Welcome to The Growth Curve. My last deep dive was “CNX Resources: The Most Aggressive Buyback Plan I Have Ever Seen”. My next deep dive will be on Perimeter Solutions (PRM), a $1B company that provides fire safety equipment and oil additives. Here is a link to the Growth Curve portfolio.

Paid subscribers can see my full portfolio, receive all my transaction alerts and research reports by email, and comment directly on every post. Subscribe below so you never miss an update.

I use Stock Unlock every day to track my portfolio and research investment opportunities. I love their portfolio tracker, side-by-side company comparisons, and discounted cash flow analysis tool. Give Stock Unlock a shot with a 30 day free trial (no credit card required) using my referral link.

Every two weeks, I’m adding $500 to the portfolio. On May 25th, I’ll use this week’s contributions to buy more ownership of Brookfield Corporation.

Brookfield Corporation Background

I view investing in Brookfield Corporation as an opportunity to benefit from the capital allocation skills of a very talented and proven executive team that has an exceptional track record of building business segments that prove to be cash flow monsters.

Here are a few slides from Brookfield’s 2022 Investor Day. The nearly three-hour presentation does a great job of laying out Brookfield’s history and management’s strategy for the future.

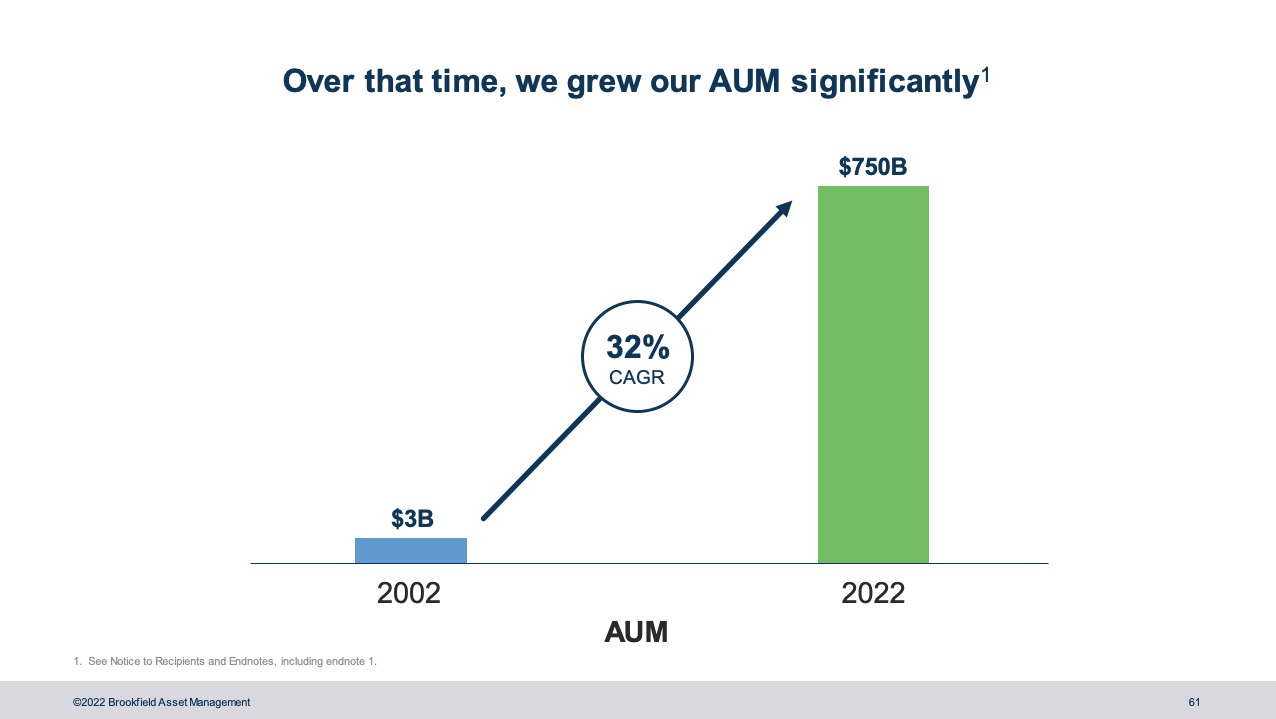

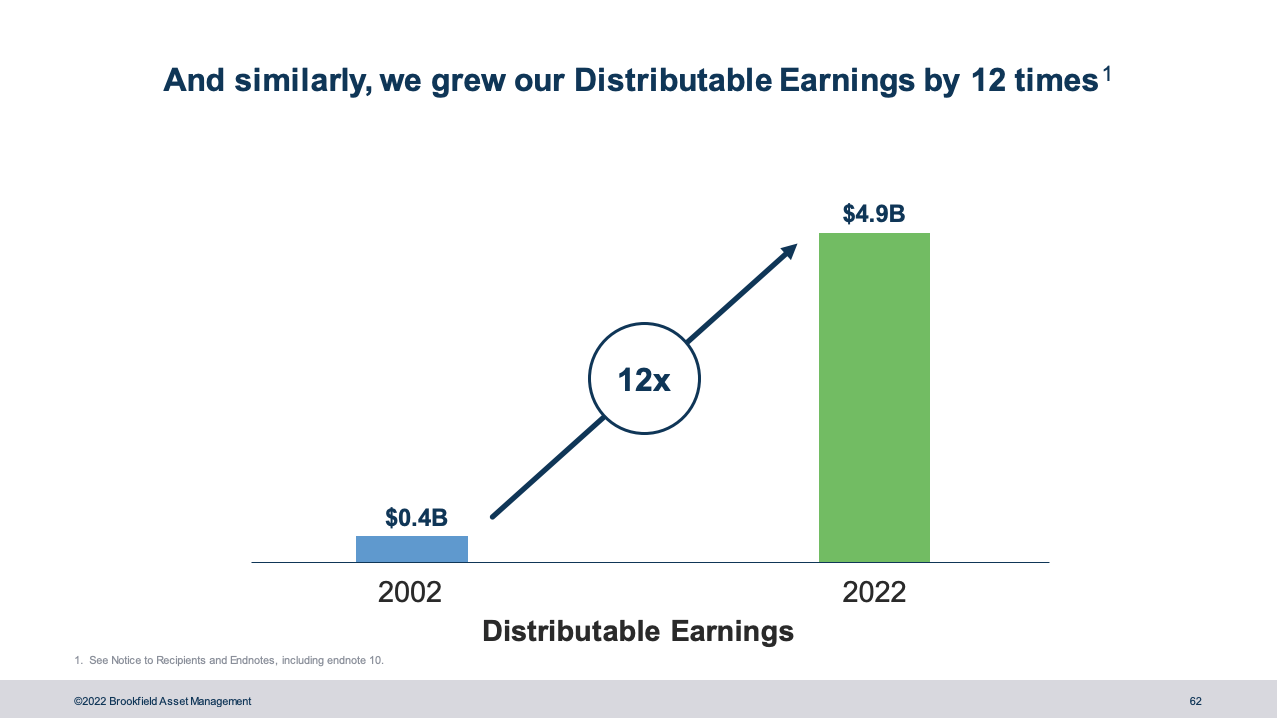

So, over the last 20 years, management set out with a goal of providing shareholders 15%+ annual returns. From 2002 to 2022 they grew AUM from $3B to $750B leading to distributable earnings (DE) growing from $0.4B to $4.9B which generated $30B of cash flow that they reinvested back into the business.

