Absolutely nothing with my core positions. If The Trade Desk wasn’t my largest position and at almost 19% of my portfolio I would look to add more. Doesn’t make sense to drop after Friday’s announcement from Amazon.

This article from Barrons appears to be at least part of what spooked investors today. It makes a couple decent points. Valuations are “high” for some companies and there are certainly companies with very high valuations that don’t deserve them. But we’re not invested in every company and my goal is to only be invested in the best of the best. But it is an important reminder. Big pull-backs happen. That’s why I don’t invest any money we may need in the next 3-5 years. I can withstand a big pull-back.

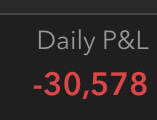

For perspective. Here are my longer-term results which include today’s sell-off.

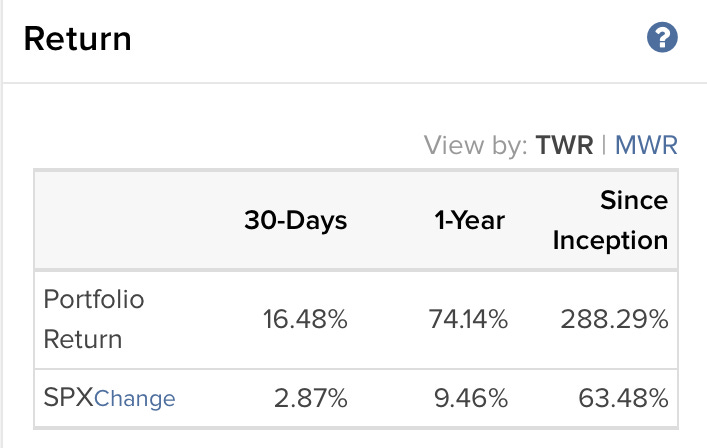

This week..

I’ve shared some short term options plays around earnings over the last couple weeks and I’m continuing those with roughly 5% of the portfolio. The rest is staying invested for the long term.

Here is what we have for companies reporting earnings after the market closes today.

Beyond Meat (BYND): I opened a $212.5 straddle (bought a put and a call) for $39. That’s little high but I could see this one plummeting if people realize these numbers aren’t sustainable. It could also jump because people are insane.

Need it < $173.5 or >$251.5

If I had to guess it plummets but no one on Earth or Mars knows.

*Beyond has already recovered back up to around $225 and my straddle is showing up 6% in less than an hour.. I may close it before earnings.

Appfolio (APPF). $105 strike and I paid a $10.50 premium. So I need it to be over $115.5 or under $94.5 to be profitable.

Is a strangle (bought put and a call at separate strike prices) on TREX . If it is between $65 and $75 I lose the entire premium (the risk of strangles). To be profitable I need it under $61.37 or over $78.63.

On Wednesday July 31st..

Two of our Top 4 long term positions, Alteryx and Twilio report earnings on so I’ll cover those this week.

On Thursday August 1st...

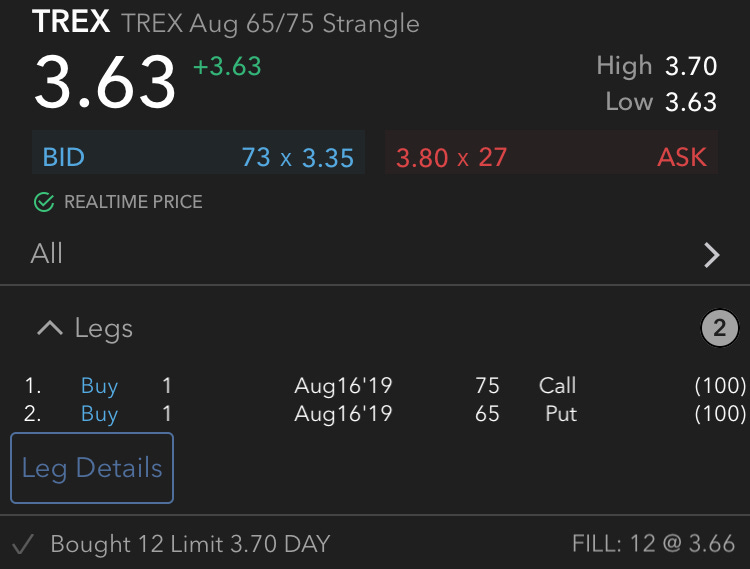

We have two additional straddles:

Shopify (SHOP). We have a $332.5 strike straddle and we paid a premium of $28.46. So we need it to be below $304.04 or above $360.96 to be profitable.

