Best Opportunities (What I’m Buying Next Week)

4 New positions & Adding to 4 current positions next week

Hey everyone, I shared that I intend to add AMZN and MGA next week, but I actually want to cover everything that I’ll be adding to.

I’ve shared before that I use M1 finance. I like it because I set my target allocations, then as contributions come in, it auto-allocates into the companies that are below my target allocations and will not add to the ones that are above my target allocations.

So if a stock becomes a big winner and I decide the business is performing great but maybe that I’m not excited enough to increase my target allocation then that stock won’t get sold down, it simply won’t get added to with new contributions until/unless the rest of my portfolio catches up or I increase my target allocation on it.

I really like this because it lets me decide which businesses I want to own, then adjust where new money gets added based on which great businesses of mine appear to be undervalued compared to their historical multiples & forward growth expectations.

So that’s what this list is. Every two weeks before my contributions come in, I’ll share the companies I believe are undervalued that I’m adding my own money to next week.

I’m not selling anything. This list is just what I’m adding to next week.

It’s also not a full thesis on these companies. I’ve already decided I like the businesses so this decision is solely based on valuation & target position size.

Growth Bucket

New Position: Amazon (AMZN) - Target allocation 7.5%

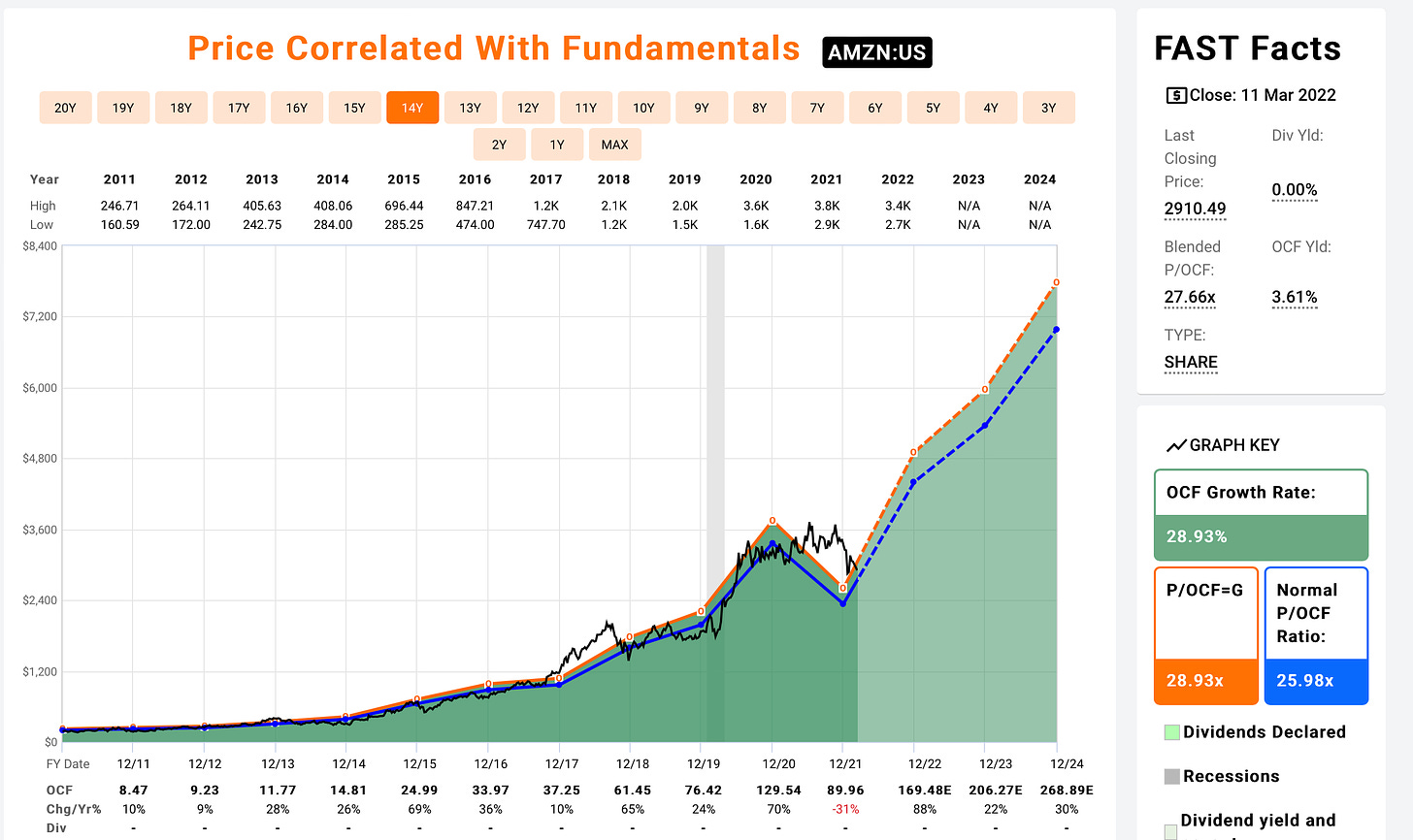

Since 2011 Amazon has grown operating cash flow 29% a year and traded at an average P/Operating Cash Flow (OCF) ratio of 26. (See chart)

The black line represents the share price. If the black line is below the orange line, it means Amazon is under its fair value when measured by OCF.

