Hey everyone,

I hope you had a nice weekend and are enjoying your week. Here’s our monthly update for April. I’ll usually get these out on Fridays during the last week of each month but I was traveling last week for some military training.

As always, please help more people find us by sharing on social media, with friends, or hit the little heart at the top of the post!

Note 1:

I am not a financial advisor. None of what I write should be taken as financial advice and investing can result in the complete loss of any money invested. I am not liable or to be held accountable for any of your financial or investment decisions.

Note 2:

I’m sharing portfolio values to offer transparency and potentially inspiration. I began seriously investing in 2012, my wife and I both have what I would consider average to slightly above average income. This portfolio is the result of consistently investing 25% - 30% of our annual income, a lot of hours spent reading about investing and learning by investing (and making mistakes).

Note 3:

We are not changing our lifestyle based off of our portfolio changing in value. We certainly have been able to make some career and lifestyle decisions (buying a home and moving closer to our family) because of how well our investments have done, but we are continuing to work full-time, living below our means, and adding to our investments every month.

Investing has changed our lives and it’s not something that requires a fancy degree or sitting in front of the t.v. or computer watching stocks all day.

Monthly Review:

All of the results discussed below are through April 30th, 2019. Going forward, I’m not going to include portfolio value at the end of each week, but I will at the end of each month and I’ll include returns and portfolio values for the previous months as well to track progress.

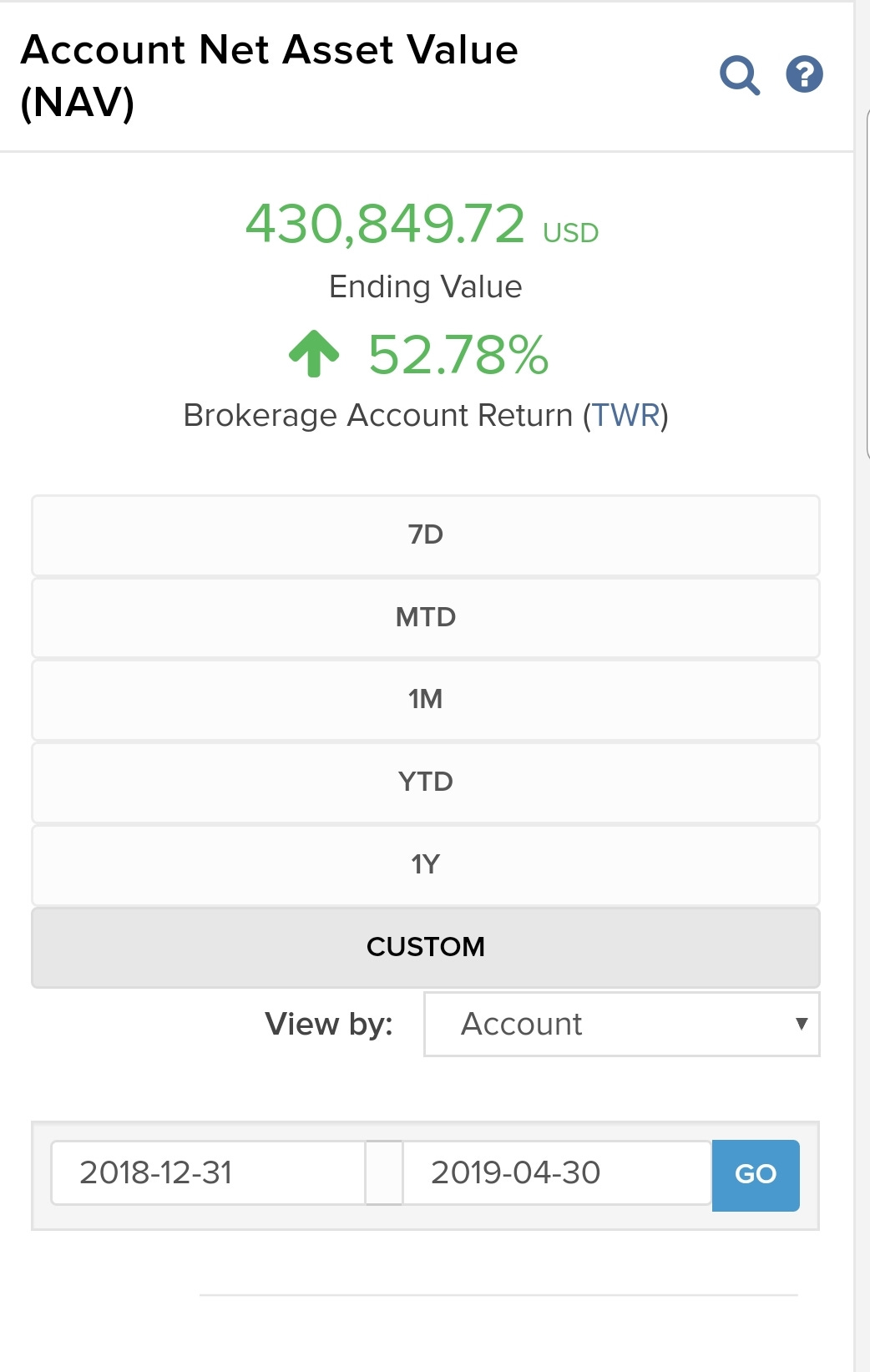

Total portfolio value:

