Welcome to Growth Curve. My last deep dive was “CNX Resources: The Most Aggressive Buyback Plan I Have Ever Seen” and my next deep dive will be on Perimeter Solutions (PRM), a $1B company that provides fire safety equipment and oil additives.

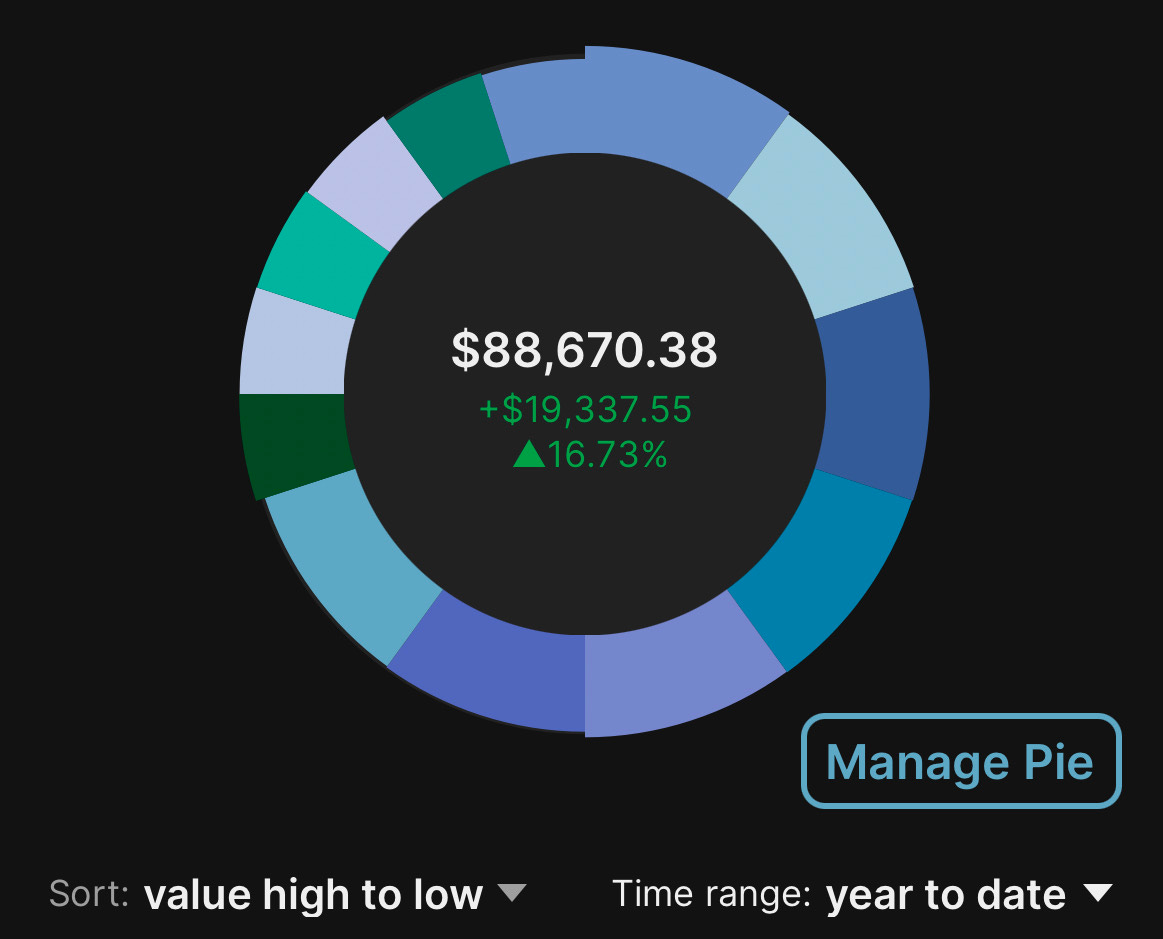

The Growth Curve Portfolio is currently up 16.73% YTD and down 6.9% since February 15, 2022. For comparison, the S&P 500 is up 7.3% YTD and down 6.4% since February 15, 2022.

My goal is to outperform over 5+ year periods but I share short-term performance for transparency.

Long-time readers will notice a major reduction in account size from $150k to $89k. I withdrew $60k from the portfolio to give myself runway since I announced I’m going full-time on the newsletter.

Today we cover:

Charles Schwab Update

Portfolio Position Update

Best reads/listens from the week

You’ll be outta here in 10 minutes to enjoy your weekend.

1. Charles Schwab Update On Banking Crisis

Update from Founder, Charles Schwab and CEO Walt Bettinger

They spent the beginning of the update discussing the historical rise in interest rates and shared how investors have reacted. Essentially, the firm has a long-history of supporting clients through economic cycles and Schwab appears to be doing just fine.

I found this bit to be very reassuring. The company received an influx of assets yet the stock price is down 35%+ since the banking crisis news…

So how has Schwab navigated during this period and how do we see the path forward?

Our business is extremely robust. This March alone, we saw a strong influx of core net new client assets of over $53 billion, the second highest March results in our history. The diversity of our business remains a strength. For example, our trading and wealth management businesses experienced a very strong first quarter.

Earlier this week, Charles Schwab earned the highest ranking in investor satisfaction among full-service wealth management firms in the J.D. Power 2023 U.S. Investor Satisfaction Study. Ironically, challenging market environments like this one allow us to shine for our clients, to make a difference in their financial lives and help deepen lifelong relationships. With 50 years of experience, we know that both our company and our clients come through times like these stronger on the other side.

Deposit flows at Schwab Bank have remained fairly consistent during this tumultuous period. In fact, adjusting for modestly increased cash movements during the week last month following national concerns about regional bank stability, the average daily outflows were below February.

The Fed’s actions to decrease the money supply and raise interest rates will naturally increase our cost of funding and consequently have some impact on earnings. But that higher cost of funding will begin to decrease, which combined with natural growth in our business and lower expenses, we will eventually begin to enjoy growth in earnings. While the first quarter was a challenging time, for sure, reflecting negative investor sentiment, ongoing interest rate hikes, and regional banking turmoil, Schwab’s client-centric growth model remains firmly intact and is performing well. The company continues to operate from a position of strength with strong current momentum. All of which leaves us extremely confident in our current progress and long-term future.

We would like to remind everyone that on April 17, at 9 am ET, we will have a soup-to-nuts review of our business and question-and-answer session as we do at every quarter end, and it is open to anyone to attend. We look forward to sharing more at that time about the robust strength of the business, our significant liquidity, conservative capital position and ongoing organic capital formation, the success to date of the integration of Ameritrade and the substantial cost savings coming from the conversion that will be roughly 90% complete this year, and of course, our continued progress on strategic initiatives that enhance Schwab’s growth.

My Take on Schwab heading into earnings:

Keep reading with a 7-day free trial

Subscribe to Growth Curve By Austin Lieberman to keep reading this post and get 7 days of free access to the full post archives.