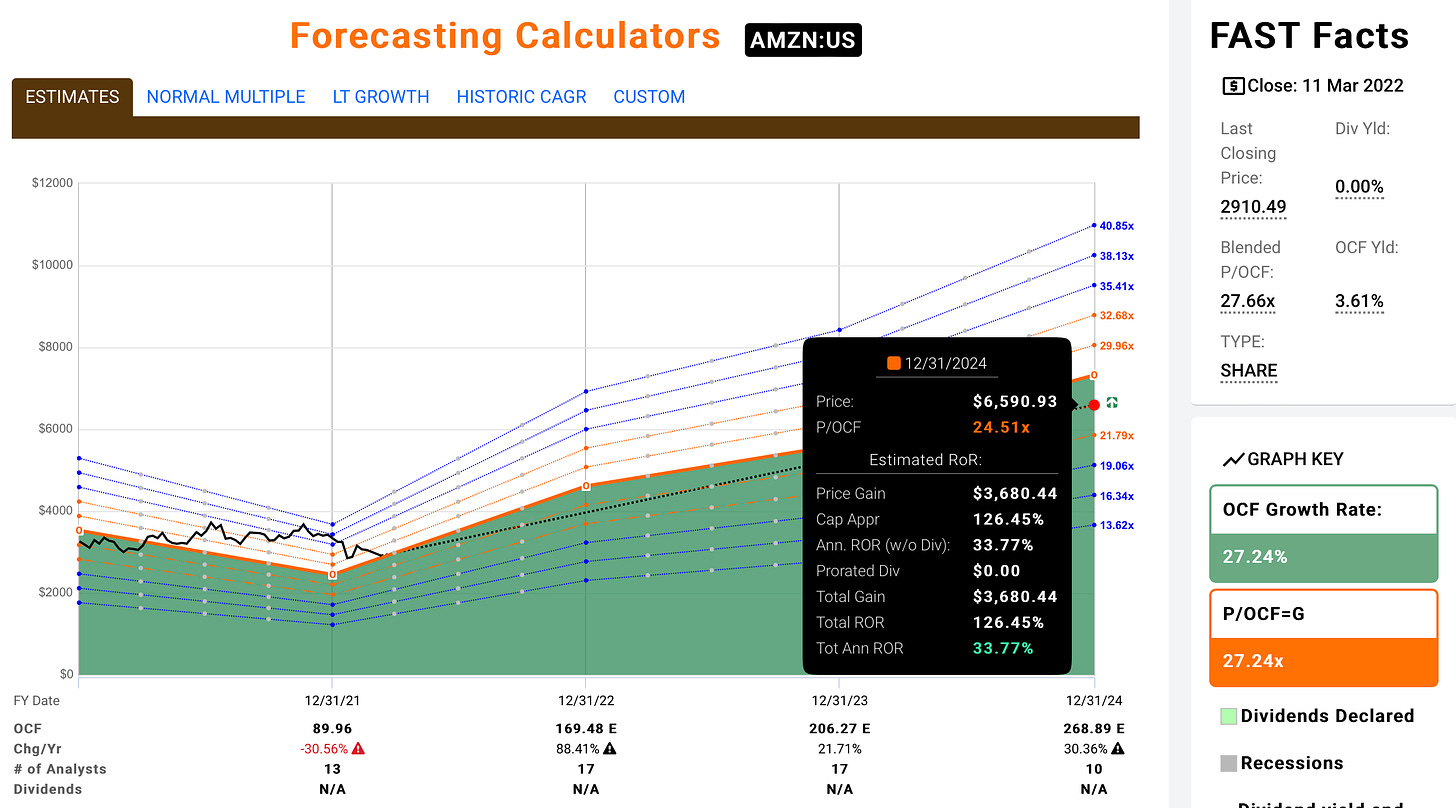

Through FY 24, Amazon is expected to grow OCF by 27% per year. As shown on the chart below if Amazon meets expectations (it historically beats expectations) and trades at a P/OCF ratio of 24 which is below where it trades today and below it’s projected OCF growth rate, shares will trade at $6,590, up 126% total a 33% CAGR

Adding to:

Keep reading with a 7-day free trial

Subscribe to Growth Curve By Austin Lieberman to keep reading this post and get 7 days of free access to the full post archives.