April 30th, 2019: $430,849.00

Year to date return as of:

April 30th, 2019: +53% | +$155,261.00

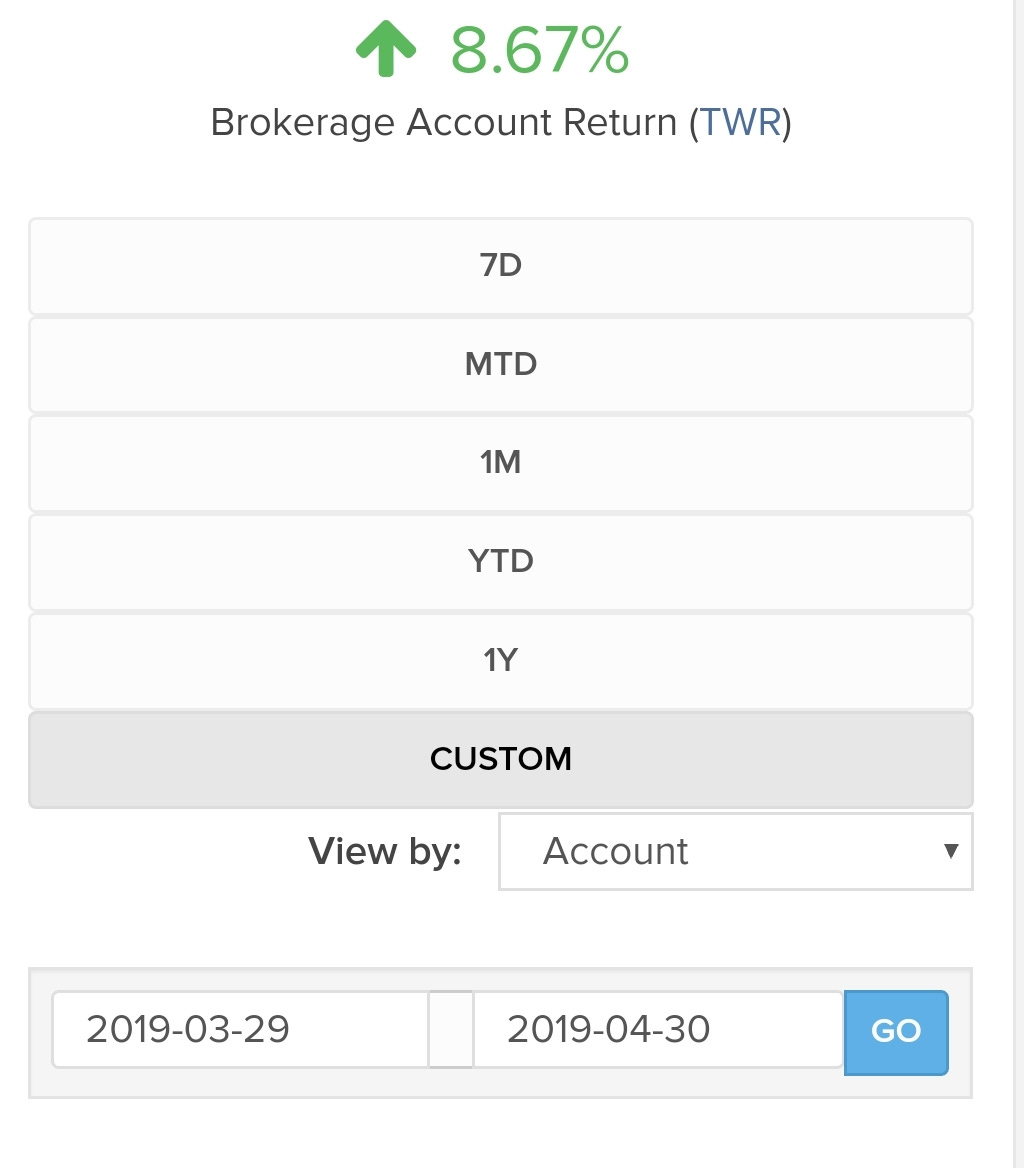

Monthly return:

April 2019: +8.67%

We are off to another fantastic start to the year. After ending last year up 65% I was not expecting anything close to the return we have seen already this year. I don’t expect this to continue. My goal is to return 20% per year and I’m prepared to see the portfolio drop significantly down to returns in the 20% (or lower) range.

