I think Amazon’s Q1 2023 results were strong. Advertising, retail, Prime, and AWS all turned in better-than-expected quarters and management is getting serious about cutting costs.

In a couple of years, I think Amazon will be a dominant player in advertising, Prime will continue to be a differentiator for their retail business, AWS will be a big beneficiary of more cloud compute demand from the growth of AI and whatever the next exciting tech thing is, and management will have trimmed a lot of the excess costs out of the business.

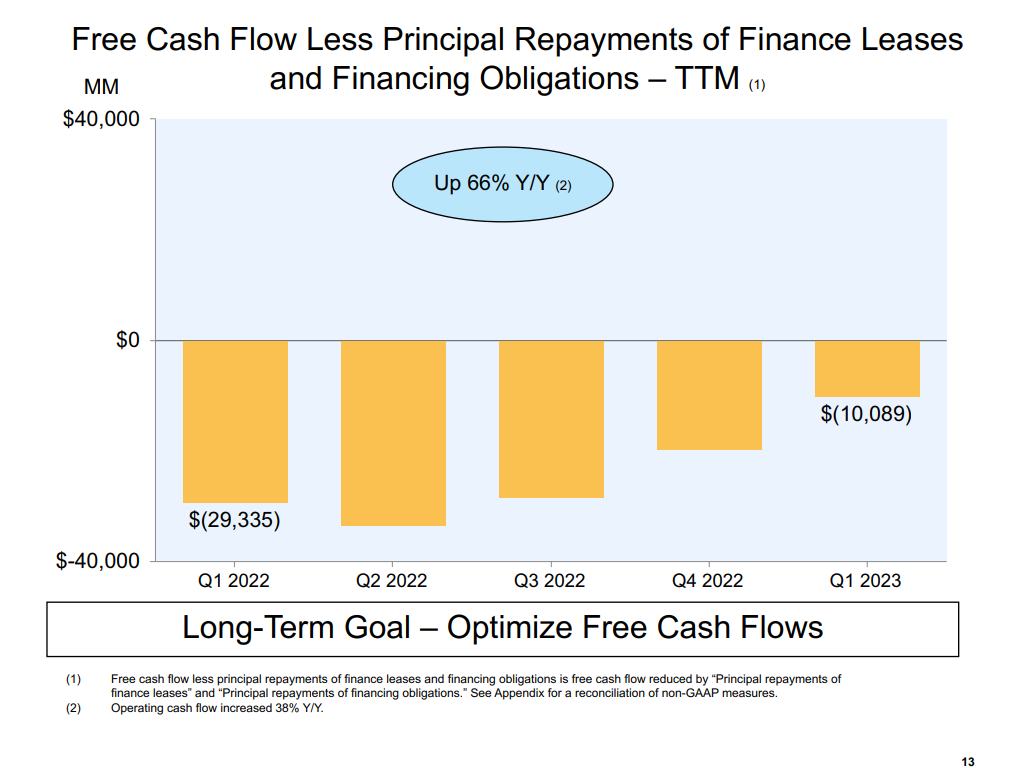

This combination is setting the foundation for Amazon to produce impressive cash flow in the future, which they can use to grow the business or return capital to shareholders through buybacks if shares trade at a discount in the future.

