None of this is advice. I’m not a financial advisor. I’m not responsible for any decisions you make. Do your own research. Any investment can lose money…. insert other warning.

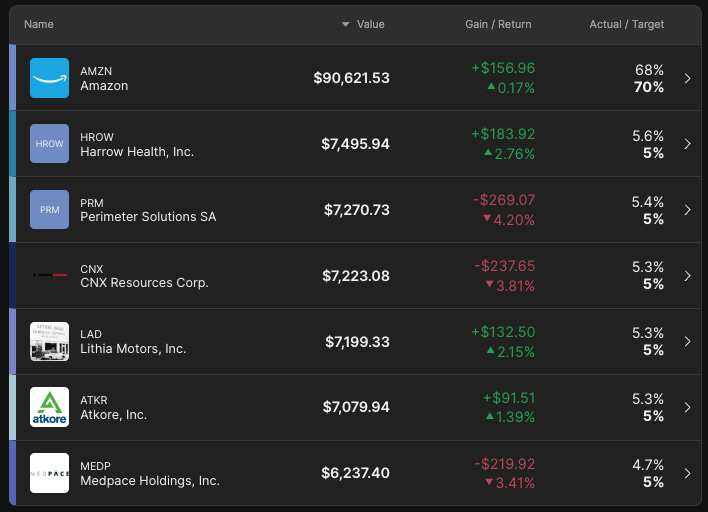

Sometimes the best opportunity is staring you right in the face. Amazon, I’m talking to you. I bought $90,000 of Amazon today.

I’ve gotten a lot of criticism for the turnover in my portfolio and not having any conviction because I’m making so many changes.

My response is that you’re right and that feedback is warranted. I have had a lot of turnover, and I’ve been very short-term oriented.

If you’re an annual member and you’re upset that this service is not what you signed up for, shoot me an email, and I’ll give you a prorated refund for all the time left on your subscription.

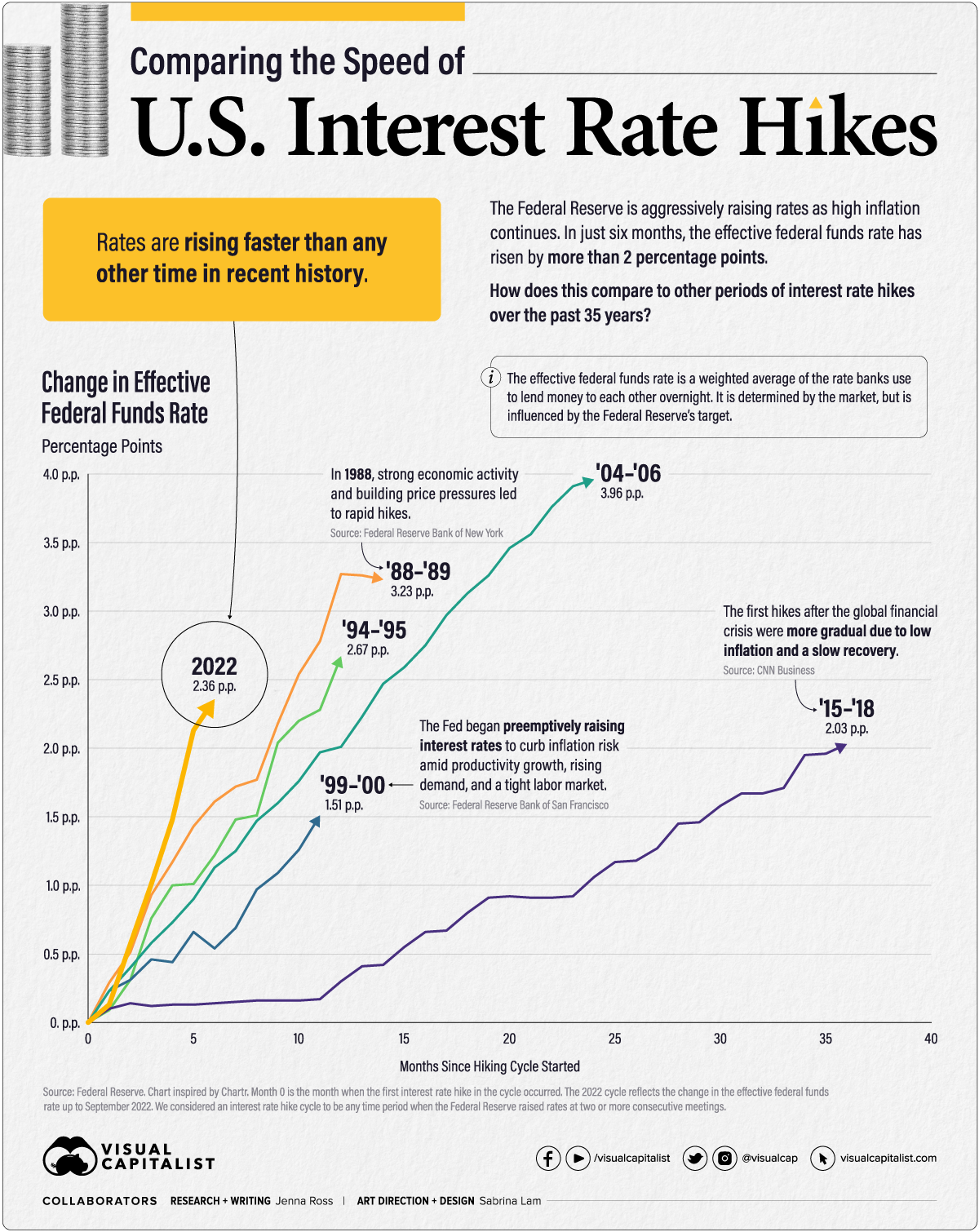

This is an extremely challenging time to invest because we’re facing things we have not faced in decades.

The fed has raised rates faster than any other time in recent history (Visual Capitalist) and as much as I hate trading and want to be a buy-and-hold investor. I think there’s an opportunity to take advantage of some of the current dislocations in the market.

I still think the Nasdaq and S&P 500 are overvalued and I think we will enter a recession sometime in 2023/2024.

But after seeing Microsoft, Google, and Meta earnings which were all stronger than I expected, I think the best opportunity is to make a big bet on Amazon.

They report earnings this afternoon, and the benefit if I’m wrong, is that I’ll own shares in one of the best companies of all time that’s currently trading at a discount to its historical multiples and its mega-cap peer group.

So I think there’s a short-term risk of an earnings disappointment but a relatively low risk of permanent loss of capital.

Here’s the current portfolio. I closed the TMF position, sold GOOGL, and piled into AMZN. I’ve made no changes to my small-cap positions.

What I like about Amazon

Keep reading with a 7-day free trial

Subscribe to Growth Curve By Austin Lieberman to keep reading this post and get 7 days of free access to the full post archives.