Welcome to Growth Curve. My last deep dive was “CNX Resources: The Most Aggressive Buyback Plan I Have Ever Seen”. My next deep dive will be on Perimeter Solutions (PRM), a $1B company that provides fire safety equipment and oil additives. Here is a link to the Growth Curve portfolio.

I’m proud to announce that I have officially partnered with Stock Unlock. I use their platform to track financials, analyst expectations, and creat DCF’s on my companies. I also LOVE their portfolio tracking tool. Use my referral link to get a 30-day free trial (no credit card required)

Paid subscribers can see my full portfolio, receive all my transaction alerts and research reports by email, and can comment directly on every post. Subscribe below so you never miss an update.

Hey everyone,

I hope you had a productive week and can take the weekend to slow down, spend time with loved ones, or grind and get some extra work in. Whatever works for you at this stage in your life.

This is the first of what will be our weekly Saturday updates. I hope the weekend gives you time to digest it.

I’m also doing something that’s kind of weird for investment newsletters. Each weekend I’ll share a picture that’s relevant to my life. It’ll be an opportunity for me to share a bit more about myself and my journey and reflect on lessons learned that have made me a better person, leader, and investor.

I’d love for you to share your feedback or what you’re reflecting on this week. Or answer this week’s question:

What is the hardest decision you’ve made in recent memory? Mine was leaving the Active Duty Air Force in 2018. I shared the story below.

The picture above is of my family leaving Lacey, Washington in 2018. We were stationed at Joint Base Lewis McChord and that assignment is where I changed my mind on making a career out of the Active Duty Air Force. When I joined, I intended to serve for 20+ years on Active Duty. I loved my job, was proud of serving, enjoyed the reliable income, and the medical + retirement benefits after 20 years were incredible.

But after we had our son in Georgia, we had a miscarriage shortly after arriving in Washington. It was devastating. I can’t put into words how helpless, angry, and just downright sad we felt the day we found out our baby had no heartbeat. But, we were also grateful to have had our beautiful, healthy son….and the loss brought my wife and me closer together. During my 7 years of active duty service, I was away from home nearly 60% of the time and we moved 3 times. As much as I loved serving on active duty, I wanted to prioritize time with family and prioritize my wife’s career. It was tough for her to progress since she was constantly changing jobs.

Fortunately, we started saving and investing in 2012, which put us in a position financially to make that decision and prioritize ourselves over the safety of a reliable income. I’m still in the Air National Guard part-time which has been great because it allows me to be home more, we don’t have to move every 2 - 3 years, and I still get to serve but I’m happy we made that decision in 2018.

This is why I’m so passionate about investing and why I started this newsletter. I want to inspire others to invest.

If anyone reading this is considering serving in the military on active duty or in the guard/reserve, I highly recommend it. Yes, it is hard, but I am forever grateful for my time serving.

Portfolio Company Updates

Here is a link to the Growth Curve portfolio.

Harrow Health (HROW) Falls 23% after reporting Q1 2023 Earnings

Harrow reported revenue of $26.1M for the quarter, up 18% YoY, and beat analyst expectations by $1.1M. The company reaffirmed their 2023 guidance of $135M to $143M in revenue. The stock was up roughly 80% YTD heading into earnings so my best guess is that investors were expecting a beat + raise and the stock got punished for not raising guidance.

Here’s how CEO Mark Baum summarized the quarter:

2023 has started out strong and we intend to continue to dig deeper and capitalize on the momentum that we have created. While there are absolutely no guarantees and a considerable amount of work lies ahead, we truly believe that Harrow is well positioned to meet our 5-year strategic plan objectives, to be 1 of the largest, if not the largest, pure-play ophthalmic pharmaceutical company in the United States, uniquely providing both branded pharmaceutical products and compounded pharmaceutical products that meet the needs of our growing customer base and, of course, millions and millions of their patients.

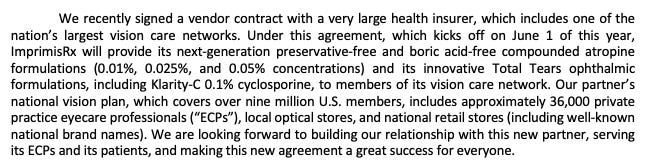

Harrow also landed a contract with a very large health insurer which should provide significant growth in the years ahead.