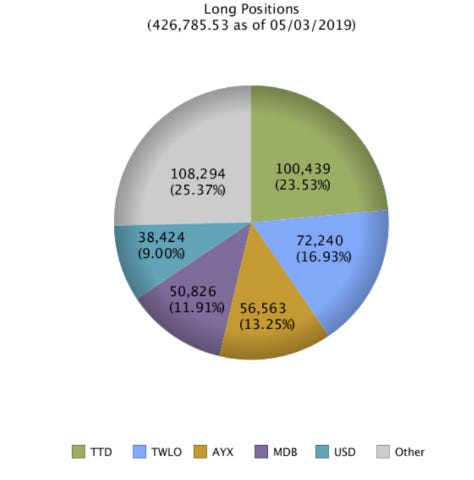

Current Positions (as of May 3, 2019):

The Trade Desk (TTD): Position size: $100,438 | Cost basis: $56,604

Twilio (TWLO): Position size: $72,240 | Cost basis: $36,545

Alteryx (AYX): Position size: $56,562 | Cost basis: $33,150

Mongo Database (MDB): Position size: $50,825 | Cost basis: $44,916

Cash: $38,424

Okta (OKTA): Position size: $36,700 | Cost basis: $24,350

Pager Duty (PD): Position size: $23,200 | Cost basis: $20,432

Zscaler (ZS): Position size: $22,848 | Cost basis: $15,864

Shopify (SHOP): Position size: $11,881 | Cost basis: $7,917

Elasticsearch (ESTC): Position size: $10,750 | Cost basis: $9,360

Transactions last week:

Sold out of Square due to growth concerns and lack of confidence in management. I could be completely wrong about this one.

Added to Twilio and Alteryx after strong earnings reports. Twilio is down after earnings, but I saw what I believe to be indications of strong growth for Flex, their Cloud Contact Center product and I think investors are a bit confused with some of the numbers after the Sendgrid acquisition.

Last Week’s Earnings:

I can’t emphasize enough how important it is to listen to and read company earnings calls. I listen to them to get a feel for the tone of management and I read to record notes/track performance. Here are links to Square, Alteryx, and Twilio’s investor relations pages where you can find earnings reports and conference calls:

Square

Twilio

Alteryx

This Week:

If you pay attention to the headlines, you’ve probably read something about U.S. and China trade talks falling apart. When I saw that, I saw a headline saying futures had fallen 400 points or something like that.

What did I do? Absolutely nothing. I was expecting yesterday to be a far worse day than it was. I think our portfolio was down .5%. A normal day. There’s no telling what will happen in the short term. There is certainly a chance I’ll have an opportunity to invest that 9% cash position I have if we see a big 10% - 20% drop which is always a possibility.

If/when I add, it won’t be to TTD, TWLO, AYX, or MDB. Those positions are all large enough. I will likely consider ZS, OKTA, or ESTC.

Summary:

The most important lesson I’ve learned in investing is to invest in a way that we are most comfortable and optimize for way of life, not for the best returns possible.

What I mean by that is we personally keep a very large cash position in a High Yield Savings account which I don’t consider an investment. Having that cushion allows us to sleep well at night and allows me to keep a long term mindset with our investment portfolio. Could we squeeze out another few % gains per year by investing that money? Probably…but it would completely change my state of mind, and could put us in a position where we need to pull from our investment accounts in an emergency which could come at the absolute worst time.

That’s not a stress we can live with. So we give up making a return on that money for the peace of mind it brings us.

When I first started investing, we didn’t have much of a cash cushion at all. However, we didn’t have kids, our parents weren’t as old (and potentially needing financial help soon), and we didn’t have as many financial responsibilities so it worked for us. We lived below our means and if we ever needed money in a pinch, we would have charged the emergency expense to a credit card and stopped our investment contributions for a few months.

I’m not saying this is the best way to do things. It probably isn't. But it works for us. Find out what works best for you and your situation and optimize for that.

Moving Forward:

I’ll get to a point where I can provide in depth reviews of company earnings reports, but this newsletter is something I do in addition to family and work obligations and I’m still working to find a good balance between writing and everything else.

Thanks so much for your time and attention. I appreciate you all. If you’d like to help more people find us, please hit the heart above, share on social media or with friends, and/or begin a paid subscription for $5 a month or $50 a year using the link below.