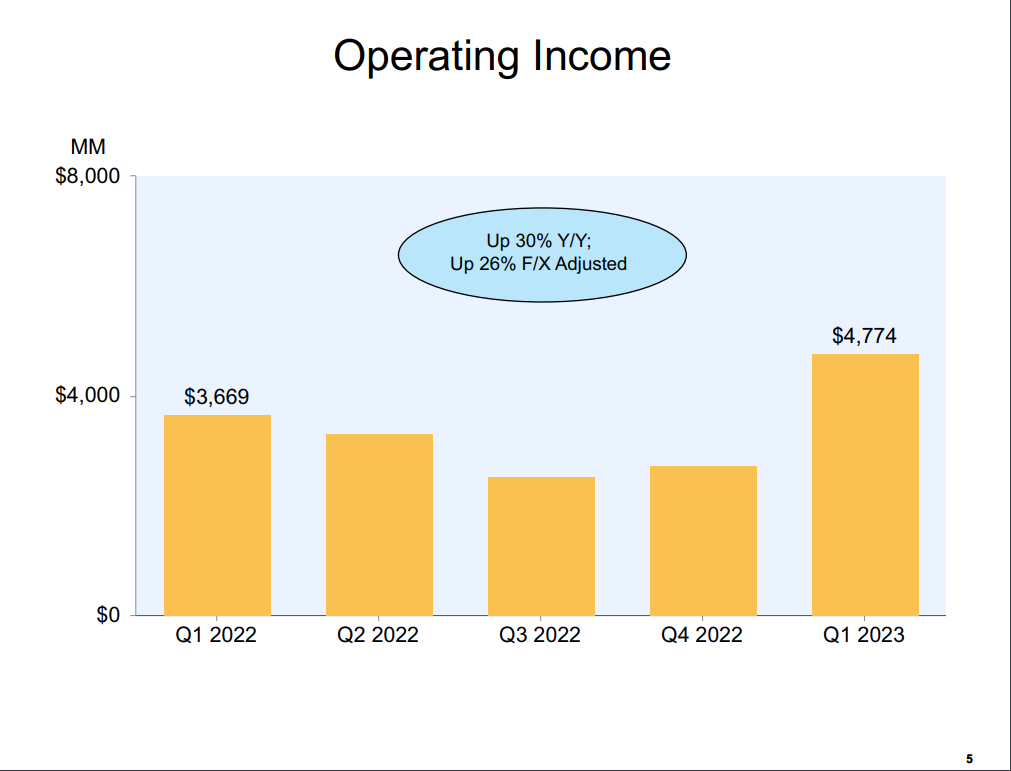

We’re already beginning to see operating income pickup and the company is clearly focused on optimizing free cash flow.

This is exactly what I want to see and why I’m adding to my position on this small pullback.

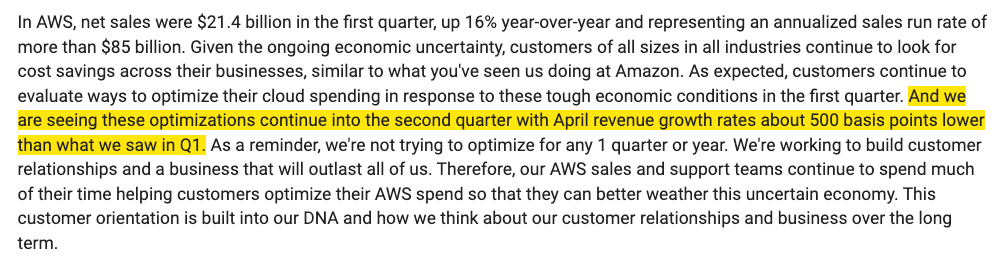

Shares were up 11% after hours yesterday. Then one sentence completely changed the market’s reaction. CFO Brian Olsavsky said that AWS revenue growth is 500 basis points lower in April than in Q1.

Come on, Brian! I could have put my son through one college class in 2035 with that $10,000 I was up after hours.

We will review Amazon’s quarter, but first, let’s cover a quick portfolio update.

Year to date, we’re up 16%, and since February 2022, we’re down 9%

This afternoon I sold Lithia Motors (LAD) and bought more Amazon. We were up about 2% on LAD, and I think the stock will likely do well in the future. However, given the uncertain economic outlook, Lithia’s exposure to auto loans, and the auto industry being very cyclical, I have much higher confidence in putting more money into Amazon than staying invested in Lithia.

Amazon will be hurt in a recession, but I think they’ll emerge stronger afterward, and the current valuation offers a great risk reward.

Here’s the current portfolio:

Keep reading with a 7-day free trial

Subscribe to Growth Curve By Austin Lieberman to keep reading this post and get 7 days of free access to the full post archives.