After the 20%+ drop, Harrow is at the top of my list to buy more with future contributions.

Brookfield Corporation (BN) reported Q1 earnings, beating revenue and EPS estimates.

Brookfield’s Non GAAP EPS was $0.72, beating estimates by $0.05 and revenue was $23.29B, beating estimates by $1.38B. Distributable earnings before realizations were up 24% to $4.3B over the last twelve months.

Financial results in the first quarter were strong, supported by the growth and resilience of our businesses. The scale and quality of our franchise and our access to large and flexible capital allow us to thrive in periods of market volatility, and we expect to continue delivering on our broad growth initiatives in these markets. Above all, we remain focused on executing our plan to create long-term wealth for all of our stakeholders.

CEO Bruce Flatt had this to say about the current state of market’s an Brookfield’s opportunity to emerge stronger

While the immediate actions taken by governments and central banks appear to have isolated these issues and prevented a broader crisis of confidence. Recent events have led to a further tightening of financial conditions, making capital scarcer and more expensive for many. The strength of our franchise is and always will be underpinned by a significant capital base that is conservatively capitalized with high levels of liquidity, and access to many different sources of capital. That has always been the great differentiator of our business, and in the current market, this advantage is even more pronounced.

We have the scale and flexibility to navigate our existing portfolio through tougher, tighter credit conditions and liquidity and access to capital to focus on growth, when many others cannot. Bottom line, this will allow us to emerge from all of this once again much stronger.

As we look ahead, we see a number of opportunities to put our vast resources to work. On our call yesterday for Brookfield Asset Management, we talked about the opportunities to accelerate growth for our asset management franchise. Highlighting the great opportunities we see in distressed debt, private credit more broadly, and an opportunity to acquire great businesses at fair prices in the public markets today. While those opportunities help our manager to accelerate its growth and we at Brookfield Corporation have committed large sums of our balance sheet capital to each. I'll focus my remarks today, on a couple of opportunities we are seeing in the rest of our business.

Brookfield is now trading at a FWD P/E of under 10 which presents what I believe to be a fantastic buying opportunity. BN is also at the top of my buy list.

Perimeter Solutions reported Q1 2023 earnings, beating revenue and EPS estimates.

Perimeter Solution’s (PRM) posted GAAP EPs of $0.06, beating estimates by $0.34 and revenue of $43.86M, beating by $2.79M. Perimeter continues to execute and I’m excited about owning shares of this business.

Here are some slides from the Q1 presentation that show why I’m optimistic as a shareholder:

