Closed Options Gambles on TSLA, NOW, and ALGN for $7,785 Profit

Remember. These are risky and a bit advanced. I keep 95%+ of my portfolio invested long term.

Hey everyone,

Quick update on those short term earnings gambles.

I sold to close out my Puts on TSLA, NOW, and ALGN. Yesterday, I did pre-earnings Straddles on all three thinking they would move 5%+ one way or the other. Had no clue which way which is why straddles can be good.

Straddle = buying a put and call at the same strike price.

All July 26 expiration

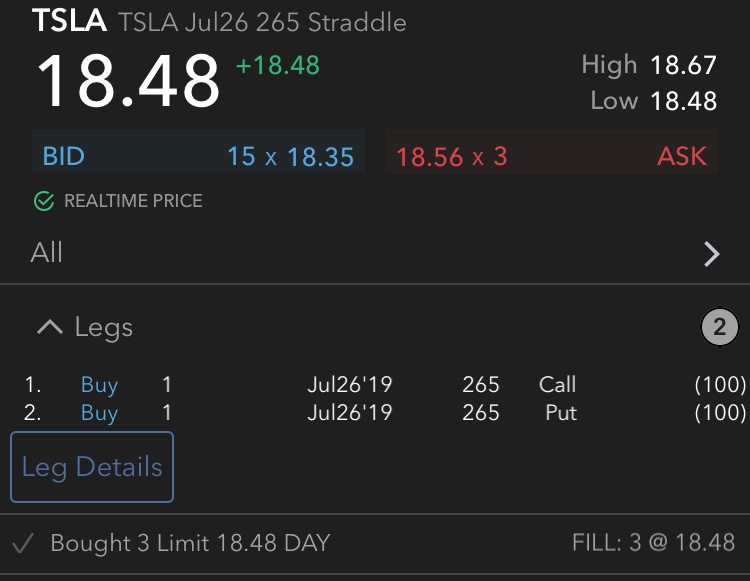

TSLA

Bought 3 x $265 strikes @ $18.48

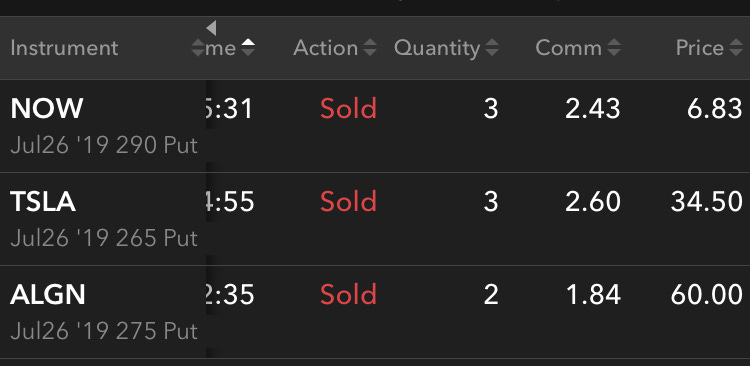

Sold @ $34.50

$34.50 - $18.48 = 16.02 x 3 = $48.06 x 100 = Profit of $4,806

ALGN Bought 2 x $275 strikes @ $27.90

Sold @ $60

$60 - $27.9 = $32.1 x 2 = $64.20 x 100 = Profit of $6,420

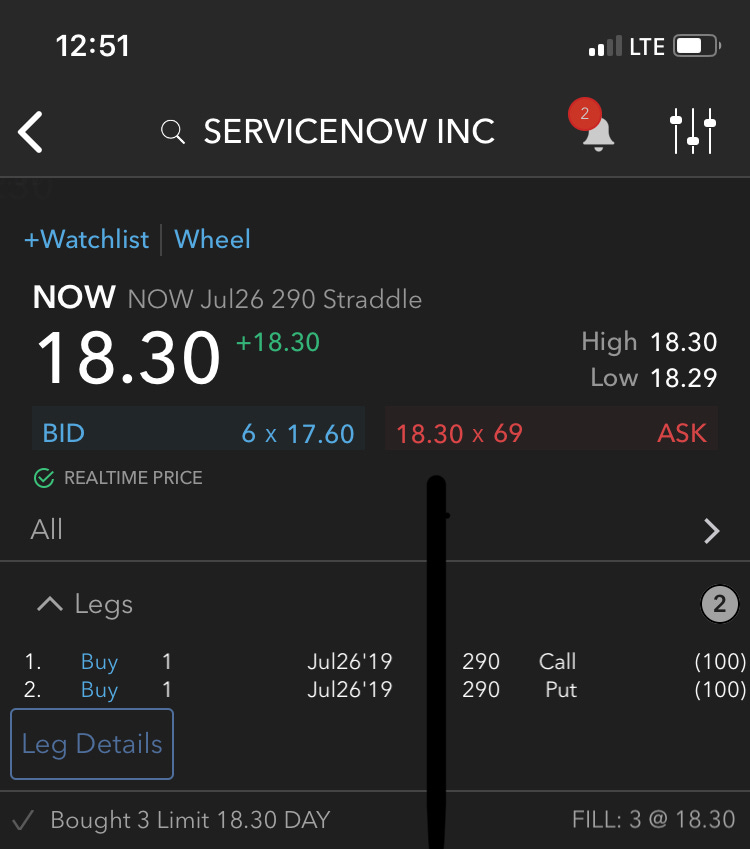

NOW Bought 3 x $290 strikes @ $18.30

Sold @ $6.83

$18.30 - $6.83 = loss of $11.47 per contract x 3 = $34.41 x 100 = Total Loss of $3,441

$4,806 + $6,420 - $3,441 = Combined Profit of $7,785

$7,785 (profit) /$16,614 (initial cost of all 3) = 47% gain

Remember

1. These are risky. I risked about 3% of my portfolio

2. This takes focus (lost time with family)

3. I keep 95% + of my port LTBH

4. Don’t feel like you’re missing out if you don’t do these options bets. They are certainly not required for building long-term wealth.

Here are the associated screenshots. Buys will be first, then one screenshot showing the sells.

Weekly portfolio review and reading list for the weekend will be out tomorrow. I’ll do my best to keep that short since I have spammed your inboxes so much this week (Sorry).