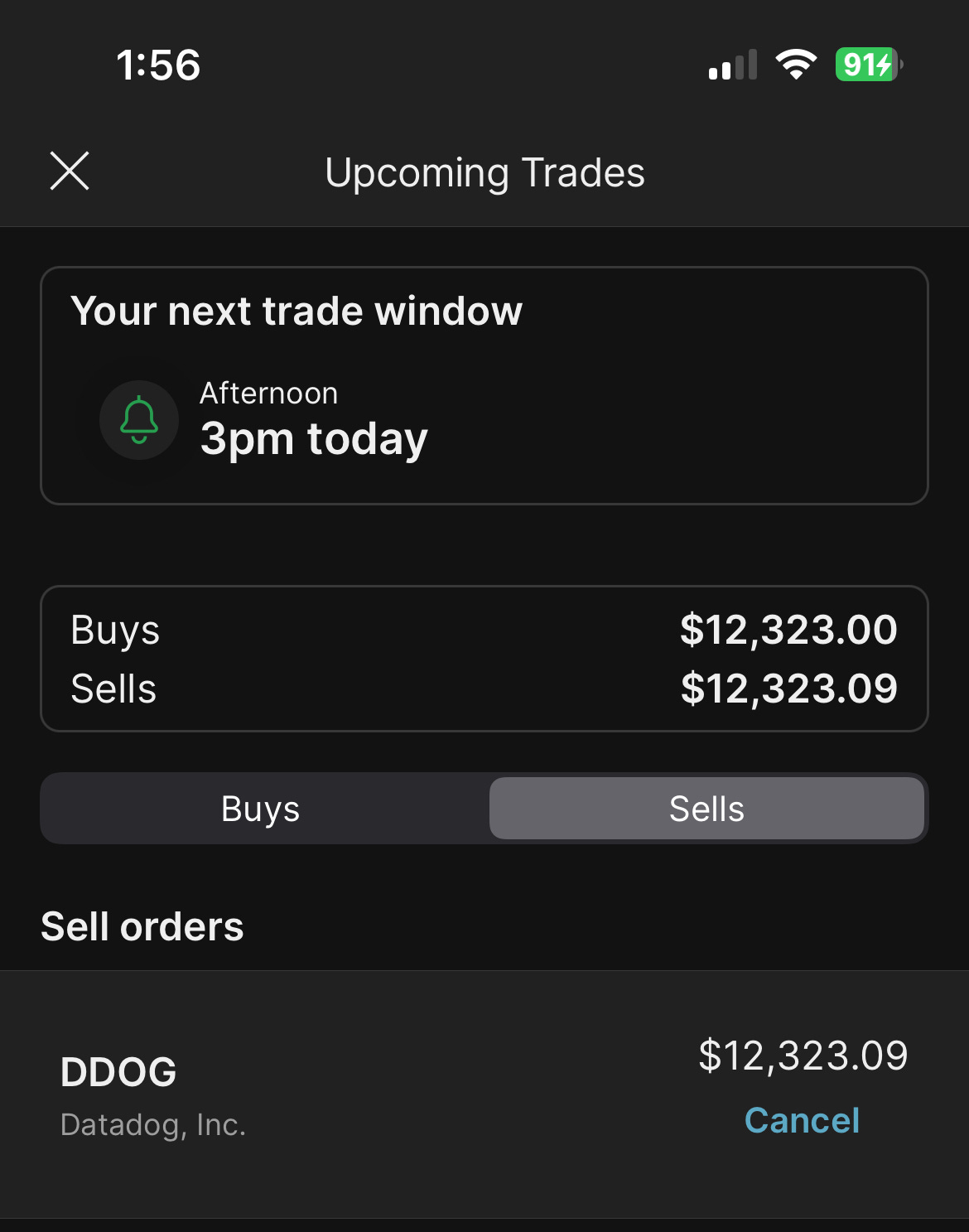

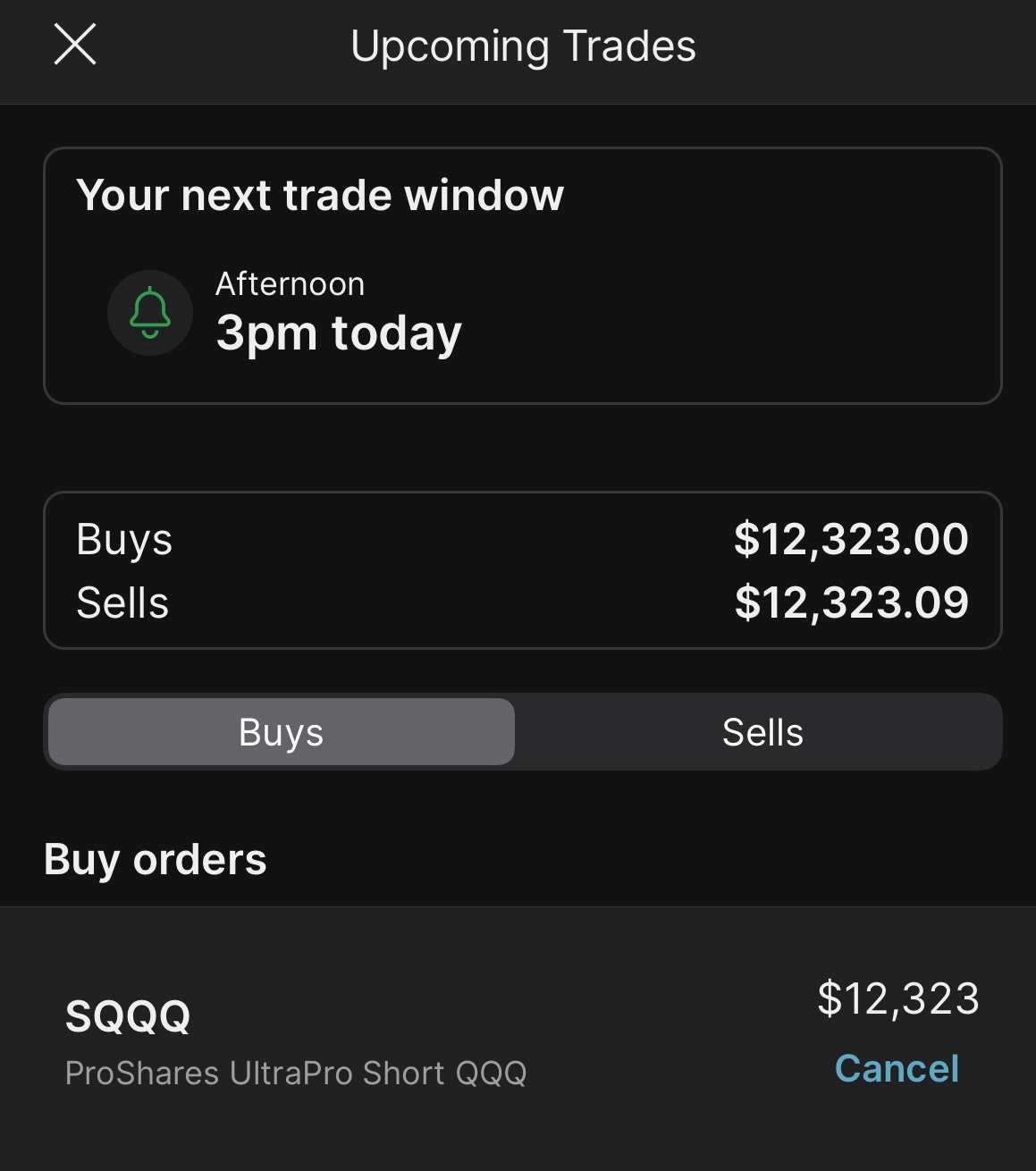

This sale will take place around 3pm EST today so you’re getting this before I make the sale. I’ll be putting the proceeds directly into my short-term SQQQ hedge.

Here’s why.