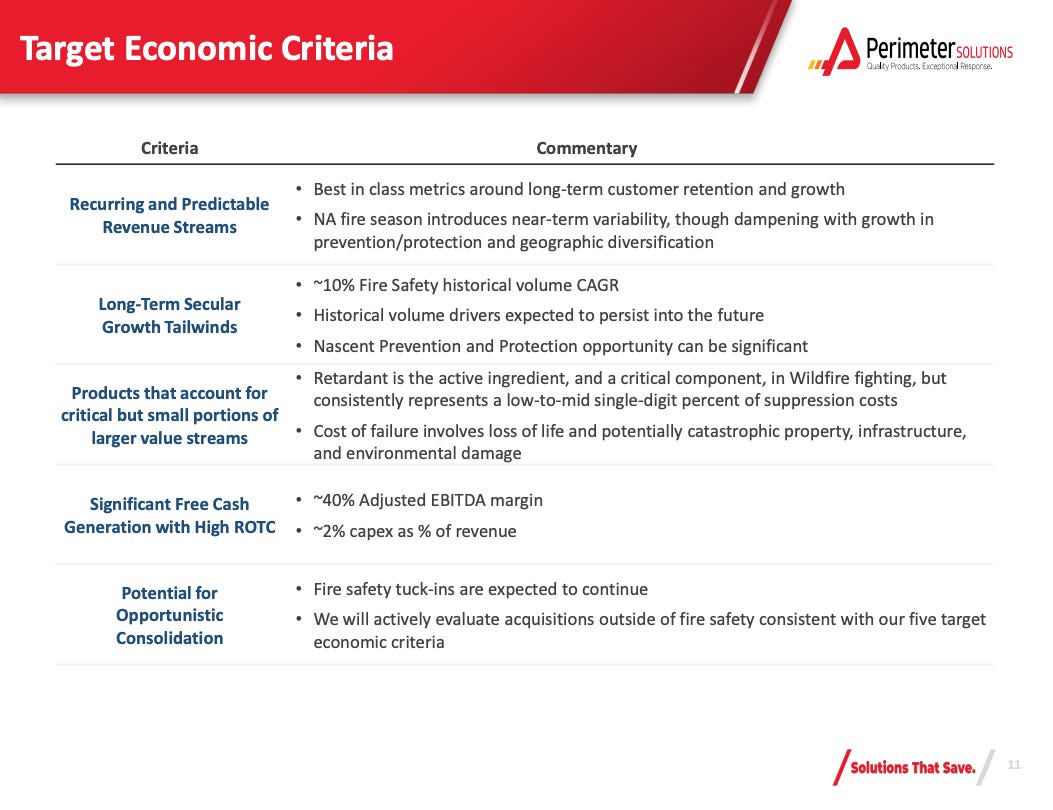

#1 Management is focused on growing high-quality businesses, recurring revenue, and significant free cash flow generation.

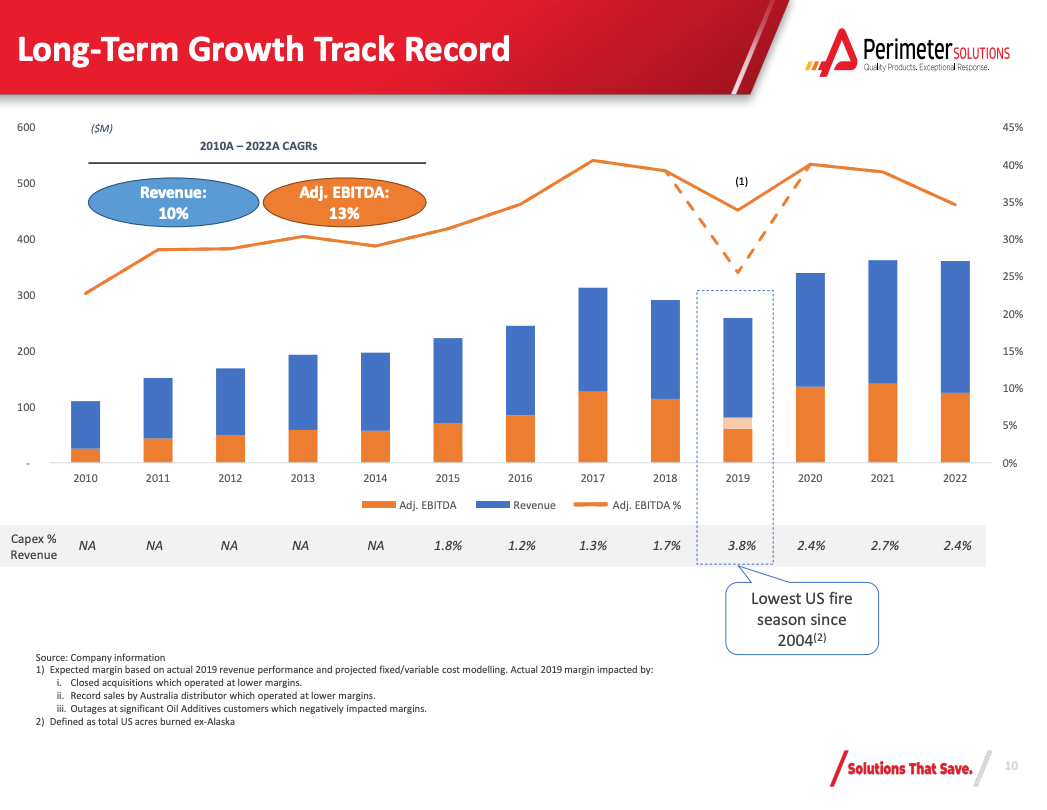

#2 The company has a 12+ year track record of double-digit revenue and adjusted EBITDA growth with a lot of room for future growth.