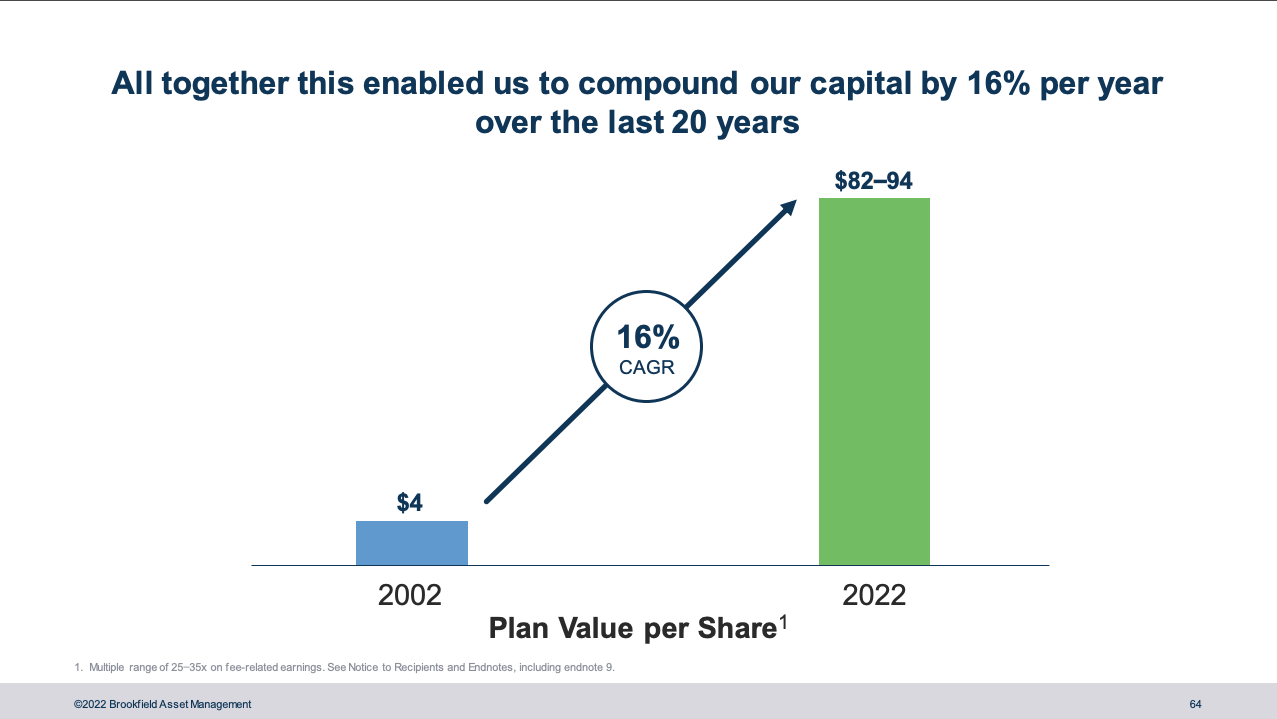

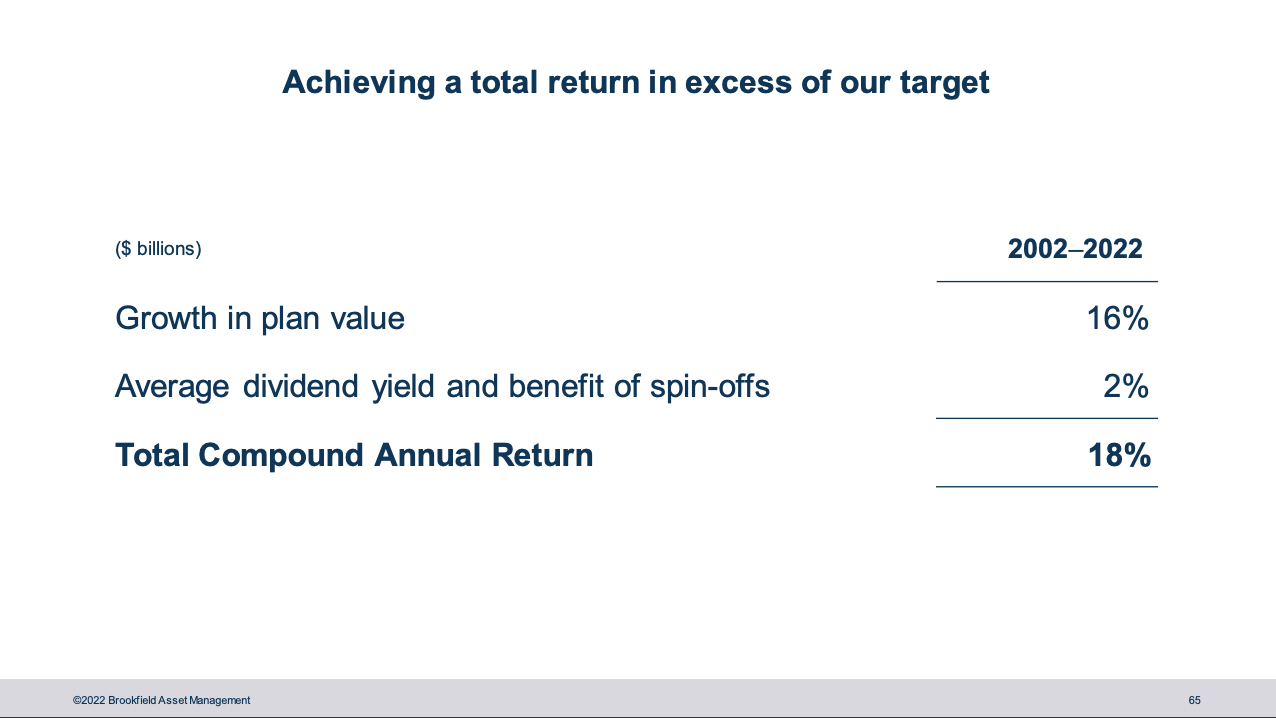

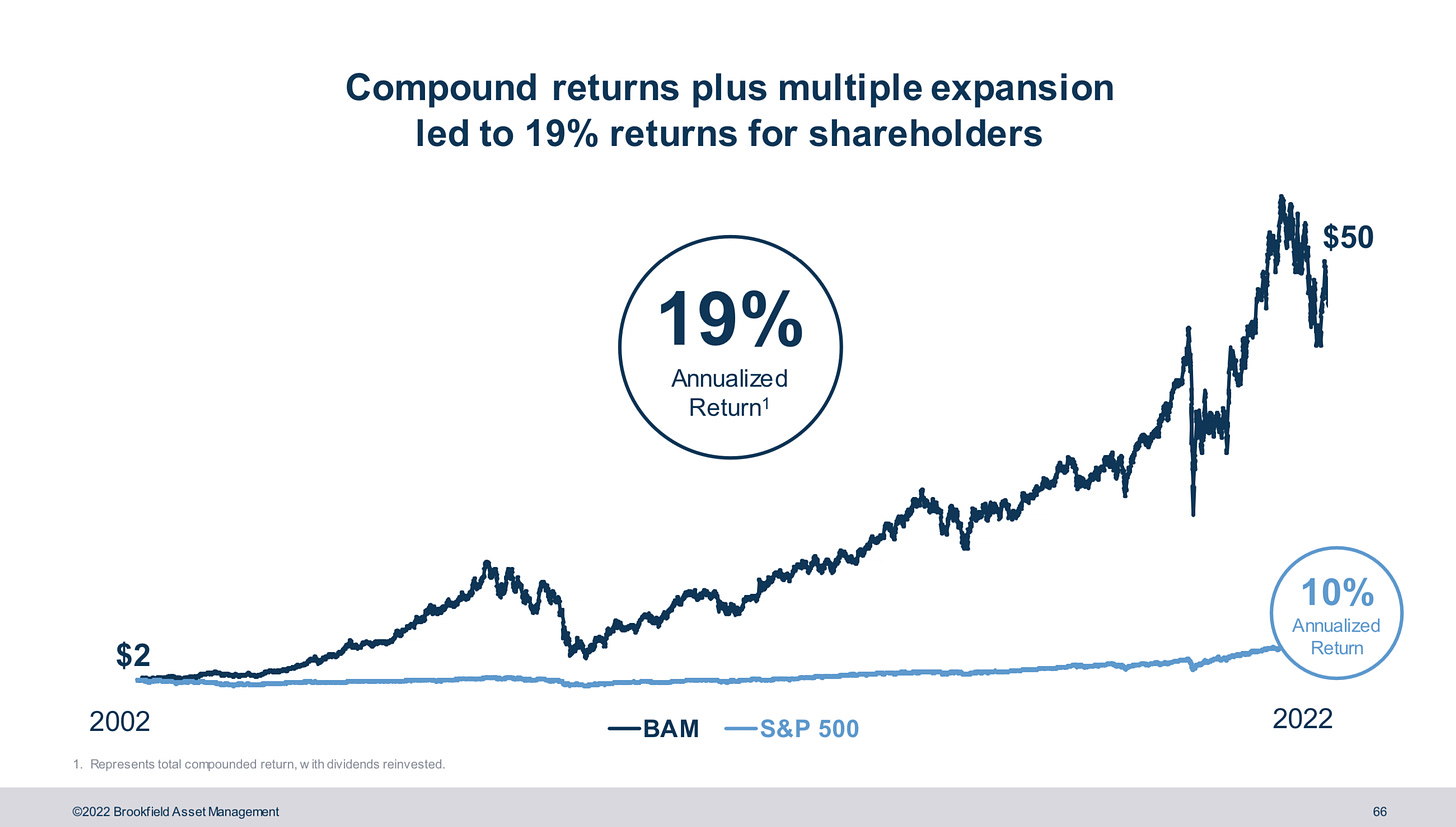

As you’ll see in the slides below, management compounded BN’s capital by 16% over the last 20 years, added an additional 2% in annual dividends for shareholders and benefitted from P/E multiple expansion which led to a 19% annualized return for shareholders.

This turned a $10,000 initial investment for a common shareholder into $250,000 if an investor held from 2002 - 2022 and reinvested dividends. Not bad.

This is an important time to say that past performance does not guarantee future success. But management has openly stated that their goal is to provide 15%+ returns for shareholders over the long-term (same goal as 20 years ago) and I believe they have the credibility to deliver on that.

Brookfield Corporation has three key areas of investment: Asset Management, Insurance Solutions, and Capital. I’m optimistic about the future of all three of them, but I think the market is currently discounting the value of BN because of fears around its $60B Capital segment, which includes $35B of real estate assets.

Keep reading with a 7-day free trial

Subscribe to Growth Curve By Austin Lieberman to keep reading this post and get 7 days of free access to the full post archives.