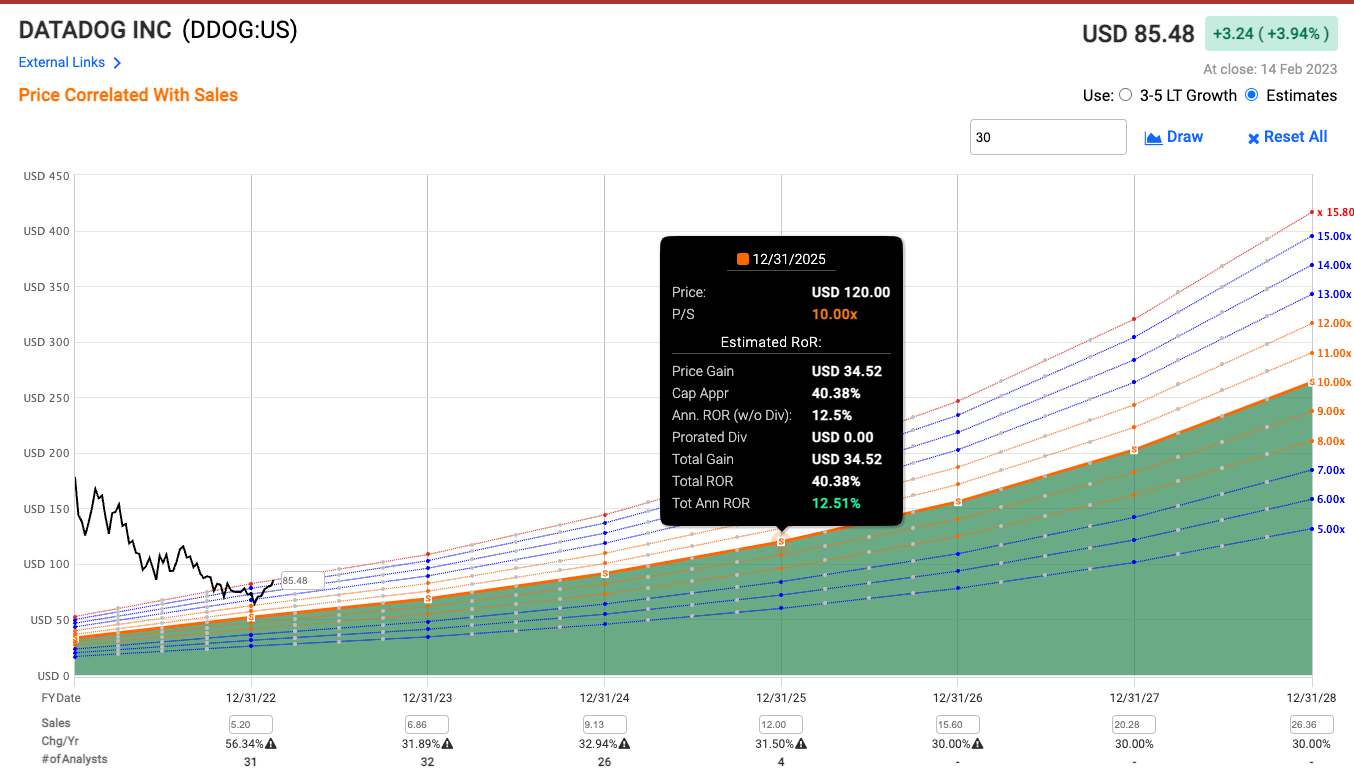

The stock is too expensive, and execution has to be perfect to make significant returns from the current price of $88/share.

What do I mean?

Datadog currently trades at a blended P/S ratio of 15.8 with roughly 30% revenue per share growth expected from now until 2025.

I think a P/S of 8-10 is more realistic given the higher-interest rate environment we’re entering.

If they hit these growth estimates and trade at a P/S of 10 in 2025, investors get a 12.5% annual return from now until then.

That’s better than the long-term market average of 10%, but I’m convinced there’s a higher probability of a miss to the downside than upside over the next couple of years so I think we will get a better entry point.