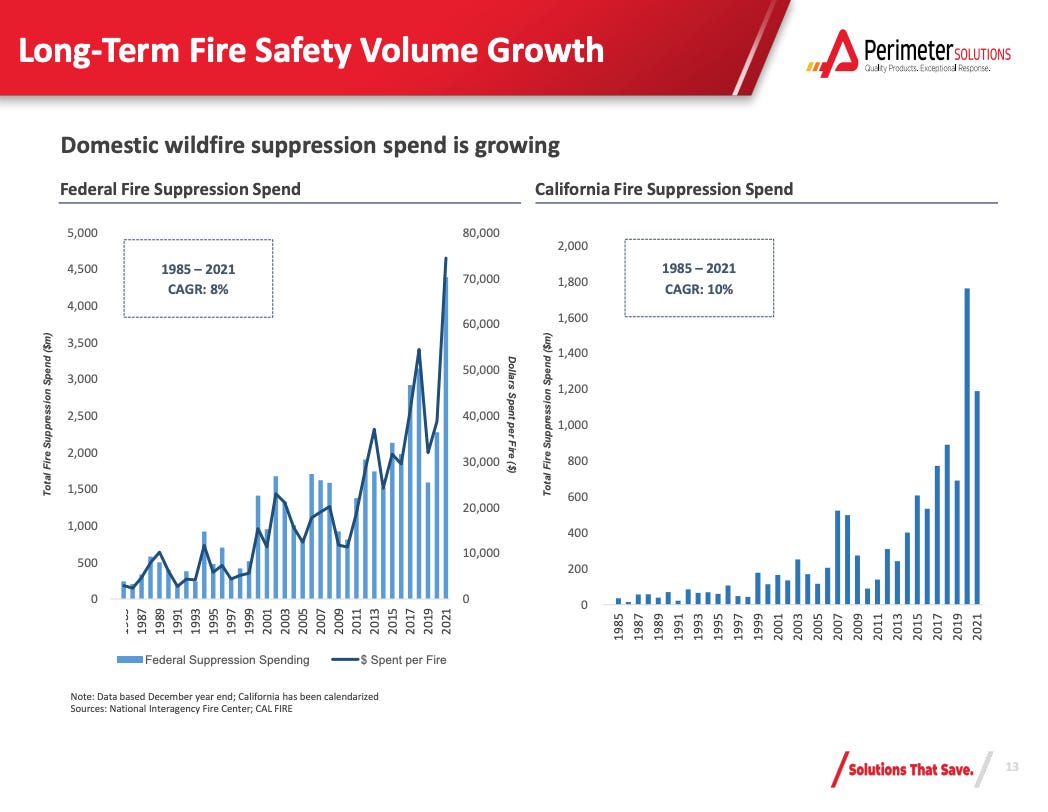

#3 The need for fire protection is not going away and Perimeter is a clear leader in the industry.

#4 Fire suppression spend continues to grow.

Conclusion

Earnings season is a busy time for investors. But in all reality no single quarter should make us jump to making major changes in our portfolio (unless things are way out of whack). It’s tempting to thrash around and make changes (as I have displayed myself) but most of the time, it’s best to understand our businesses and sit on our hands to give great management teams time to execute and grow their businesses.

It’s really hard to do at times, especially when the market feels crazy which it certainly does right now.

With that being said, I highly encourage investors to set themselves up to be able to stay invested and keep investing during a potential down turn. Any money that anyone might need over the next 5 years should NOT be invested in the stock market. Especially with some of the crazy interest rates we’re seeing on high-yield savings accounts.

I just opened a HYSA with M1 finance that yields 5% and has FDIC insurance for up to $5 million. Here’s my referral code if you’d like to check out their HYSA. I think we both get $100 if you sign up.

We are likely in for some pretty rocky times for the stock market and the economy. I won’t be moving my investment account into cash because I view my investment accounts as money to invest for 5+ years and we deliberately keep our cost of living low and have a fully funded emergency fund. This isn’t investment advice, but I recommend friends and family do the same.

If you enjoyed this and learned something, let me know in the comments. What do you want to learn more of?

Paid subscribers can see my full portfolio, receive all my transaction alerts and research reports by email, and can comment directly on every post. Subscribe below so you never miss an update.

Have a great weekend. See you next week.

Would love to hear you answer this week’s question: What is the hardest decision you’ve made in recent memory?

Mine was leaving the Active Duty Air Force in 2018. I shared the story in today’s newsletter.