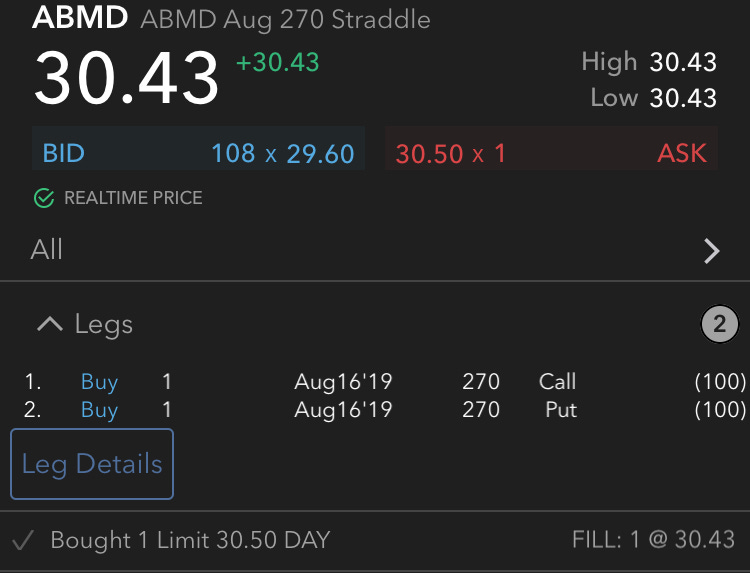

Abiomed (ABMD). We have a $270 Straddle that we paid $30.43 for so it needs to be below $239.57 or above $300.43

Finally, a quick thank you. I asked you all to help support the newsletter if you like it by hitting the heart at the top of your email (or the article page), by sharing with friends, and by starting a paid subscription for $5/mo or $50 a yr.

We now have over 600 total subscribers and 34 paid subscribers which brings in $1700 a year. So amazing that you all find this valuable enough subscribe to and/or pay. Thank you.

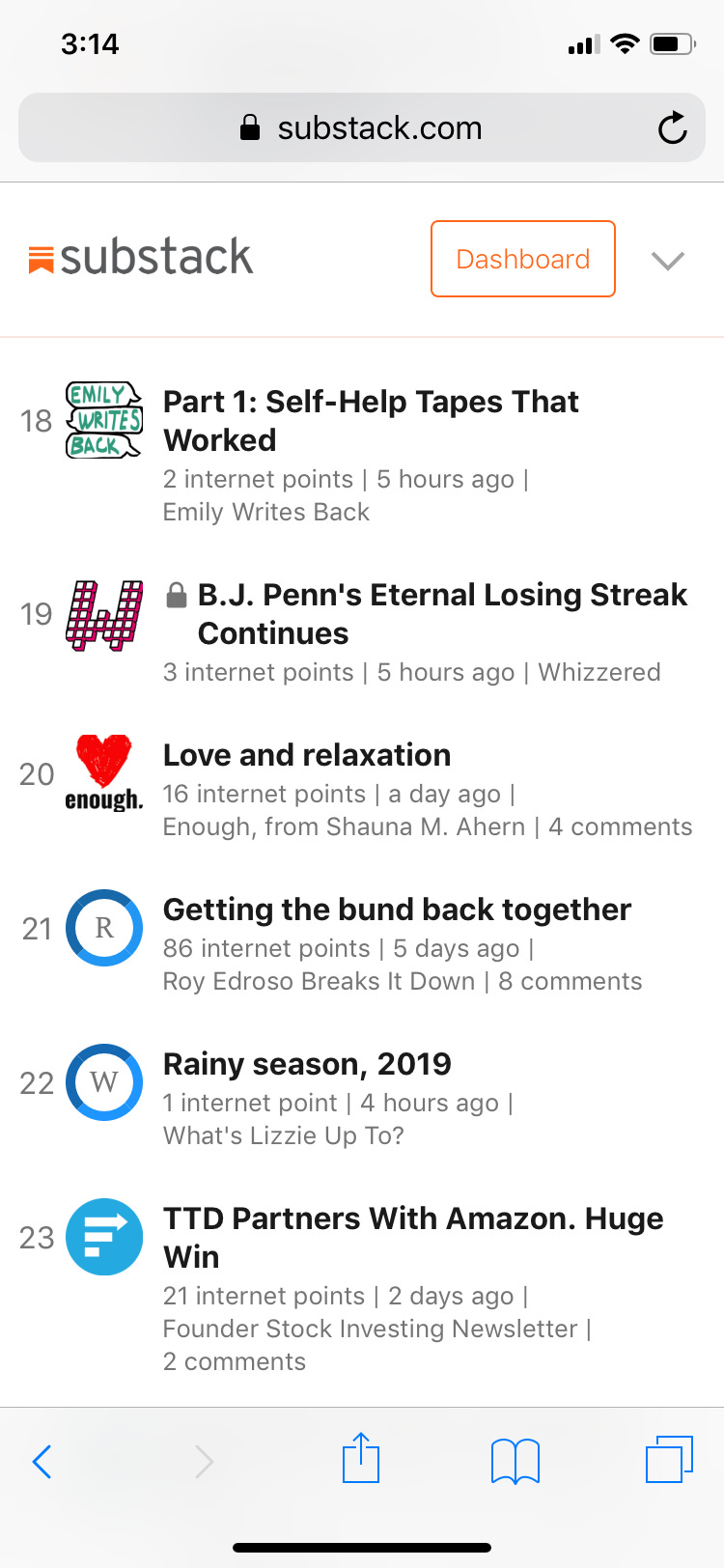

Also, you all helped this newsletter land in the top 3 articles on Substack on Friday afternoon and kept it in the top 25 over the weekend by hitting those hearts. That is SO AWESOME!

Alright thanks again and have a great week. I’ll send updates out as the week progresses!