What am I basing this on?

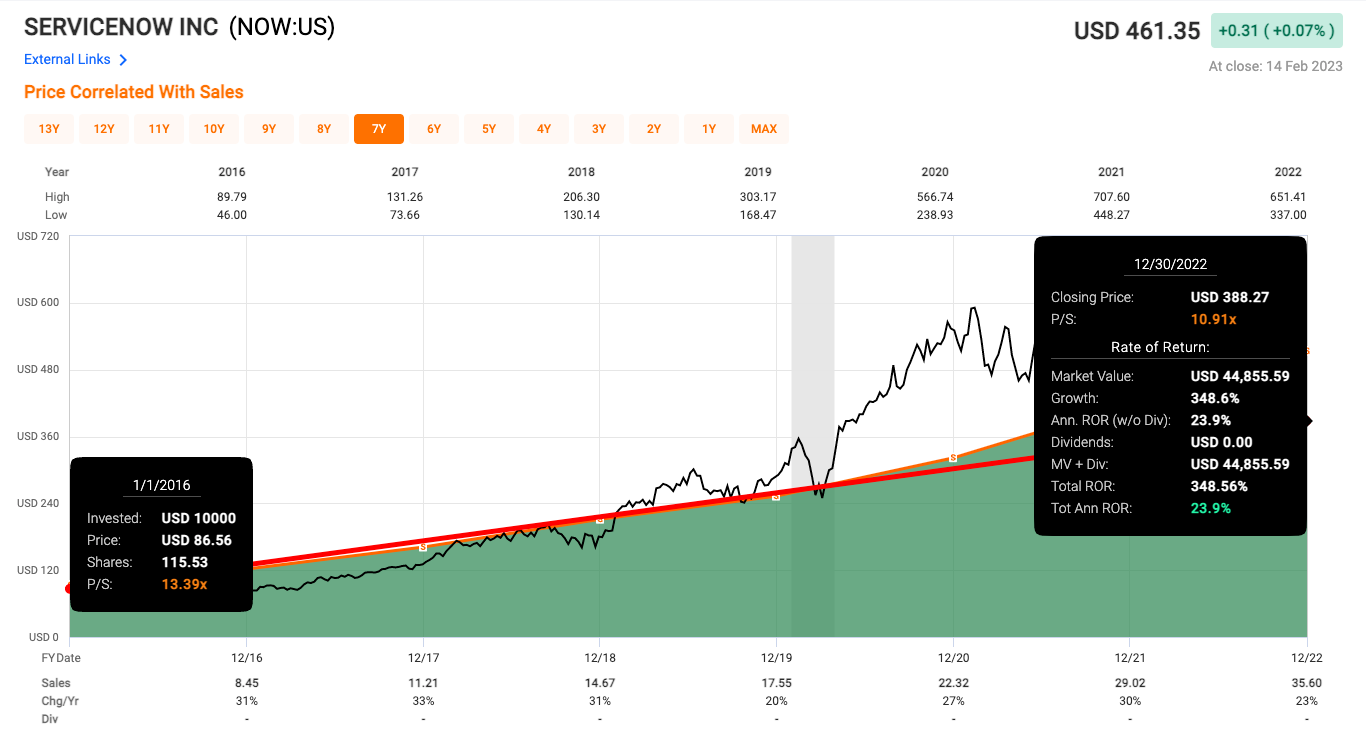

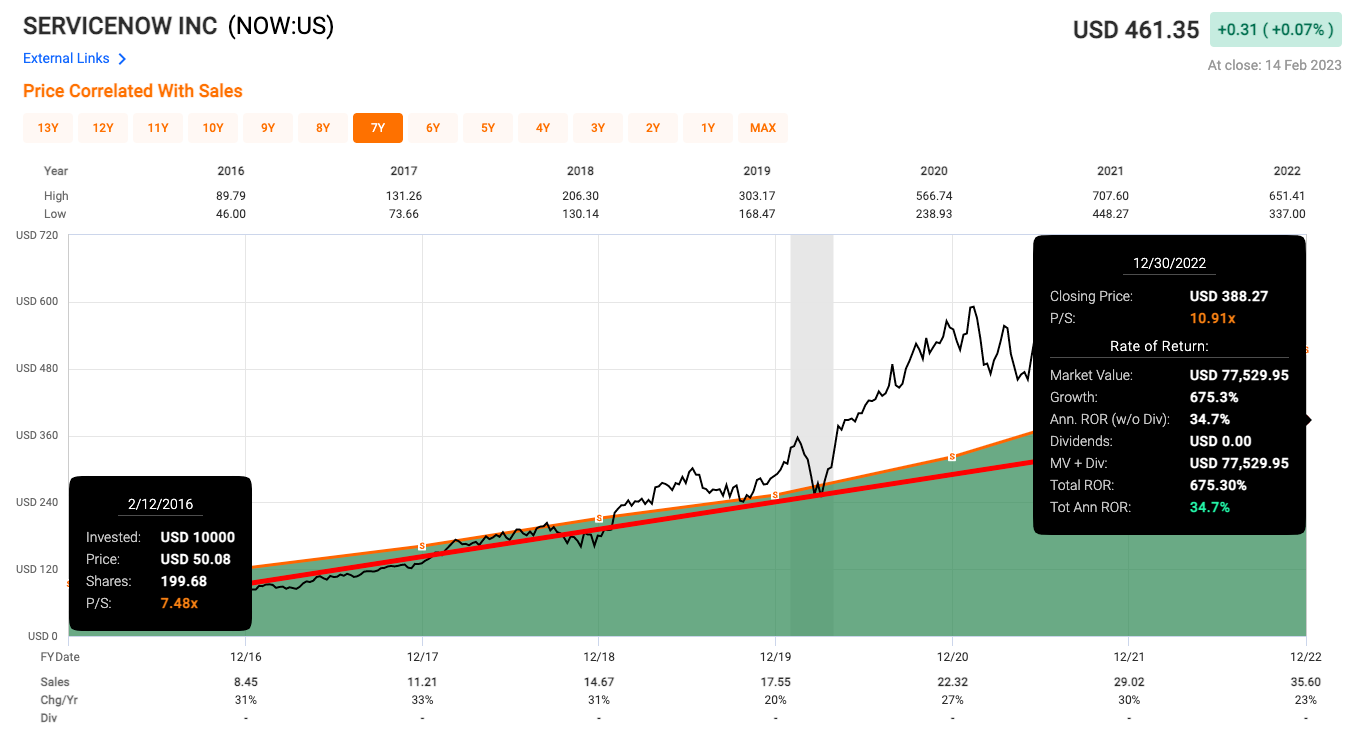

Take a look at ServiceNow NOW 0.00%↑ since 2013.

The company has grown sales per share at 27% per year annually and the stock is up 1,200% over the last 10 years.

So I’m crazy to sell DDOG just because I think it’s expensive right?

Well, I don’t think so. Service Now started at a P/S of 8.8 which is roughly 50% lower than Datadog’s multiple today.

In 2015, things were going really well for NOW shareholders and the P/S multiple jumped all the way up to 14.22.

Over the next few months, the P/S contracted to 7.48 and shares fell 44%

If you would have owned NOW 0.00%↑ from when it had a P/S of 13 in 2016 until the end of 2022 you would have earned a total return of 348%... roughly 4.5x your initial investment.

If you waited and bought when NOW 0.00%↑ was at a more reasonable 7.5x P/S and held until the end of 2022, you would have earned a total return of 675% or almost 8x your initial investment.

We’re now in a higher interest rate environment after a pretty great bull run. I believe there is more probability things get re-rated lower than keep going higher.

I could be wrong and most of the time people are better off just staying invested for the long-term.

This isn’t advice and be sure to make your own decisions. I’m simply sharing what I’m doing with my own portfolio as I try to build wealth.

I’ll

Hi Austin,

I just joined today - where can i see ur portfolio ?