End of Week Portfolio Review

Hey everyone, hope you had a great week. After a good week last week, our portfolio was down 3.60% this week. It doesn’t really affect my investment decisions, but for what it’s worth it seems like this has become a pattern over the last month or so.

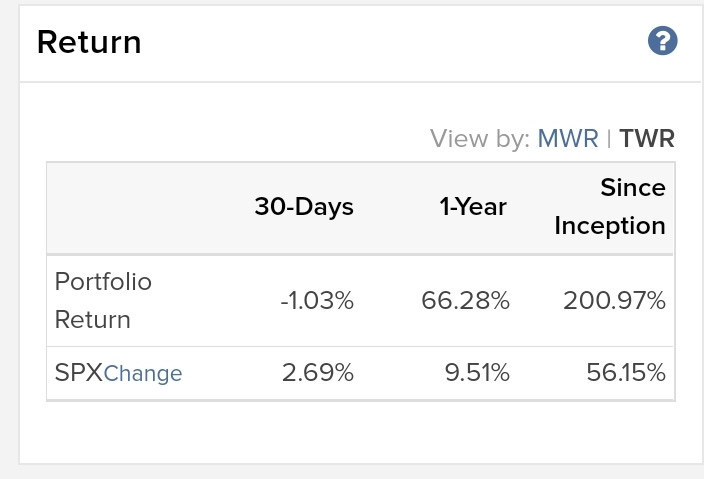

Here’s our 30-Day, 1-Year, and since inception (Nov 2014) results. I’ve thought about not including these each week because I want to focus on the long-term (the only way to be a successful investor in my opinion). But the truth is, I pay attention to these results (I actually check my portfolio daily) so I decided to include them. The bottom line is that it’s something investors have to deal with so at least by sharing, it gives me an opportunity to share and track how it may impact my decisions.

Do you think I should include them in the weekly reviews or just monthly? Reply to this email or comment and let me know!

Transactions

Wednesday April 17, 2019:

Sold all our shares of Smart Sheet (SMAR) at $39.73

Sold all our shares of Domo (DOMO) at $36.43

Sold all our shares of Guardent Health (GH) at $69.80

Sold all our shares of Abiomed (ABMD) at $260.66

Details of why we sold here

Thursday April 18, 2019

Bought 26 more shares of Elastic Search (ESTC) at $82.32

Bought 81 more shares of Atlassian (TEAM) at $100.65 - I know I said I planned to wait, but I love this business and it was down 10% after a strong earnings report.

Bought 78 more shares of Mongo Database (MDB) at $127.15

Bought 160 shares of Zoom Video Technologies (ZM) at $62.30

Notes:

With the exception of ZM, all of these were already positions in the portfolio. I added ZM despite it’s incredible 70%+ rise and its extremely high price to sales ratio that apparently even CEO Eric Yuan thinks is a bit excessive (NY Times article). He and many who are saying the company is overvalued right now are probably correct. I’m a big fan of this company and I plan to be an investor long term. I started a 2.5% position in the company so it is relatively small. I invested because I think this company will be much larger in 5-10 years than it is now and I wanted to have at least a small position.

Do not jump into this or any stock just because I or someone else owns it. Please do your own research and make your own decisions. I might decide to sell this or any other stock next week. You have to have your own reasons for investing.

The Best of What I read & listened to this week

Articles:

This is one of the most important and terrifying things I’ve read in a very long time. It’s a story of a father building a video game to document his family’s experience battling cancer with their 1-year old son. Absolutely terrifying

Enter the booth. There are two monitors on a table. Players sit before them, silently steering through the latest demo. Here is what they see: a young boy, his facial features obscured, feeding bread crumbs to a duck, while his parents explain to his brothers why his treatment has left him unable to speak at age 2; a man sitting at a picnic table, ruminating on what his son must be experiencing without the words to express it; a playground, where the boy rocks on a toy horse, swings, giggles, spins on a carousel, then disappears; a path to a beach, where the boy is now strapped to a gurney, his tiny body hooked up to machines, the water filled with bobbing, gnarled tumors; the shadow of a dragon against the sea; a flight through the window of a hospital; a doctor telling the family that a recent MRI shows the boy’s tumors have returned; a nurse assuring them that the staff is very good at end-of-life care; the boy’s parents sitting still and silent while the room fills with water; the boy, now sitting in a rowboat, wearing a tiny life jacket that doesn’t look sufficient to protect him.

You know you will have to play this game at some point. You will have to confront all of these moments, and many more.

How irrational the market and people can be: This is an article about the stock of Zoom Technologies (ZOOM) not Zoom Video Communications (ZM) increasing 54,000% since March 2019 when Zoom Video Communications announced its plans to IPO. There are a lot of things wrong with what happened and in my opinion, a lot of people to blame. Probably some people intentionally scamming others, definitely people making uninformed investments, and I believe the financial entertainment networks (CNBC, Bloomberg, etc) also played a role because they hyped Zoom Video Communications over the last month and very rarely made the extra effort to clarify things like ticker symbols or that there was another ticket ZOOM that was not related at all.

The point is there’s a lot of ways for you to get hurt in this world which is why we need to take ownership of these aspects of our lives. In this case it’s investing and money, but it applies widely.

I did a Tweet storm about this. If you want to see my hissy fit click here (and follow @austinlieb on Twitter while you’re at it).

Book:

Atomic Habits by James Clear: I really don’t like “self-help” or “life-hack” style books and that’s what I thought this book was going to be. I’m still early in the book, but so far I like it. James’ personal story of how he overcame some injuries younger in life and how he authentically grew his brand are worth the price of the book alone.

We all have a brand so these lessons are applicable to everyone.

Note: that is an affiliate link so it won’t cost you any more and the author still gets the same amount, but if you purchase the book, I’ll get a very small commission.

Podcast:

Acquired Podcast Ep 47: The Atlassian IPO. This episode is from 2017, but I really enjoy the Acquired crew’s style. I’m fascinated by their deep dives into these companies because there are so many things required under the surface to build these amazing companies. I’d like to eventually get the Founder Stock Investing podcast up to that kind of quality.

Anyways, this podcast made me even more of a fan of Atlassian (notice I increased my position this week) because of their culture and how their product simply works and doesn’t require a lot of sales and marketing spend. It was also cloud native and Atlassian busted into an industry that had a lot of huge players which people said they couldn’t build a moat. They’ve shown this model can work if your product is good enough.

This leads into my feelings about Zoom (ZM). I know the stock is outrageously overpriced. But I think they’re going to follow a similar path as Atlassian did. Sure there will be ups and downs in the stock price, but I believe this is one of the best companies we have seen come public in a very long time. So I wanted to own a piece.

One final note on Zoom. I might sell the shares I bought sometime soon. I don’t normally pay attention to whether a stock is overvalued and I believe being seen as overvalued by the public can actually be a sign of a great company. However, ZM might be too far to that extreme for me to be comfortable.

Only time will tell. I’ll update you all if I decide to sell my shares.

Hate to bother you with this, but if you enjoy these emails, please hit like, comment, and share with your friends. It sounds silly, but by liking these emails it actually makes it easier for others to discover it because of the way Substack does newsletter rankings.

Thanks so much for reading. Have a wonderful weekend.

Best,

Austin.